Carta De Custodia Withholding

Description

How to fill out Indiana General Power Of Attorney For Care And Custody Of Child Or Children?

Locating a reliable source for the latest and suitable legal templates is a significant part of navigating bureaucracy.

Selecting the appropriate legal documents requires accuracy and meticulousness, which highlights the importance of acquiring samples of Carta De Custodia Withholding solely from trustworthy providers, such as US Legal Forms. An incorrect template will squander your time and delay your current situation.

Eliminate the complications associated with your legal paperwork. Browse the extensive US Legal Forms catalog to discover legal templates, verify their relevance to your circumstances, and download them instantly.

- Utilize the catalog navigation or search bar to locate your sample.

- Examine the form’s details to confirm it meets the criteria of your state and region.

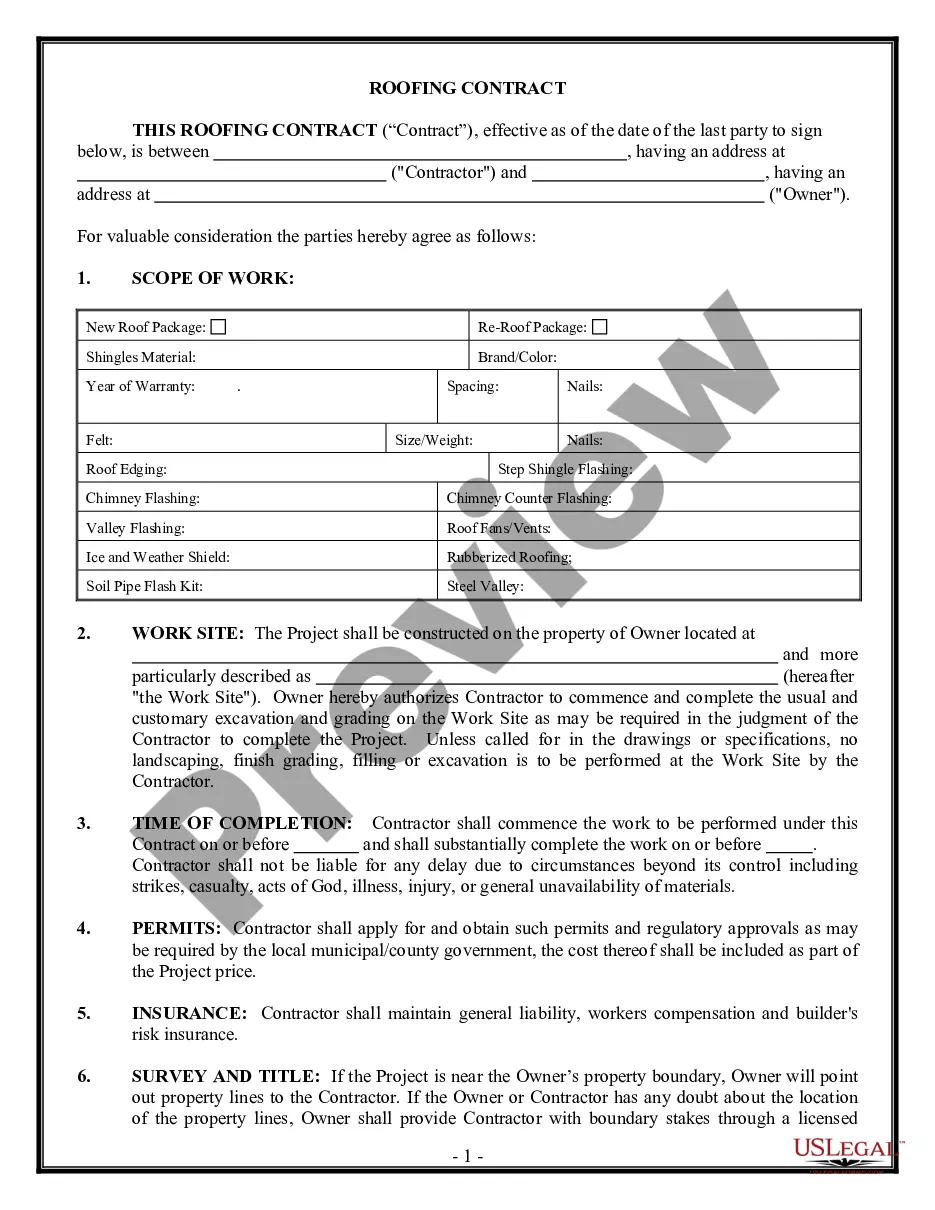

- Check the form preview, if available, to make sure the template is indeed the one you seek.

- Return to the search and look for the appropriate template if the Carta De Custodia Withholding does not meet your requirements.

- When you are confident about the form’s suitability, download it.

- If you are a registered user, click Log in to verify and access your chosen forms in My documents.

- If you haven't created an account yet, click Buy now to acquire the template.

- Select the pricing option that fits your needs.

- Proceed to the registration to finalize your purchase.

- Complete your transaction by choosing a payment method (credit card or PayPal).

- Select the file format for downloading Carta De Custodia Withholding.

- Once the form is on your device, you can edit it with the editor or print it and fill it out by hand.

Form popularity

FAQ

Is there an additional amount you want withheld from your paycheck? This is optional. You might choose it if, for instance, you earn freelance or other income and would like to increase your withholding to cover that income (although you should also consider paying quarterly estimated taxes in this case).

Exemption From Withholding If an employee qualifies, he or she can also use Form W-4 to tell you not to deduct any federal income tax from his or her wages. To qualify for this exempt status, the employee must have had no tax liability for the previous year and must expect to have no tax liability for the current year.

What Is Withholding Tax? The term withholding tax refers to the money that an employer deducts from an employee's gross wages and pays directly to the government.

For employees, withholding is the amount of federal income tax withheld from your paycheck. The amount of income tax your employer withholds from your regular pay depends on two things: The amount you earn. The information you give your employer on Form W?4.

If the stakeholder moved from one US state to another, Carta's tax system will estimate and split the total tax withholding amount across each jurisdiction based on how long the stakeholder lived in each jurisdiction.