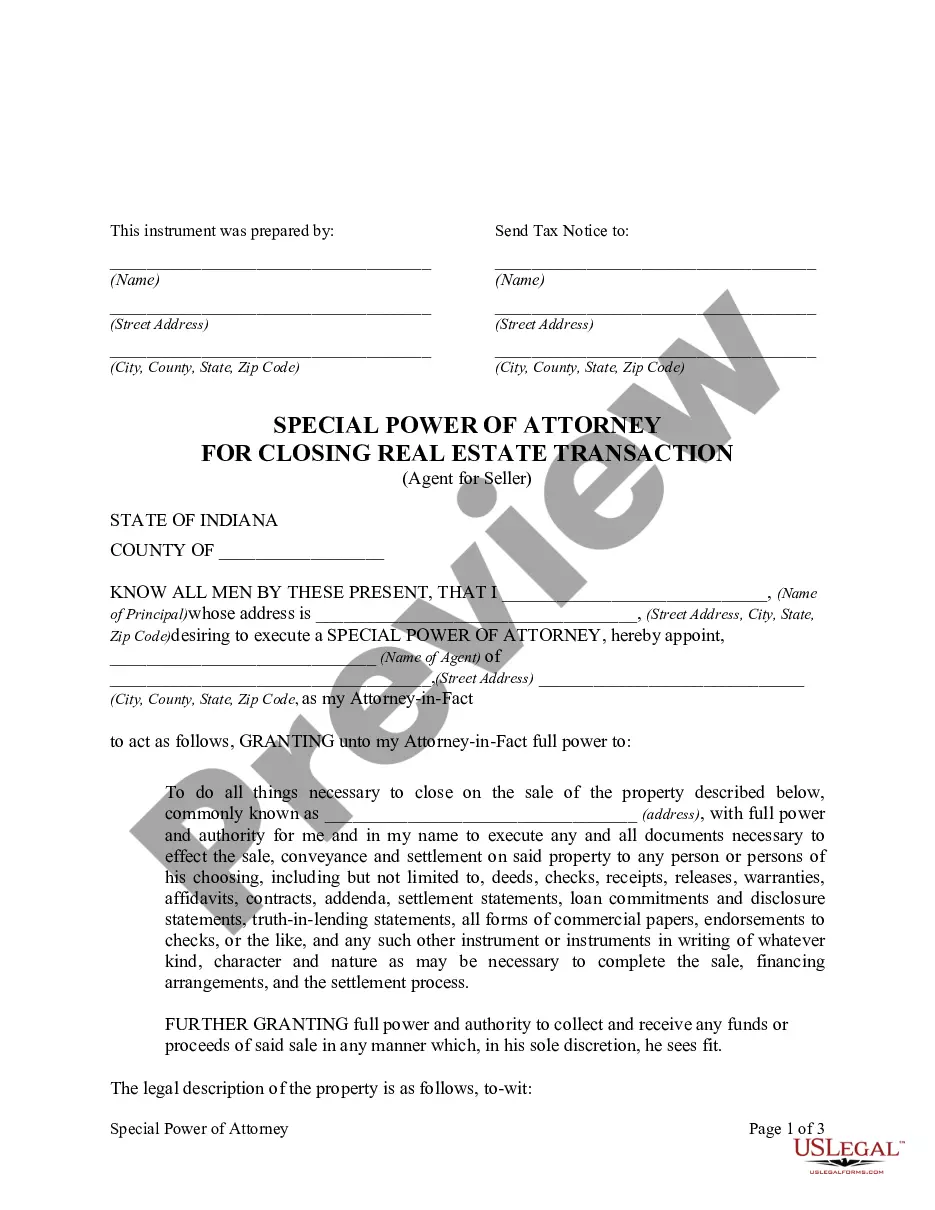

This Special or Limited Power of Attorney for Real Estate Sales Transaction By Seller form is for a Seller to authorize an attorney-in-fact to execute all documents and do all things necessary to convey a particular parcel of real estate for Seller.

State Of Indiana Limited Power Of Attorney Form

Description

How to fill out Indiana Special Or Limited Power Of Attorney For Real Estate Sales Transaction By Seller?

Navigating through the red tape of official documents and templates can be challenging, particularly when one does not engage in this professionally.

Even selecting the appropriate template for a State Of Indiana Limited Power Of Attorney Form can be laborious, as it needs to be valid and accurate to the final detail.

However, you will spend considerably less time picking a suitable template if it originates from a trustworthy source.

Obtain the correct form in a few straightforward steps.

- US Legal Forms is a platform that streamlines the process of locating the right forms online.

- US Legal Forms is a centralized hub for acquiring the latest document samples, understanding their application, and downloading them for completion.

- It serves as a repository with over 85K forms applicable in various sectors.

- When searching for a State Of Indiana Limited Power Of Attorney Form, you won’t need to doubt its authenticity since all forms are validated.

- Having an account at US Legal Forms ensures you have all the necessary documents at your fingertips.

- You can save them in your history or add them to the My documents collection.

- You can access your saved documents from any device by clicking Log In on the library site.

- If you do not yet possess an account, you can always search for the template you require.

Form popularity

FAQ

How to Fill Out an Application for Title or Registration FormVehicle Information.The Owner's Information.Title Holder's Information.Fill in the Cost and Operation Information.The Owner's Signature.The Owner's Second Signature.Recheck the Vehicle Information.Verify Proper Assignation of the title.More items...?

Indiana POA RequirementsBe in writing.Name an attorney in fact.Give the attorney in fact the power to act on behalf of the principal.Be signed by the principal or at the principal's direction by another individual in the presence of a notary public.

Notarization or Witnessing RequirementIndiana law requires that you either sign your POA in the presence of a notary public or in the presence of two witnesses. Witnesses cannot be: someone you named as an agent or successor agent in the POA. someone who is granted some other power or benefit in the POA.

The Indiana Power of Attorney Act sets out four requirements for a valid power of attorney: (1) it must be in writing; (2) it must name the attorney in fact; (3) it must give the attorney in fact the power to act on behalf of the principal; and (4) it must be signed by the principal in the presence of a notary public.

Submit the form to the Indiana DOR.Submit the POA-1 by fax to (317) 615-2605.Send the original POA-1 by mail to Indiana Department of Revenue, PO Box 7230, Indianapolis, IN 46207-7230.