Kentucky Llc Operating Agreement With Non Voting Members

Description

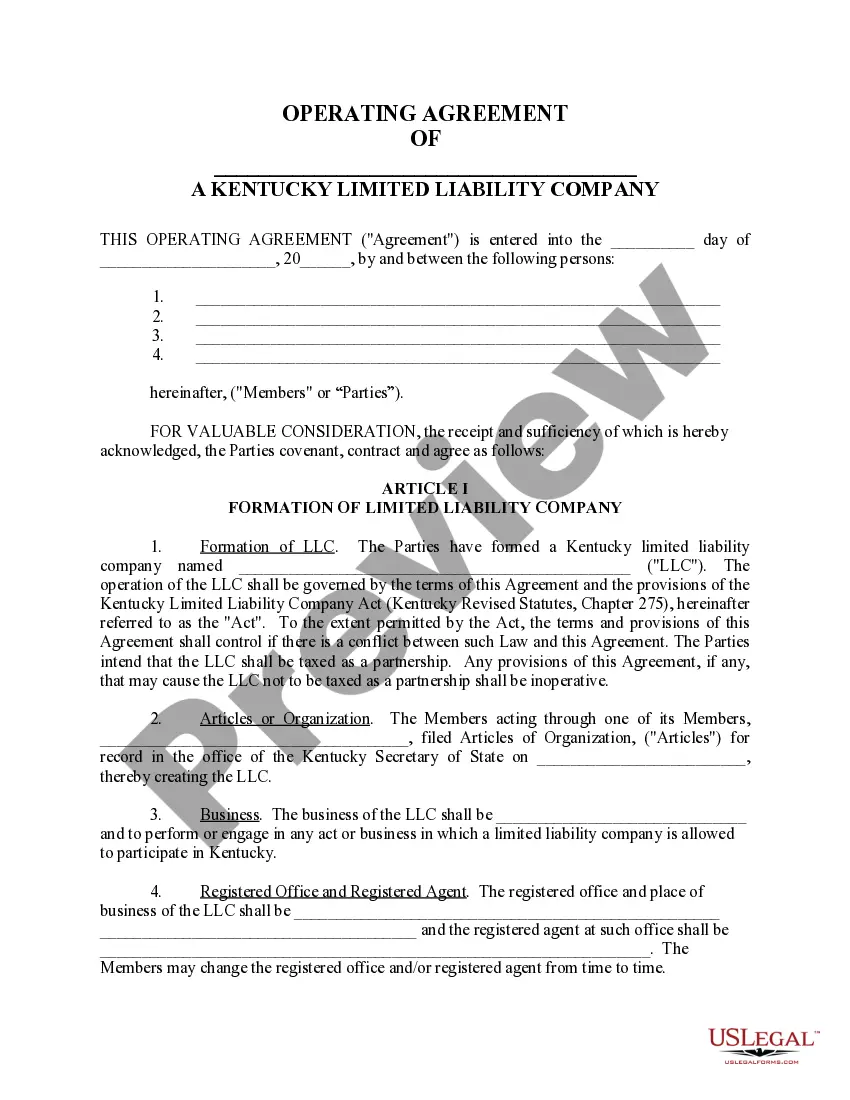

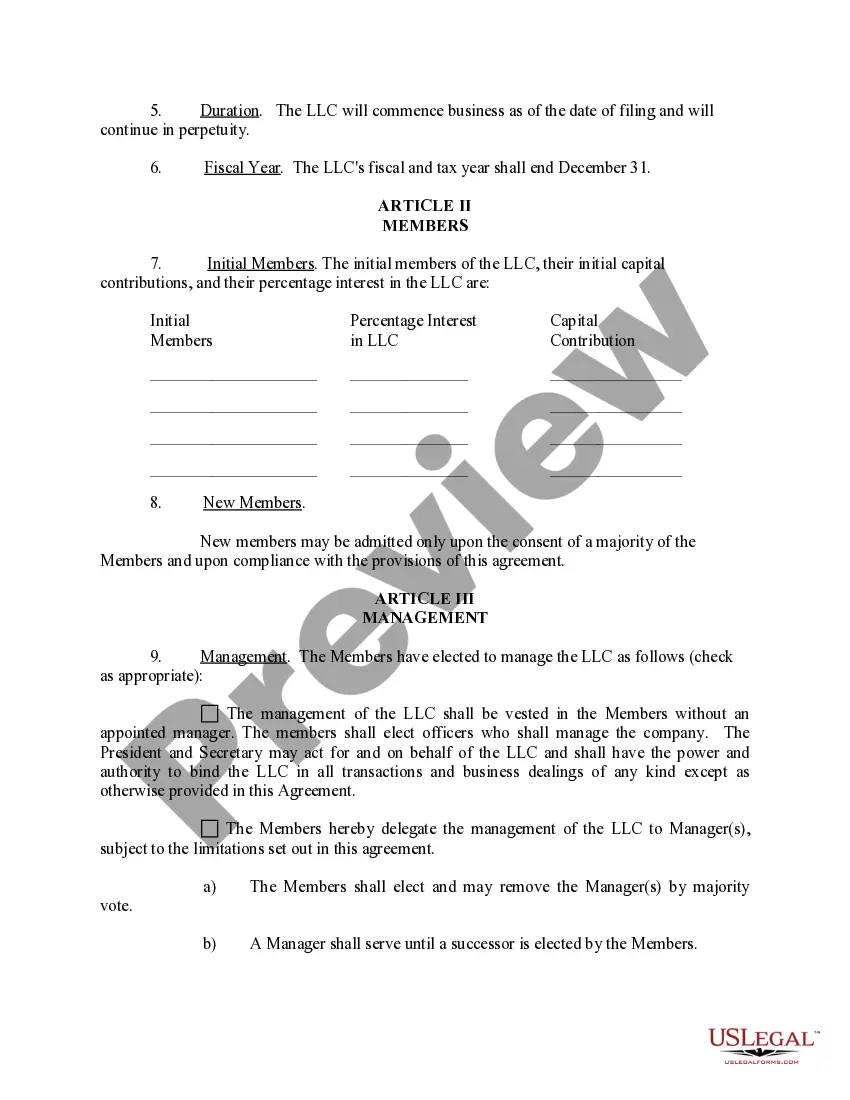

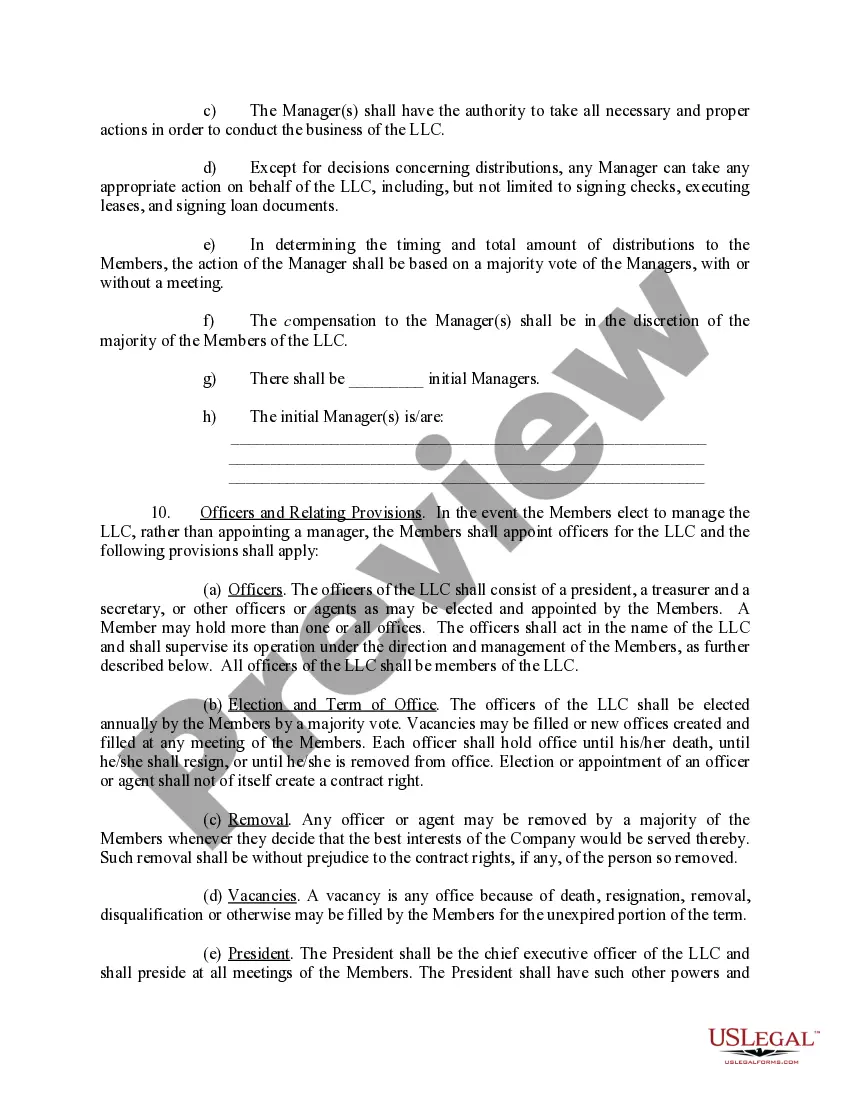

How to fill out Kentucky Limited Liability Company LLC Operating Agreement?

It’s no secret that you can’t become a law professional overnight, nor can you figure out how to quickly prepare Kentucky Llc Operating Agreement With Non Voting Members without having a specialized background. Creating legal forms is a long process requiring a particular training and skills. So why not leave the preparation of the Kentucky Llc Operating Agreement With Non Voting Members to the professionals?

With US Legal Forms, one of the most comprehensive legal document libraries, you can find anything from court papers to templates for in-office communication. We know how important compliance and adherence to federal and state laws and regulations are. That’s why, on our platform, all templates are location specific and up to date.

Here’s how you can get started with our website and obtain the form you require in mere minutes:

- Find the form you need with the search bar at the top of the page.

- Preview it (if this option available) and check the supporting description to figure out whether Kentucky Llc Operating Agreement With Non Voting Members is what you’re looking for.

- Start your search again if you need any other form.

- Set up a free account and choose a subscription plan to buy the template.

- Pick Buy now. As soon as the transaction is through, you can get the Kentucky Llc Operating Agreement With Non Voting Members, complete it, print it, and send or send it by post to the necessary people or entities.

You can re-gain access to your documents from the My Forms tab at any time. If you’re an existing customer, you can simply log in, and find and download the template from the same tab.

Regardless of the purpose of your forms-whether it’s financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

Kentucky Revised Statutes § 275.003: In Kentucky, an Operating Agreement is not a legal requirement to form an LLC. However, having one provides clarity to member responsibilities, business operations, and mitigates potential business disputes.

Converting a Single-Member LLC to a Multi-Member LLC If your LLC already has an employer identification number (EIN), you have to file Form 8832 with the IRS to elect partnership taxation and provide the names of the new members.

How to Start an LLC in Kentucky Name Your LLC. First thing's first, your LLC needs a name. ... Designate a Registered Agent. Next, you'll need to designate a Kentucky registered agent. ... Submit LLC Articles of Organization. ... Write an LLC Operating Agreement. ... Get an EIN. ... Open a Bank Account. ... Fund the LLC. ... File State Reports & Taxes.

Kentucky LLC Cost. To start an LLC in Kentucky, the state fee is $40 to file your LLC Articles of Organization online or in-person. Along with the fee you'll pay to the Secretary of State, you'll also have to pay $15 every year when you file your annual report.

Kentucky does not require LLCs to include member information with their Articles of Organization, so chances are you won't have to contact the Kentucky Division of Business Filings to change your filing with the state. Instead, you'll include your new LLC member information when you file your Kentucky Annual Report.