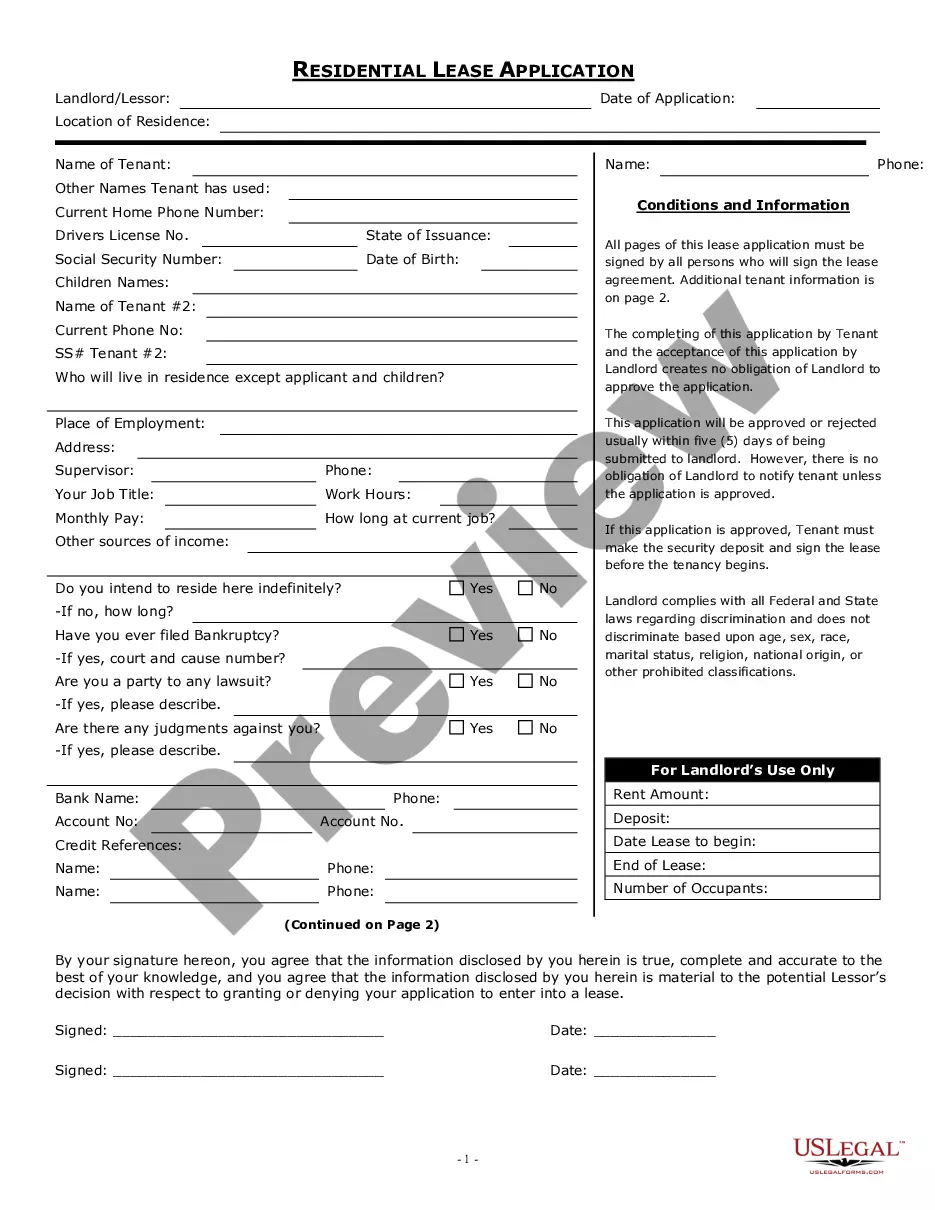

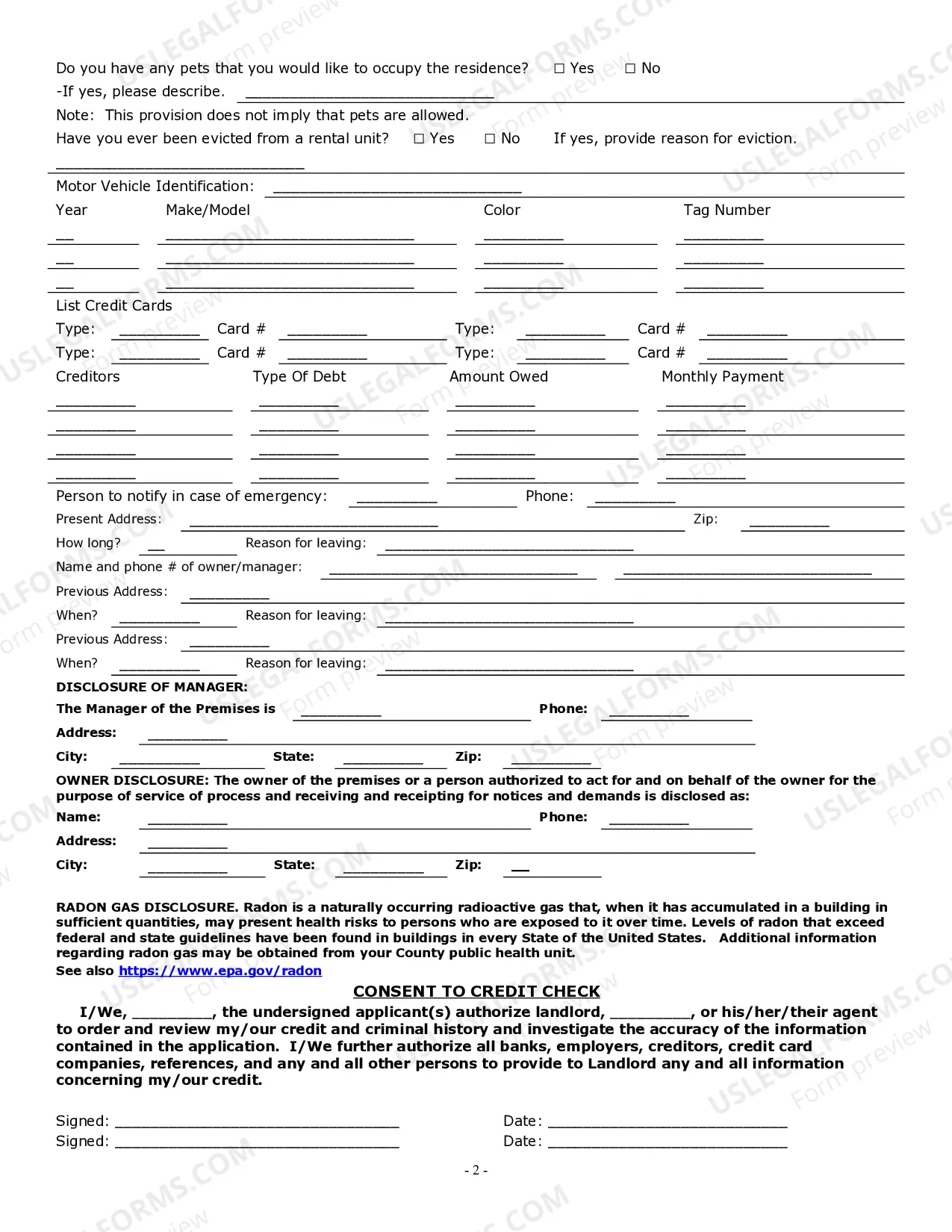

Illinois Rental Application Fee: A Comprehensive Guide Are you currently searching for a rental property in Illinois? If so, it is essential to understand the concept of a rental application fee. This detailed description will provide you with all the information you need about Illinois rental application fees, their types, and how they impact the rental process. What is an Illinois Rental Application Fee? An Illinois rental application fee refers to a non-refundable charge that landlords or property management companies collect from prospective tenants to cover the costs associated with processing their rental applications. This fee is typically paid upfront when submitting the application and is in addition to the security deposit. Types of Illinois Rental Application Fees: 1. Standard Application Fee: The most common type of rental application fee in Illinois is a standard fee charged to all prospective tenants. This fee covers the cost of background checks, credit checks, employment verification, and other administrative expenses related to reviewing the application. 2. Pet Application Fee: Some landlords or property owners charge an additional fee, known as a pet application fee, if you plan to have pets in the rental property. This fee covers the expenses involved in assessing the suitability of the property for pets and potential damages they might cause. 3. Co-Signer or Guarantor Application Fee: In situations where a tenant requires a co-signer or guarantor to secure the lease, a separate application fee may be applicable. This fee covers the additional background checks and verification procedures related to the co-signer or guarantor. 4. Expedited Application Fee: If you need a quick response from the landlord or property management company regarding your rental application, an expedited application fee can be charged. This fee expedites the application review process and prioritizes your application above others. Importance and Legality of Rental Application Fees: Illinois rental application fees serve multiple purposes for landlords and property management companies. Firstly, they help cover the costs associated with processing numerous applications and conducting necessary background checks. Secondly, these fees discourage individuals from submitting multiple applications, allowing landlords to focus on qualified applicants efficiently. It is important to note that Illinois law allows landlords to charge rental application fees, as long as they are reasonable and non-discriminatory. Applicants should be aware of their rights and ensure that the fee is stated clearly in writing before submitting their application. Conclusion: In summary, the rental application fee in Illinois is a non-refundable charge collected by landlords or property management companies to cover the costs associated with processing rental applications. The types of rental application fees may include standard application fees, pet application fees, co-signer or guarantor application fees, and expedited application fees. Understanding these fees and their legality is crucial for prospective tenants to navigate the rental process effectively and avoid any surprises during the application process.

Illinois Rental Application Fee

Description

How to fill out Illinois Rental Application Fee?

Finding a go-to place to take the most current and appropriate legal templates is half the struggle of dealing with bureaucracy. Choosing the right legal documents demands accuracy and attention to detail, which is why it is very important to take samples of Illinois Rental Application Fee only from reputable sources, like US Legal Forms. An improper template will waste your time and delay the situation you are in. With US Legal Forms, you have very little to worry about. You may access and check all the information about the document’s use and relevance for your situation and in your state or region.

Take the listed steps to finish your Illinois Rental Application Fee:

- Utilize the catalog navigation or search field to locate your sample.

- View the form’s information to ascertain if it suits the requirements of your state and region.

- View the form preview, if there is one, to ensure the form is the one you are searching for.

- Go back to the search and locate the appropriate document if the Illinois Rental Application Fee does not match your requirements.

- When you are positive about the form’s relevance, download it.

- If you are an authorized customer, click Log in to authenticate and access your selected templates in My Forms.

- If you do not have an account yet, click Buy now to obtain the form.

- Choose the pricing plan that suits your requirements.

- Proceed to the registration to finalize your purchase.

- Complete your purchase by selecting a payment method (bank card or PayPal).

- Choose the document format for downloading Illinois Rental Application Fee.

- When you have the form on your device, you can modify it using the editor or print it and complete it manually.

Get rid of the hassle that comes with your legal paperwork. Discover the comprehensive US Legal Forms library where you can find legal templates, check their relevance to your situation, and download them on the spot.

Form popularity

FAQ

Rental application fees in Illinois can seem high due to several factors. Landlords typically use these fees to cover the costs of background checks, credit reports, and administrative tasks. Additionally, these fees help landlords ensure they attract serious tenants who are willing to invest in the application process. If you're concerned about these costs, consider using platforms like US Legal Forms, which offer various resources to understand and potentially minimize your rental application fees.

An assignment transfers all the original mortgagee's interest under the mortgage or deed of trust to the new bank. Generally, the mortgage or deed of trust is recorded shortly after the mortgagors sign it, and, if the mortgage is subsequently transferred, each assignment is recorded in the county land records.

The assignment transfers all of the interest the original lender had under the mortgage to the new bank. By tracking loan transfers electronically, MERS eliminates the long-standing practice that the lender must record an assignment with the county recorder every time the loan is sold from one bank to another.

The Court's holding requires that prior to the assignee of a mortgage loan filing suit on the note or mortgage, the assignee must have received both an allonge/assignment of the note and an assignment of the mortgage.

Assignment refers to the transfer of some or all property rights and obligations associated with an asset, property, contract, etc. to another entity through a written agreement. For example, a payee assigns rights for collecting note payments to a bank.

A typical assignment amounts to the transfer of the rights of the lender (assignor) under the loan documentation to another lender (assignee), whereby the assignee takes on the assignor's rights, such as the right to receive payment of principal and interest on the loan.

Mortgages are assigned using a document called an assignment of mortgage. This legally transfers the original lender's interest in the loan to the new company. After doing this, the original lender will no longer receive the payments of principal and interest.

The most common example of an Assignment of Mortgage is when a mortgage lender transfers/sells the mortgage to another lender. This can be done more than once until the balance is paid. The lender does not have to inform the borrower that the mortgage is being assigned to another party.