Any Exempt Property For A 6th Grader

Description

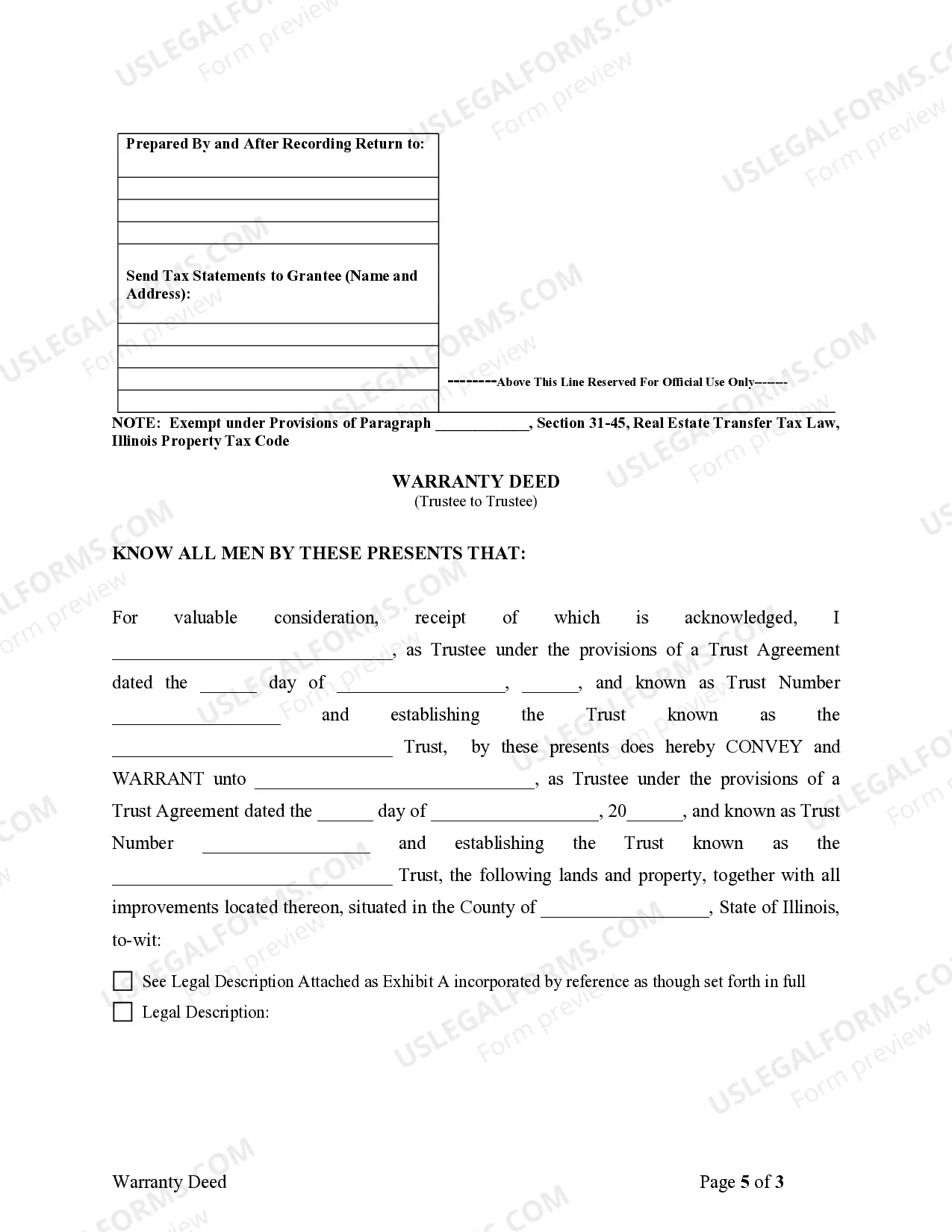

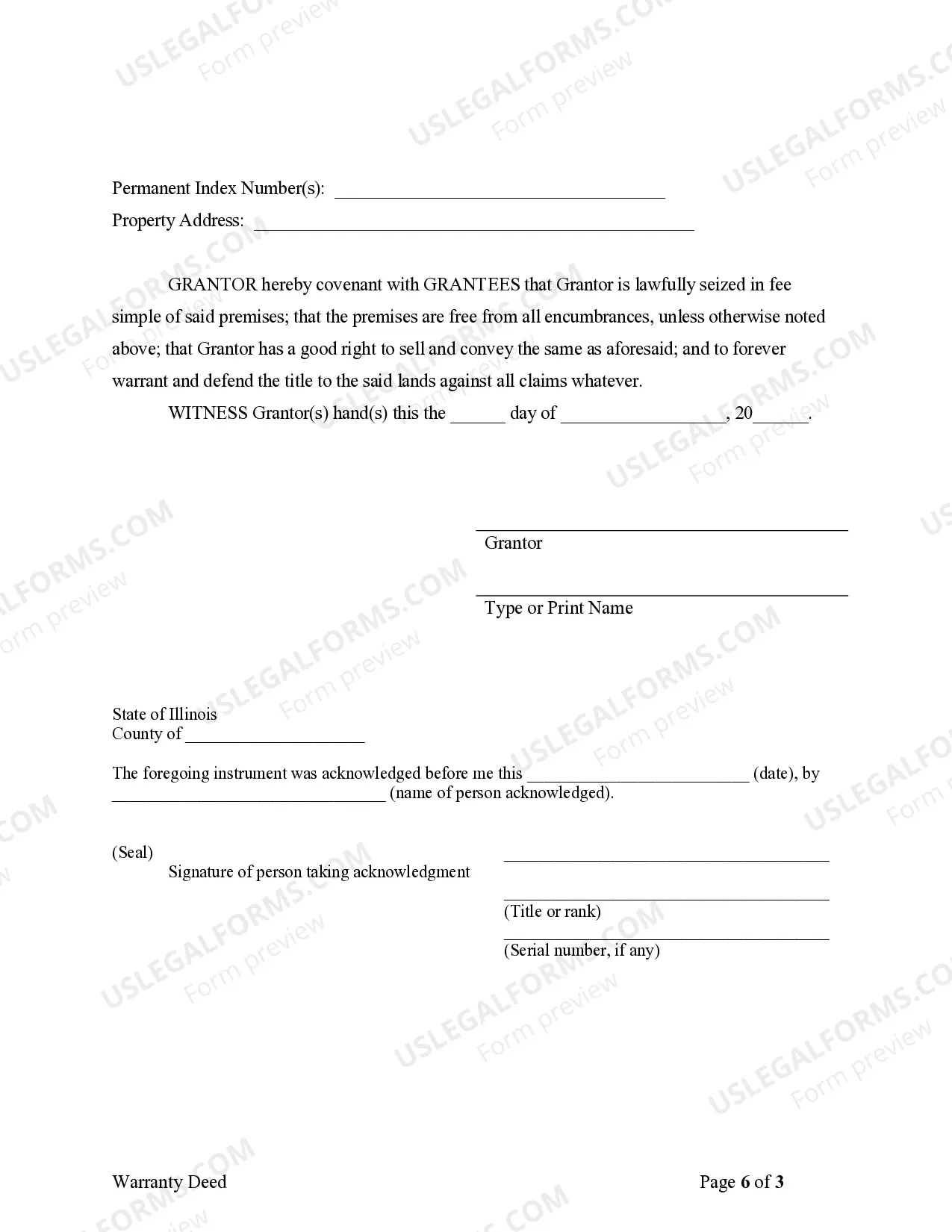

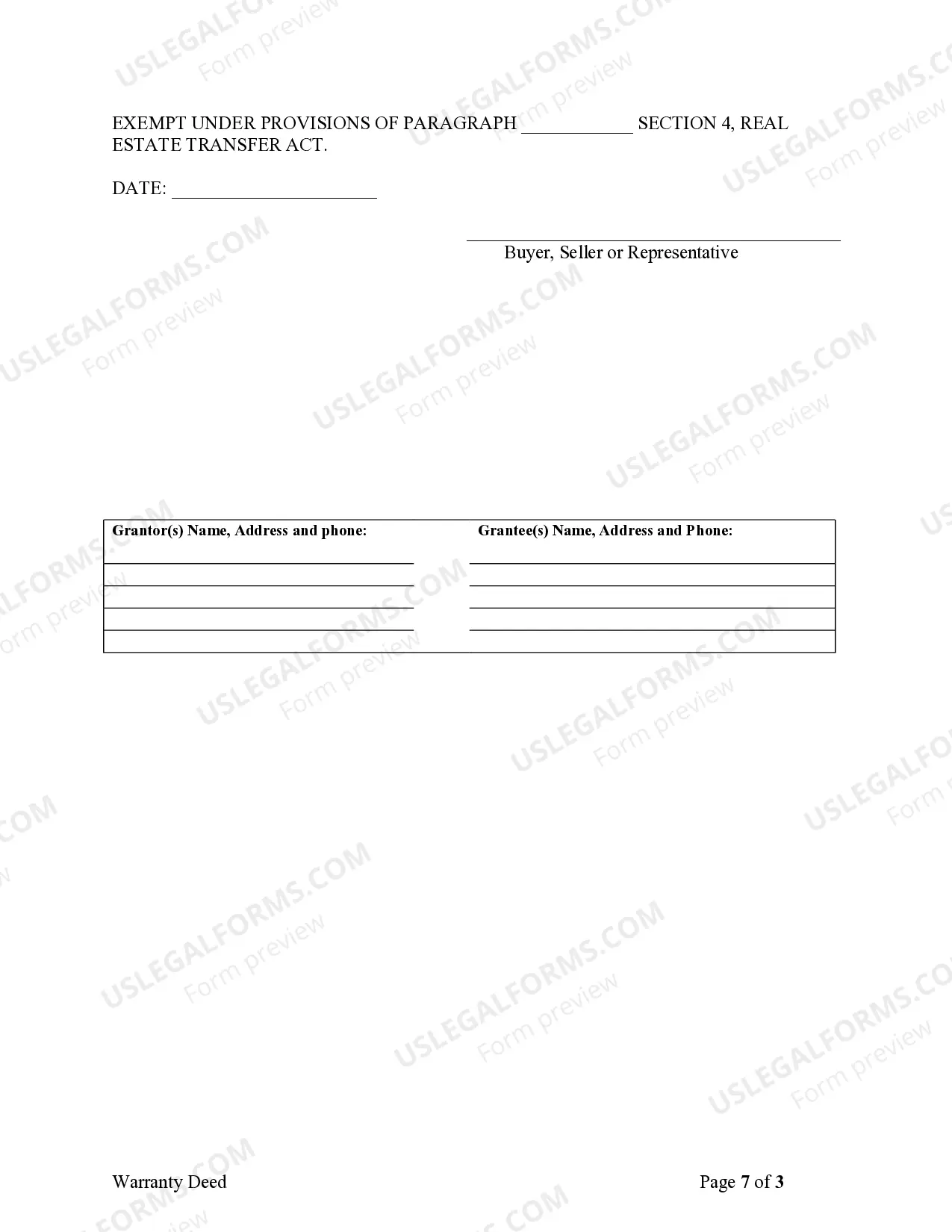

How to fill out Illinois Warranty Deed From Trustee To Trustee?

The Any Exempt Property For A 6th Grader displayed on this page is a reusable legal template crafted by expert attorneys in accordance with federal and state regulations.

For over 25 years, US Legal Forms has supplied individuals, organizations, and legal practitioners with more than 85,000 authenticated, state-specific documents for any business and personal situation. It’s the quickest, easiest, and most reliable method to obtain the forms you require, as the service ensures bank-grade data security and anti-malware safeguards.

Subscribe to US Legal Forms to have verified legal templates for all of life’s situations at your fingertips.

- Explore the document you require and review it.

- Scan through the example you searched for and preview it or review the form description to confirm it meets your needs. If it doesn’t, utilize the search function to find the correct one. Click Buy Now once you have located the template you need.

- Register and Log In.

- Select the pricing option that works for you and create an account. Use PayPal or a credit card to make an immediate payment. If you already possess an account, Log In and check your subscription to proceed.

- Acquire the editable template.

- Choose the format you desire for your Any Exempt Property For A 6th Grader (PDF, DOCX, RTF) and save the document on your device.

- Fill out and sign the documentation.

- Print the template to complete it manually. Alternatively, use an online multifunctional PDF editor to quickly and accurately fill out and sign your form with a valid signature.

- Download your document again.

- Use the same document again whenever necessary. Open the My documents tab in your profile to redownload any forms you previously downloaded.

Form popularity

FAQ

49 - Newly Built Home A transfer of a newly built home. See Newly Built Home Exemption for more information about this exemption.

Permissive Tax Exemptions Property owned or held by a not-for-profit corporations. Art galleries or museums owned by charitable or philanthropic organizations. Property owned or held by a public authority but not eligible for a statutory tax exemption. Riparian or heritage property.

If you sold or if you were considered to have sold, more than one property in the same calendar year and each property was, at one time, your principal residence, you must show this by completing a separate Form T2091(IND) for each property to designate what years each was your principal residence and calculate the ...

When you sell your home, you may realize a capital gain. If the property was solely your principal residence for every year you owned it, you do not have to pay tax on the gain.

The principal residence exemption is not an automatic rule; to get the full exemption, you have to designate your home as a principal residence for all the years you lived in it by filing the appropriate form(s). Federally, the relevant form is the T2091; residents of Quebec also have to file the TP-274 form.