201k Illinois Withdrawal

Description

How to fill out Illinois Motion To Compel?

Handling legal documents and procedures can be an exhausting addition to your whole day.

201k Illinois Withdrawal and similar forms frequently require you to locate them and comprehend how to fill them out accurately.

Consequently, whether you are managing financial, legal, or personal issues, having an extensive and user-friendly online repository of forms readily available will greatly assist you.

US Legal Forms is the leading online platform for legal templates, showcasing over 85,000 state-specific documents and various tools that will enable you to finalize your paperwork swiftly.

Simply sign in to your account, locate 201k Illinois Withdrawal and retrieve it instantly from the My documents section. You can also revisit previously downloaded documents.

- Explore the collection of pertinent documents accessible to you with just a single click.

- US Legal Forms provides state- and county-specific documents available for download at any moment.

- Safeguard your document handling processes by utilizing a premium service that allows you to prepare any document within minutes, free from extra or hidden charges.

Form popularity

FAQ

The tax rate on a 401k withdrawal in Illinois mirrors your ordinary income tax rate, which typically ranges between 4.95% and 7.99%, depending on your income level. This means that any funds you withdraw will be taxed at your current rate, impacting your overall financial situation. Therefore, when considering a 201k Illinois withdrawal, it's vital to account for these taxes in your planning. Using tools like USLegalForms can help you understand and prepare for the tax implications of your withdrawal.

When you withdraw from your 401k in Illinois, you generally face a 10% early withdrawal penalty if you are under the age of 59½. This penalty is in addition to regular income tax on the amount you withdraw, making the 201k Illinois withdrawal a costly decision. However, certain exceptions may apply, such as financial hardship or disability. It's essential to understand these penalties and consider using platforms like USLegalForms to navigate your options effectively.

The 48-hour Rule in Illinois refers to the requirement that individuals must be informed of their rights within 48 hours of being detained by law enforcement. This rule is designed to protect individuals' rights and ensure they understand their legal situation. Knowing this rule can significantly impact how you navigate legal challenges, particularly in issues related to a 201k Illinois withdrawal or any other legal matters.

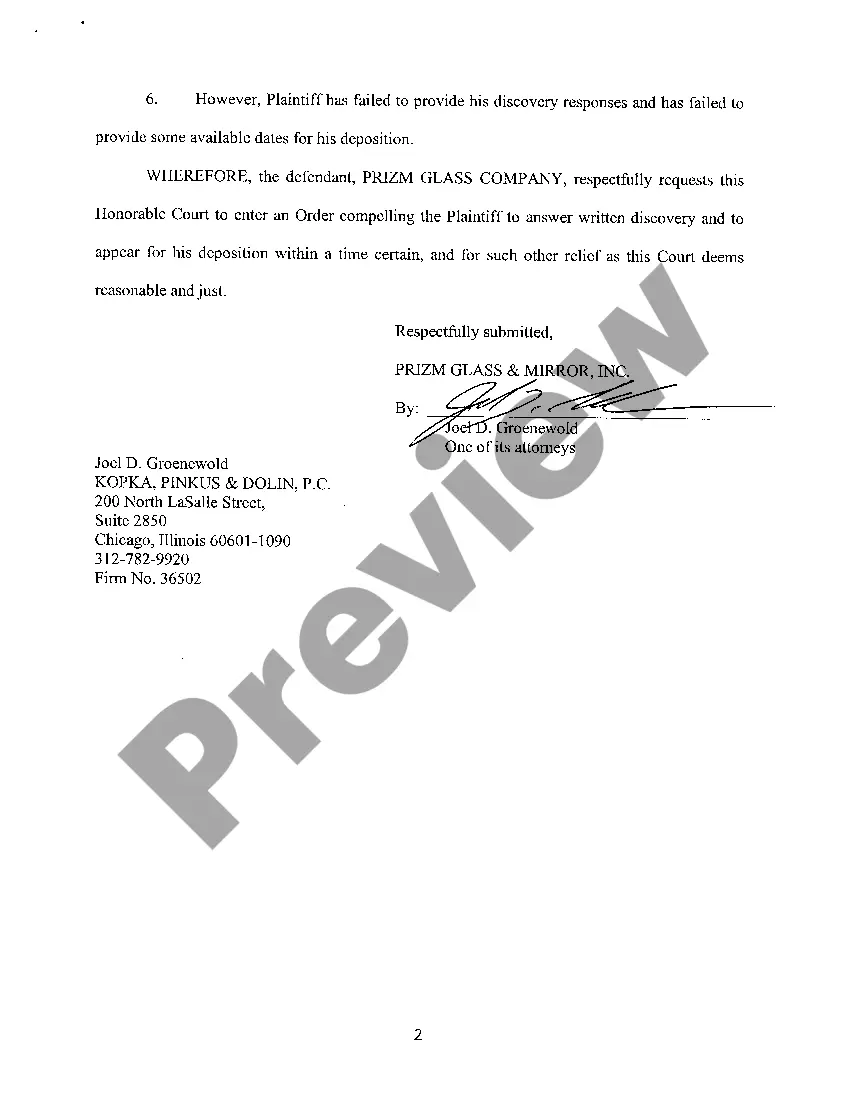

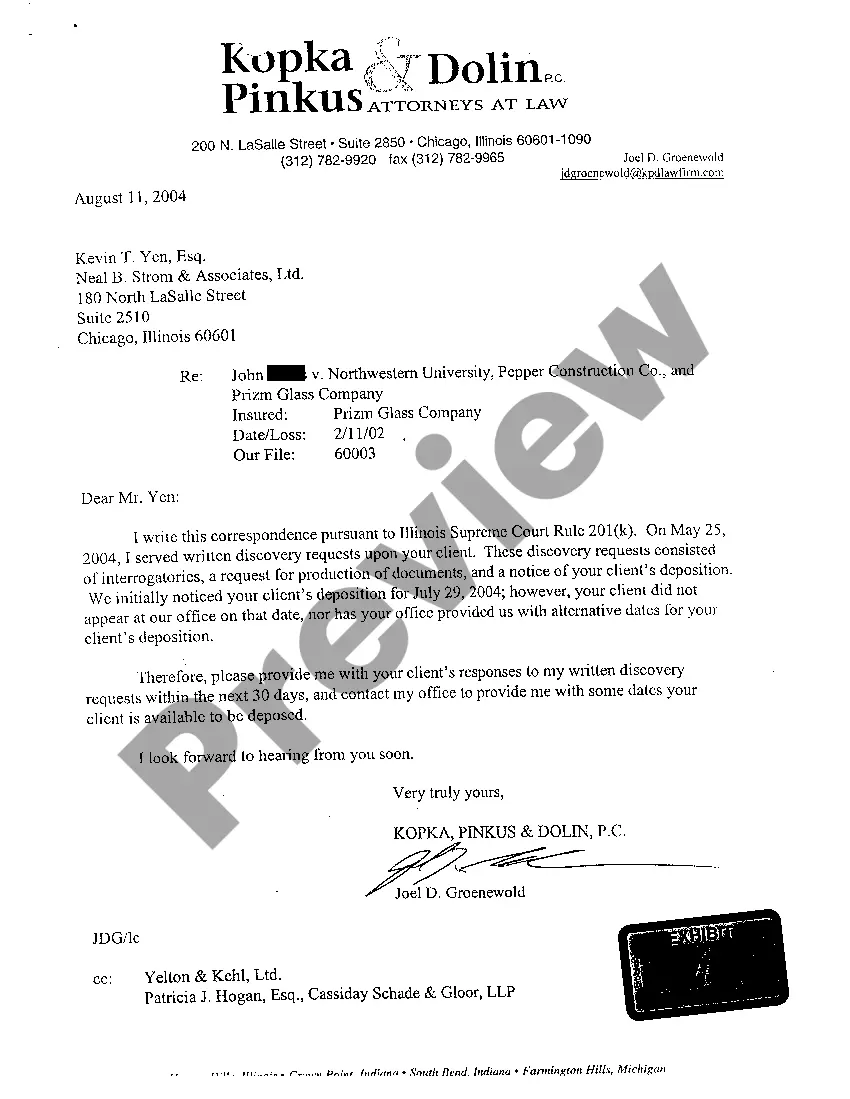

The discovery Rule 201 in Illinois governs the process of gathering evidence in legal cases. It specifies the timeline and procedures for parties to exchange information relevant to their case. This rule is important for those involved in legal disputes, as it ensures transparency and fairness, making the legal process smoother and more efficient.

A 201k letter is a document that informs a participant about their rights and options regarding their retirement account, specifically in the context of a 201k Illinois withdrawal. This letter typically outlines the process to access funds, including any potential tax implications. Understanding this letter is crucial for anyone considering a withdrawal, as it helps clarify your options and ensures you make informed decisions.

Rule 201 K in Illinois is a specific regulation that governs the discovery process in family law cases, especially regarding the disclosure of financial information. This rule emphasizes the importance of transparency and requires both parties to provide accurate financial data. Familiarity with Rule 201 K can significantly impact the outcome of your case. US Legal Forms can help you navigate these complexities by offering the right forms and information.

The 201k rule in Illinois specifically relates to the procedural framework for handling discovery disputes. It establishes guidelines for resolving issues that arise during the discovery phase of a case. Understanding this rule is crucial for maintaining compliance and ensuring a smooth legal process. For assistance with the 201k Illinois withdrawal, consult US Legal Forms for appropriate resources.

The divorce discovery process in Illinois involves gathering and exchanging relevant information between parties. This process can include interrogatories, document requests, and depositions. It is essential for both parties to comply with these requests to ensure a fair resolution. To simplify your discovery process, consider US Legal Forms for templates and legal documentation.

A 201k conference is a court-mandated meeting in Illinois designed to address issues related to the discovery process in divorce cases. During this conference, both parties and their attorneys discuss the exchange of information and documents. This meeting aims to streamline the process and reduce conflicts. If you need help organizing your approach to a 201k conference, US Legal Forms offers valuable templates and guidance.

The 214 Rule in Illinois pertains to the disclosure of financial information in divorce cases. It requires parties to exchange financial documents to ensure transparency during the proceedings. This rule helps facilitate fair negotiations and settlements. For more detailed guidance on navigating these requirements, US Legal Forms can provide the necessary resources.