Limited Liability Company With Shares

Description

How to fill out Indiana Limited Liability Company LLC Operating Agreement?

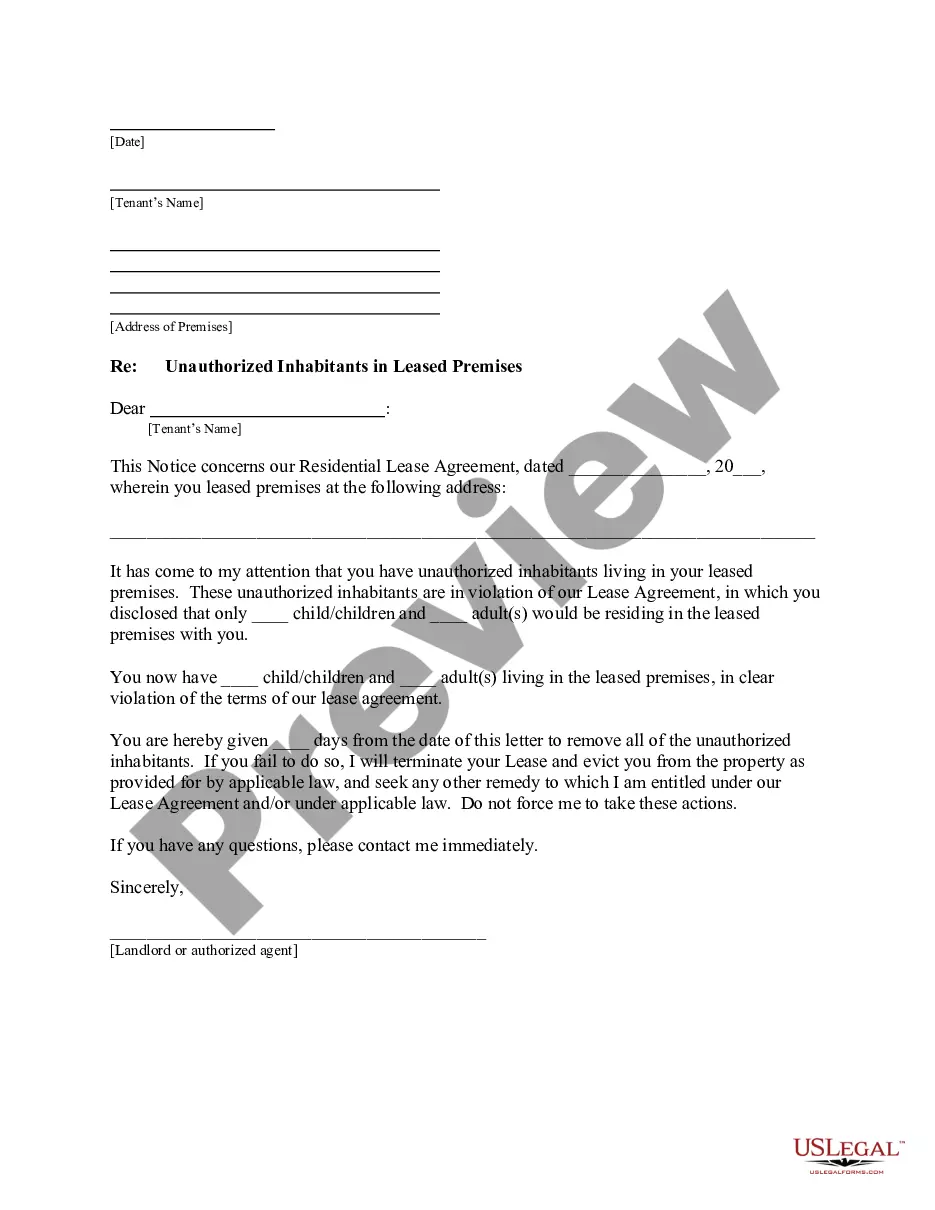

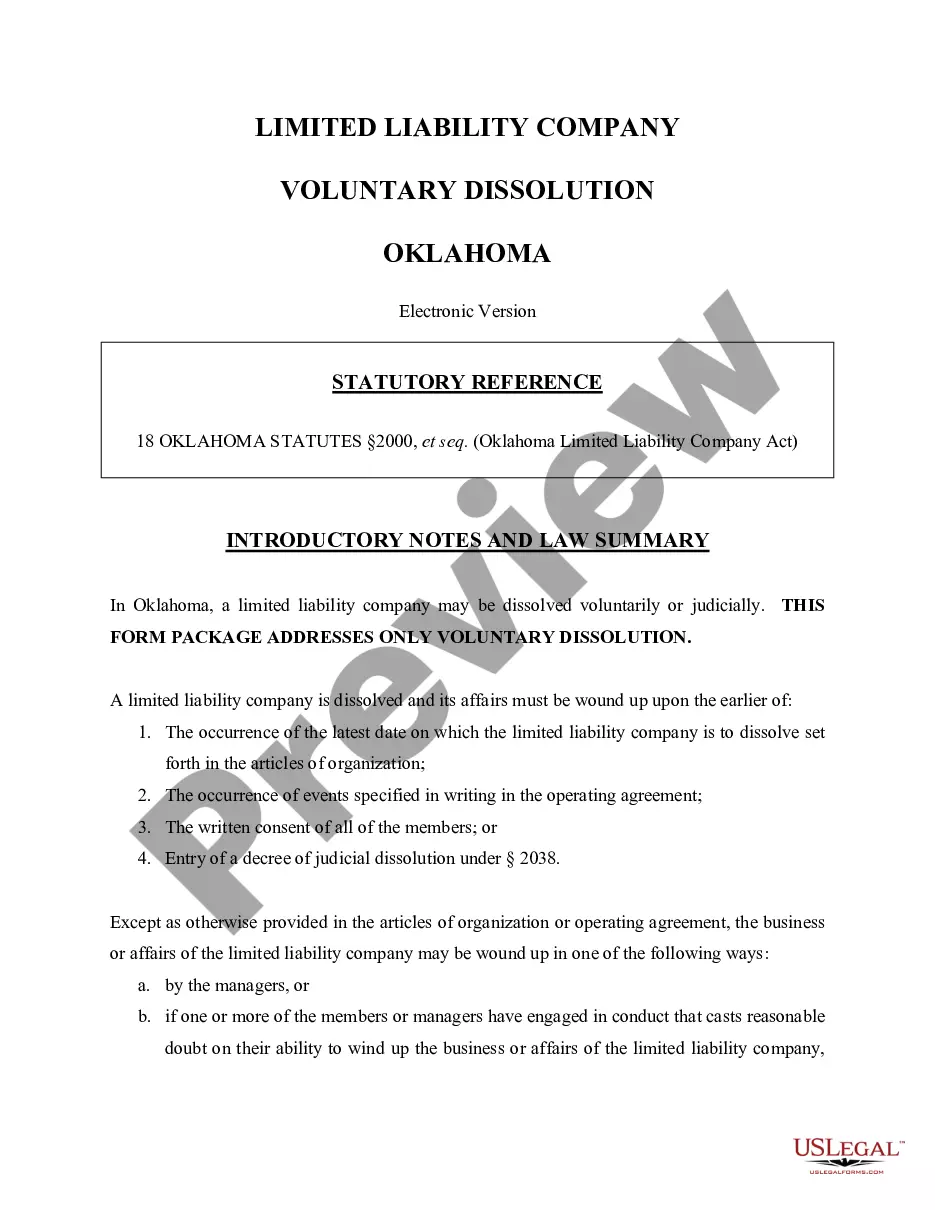

Whether for business purposes or for individual matters, everybody has to manage legal situations at some point in their life. Filling out legal paperwork demands careful attention, starting with picking the proper form template. For instance, if you choose a wrong edition of a Limited Liability Company With Shares, it will be turned down when you send it. It is therefore essential to get a dependable source of legal documents like US Legal Forms.

If you have to get a Limited Liability Company With Shares template, stick to these easy steps:

- Get the template you need using the search field or catalog navigation.

- Look through the form’s description to ensure it matches your situation, state, and county.

- Click on the form’s preview to see it.

- If it is the incorrect document, go back to the search function to find the Limited Liability Company With Shares sample you require.

- Get the file if it matches your needs.

- If you have a US Legal Forms profile, just click Log in to gain access to previously saved templates in My Forms.

- If you don’t have an account yet, you can download the form by clicking Buy now.

- Select the proper pricing option.

- Complete the profile registration form.

- Pick your payment method: you can use a credit card or PayPal account.

- Select the document format you want and download the Limited Liability Company With Shares.

- Once it is saved, you can complete the form with the help of editing applications or print it and finish it manually.

With a vast US Legal Forms catalog at hand, you do not need to spend time seeking for the right template across the internet. Utilize the library’s straightforward navigation to find the appropriate form for any situation.

Form popularity

FAQ

A limited liability company (LLC) cannot issue shares of stock. An LLC is a business entity structured to have either a single or multiple owners, who are referred to as the LLC's members.

Understanding Company Limited by Shares The ownership of a company limited by shares includes the members of the general public. Any person from the public can own a share in the company by buying through the stock exchange. The liability of the shareholders of the company is limited to the nominal value of the shares.

The LLC does not have stock or stockholders. Instead, the Operating Agreement has membership interests. The Operating Agreement lists the membership interests of each member rather than in separate member certificates.

The IRS rules restrict S corporation ownership, but not that of limited liability companies. IRS restrictions include the following: LLCs can have an unlimited number of members; S corps can have no more than 100 shareholders (owners).

How is LLC ownership divided? Usually, ownership percentage is directly correlated to how much each owner initially contributes to the LLC?so if one member contributes $2,000 while another contributes $8,000, the first member would own 20% of the LLC while the other would own 80%.