Kansas Lease Agreement For Car

Description

How to fill out Kansas Office Lease Agreement?

There's no longer a necessity to squander time looking for legal papers to fulfill your local state obligations.

US Legal Forms has gathered all of them in a single location and enhanced their accessibility.

Our platform offers over 85,000 templates for any business and personal legal situations organized by state and area of usage.

Completing legal documentation under federal and state guidelines is quick and easy with our platform. Try US Legal Forms today to organize your paperwork!

- All forms are properly crafted and verified for authenticity, ensuring you receive an updated Kansas Lease Agreement for Car.

- If you are acquainted with our service and possess an account, make sure your subscription is active before retrieving any templates.

- Log In to your account, choose the document, and click Download.

- You can also revisit all accessed documents whenever necessary by clicking the My documents tab in your profile.

- If you've never utilized our service before, the process will require a few additional steps to finalize.

- Here's how new users can locate the Kansas Lease Agreement for Car in our catalog.

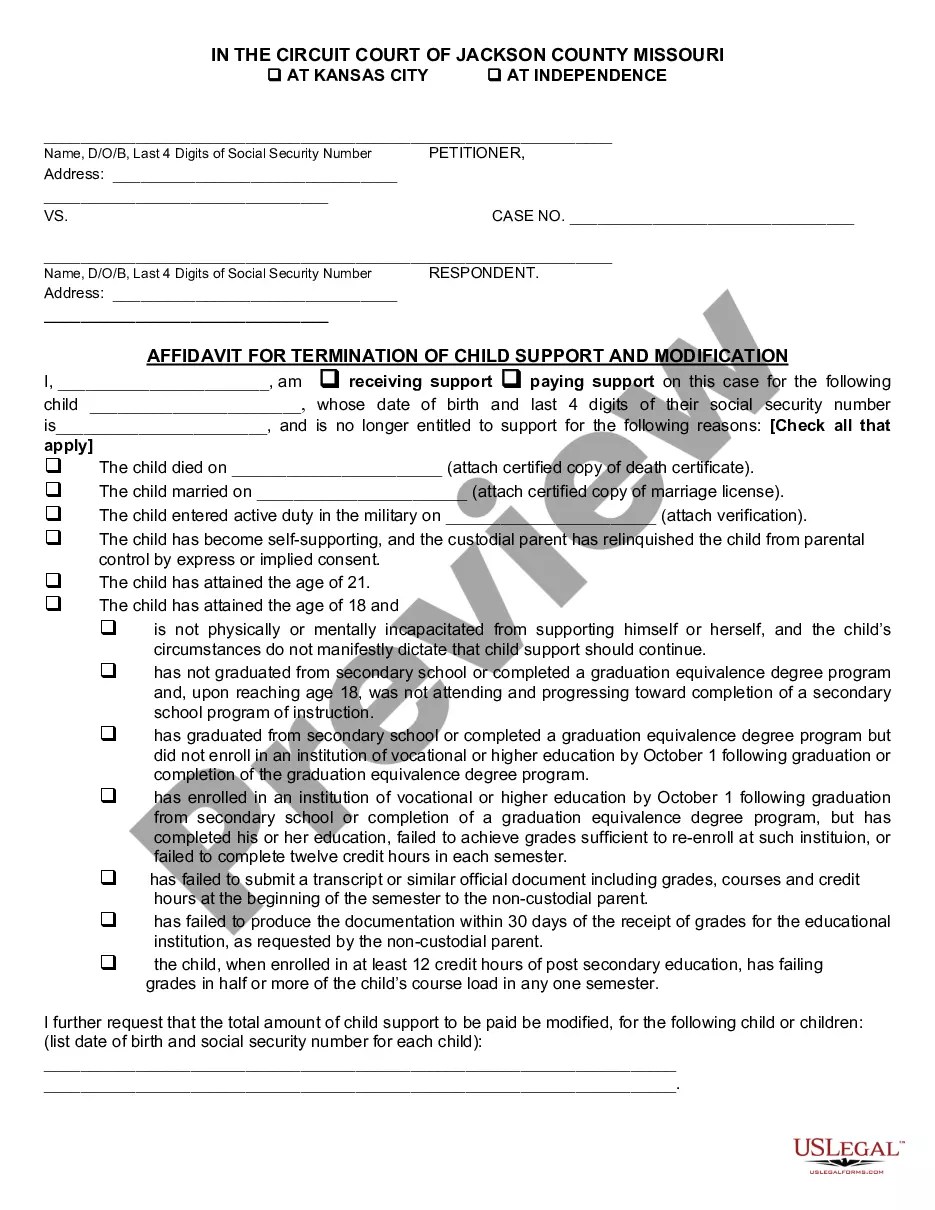

- Review the page content meticulously to confirm it includes the sample you seek.

- To assist, use the form description and preview options if available.

Form popularity

FAQ

A car lease lets you drive a new vehicle without paying a large sum of cash or taking out a loan. To lease a car, you simply make a small down payment -- less than the typical 20% of a car's value you'd pay to buy-- followed by monthly payments for the term of the lease. When the term expires, you return the car.

Here in Kansas, buying a car is subject to sales tax. However, when you trade in your old car, the amount you get is deducted from the total purchase price. You will only have to pay sales tax on the difference between the two.

What information is necessary to include in a Vehicle Lease Agreement template?A description of the vehicle.The vehicle manufacturer's suggested retail price.The residual value of the car (the anticipated price of the car at the end of the lease term)The lessee's contact information.More items...

DEALER SALES TO RESIDENTS OF KANSASThe dealer is required to collect sales tax on $19,500 at the rate in effect at the dealer's place of business (6.5% state tax and 2% local tax).

Leasing contracts occasionally require the lessee to pay property taxes directly to the county treasurer. When a lease agreement requires the lessee to pay property taxes directly to the county treasurer, the property tax paid by the lessee is not subject to sales tax.