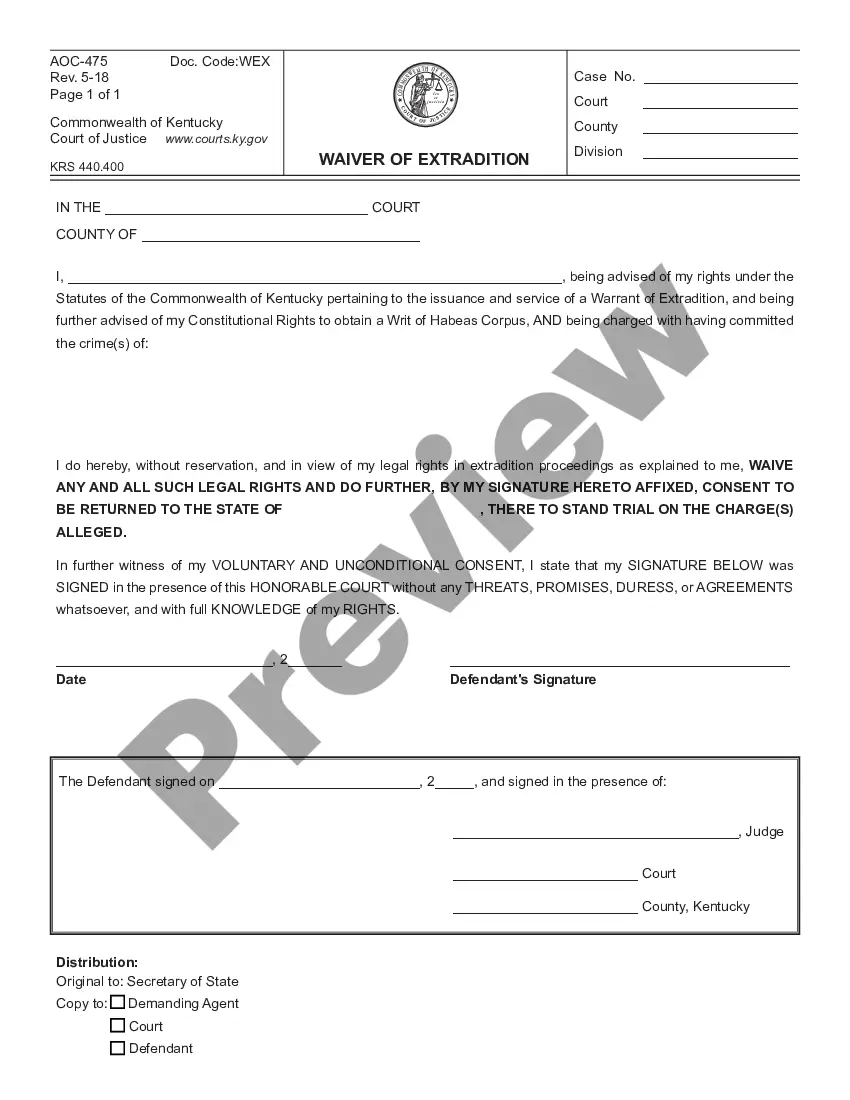

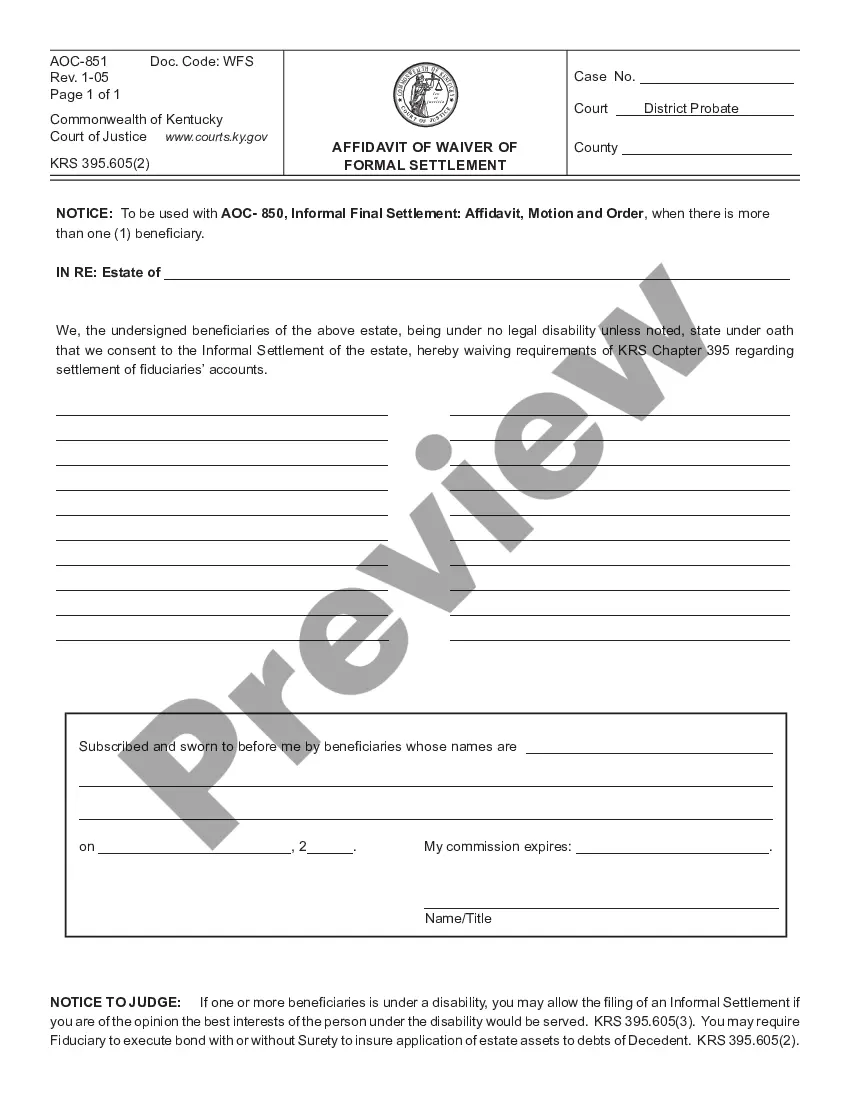

This Waiver of Recording is an official form used by the Commonwealth of Kentucky, and it complies with all applicable state and Federal codes and statutes. USLF updates all state and Federal forms as is required by state and Federal statutes and law.

Kentucky Recording Laws For 2018

Description

How to fill out Kentucky Waiver Of Recording?

Regardless of whether it is for corporate reasons or personal matters, everyone ultimately encounters legal issues during their lifetime.

Completing legal paperwork requires meticulous attention, starting from selecting the appropriate form template.

With an extensive US Legal Forms collection available, you won’t need to waste time searching for the appropriate sample online. Utilize the library’s straightforward navigation to find the right form for any scenario.

- Locate the sample you require using the search bar or catalog browsing.

- Review the form’s details to confirm it aligns with your situation, state, and county.

- Click on the form’s preview to examine it.

- If it is not the correct form, return to the search feature to find the Kentucky Recording Laws For 2018 sample you need.

- Download the document if it suits your specifications.

- If you possess a US Legal Forms account, simply click Log in to access previously stored documents in My documents.

- If you do not yet have an account, you can secure the form by clicking Buy now.

- Choose the correct pricing option.

- Fill out the account registration form.

- Select your payment method: utilize a credit card or PayPal account.

- Choose the document format you prefer and download the Kentucky Recording Laws For 2018.

- Once it is downloaded, you can fill out the form using editing software or print it and complete it by hand.

Form popularity

FAQ

How much does an estate have to be worth to go to probate in Connecticut? In the state of Connecticut, the minimum value of the deceased's assets is $40,000.

In Connecticut, if a decedent had no solely owned real estate and the total value of all of the decedent's personal property does not exceed $40,000, the small estates procedure may be used. The small estates procedure is a simplified method of settling an estate that avoids formal probate proceedings.

Step 1 ? Inventory Assets. Step 2 ? Fill out Form PC 212. Step 3 ? File the Forms. Step 4 ? Await Distribution. Connecticut Jurisdiction. Petitioner Status. Expenses And Claims.

Connecticut law defines it as a probate estate where the decedent's tangible and intangible personal property does not exceed $40,000. ?Tangible? property refers to physical items, such as a car or furniture; while ?intangible? property includes non-physical assets like bank accounts.

Connecticut allows small estate affidavits to be filed electronically here. Alternatively, the forms may also be filed in person using this Court Locator. If Filing Form PC-212 in person, make sure to have two notarized copies to submit.

1) A petitioner filing a PC-212, Affidavit in Lieu of Probate of Will/Administration, may use this form to request an order of distribution if (a) assets exceed expenses and claims or (b) a person who paid expenses or claims waives reimbursement for payment of the expense or claim.

The answer is YES. If the total assets left by a decedent in his or her name alone do not exceed $40,000 and do not include real estate, a simpler small estate procedure can be used. The decedent may own assets exceeding $40,000 if they are in joint name(survivorship) and still qualify for this small estates.