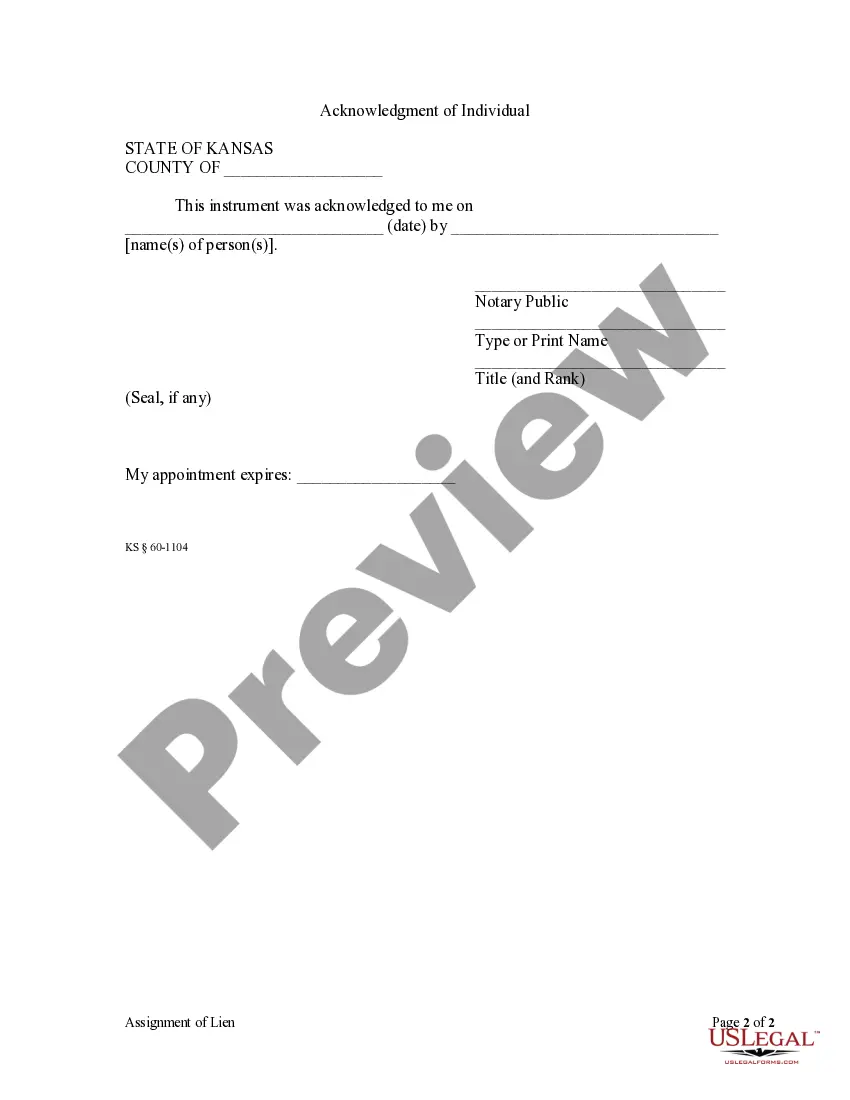

This Assignment of Lien form is for use by an individual lien claimant who furnished or supplied labor, materials, or laborers for the purpose of improvements of real property, such that the lien claimant is entitled to a lien for the value of labor, materials, or laborers supplied, to assign his or her claim and lien, including all the rights and remedies under law to which the lien claimant is entitled, subject to all defenses thereto that might be made if such assignment had not been made, for the purpose of filing and for the enforcement of the lien.

Kansas Lien Entry Form

Description

Form popularity

FAQ

In Kansas, you generally have six months from the date the debt was incurred to file a lien. However, there are some exceptions based on the type of lien, which may alter the timeframe. It’s crucial to act promptly to protect your rights and secure a claim on the property. For guidance, utilizing the Kansas lien entry form can ensure you meet all legal criteria within the specified timeframe.

A notice of intent to file a lien in Kansas serves as a warning to the property owner of a pending lien due to unpaid obligations. This notice must be sent before filing the actual lien, providing the owner a chance to resolve the debt. It often helps in reducing disputes and encourages timely payment. This step ensures transparency and is sometimes a requirement based on the type of work done.

To deal with a title that has a lien, you may need to negotiate with the lienholder for a release or accept a subordinate position. Alternatively, consider paying off the lien, which clears the title and allows for smoother transactions. If you plan to sell or refinance the property, having a clear title simplifies the process. Utilize services like USLegalForms to assist with necessary documentation.

Yes, a contractor in Kansas can file a lien without a formal contract if they have provided services or materials that benefited the property. However, it's important to document any agreements or communications relating to the work done. To do this, use the Kansas lien entry form, stating clearly the services rendered and the amount owed. Filing in this way protects your rights as a contractor.

Filing a lien on a car in Kansas involves filling out the Kansas lien entry form specific to vehicle liens. Gather necessary details, such as the vehicle’s VIN, the debtor's information, and the amount owed. Submit the completed form to the Kansas Department of Revenue along with any required fees. Ensure you notify the vehicle owner about the lien to maintain transparency.

To get a lien release in Kansas, you should first obtain a lien release form, confirming that the debt has been satisfied. Once you complete the form, file it with the same county register of deeds where the original lien was recorded. It’s important to provide any evidence of payment or satisfaction of the debt. This process clears the property title and updates public records.

To file a lien in Kansas, start by obtaining the appropriate Kansas lien entry form. You need to complete this form with accurate details about the property and the debt owed. Once you have filled it out, file it with the county register of deeds in the county where the property is located. Ensure you keep a copy for your records and check for any additional requirements.

In Kansas, a lien is generally valid for a period of five years unless it is renewed or released. If the debt remains unpaid, the lien can be extended by filing a Kansas lien entry form before the original lien expires. This extension allows you to maintain your claim over the property for an additional period. It is wise to keep track of the lien's validity to ensure your rights remain protected.

Releasing a lien in Kansas involves completing a Kansas lien entry form, which documents the satisfaction of the debt. You should ensure that the lien holder signs this form, as their signature is essential for validation. After completing the form, file it with the relevant county clerk’s office to officially release the lien. This process safeguards your financial interests and clears any encumbrance on your property.

To obtain a lien release in Kansas, you need to secure the necessary documentation from the lien holder. Typically, this involves filling out a Kansas lien entry form that the lien holder will provide upon request. This form confirms the satisfaction of the debt associated with the lien. Additionally, it allows you to file the release with the appropriate county office.