Kansas Llc Registration

Description

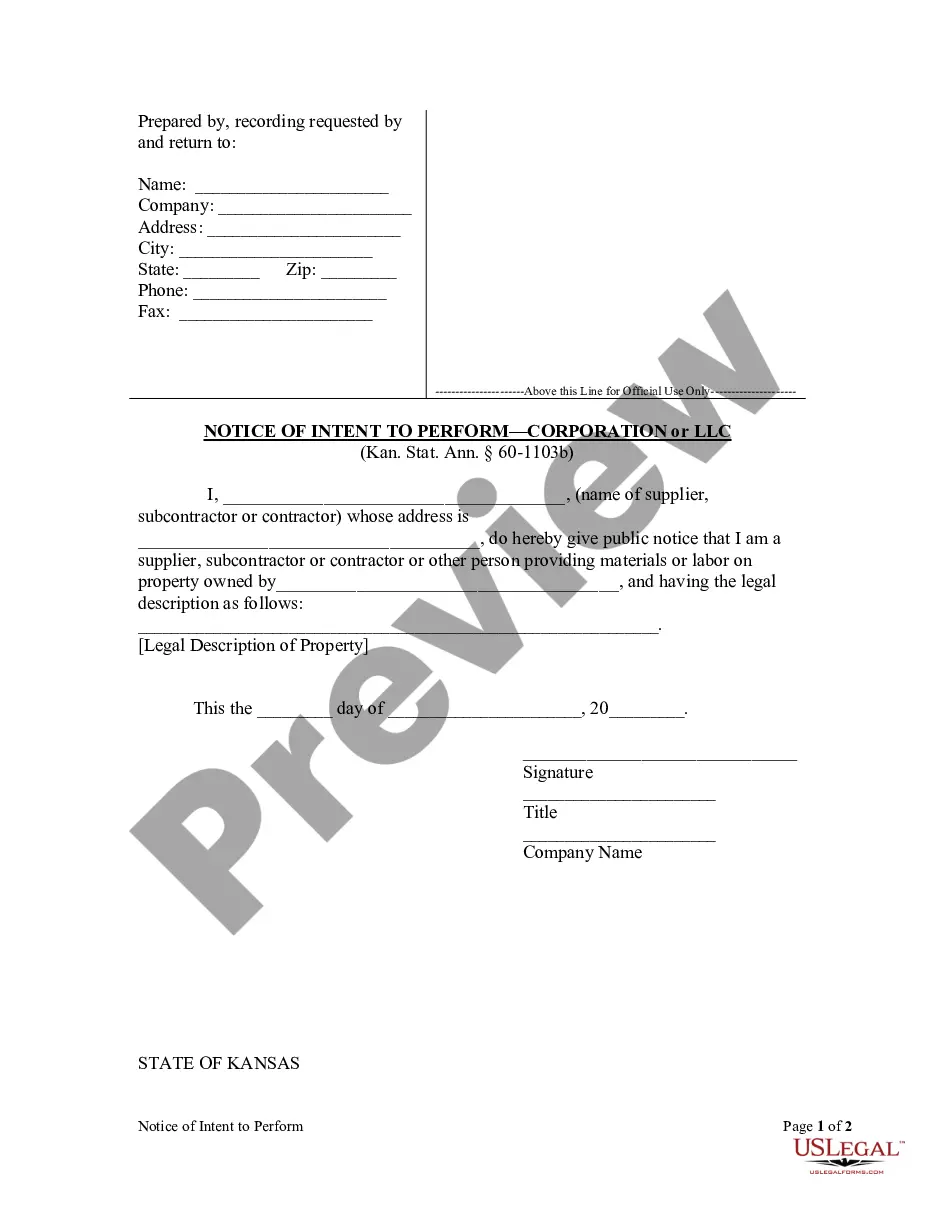

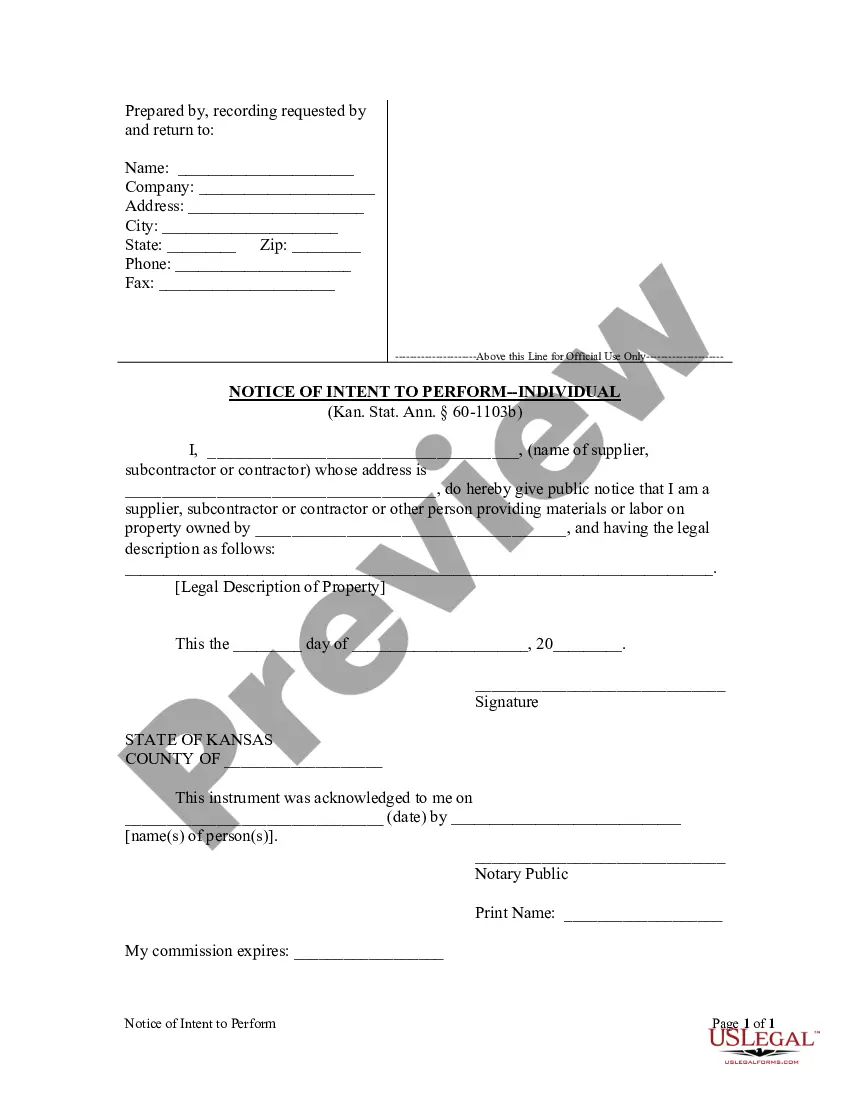

How to fill out Kansas Notice Of Intent To Perform By Corporation Or LLC?

- Log in to your account at US Legal Forms. If this is your first time, create an account and choose a subscription plan that fits your needs.

- Explore the extensive library. Use the search function to find the specific Kansas LLC registration form that meets your local jurisdiction requirements.

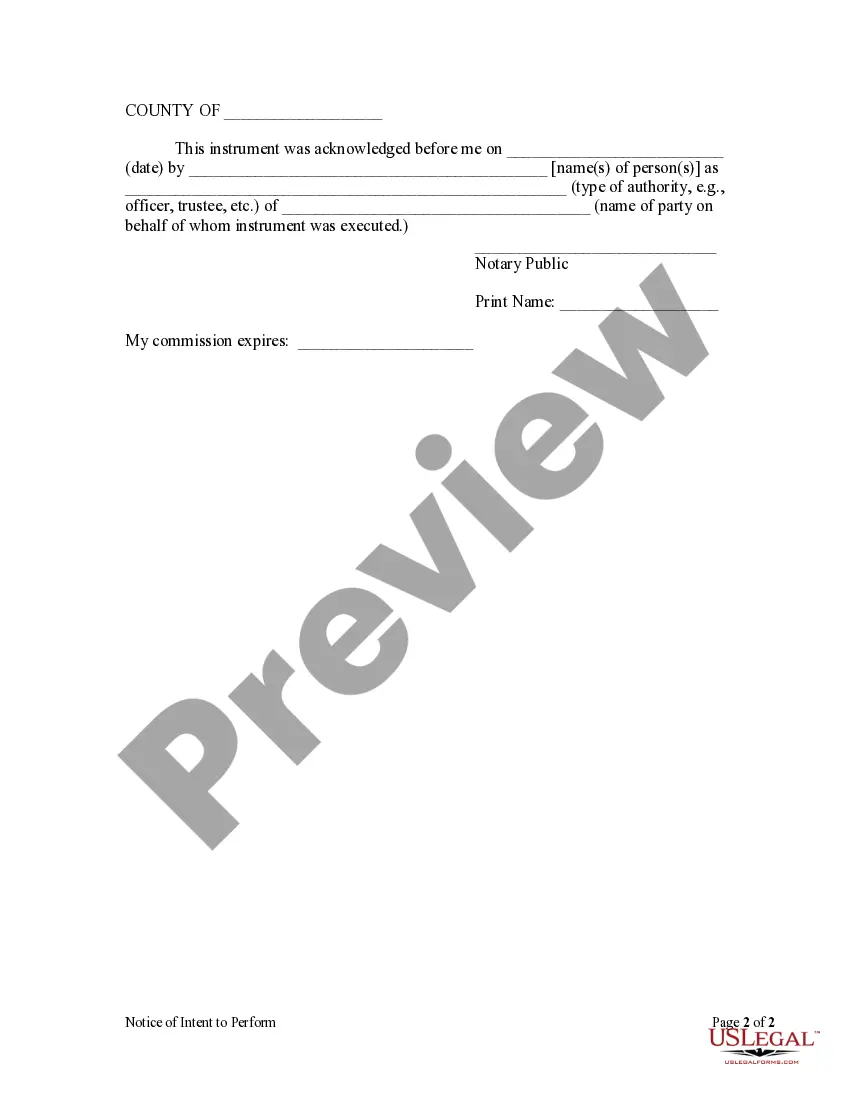

- Review the selected form in Preview mode. Ensure it matches your needs and covers all necessary details to avoid inconsistencies.

- Purchase the document. Click on the Buy Now button and follow through with your credit card or PayPal payment.

- Download the form. Once your payment is processed, save the template to your device for easy access and completion.

By choosing US Legal Forms for your Kansas LLC registration, you gain access to a robust collection of legal forms that are fillable and editable. Additionally, you can leverage premium expert assistance for form completion, ensuring your documents are accurate and compliant with legal standards.

Don't wait any longer to establish your business. Start your Kansas LLC registration with US Legal Forms today and experience the convenience of having professional legal support at your fingertips.

Form popularity

FAQ

Once you submit your application for Kansas LLC registration, you can expect approval within 1 to 2 weeks for online submissions. Mail submissions will take longer, generally up to a few weeks more. Consider using expedited services to speed up the approval process if timing is vital for your business plans. Being proactive can help you avoid unnecessary delays.

Yes, a Kansas LLC must file a tax return, but the specifics depend on how the LLC is classified for tax purposes. Single-member LLCs are typically treated as sole proprietorships, meaning they report income on personal tax returns. Multi-member LLCs generally file as partnerships. Regardless of classification, understanding your tax obligations is crucial during your Kansas LLC registration to avoid pitfalls.

Yes, after completing your Kansas LLC registration, you must file an annual report each year to keep your business in good standing. This filing is straightforward and helps maintain your LLC's official status. Staying compliant is essential, and using tools from platforms like US Legal Forms can simplify this yearly process and remind you of important deadlines.

The time it takes for Kansas LLC registration can vary, but typically, you can expect processing to take about 3 to 5 business days if filing online. If you choose to mail your application, it may take longer due to postal delays. To expedite the process, consider using a reliable service like US Legal Forms, which helps guide you through each step and ensures all paperwork is properly submitted.

To start the Kansas LLC registration process, you need to choose a unique name for your business that complies with state rules. Next, you will file the Articles of Organization with the Kansas Secretary of State, either online or via mail. It's also important to create an operating agreement to outline the ownership and management structure. Finally, consider obtaining any necessary licenses or permits based on your business type.

Finalizing an LLC in Kansas can take a varied amount of time based on several factors, including filing methods and processing times. Once you have submitted your articles of organization, it usually takes 3 to 10 business days for approval. However, additional time may be needed for any corrections or additional requests from the Secretary of State. By using professional services like USLegalForms, you can manage this process efficiently.

Yes, it is possible to get denied for an LLC if there are issues with your application or if it does not meet Kansas requirements. Common reasons for denial include incomplete forms, failure to provide necessary documentation, or name conflicts with existing entities. Careful attention to detail during the Kansas LLC registration process can help you avoid these pitfalls.

Yes, every LLC in Kansas must designate a registered agent. This agent can be an individual or an entity authorized to do business in Kansas; their role is to receive legal documents on behalf of your LLC. Having a registered agent ensures that your LLC remains compliant and operates smoothly. Consider choosing a reliable service to assist you during your Kansas LLC registration.

Getting an LLC in Kansas can take anywhere from a few days to several weeks. This timeframe largely depends on how you complete the Kansas LLC registration and the backlog of the Secretary of State's office. If you file online and ensure all documents are accurate, you can significantly shorten your wait time. Utilizing platforms like USLegalForms can streamline this process for you.

The approval time for an LLC in Kansas typically takes about 3 to 10 business days, depending on how you file. If you choose online filing, the process usually moves faster than postal submissions. Staying organized and submitting all required documents correctly can help expedite this timeframe. With proper guidance, Kansas LLC registration can be straightforward.