Name Deed Tenants With Title

Description

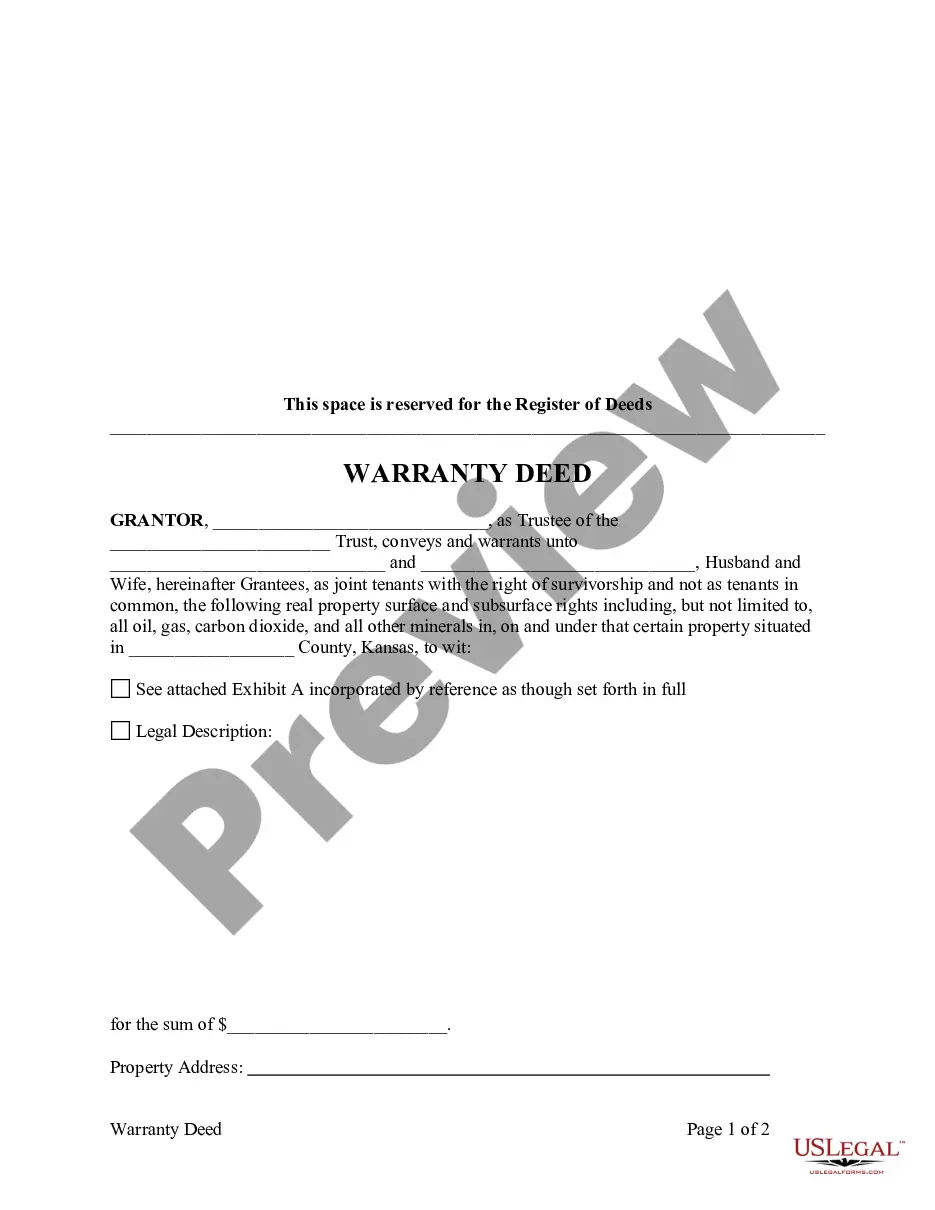

How to fill out Kansas Warranty Deed - Trust To Husband And Wife?

- Log in to your existing US Legal Forms account to download the requested form template. Check that your subscription is active; renew if necessary.

- If you're new to US Legal Forms, begin by selecting the appropriate form. Review the Preview mode for accuracy and compliance with local jurisdiction.

- Utilize the Search tab if you need alternative templates. Ensure that the form fits your requirements before proceeding.

- Purchase the document by clicking the Buy Now button. Choose the subscription plan that best suits your needs and create an account for full access.

- Complete your purchase using your credit card or PayPal. Make sure the payment is processed.

- Download the completed document. You can save the template on your device and access it anytime through the My Forms section of your profile.

In conclusion, US Legal Forms simplifies the process of naming deed tenants with title. Their extensive library and support from premium experts ensure you can create legally sound documents effortlessly.

Start exploring your legal form options today and streamline your document creation process!

Form popularity

FAQ

Most married couples opt for joint tenancy because it provides automatic rights of survivorship, allowing one spouse to inherit the property if the other passes away. This arrangement offers both protection and simplicity in estate planning. However, some couples may choose tenants in common for various reasons, including individual ownership percentages. It’s important to know how to name deed tenants with title to align with your goals.

The term 'tenant' can be confusing. In the context of property ownership, a tenant can refer to someone who holds an interest in the property but may not have full ownership rights. For example, in joint tenancy or tenants in common, you share ownership with other parties. Accurately naming deed tenants with title is essential for understanding your level of ownership.

If your deed refers to you as a tenant, it usually indicates that you have a specific ownership interest in a property. This terminology often reflects the type of ownership structure in place, such as joint tenancy or tenants in common. Understanding these terms can help clarify your rights and responsibilities when you name deed tenants with title.

A deed can become invalid for various reasons, including lack of proper signatures, absence of legal descriptions, or failure to acknowledge the deed correctly. Additionally, if the signers do not have the legal capacity to execute the deed, it becomes invalid. It is crucial to ensure everything is in order when you name deed tenants with title to maintain its validity.

One disadvantage of joint tenancy ownership is that the property may face complications during the owner's bankruptcy or legal issues. If one tenant has debts, creditors may claim their share of the property. This can lead to loss of control for other tenants. Knowing how to name deed tenants with title can help you avoid such pitfalls.

Tenants by the entirety refers to a form of property ownership specifically for married couples. In this arrangement, both spouses have equal ownership and rights to the property. This means that if one spouse passes away, the other automatically inherits the full title. Understanding this term is essential when you name deed tenants with title.

Yes, your parents can put you on the deed to their house. This decision can facilitate shared ownership and make future plans regarding the property easier. However, it’s essential to consider the implications of shared ownership, including tax responsibilities and estate planning, to ensure that the name deed tenants with title aligns with everyone's long-term goals.

Adding a name to a deed can take anywhere from a few days to a couple of weeks, depending on local processing times. Once you file the new deed with the appropriate government office, they will review the document for accuracy and compliance. Using the US Legal Forms service can streamline this process by providing you with the right tools and templates to ensure your submission is correct.

When you put someone's name on a deed, that person gains a legal interest in the property. This change can impact tax obligations, ownership rights, and responsibilities related to the property. It is crucial to understand these implications fully before making such a decision, as the name deed tenants with title may affect future transactions.

Yes, you can add someone to your deed without refinancing. This process involves drafting a new deed and recording it with your local government office. Keep in mind that while refinancing is not necessary, you should also consider the potential tax implications and ensure the new tenant's name fits your title's legal requirements.