Llc Operating Agreement Kansas For Married Couple

Description

How to fill out Kansas Limited Liability Company LLC Operating Agreement?

Regardless of whether you manage documents often or occasionally need to submit a legal file, it's essential to find a resource where all the examples are pertinent and current.

The first step you should take with a Llc Operating Agreement Kansas For Married Couple is to ensure that it is indeed the latest version, as this determines whether it can be submitted.

If you want to streamline your search for the most recent document samples, consider looking for them on US Legal Forms.

Utilize the search menu to locate the desired form.

- US Legal Forms is an extensive repository of legal documents that includes nearly every sample you might need.

- Locate the templates you require, assess their relevance immediately, and learn more about their application.

- With US Legal Forms, you gain access to over 85,000 form templates across various fields.

- Find the Llc Operating Agreement Kansas For Married Couple samples in just a few clicks and save them anytime in your account.

- Having a US Legal Forms account enables you to access all the samples you require with ease and minimal hassle.

- Simply click Log In on the website header and navigate to the My documents section to have all the forms you need at your fingertips, eliminating the need to spend time searching for the appropriate template or evaluating its suitability.

- To obtain a form without an account, follow these steps.

Form popularity

FAQ

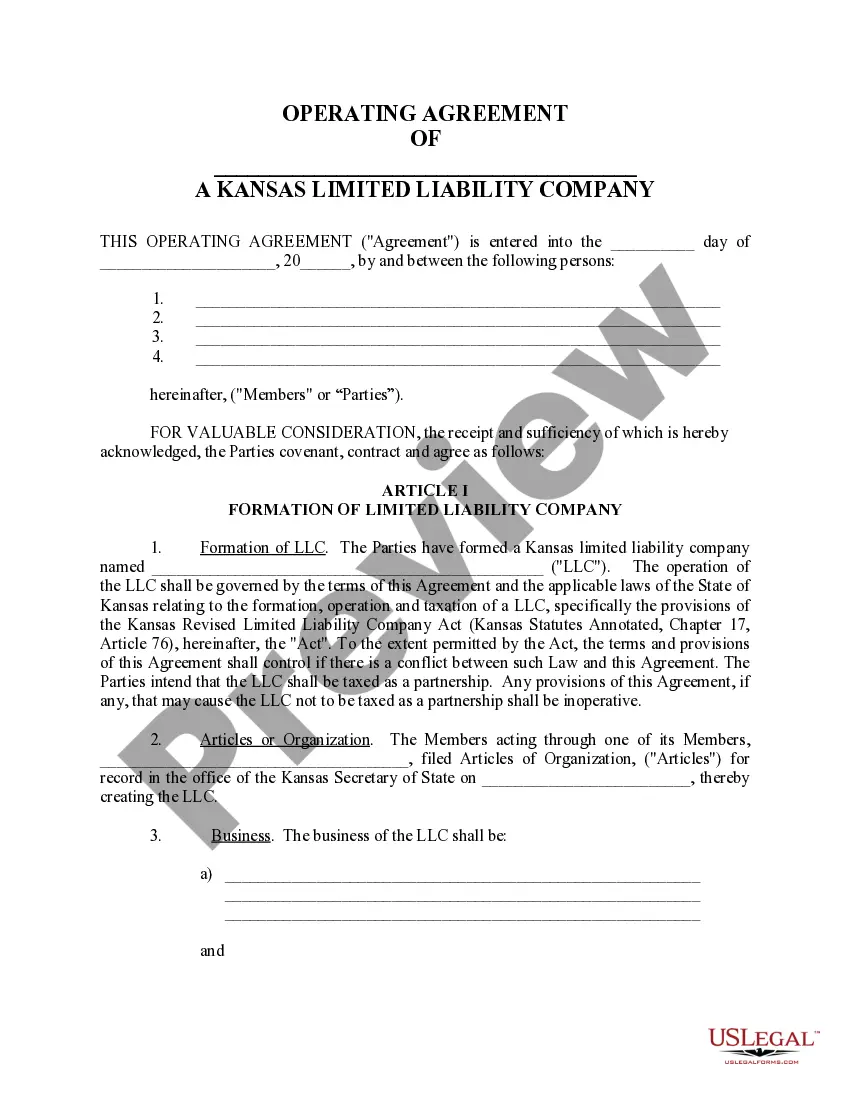

How to Write an Operating Agreement Step by StepStep One: Determine Ownership Percentages.Step Two: Designate Rights, Responsibilities, and Compensation Details.Step Three: Define Terms of Joining or Leaving the LLC.Step Four: Create Dissolution Terms.Step Five: Insert a Severability Clause.

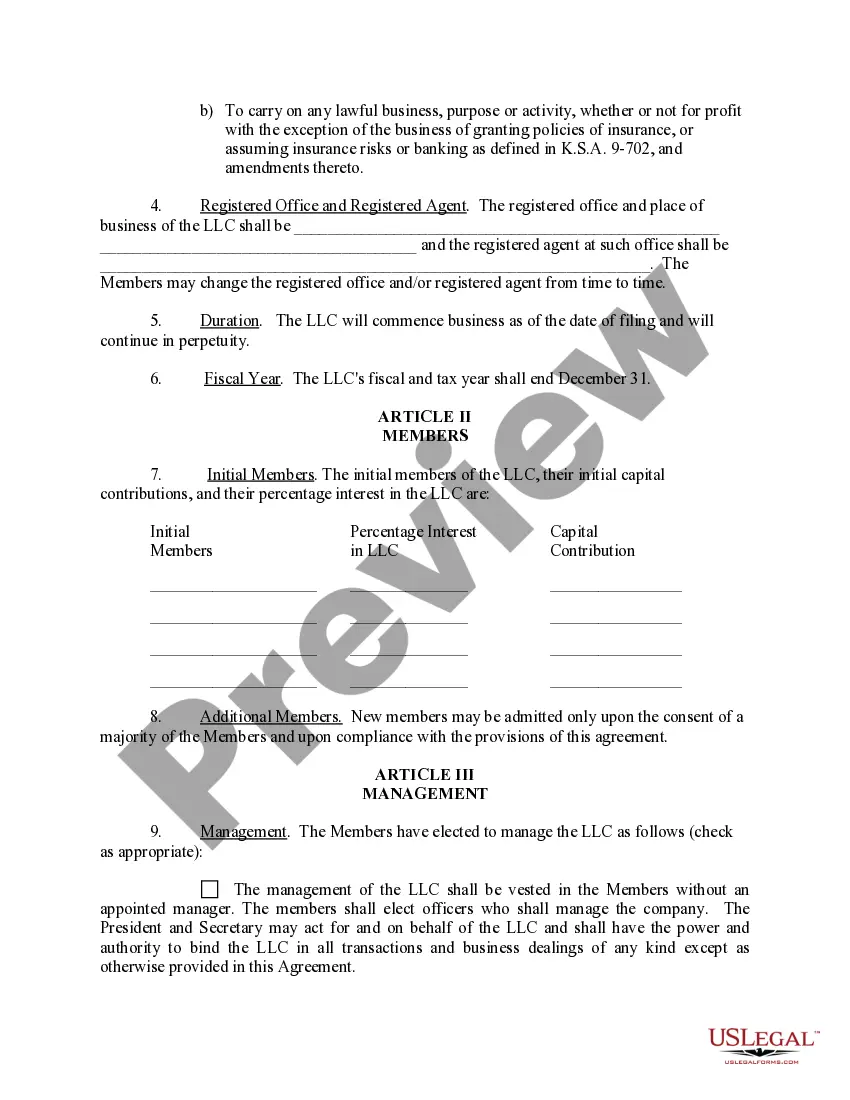

The LLC is wholly owned by the husband and wife as community property under state law. no one else would be considered an owner for federal tax purposes, and. the business is not otherwise treated as a corporation under federal law.

If your LLC has one owner, you're a single member limited liability company (SMLLC). If you are married, you and your spouse are considered one owner and can elect to be treated as an SMLLC.

Kansas does not require LLCs to have operating agreements, but it is highly advisable to have one. An operating agreement will help protect your limited liability status, prevent financial and managerial misunderstandings, and ensure that you decide on the rules governing your business instead of state law by default.

Get together with your co-owners and a lawyer, if you think you should (it's never a bad idea), and figure out what you want to cover in your agreement. Then, to create an LLC operating agreement yourself, all you need to do is answer a few simple questions and make sure everyone signs it to make it legal.