Kansas Odometer Statement For Florida

Description

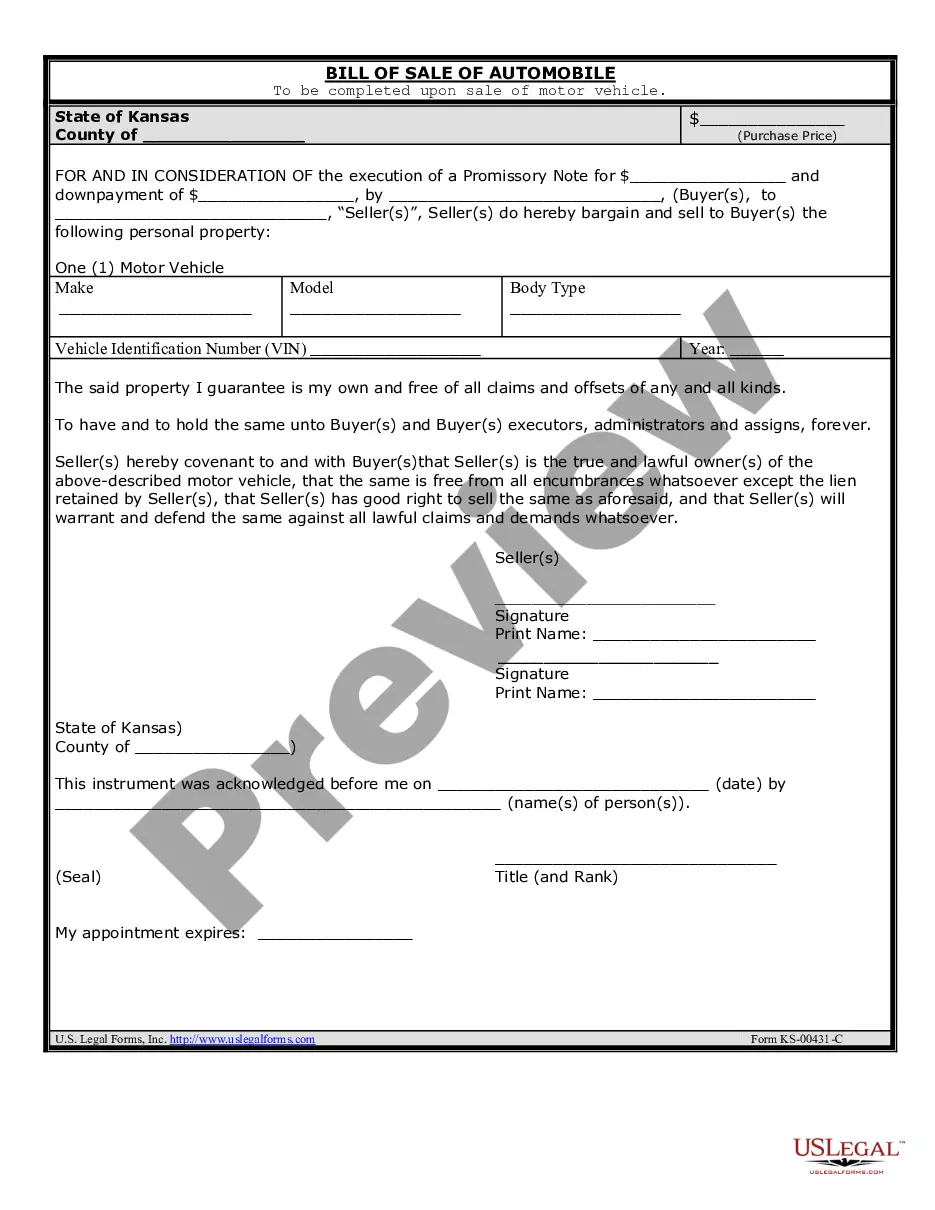

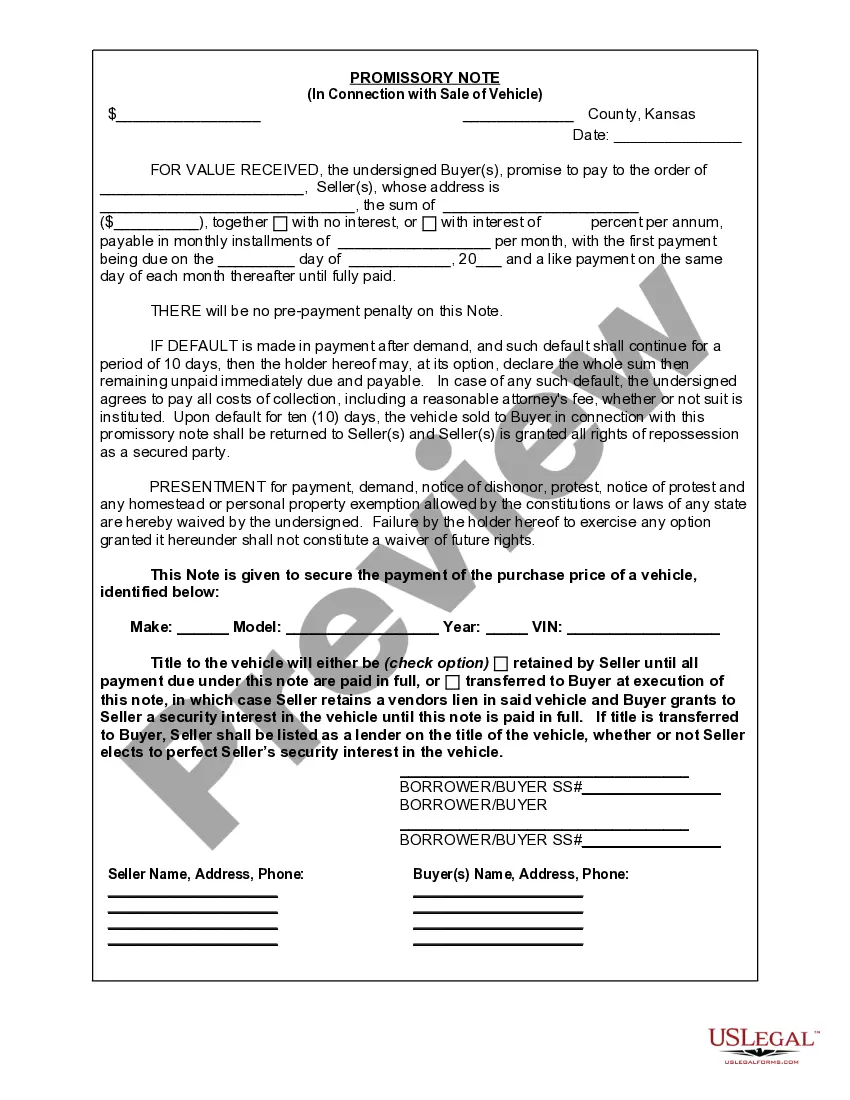

How to fill out Kansas Bill Of Sale For Automobile Or Vehicle Including Odometer Statement And Promissory Note?

Obtaining a reliable source for the most up-to-date and suitable legal templates is half the battle of dealing with bureaucracy. Selecting the correct legal documents requires precision and careful attention, which is why it is essential to obtain samples of Kansas Odometer Statement For Florida exclusively from reputable sources, such as US Legal Forms. An incorrect template will squander your time and hinder your current situation. With US Legal Forms, you have minimal concerns. You can access and review all the information regarding the document’s application and significance for your circumstances and in your state or region.

Consider the outlined steps to complete your Kansas Odometer Statement For Florida.

Once you have the form on your device, you may modify it using the editor or print it and fill it out manually. Eliminate the complications associated with your legal documentation. Explore the extensive US Legal Forms collection to locate legal templates, assess their applicability to your situation, and download them instantly.

- Utilize the library navigation or search bar to locate your sample.

- Examine the form’s description to determine if it meets the criteria of your state and county.

- Check the form preview, if available, to confirm the template is what you are looking for.

- Continue searching for the suitable template if the Kansas Odometer Statement For Florida does not align with your needs.

- If you are confident about the form’s applicability, download it.

- If you are a registered user, click Log in to verify and access your chosen forms in My documents.

- If you do not have an account yet, click Buy now to acquire the form.

- Select the pricing plan that best fits your requirements.

- Proceed to the registration to complete your purchase.

- Finalize your purchase by choosing a payment method (credit card or PayPal).

- Select the document format for downloading Kansas Odometer Statement For Florida.

Form popularity

FAQ

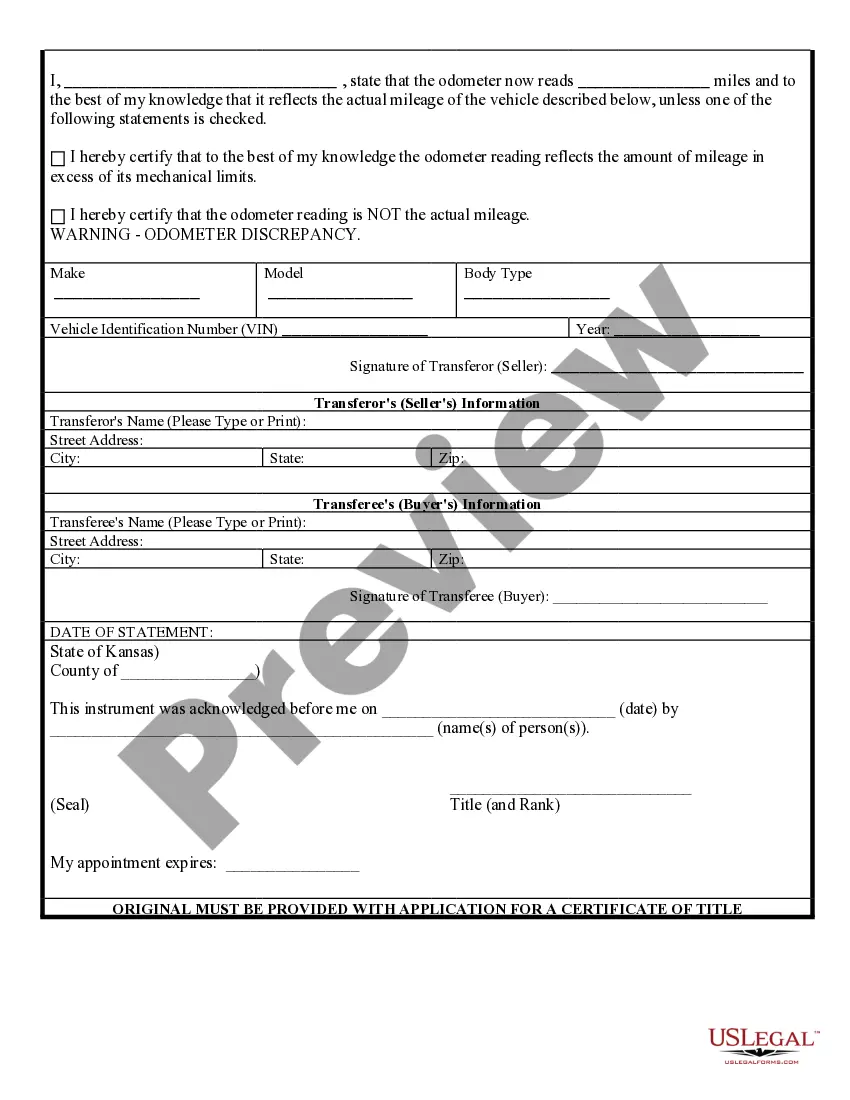

Obtaining an odometer disclosure statement is a simple process. You can create one through various platforms, including US Legal Forms, which offers templates specifically designed for both Kansas and Florida. Just fill in the required details, and you'll have the statement ready for your vehicle transaction. This will ensure you comply with the legal requirements and protect your interests.

Not all states have the same requirements regarding odometer disclosure. However, most states, including Florida, do require it during vehicle sales to prevent fraud. Understanding these regulations is essential, especially if you're moving from Kansas to Florida. You can find helpful resources and forms on US Legal Forms to assist you with the necessary odometer statements.

Yes, Florida does require an odometer disclosure statement when you transfer ownership of a vehicle. This statement is crucial as it protects both the seller and the buyer by ensuring accurate mileage reporting. If you're coming from Kansas, you can use the Kansas odometer statement for Florida to meet this requirement easily. US Legal Forms provides a straightforward solution to obtain this document quickly.

Effective July 1, 2021, Senate Bill 1134 passed amending section 319.225(4), Florida Statutes, exempting a vehicle with a model year of 2011 or newer from odometer disclosure after 20 years, and a vehicle with a model year of 2010 or older from odometer disclosure after 10 years.

(1)(a) It is unlawful for any person knowingly to tamper with, adjust, alter, set back, disconnect, or fail to connect an odometer of a motor vehicle, or to cause any of the foregoing to occur to an odometer of a motor vehicle, so as to reflect a lower mileage than the motor vehicle has actually been driven, or to ...

Section 319.225(4), Florida Statutes, provides that upon transfer or reassignment of a certificate of title, the transferor shall complete the odometer disclosure statement and the transferee shall acknowledge the disclosure by signing and printing their names in the spaces provided.

A motor vehicle with a model year of 2011 or newer is exempt after twenty (20) years and a motor vehicle with a model year of 2010 or older is exempt after ten (10) years. EXEMPT VEHICLES - A vehicle should not be automatically exempted if an odometer reading is available.

Federal and Kansas law requires that you state the mileage upon transfer of ownership. Providing a false statement may result in fines and/or imprisonment.