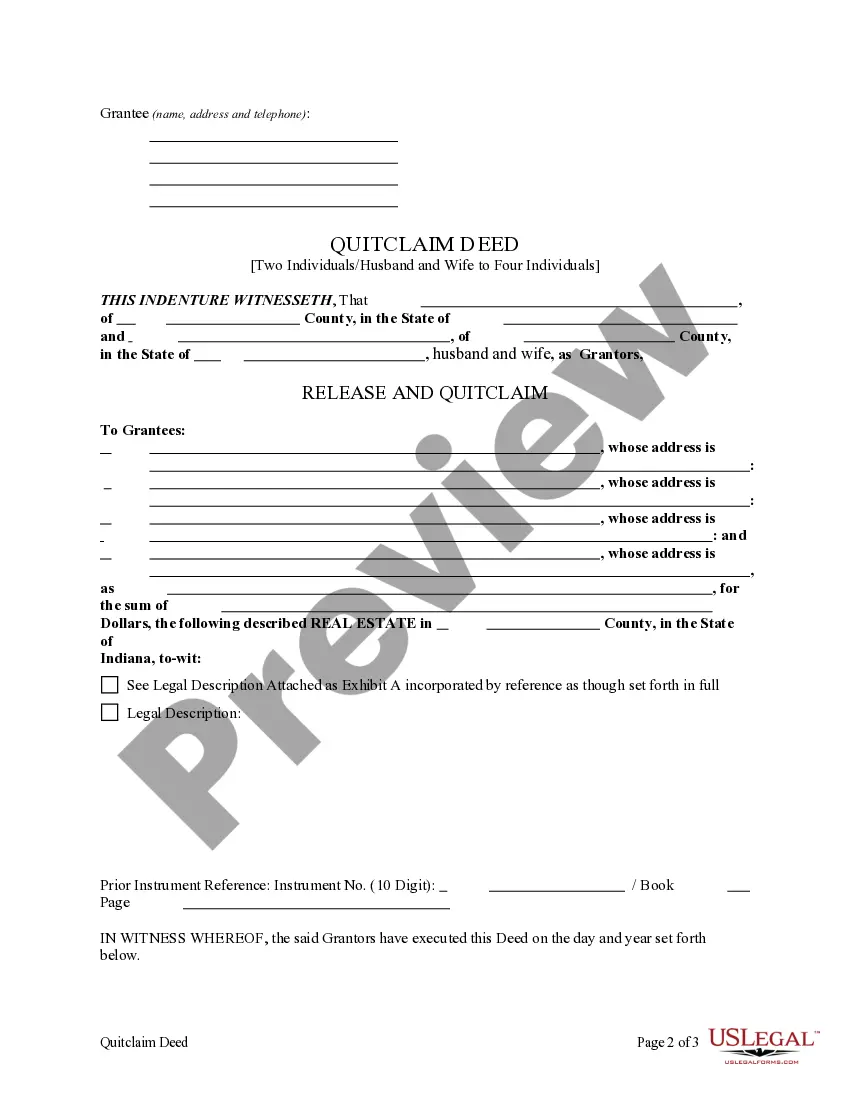

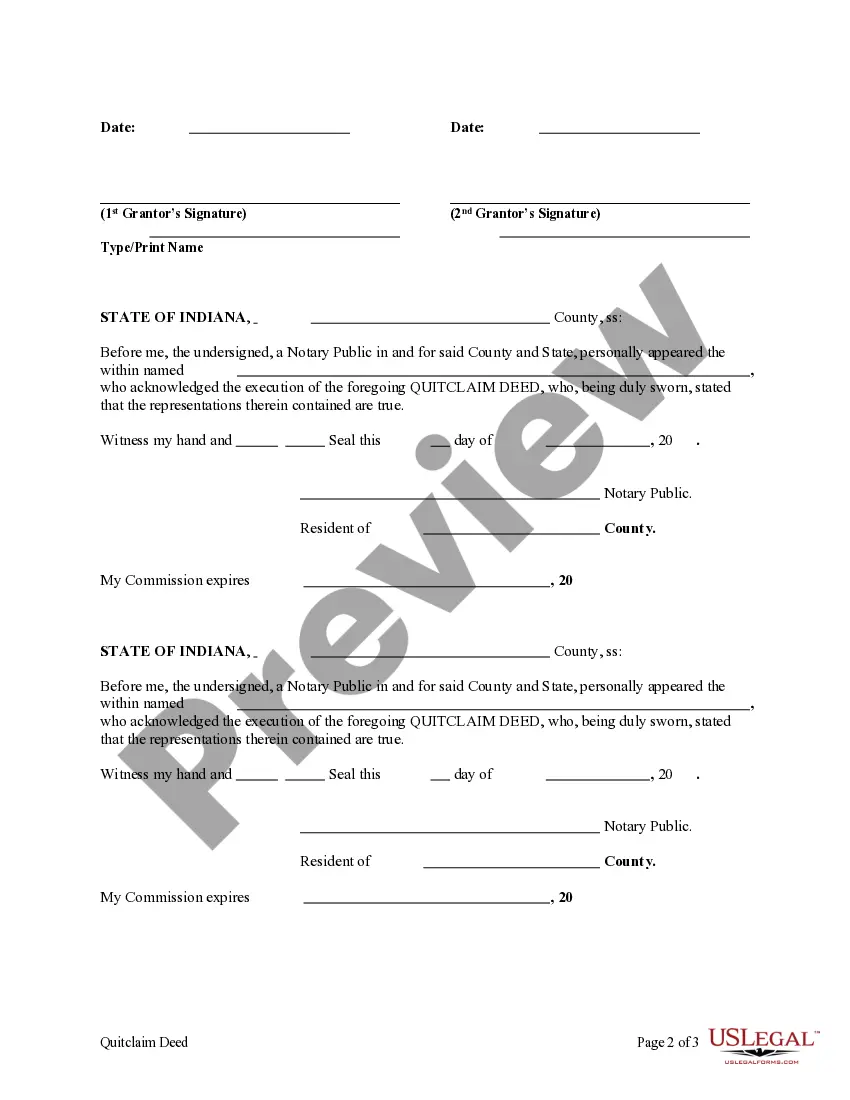

This form is a Quitclaim Deed where the Grantors are two individuals or husband and wife and the Grantee are four individuals. Grantors convey and quitclaim the described property to Grantees. The Grantees take the property as tenants in common or joint tenants with the right of survivorship. This deed complies with all state statutory laws.

In Quitclaim Deed Without Refinancing

Description

How to fill out In Quitclaim Deed Without Refinancing?

How to locate professional legal documents that adhere to your state regulations and prepare the In Quitclaim Deed Without Refinancing without hiring an attorney.

Numerous services online offer templates to address various legal situations and formalities. However, it may require time to identify which of the accessible samples meet both functionality and legal standards for you.

US Legal Forms is a trustworthy platform that assists you in finding formal documents crafted in accordance with the most recent state law amendments, allowing you to save on legal fees.

If you lack an account with US Legal Forms, then follow the steps below: Review the webpage you've opened and determine if the form meets your needs. To do this, make use of the form description and preview options if accessible. Search for another template in the header providing your state if needed. Click the Buy Now button once you find the suitable document. Select the most appropriate pricing plan, then Log In or register for an account. Choose the payment method (by credit card or via PayPal). Select the file format for your In Quitclaim Deed Without Refinancing and click Download. The obtained documents remain yours: you can always return to them in the My documents section of your profile. Subscribe to our platform and create legal documents independently like an expert legal professional!

- US Legal Forms is not just a standard web directory.

- It is a repository of over 85,000 verified templates for assorted business and life scenarios.

- All documents are categorized by area and state to expedite your search process and make it more user-friendly.

- Furthermore, it integrates with advanced solutions for PDF editing and electronic signatures, allowing users with a Premium subscription to swiftly finalize their paperwork online.

- Acquiring the necessary documents requires minimal effort and time.

- If you already possess an account, Log In and confirm that your subscription is active.

- Download the In Quitclaim Deed Without Refinancing using the appropriate button beside the file name.

Form popularity

FAQ

In Canada, you can remove someone's name from a mortgage without refinancing by using a quitclaim deed. This method permits you to alter the property title while keeping the mortgage intact, which can save you from the complexities of refinancing. It’s best to discuss this strategy with your lender and possibly a legal expert to ensure compliance with all regulations.

Yes, it is possible to remove someone from a mortgage without remortgaging. Utilizing a quitclaim deed without refinancing allows you to transfer ownership efficiently while maintaining the existing mortgage terms. It's advisable to coordinate with your lender to understand their specific requirements for this process.

Yes, you can take over someone's mortgage in Canada through a process known as mortgage assumption. This allows you to continue making payments without the need for refinancing, as long as the lender approves the transfer. Furthermore, a quitclaim deed can facilitate the change of ownership, simplifying the transition.

Removing a co-signer from a mortgage in Canada can be challenging but not impossible. One effective method is through a quitclaim deed without refinancing, which allows you to remove their name from the title while keeping the original mortgage intact. Consult with your lender and consider legal advice to ensure a seamless process.

You can refinance your mortgage as soon as you want, but it often makes sense to wait. Typically, you should allow at least six months to a year after obtaining your original mortgage. If you are considering a quitclaim deed without refinancing, you may find it beneficial to assess your equity and financial situation before deciding. Remember, using a quitclaim deed does not require refinancing, which can simplify your options.

The quickest way to get out of a mortgage often involves selling the property or using a quitclaim deed without refinancing. Selling allows you to clear the mortgage balance immediately, while a quitclaim deed transfers ownership without altering the mortgage terms. Whichever route you choose, ensuring you understand the implications on your finances is essential. Working with a professional can swiftly navigate you through these choices.

Removing yourself from a joint mortgage is possible, often achieved through a quitclaim deed. This approach enables you to transfer your interest while the remaining parties retain the mortgage. However, it's critical to discuss this with your lender, as they may require your joint partner's consent. Seeking professional advice can make this transition smoother.

Yes, it is possible to remove someone from a mortgage through specific methods, including a quitclaim deed. This document helps in transferring ownership rights without requiring refinancing. However, you must confirm with your lender whether they allow such changes without penalty. Engaging a legal expert can guide you through the process smoothly.

Breaking a mortgage can lead to penalties, ranging from fees to losing potential interest rate discounts. Typically, lenders impose a penalty for early termination, calculated as a percentage of the remaining mortgage balance or three months’ interest. Understanding these fees before proceeding is crucial for your financial planning. Always explore alternatives such as a quitclaim deed without refinancing to mitigate costs.

To remove someone from a mortgage without refinancing in Canada, you can utilize a quitclaim deed. This document transfers ownership interest from one party to another without affecting the existing mortgage terms. It’s essential to check with your lender, as they may have specific requirements. Always consider consulting a legal professional to ensure everything is handled correctly.