Limited Liability Company Formation

Description

How to fill out Indiana Limited Liability Company LLC Operating Agreement?

It’s clear that you cannot transform into a legal expert instantly, nor can you comprehend how to swiftly prepare Limited Liability Company Formation without possessing a distinct set of abilities.

Drafting legal documents is a lengthy process that necessitates specific training and expertise. So why not entrust the development of the Limited Liability Company Formation to the professionals.

With US Legal Forms, one of the most comprehensive legal template repositories, you can access everything from court documents to templates for office correspondence. We recognize how vital compliance and adherence to federal and local regulations are.

Create a free account and select a subscription plan to purchase the template.

Click Buy now. Once the purchase is finalized, you can download the Limited Liability Company Formation, fill it out, print it, and send or mail it to the required individuals or organizations.

- Thus, on our platform, all templates are region-specific and current.

- Begin by visiting our website and obtain the document you require in just a few minutes.

- Find the form you need using the search bar at the top of the page.

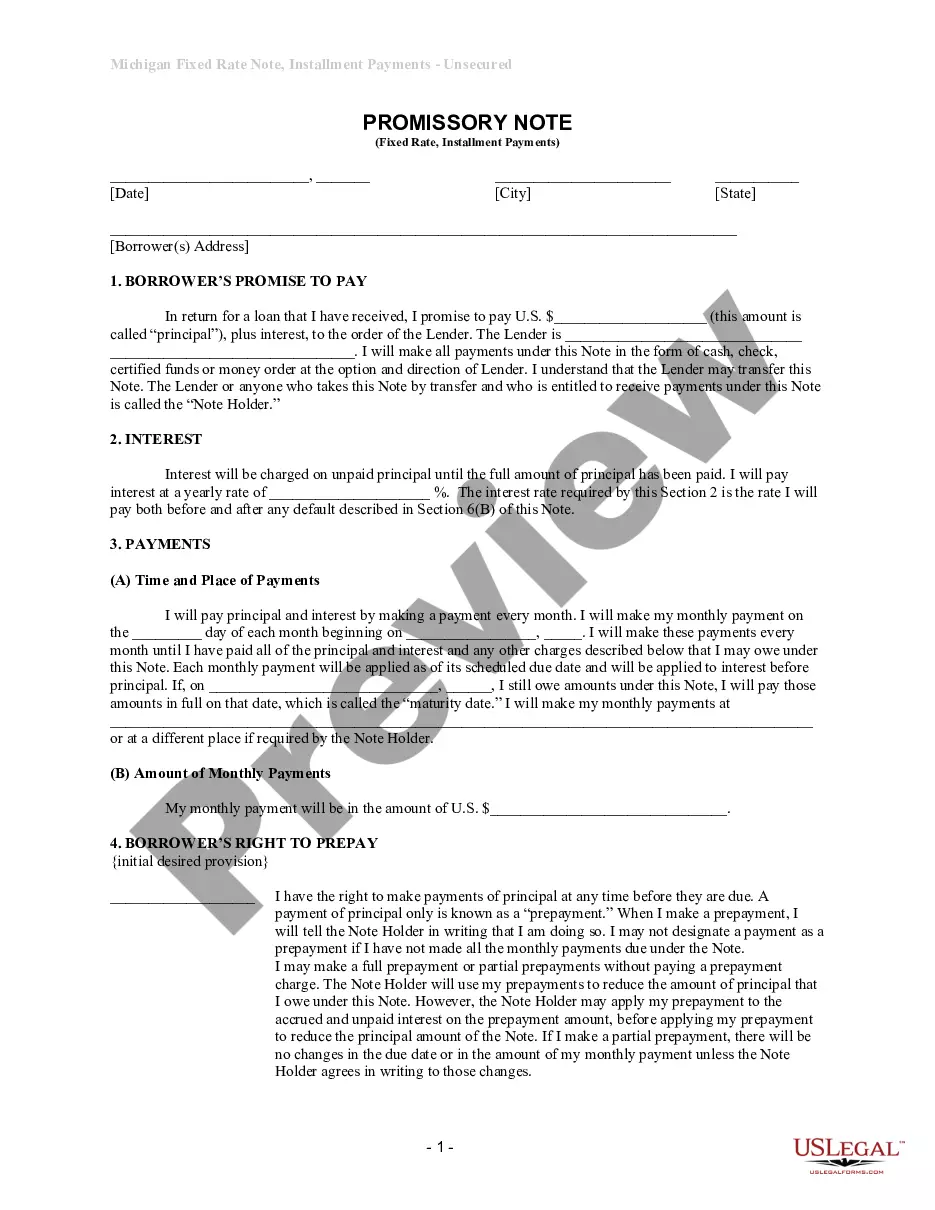

- Preview it (if this option is available) and review the accompanying description to determine whether Limited Liability Company Formation is what you seek.

- Restart your search if you require a different template.

Form popularity

FAQ

In Canada, a corporation is any business that is incorporated under the Canada Business Corporations Act (CBCA). This includes all businesses operating as LLCs in other countries or as corporations in any country.

LLPs and LLCs are functionally similar types of businesses in many countries, but LLCs gain classifications as corporations in Canada. This means that a business that already exists as an LLC may reestablish itself as an LLP to maintain the same types of protections in Canada.

25% LLC names must include ?LLC? in the name. ... Don't imply you're a different type of enterprise. ... Don't mislead the public. ... The name must match your business's purpose.

To make your new LLC officially exist you must file LLC formation documents (also known as a Certificate of Organization, Certificate of Formation, or Articles of Organization) with the Secretary of State's office or whichever department handles business filings in the state in which you are forming.

Single-member LLC owners are automatically treated like self-employed sole proprietors for tax purposes. But an LLC can also elect to be taxed as a corporation. With corporate taxation, an LLC owner can be an employee of the company rather than being self-employed.