Kansas 60 Lien With Lien

Description

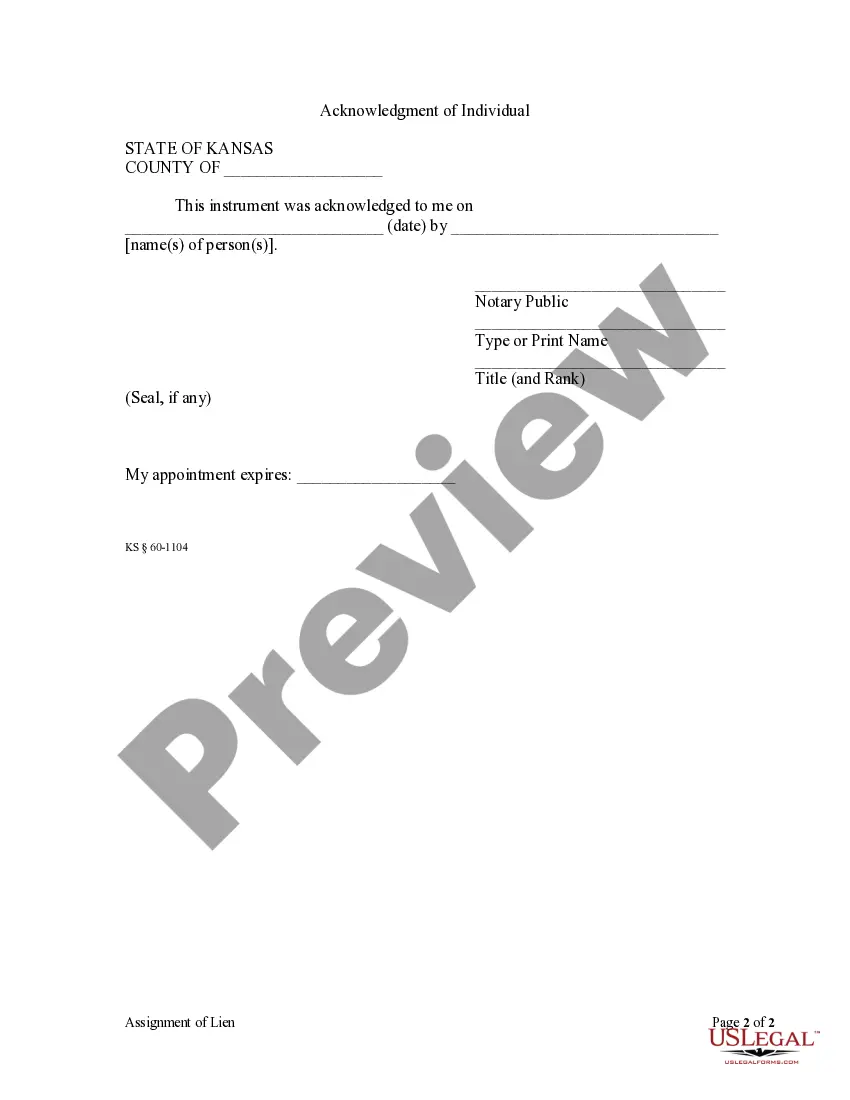

How to fill out Kansas Assignment Of Lien - Individual?

- If you're an existing user, log in to your account and download the Kansas 60 lien with lien form by clicking the Download button. Ensure your subscription is active; renew it if necessary.

- For first-time users, begin by checking the Preview mode and description of the Kansas 60 lien with lien form to confirm its suitability for your needs.

- If you need a different form, use the Search tab to find one that meets your requirements.

- Select the appropriate document by clicking the Buy Now button and choosing a subscription plan. Register an account to gain access.

- Complete your purchase by entering your credit card details or using PayPal to finalize the subscription.

- Once your transaction is complete, download the Kansas 60 lien with lien form to your device and access it anytime through the My documents menu.

In conclusion, US Legal Forms empowers individuals and attorneys with a diverse library of over 85,000 fillable legal forms. By following these simple steps, you can easily obtain the Kansas 60 lien with lien form tailored to your specific needs.

Don't wait; start your legal journey today with US Legal Forms to ensure your documents are precise and legally sound!

Form popularity

FAQ

A lien in Kansas is generally valid for a period of six months after it is filed. If the lienholder does not enforce the lien within this timeframe, they may lose their rights, including any associated claims with a Kansas 60 lien with lien. This time limitation highlights the importance of acting promptly and seeking advice from professionals when dealing with liens. Keeping informed lets you navigate this effectively.

In Kansas, the penalty for disorderly conduct can include fines and potentially jail time. This can vary based on the severity of the conduct and prior offenses. Understanding the implications of such laws is important, especially if they could affect property disputes related to a Kansas 60 lien with lien. If you find yourself in a legal bind, seeking professional advice can help.

When you receive a lien release in Kansas, it indicates that the lien has been lifted, clearing your property title. It's important to file this document with the appropriate county office to update public records and ensure your property's status is clear. This makes it crucial in the context of a Kansas 60 lien with lien. Keep a copy for your records as proof of the release.

Statute 60 1101 in Kansas establishes the framework for the enforcement of liens, including the Kansas 60 lien with lien. This statute outlines the requirements for creating, enforcing, and releasing liens on property. Understanding this statute empowers individuals to navigate the lien process effectively. If you need assistance, our platform offers resources that explain this statute in detail.

In Kansas, a contractor must file a lien within four months after the last day of work or delivery of materials. This timeframe is crucial for ensuring a valid Kansas 60 lien with lien. If the contractor fails to file within this period, they risk losing their right to enforce the lien. It's vital to keep track of dates to protect your interests in lien situations.

The discovery rule in Kansas allows a party to delay filing a claim until they discover or should have discovered the injury or damage. This rule is particularly useful in cases involving liens, such as a Kansas 60 lien with lien. By applying this rule, individuals gain the necessary time to gather evidence and ensure their claims are valid. If you are dealing with a lien issue, knowing this rule can help protect your rights.

To put a lien on property in Kansas, begin by determining the basis for the lien, such as unpaid services or debts. You must complete a lien statement, accurately providing details about the debtor and the debt owed. File the statement with the relevant county office to make it official. Platforms like UsLegalForms offer templates to help you create and file your lien accurately.

A notice of intent to lien in Kansas serves as a formal communication indicating your plan to file a lien against a property. This notice must be sent to the property owner before you file, giving them an opportunity to resolve the debt. It's an important step that can help avoid legal complications later. Understanding this process is key to successfully managing a Kansas 60 lien with lien.

To file a lien on a property in Kansas, identify the appropriate court and prepare the necessary documentation. You will typically need to fill out a lien statement that details the debt and property information. After filing, remember to serve a copy to the property owner, ensuring they are aware of the Kansas 60 lien with lien against their property. For assistance, consider using UsLegalForms, which offers resources to navigate this process.

Getting a title for a car that was charged off involves addressing the lien situation first. Contact the lender to request any necessary documentation like a lien release. Then, proceed to your DMV to apply for a new title using this documentation. This process ensures that you properly rectify the situation while navigating challenges related to Kansas 60 lien with lien.