Tax Deed Sale In Palm Beach County

Description

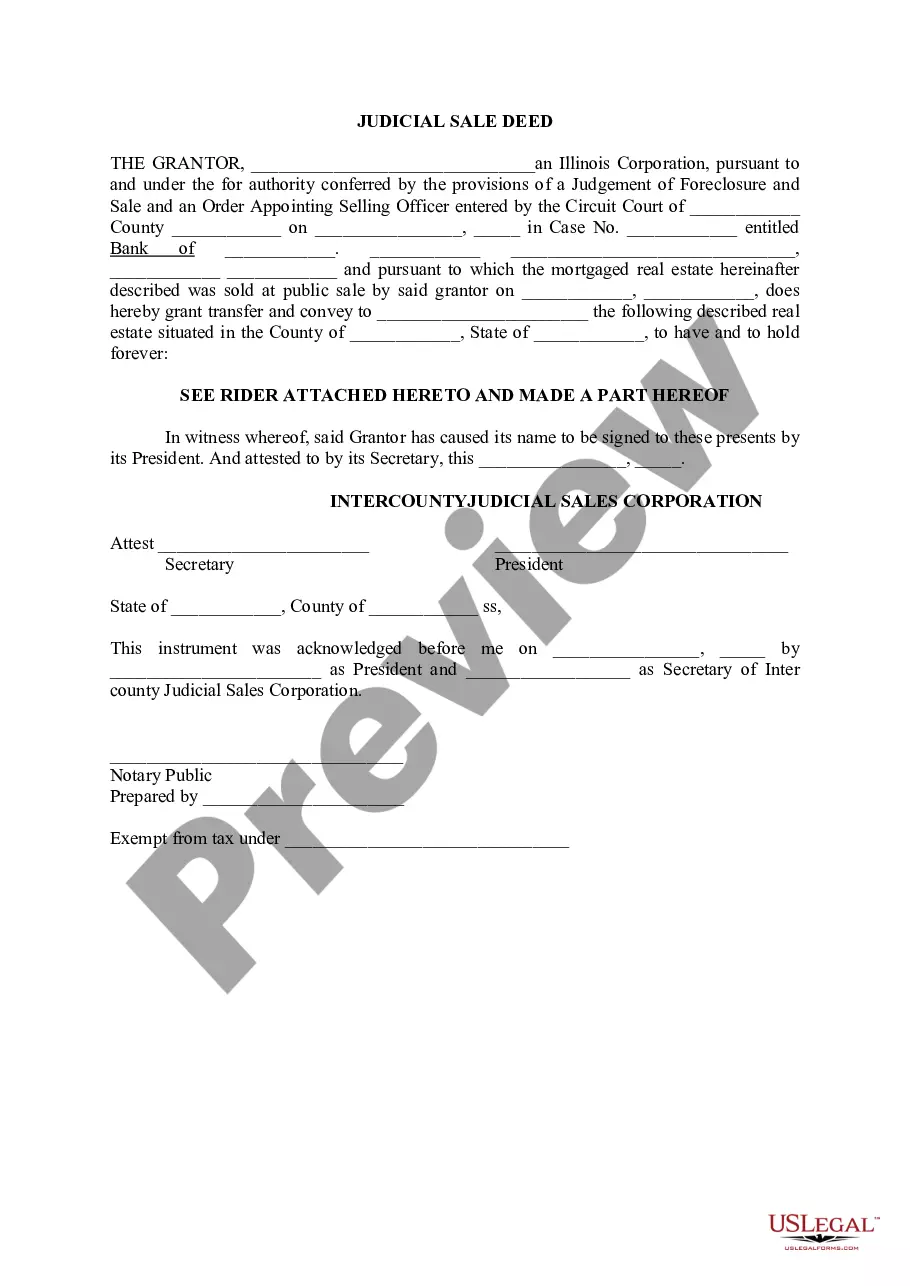

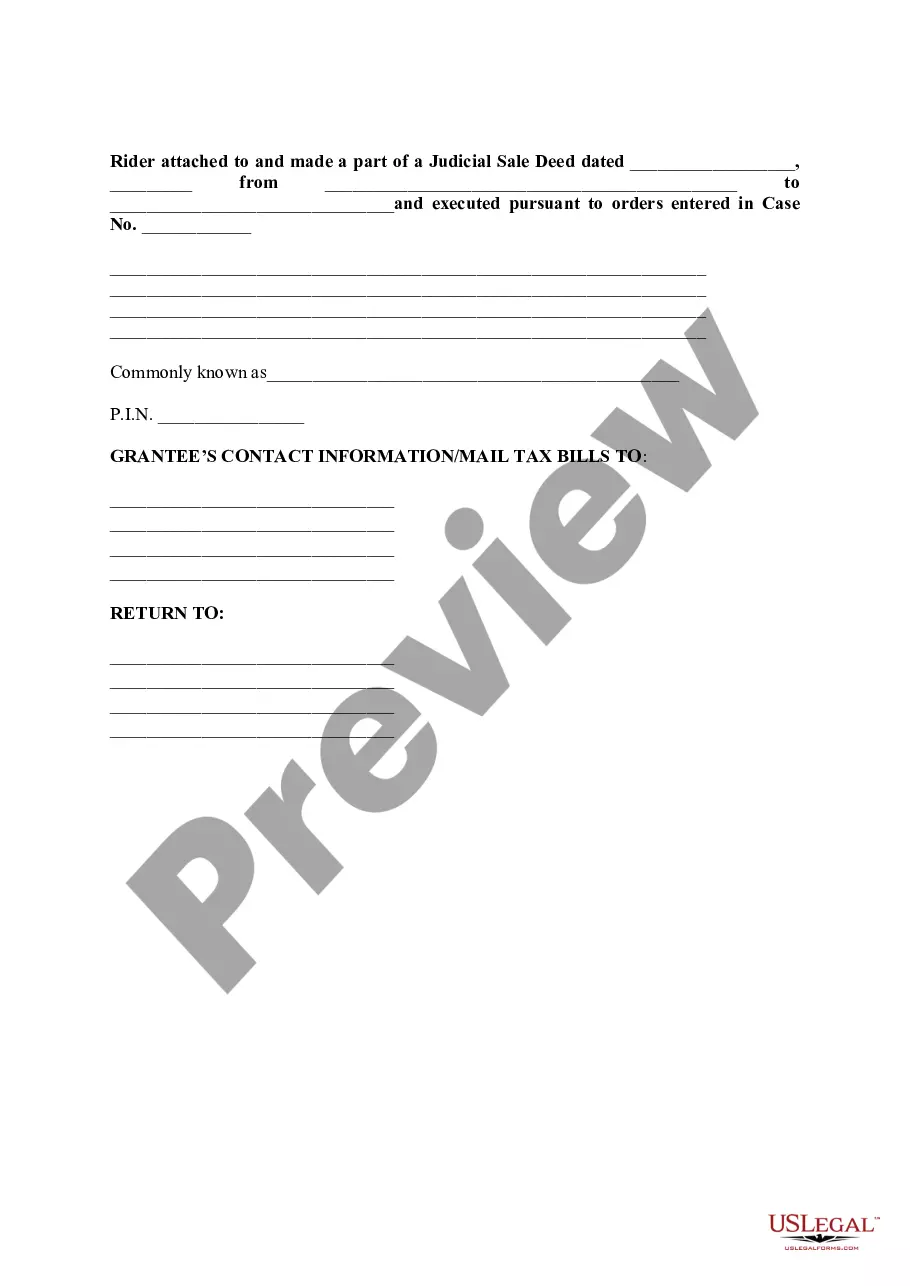

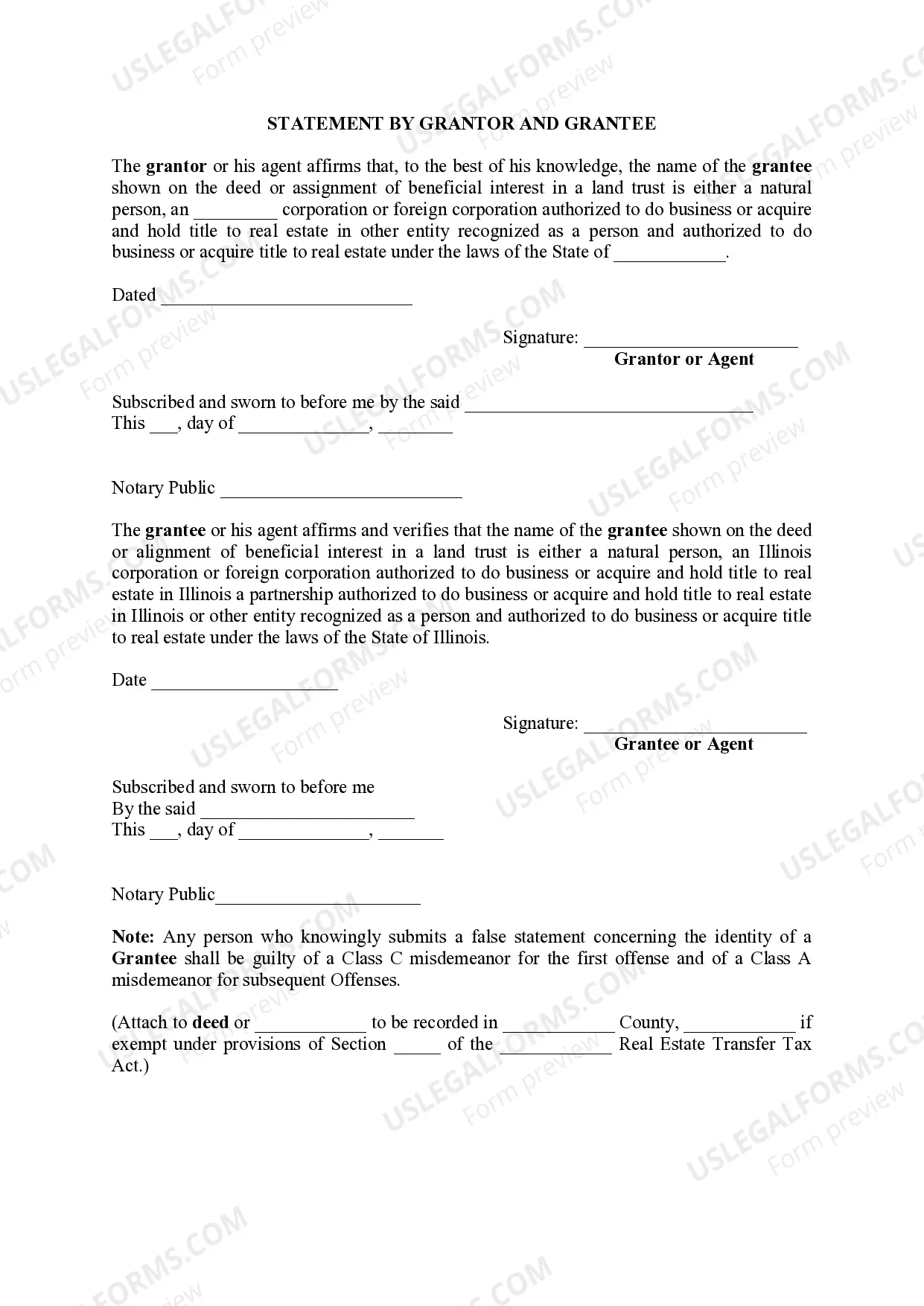

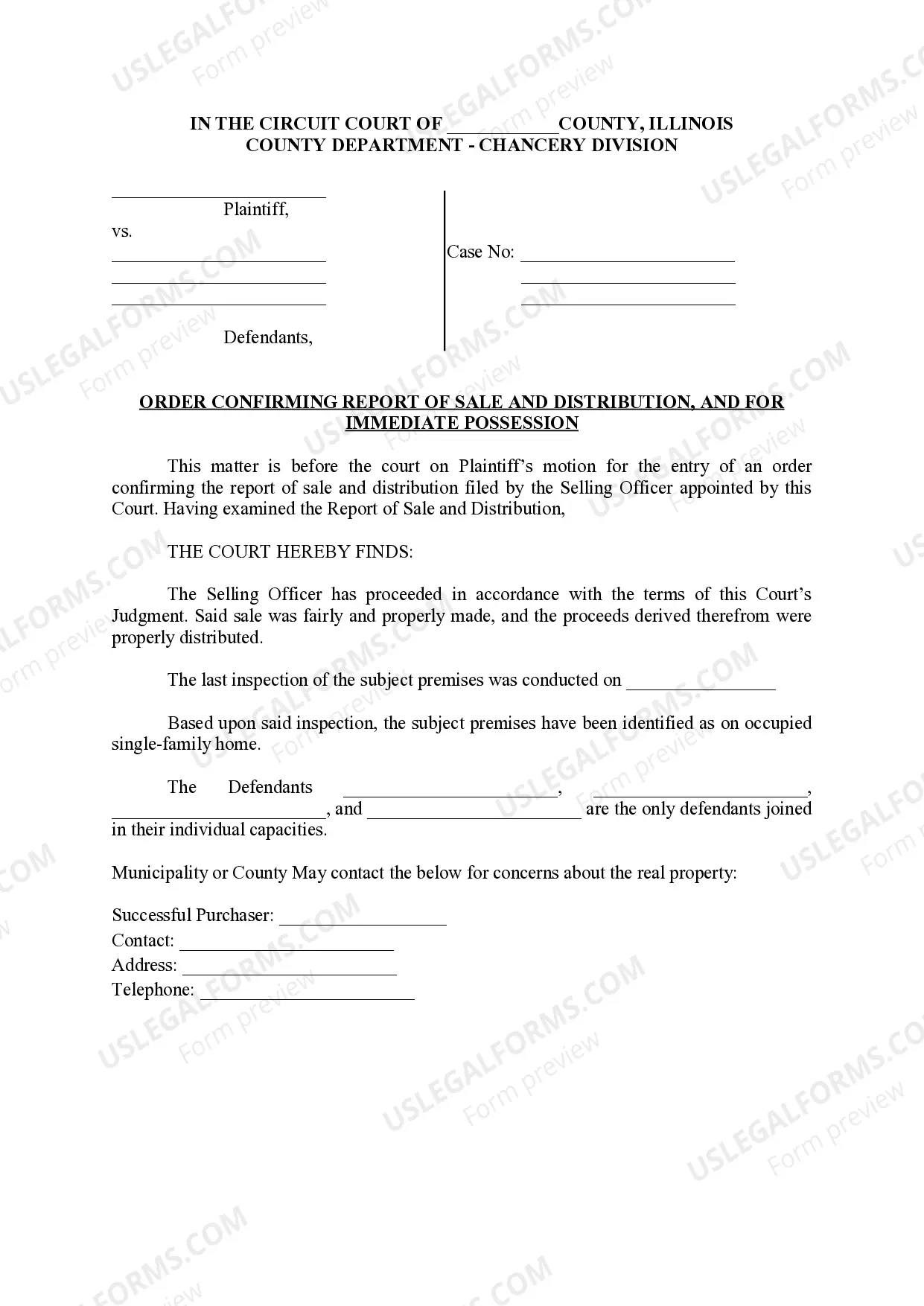

How to fill out Illinois Judicial Sale Deed?

Legal managing might be frustrating, even for the most experienced professionals. When you are interested in a Tax Deed Sale In Palm Beach County and don’t get the time to spend looking for the correct and up-to-date version, the operations may be nerve-racking. A strong online form catalogue could be a gamechanger for anybody who wants to deal with these situations effectively. US Legal Forms is a market leader in online legal forms, with more than 85,000 state-specific legal forms available to you whenever you want.

With US Legal Forms, you can:

- Access state- or county-specific legal and organization forms. US Legal Forms handles any needs you might have, from personal to organization papers, all in one place.

- Employ advanced tools to accomplish and control your Tax Deed Sale In Palm Beach County

- Access a useful resource base of articles, guides and handbooks and resources connected to your situation and needs

Help save effort and time looking for the papers you need, and utilize US Legal Forms’ advanced search and Preview tool to find Tax Deed Sale In Palm Beach County and acquire it. In case you have a subscription, log in in your US Legal Forms account, search for the form, and acquire it. Take a look at My Forms tab to see the papers you previously downloaded and also to control your folders as you see fit.

Should it be the first time with US Legal Forms, create a free account and obtain unrestricted use of all advantages of the library. Listed below are the steps to take after downloading the form you need:

- Confirm it is the right form by previewing it and looking at its information.

- Ensure that the sample is acknowledged in your state or county.

- Pick Buy Now once you are ready.

- Select a monthly subscription plan.

- Find the format you need, and Download, complete, sign, print and send out your papers.

Enjoy the US Legal Forms online catalogue, backed with 25 years of experience and reliability. Enhance your day-to-day papers management in to a smooth and easy-to-use process right now.

Form popularity

FAQ

Florida Law A tax certificate sale is not a sale of land, but rather a lien against the subject property. Delinquent taxes are advertised in a local newspaper prior to the tax certificate sale. The tax certificate sale is open to the public and participants purchase the certificates as investments.

Property may be redeemed any time prior to the issuance of a tax deed but cannot be redeemed once the Clerk has received full payment for the tax deed. The redemption amount (subject to change) is listed on the "Notice of Application for Tax Deed" mailed prior to the sale.

A tax deed sale is a public auction where property is sold to the highest bidder to recover delinquent taxes. Once notice has been given to everyone, the Clerk of the Circuit Court holds a Tax Deed Sale (Auction) to determine the new property owner.

Florida will issue the bidder a tax deed, usually within 30, possibly 40 days. Once you have the deed, you can legally sell the property.

Delinquent tax defaulted properties are sold at public auctions that anyone can attend and to qualify is simple. Register at the door. If you're buying tax deeds in Florida, some auctions may require that you demonstrate you have funds to bid, while others may not ask you.