Tax Deed Sale In Bexar County Tx

Description

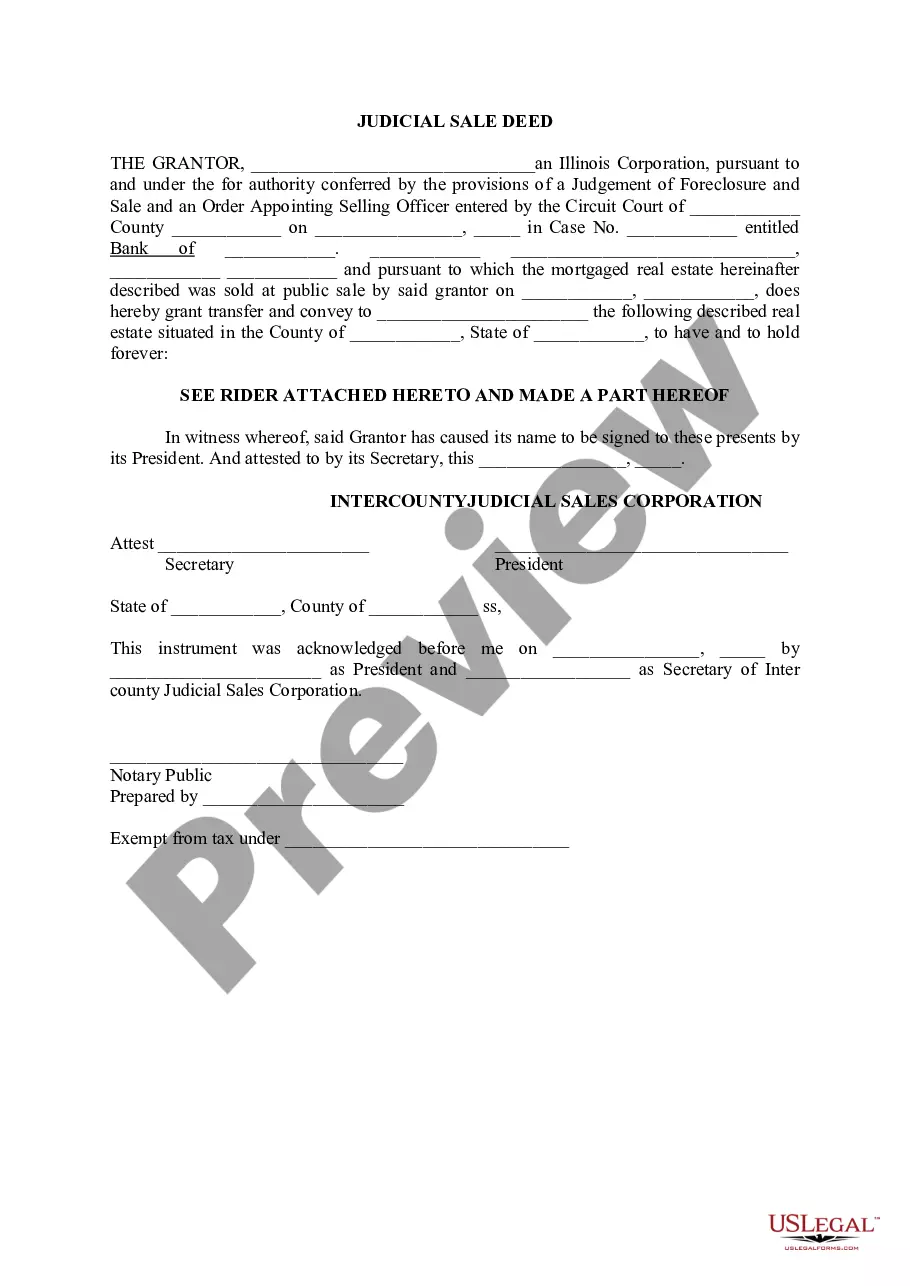

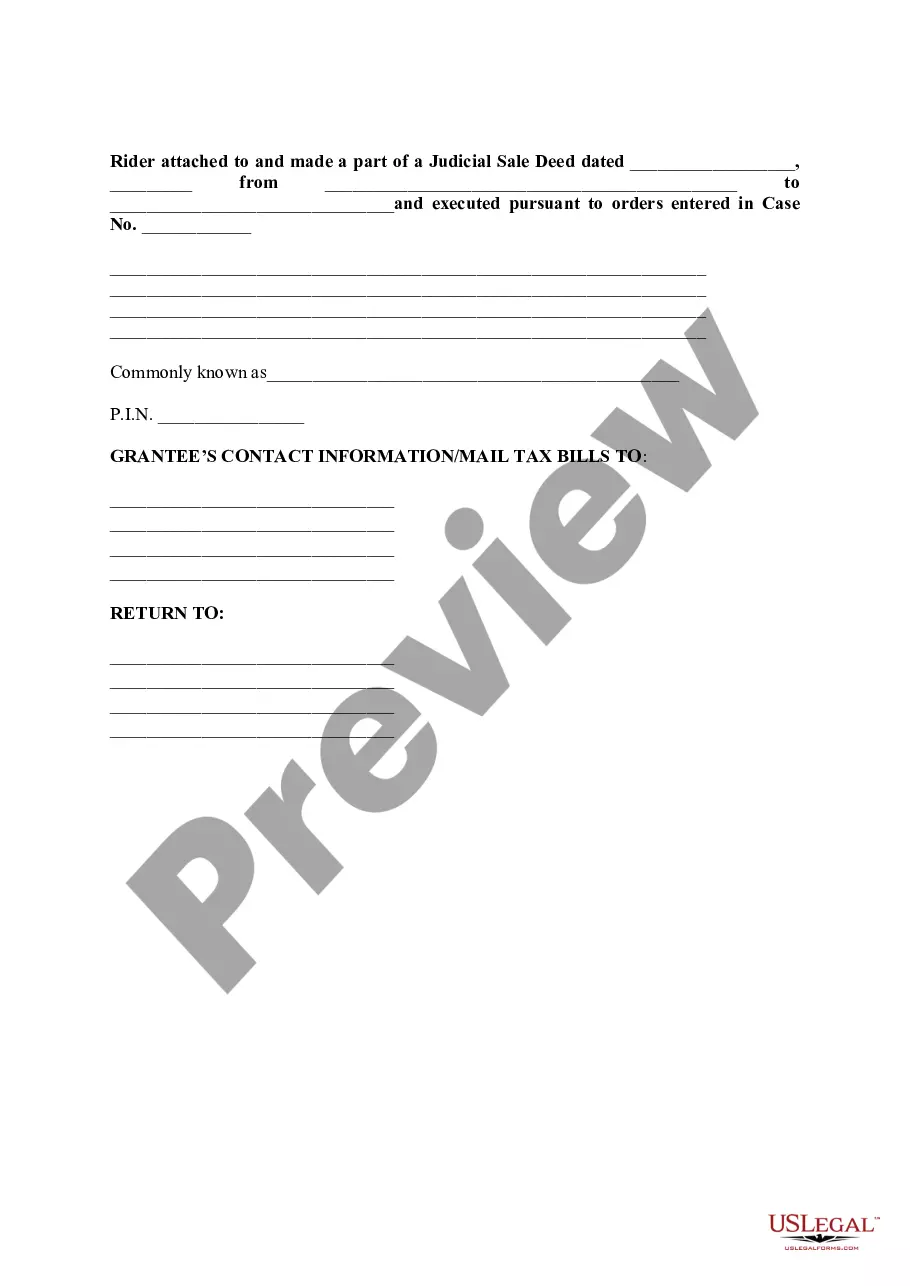

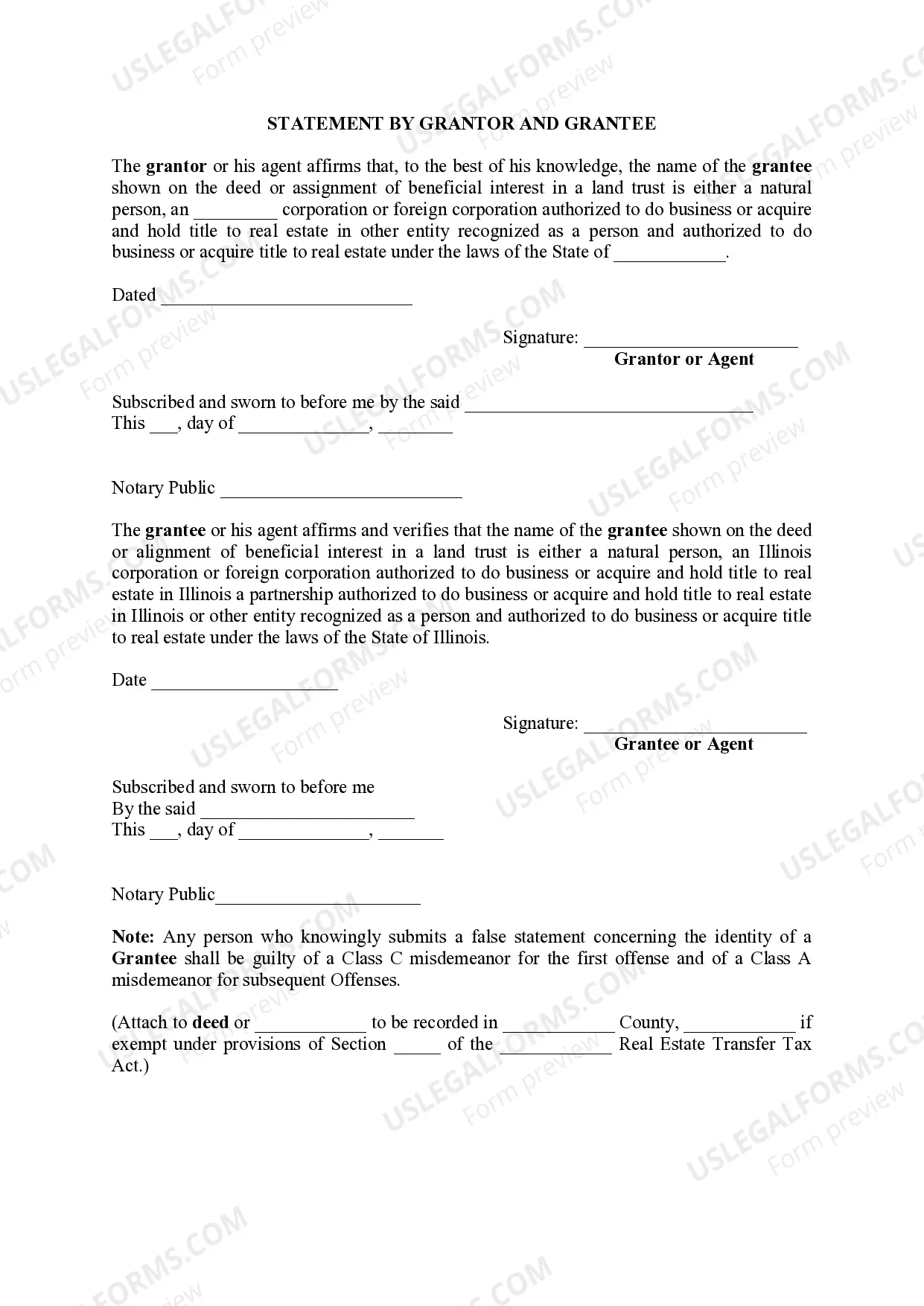

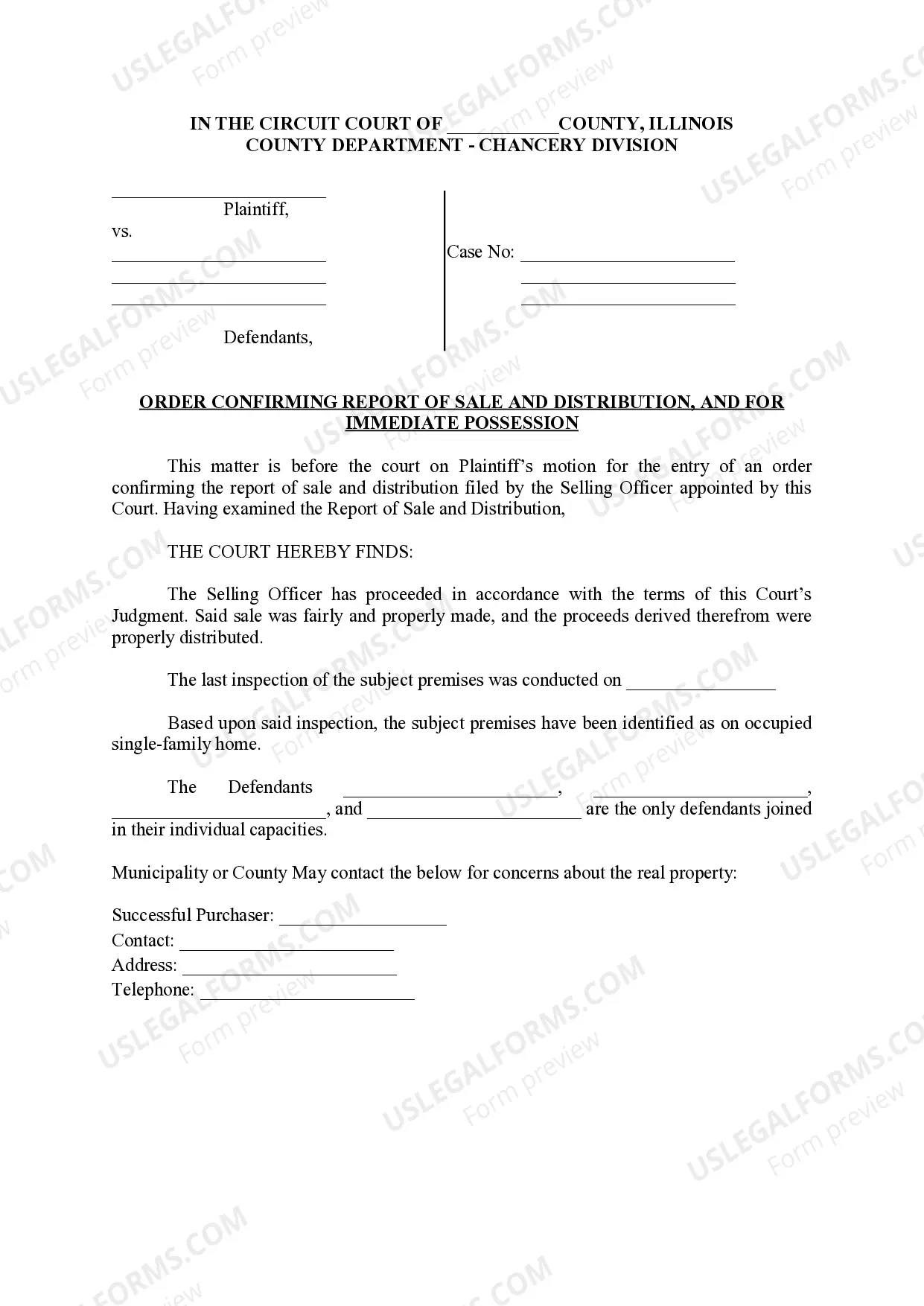

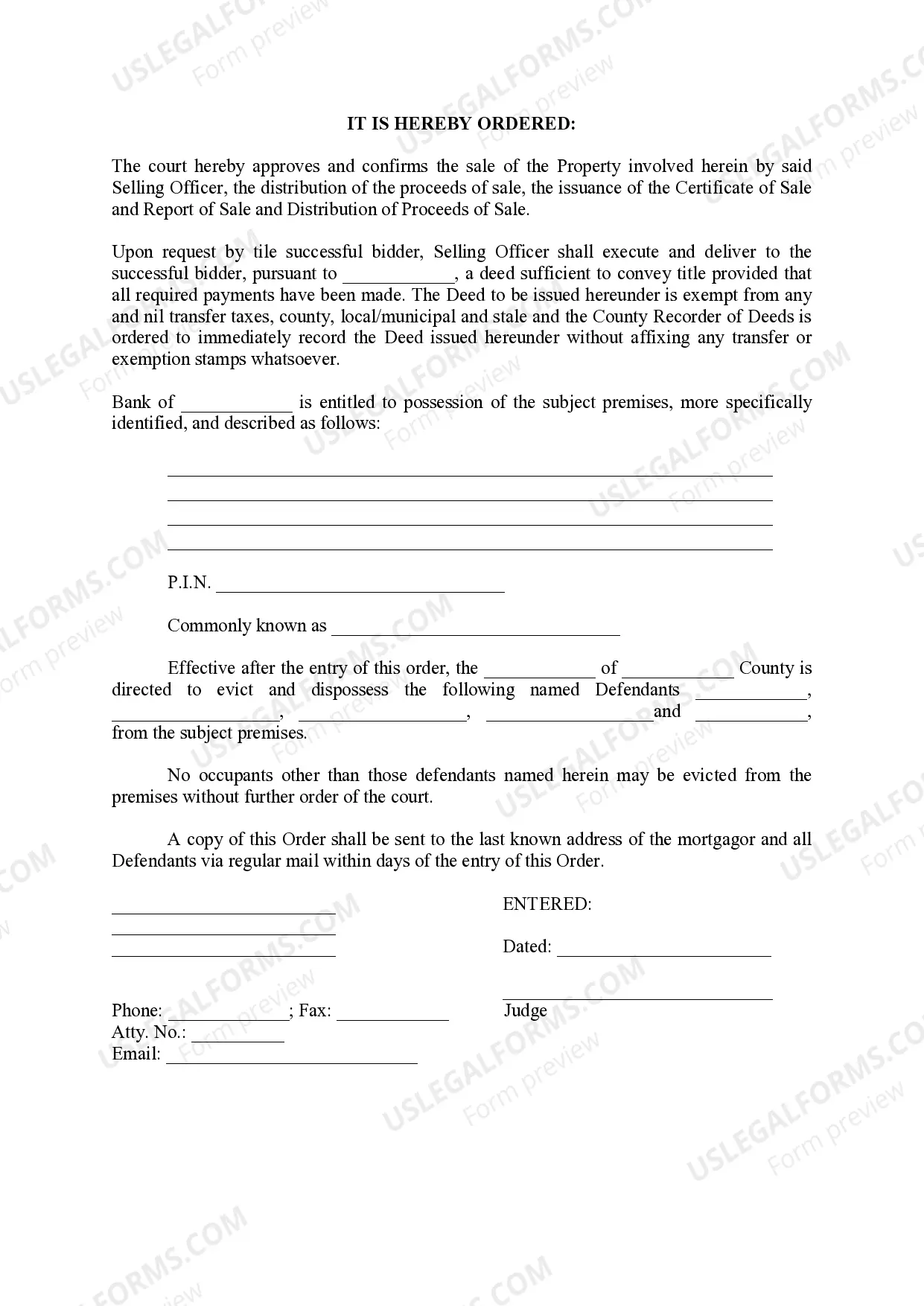

How to fill out Illinois Judicial Sale Deed?

Accessing legal document samples that comply with federal and state regulations is essential, and the internet offers numerous options to choose from. But what’s the point in wasting time looking for the correctly drafted Tax Deed Sale In Bexar County Tx sample on the web if the US Legal Forms online library already has such templates accumulated in one place?

US Legal Forms is the greatest online legal library with over 85,000 fillable templates drafted by lawyers for any professional and personal case. They are easy to browse with all documents grouped by state and purpose of use. Our professionals keep up with legislative updates, so you can always be sure your paperwork is up to date and compliant when acquiring a Tax Deed Sale In Bexar County Tx from our website.

Obtaining a Tax Deed Sale In Bexar County Tx is simple and fast for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you require in the preferred format. If you are new to our website, adhere to the guidelines below:

- Analyze the template utilizing the Preview feature or through the text description to ensure it fits your needs.

- Locate a different sample utilizing the search tool at the top of the page if necessary.

- Click Buy Now when you’ve located the suitable form and opt for a subscription plan.

- Register for an account or log in and make a payment with PayPal or a credit card.

- Select the best format for your Tax Deed Sale In Bexar County Tx and download it.

All templates you locate through US Legal Forms are multi-usable. To re-download and complete previously saved forms, open the My Forms tab in your profile. Take advantage of the most extensive and straightforward-to-use legal paperwork service!

Form popularity

FAQ

Recording Deeds The recording fee is $26 for the 1st page and $4 for each additional page (per document). Acceptable forms of payment are cash, check, or money order. Please make checks payable to Bexar County Clerk. The County Clerk's Office does not prepare deeds or any other documents.

You cannot buy tax liens in Texas; it's a tax deed state, but why is the county selling redeemable deeds?

What Is A Tax Deed Sale? Tax deed sales mean that when you pay for the past due taxes, you have the right to foreclose and own the property. However, the owner can buy it back by paying you for the past due taxes plus interest within a short period of time.

The minimum combined 2023 sales tax rate for San Antonio, Texas is 8.25%. This is the total of state, county and city sales tax rates.

The minimum combined 2023 sales tax rate for Bexar County, Texas is 8.25%. This is the total of state and county sales tax rates. The Texas state sales tax rate is currently 6.25%.