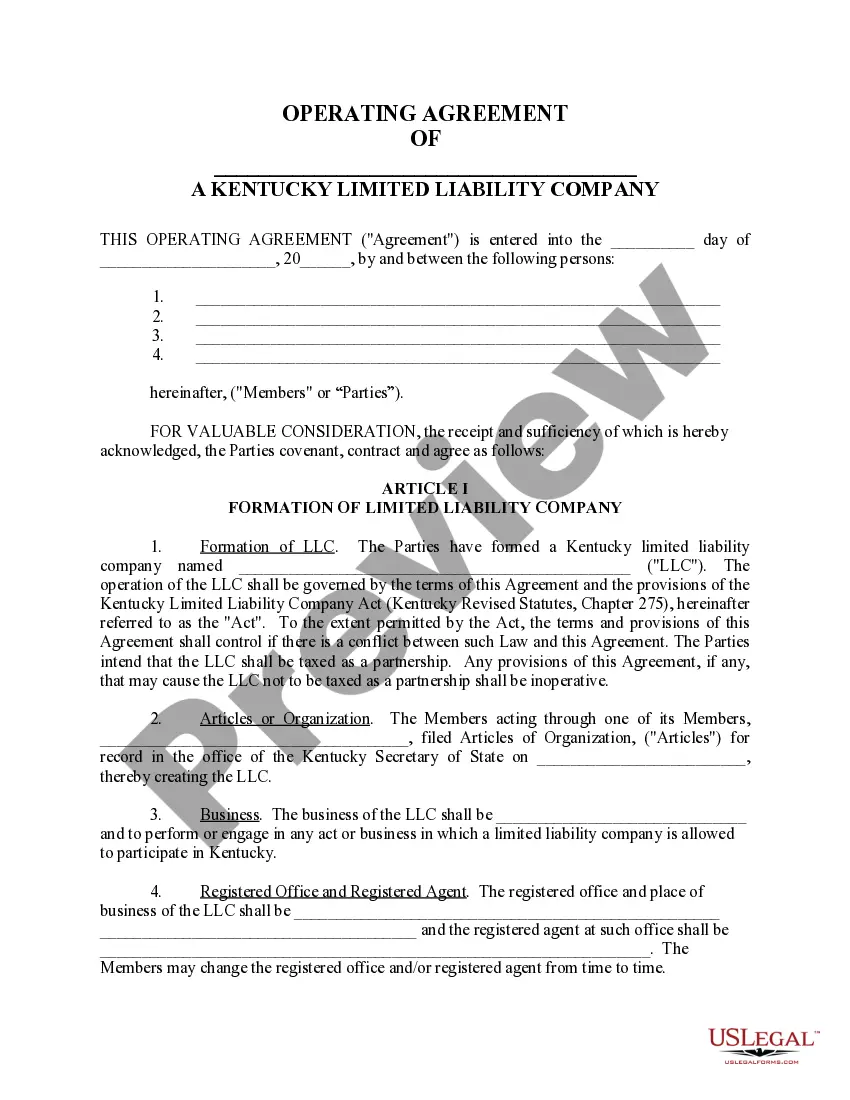

Kentucky Llc Operating Agreement With Profits Interest

Description

How to fill out Kentucky Limited Liability Company LLC Operating Agreement?

Finding a go-to place to access the most current and appropriate legal samples is half the struggle of handling bureaucracy. Discovering the right legal files requirements precision and attention to detail, which is the reason it is vital to take samples of Kentucky Llc Operating Agreement With Profits Interest only from reliable sources, like US Legal Forms. A wrong template will waste your time and delay the situation you are in. With US Legal Forms, you have little to worry about. You may access and check all the information about the document’s use and relevance for the situation and in your state or region.

Take the following steps to finish your Kentucky Llc Operating Agreement With Profits Interest:

- Use the catalog navigation or search field to locate your template.

- View the form’s description to ascertain if it fits the requirements of your state and region.

- View the form preview, if available, to make sure the template is the one you are searching for.

- Resume the search and look for the proper document if the Kentucky Llc Operating Agreement With Profits Interest does not suit your needs.

- When you are positive regarding the form’s relevance, download it.

- If you are an authorized user, click Log in to authenticate and access your selected templates in My Forms.

- If you do not have a profile yet, click Buy now to obtain the template.

- Select the pricing plan that suits your needs.

- Proceed to the registration to finalize your purchase.

- Complete your purchase by picking a transaction method (bank card or PayPal).

- Select the document format for downloading Kentucky Llc Operating Agreement With Profits Interest.

- When you have the form on your device, you can alter it using the editor or print it and complete it manually.

Get rid of the inconvenience that accompanies your legal paperwork. Explore the comprehensive US Legal Forms library to find legal samples, check their relevance to your situation, and download them on the spot.

Form popularity

FAQ

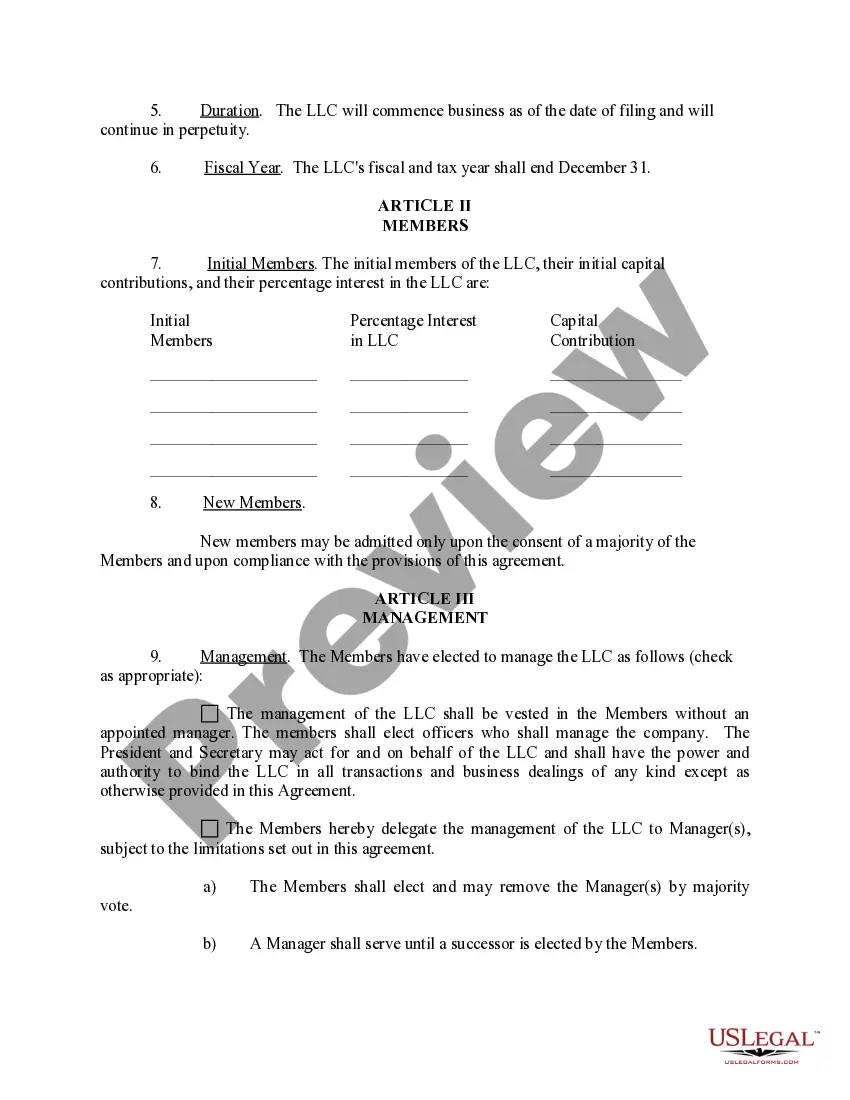

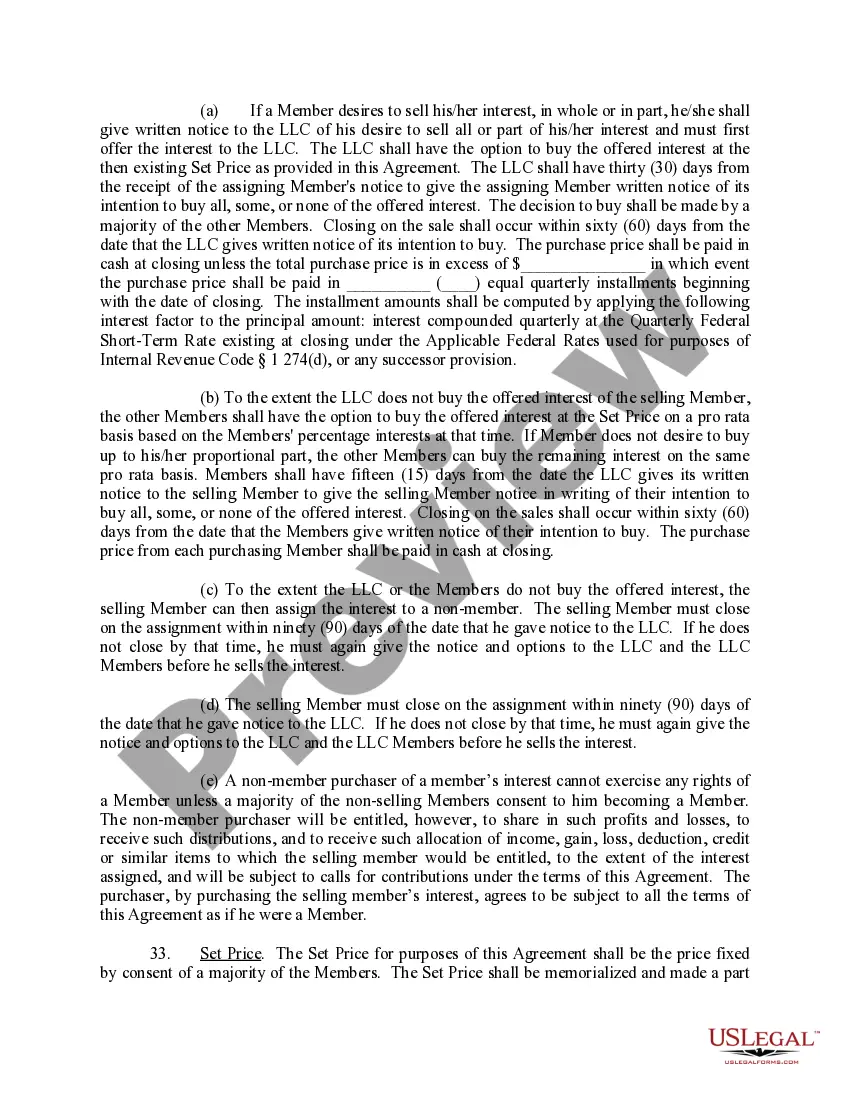

To get you started, here is a Top 10 list underscoring the major provisions that an LLC operating agreement should have. Member Financial Interest. ... Corporate Governance. ... Corporate Officer's Power and Compensation. ... Non-Compete. ... Books and Records Audit. ... Arbitration/Forum Selection.

LLC operating agreements usually provide much more information, and almost all the provisions for how the business will be managed, and the rights, duties, and liabilities of members and managers are contained in the operating agreement. An operating agreement is a private document.

Kentucky Revised Statutes § 275.003: In Kentucky, an Operating Agreement is not a legal requirement to form an LLC. However, having one provides clarity to member responsibilities, business operations, and mitigates potential business disputes.

Kentucky LLC Cost. To start an LLC in Kentucky, the state fee is $40 to file your LLC Articles of Organization online or in-person. Along with the fee you'll pay to the Secretary of State, you'll also have to pay $15 every year when you file your annual report.

Kentucky does not require LLCs to include member information with their Articles of Organization, so chances are you won't have to contact the Kentucky Division of Business Filings to change your filing with the state. Instead, you'll include your new LLC member information when you file your Kentucky Annual Report.