Collection Letter Template With Address

Description

How to fill out Illinois Collection Letter By Contractor?

Creating legal documents from the beginning can frequently be somewhat daunting.

Certain situations may require extensive research and significant financial investment.

If you’re searching for a simpler and more economical method of generating a Collection Letter Template With Address or any other documentation without extensive obstacles, US Legal Forms is always accessible.

Our online collection of over 85,000 recent legal templates covers nearly every facet of your financial, legal, and personal affairs. With just a few clicks, you can swiftly access state- and county-compliant forms meticulously prepared by our legal experts.

Examine the document preview and descriptions to ensure you have located the document you are seeking.

- Utilize our site whenever you require a trusted and dependable service through which you can promptly locate and download the Collection Letter Template With Address.

- If you’re not unfamiliar with our website and have previously registered an account with us, simply Log In to your account, choose the template, and download it immediately or re-download it at any time later in the My documents section.

- Not registered yet? No worries. Setting up an account and exploring the library takes just a few minutes.

- However, before you dive straight into downloading the Collection Letter Template With Address, heed these suggestions.

Form popularity

FAQ

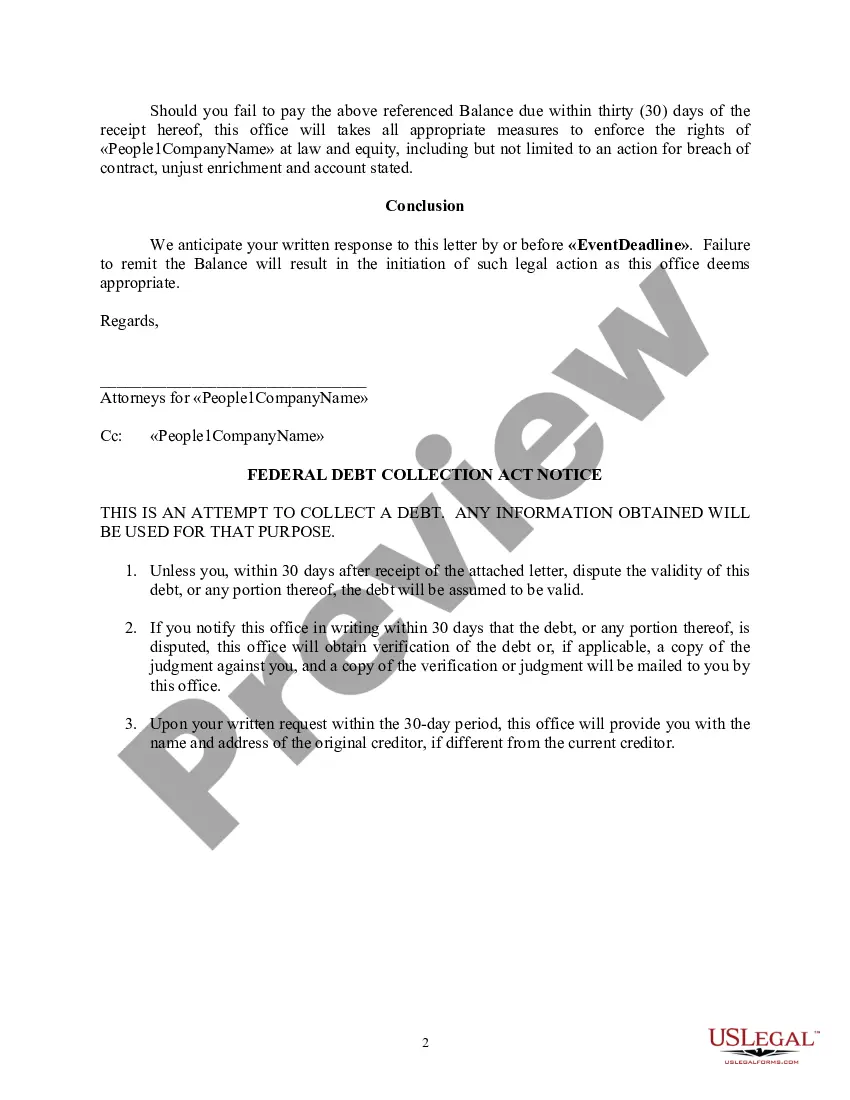

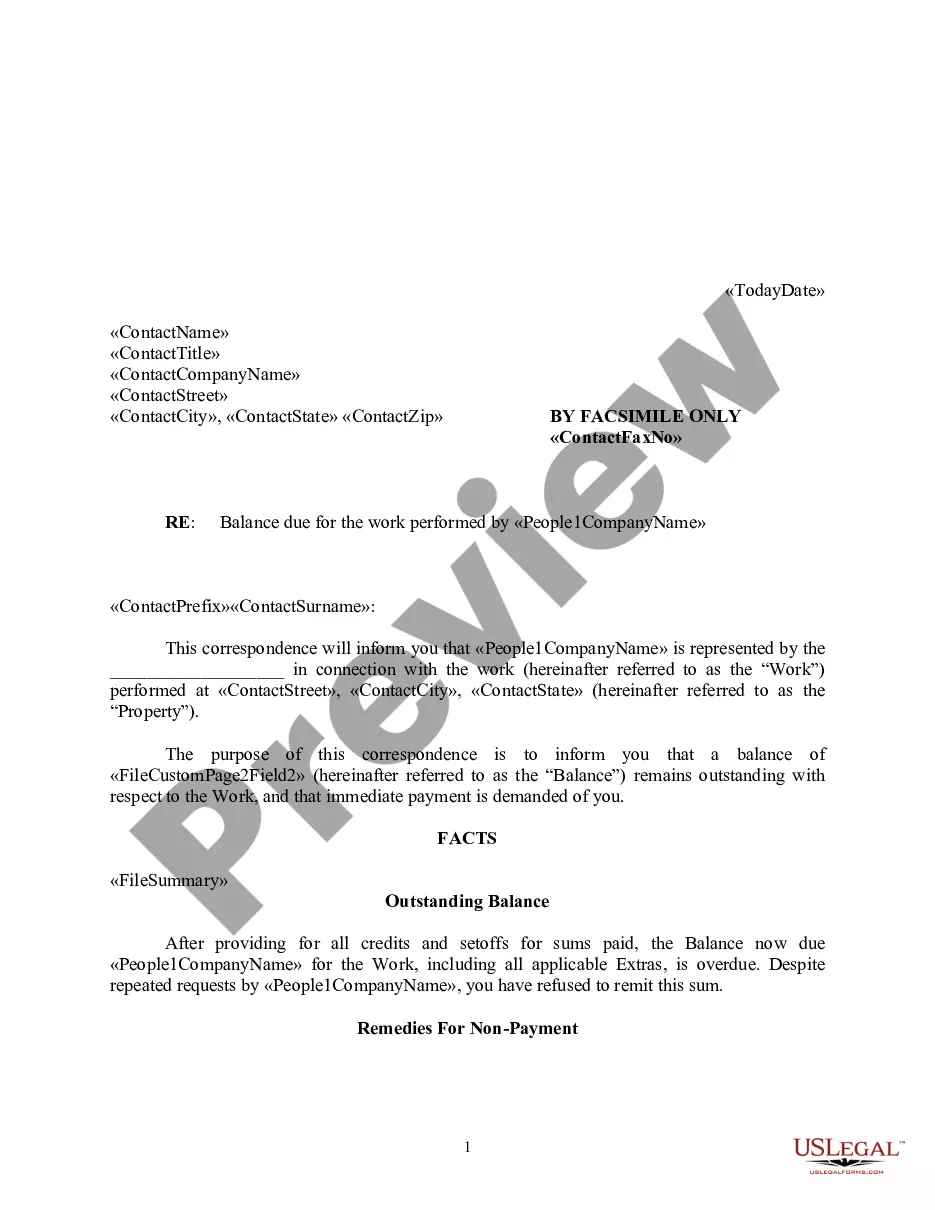

A debt collection letter should include elements such as the debt owed, the initial due date and, if necessary, warnings of impending legal action.

What do you include in a debt collection letter? The amount the debtor owes you, including any interest (attach the original invoice as well); The initial date of payment and the new date of payment; Clear instructions on how to pay the outstanding debt (banking details, etc);

Collection letter sample template Dear [Client name], We're sending you this letter as a friendly reminder that your account in the amount of [amount due to you] is past due. Your invoice was due on [month, day and year their payment was originally due as stated in their invoice].

How to Write An Effective Collection Letter Reference the products or services that were purchased. ... Maintain a friendly but firm tone. ... Remind the payee of their contract or agreement with you. ... Offer multiple ways the payee can take action. ... Add a personal touch. ... Give them a new deadline.

This first collection letter should contain the following information: Days past due. Amount due. Note previous attempts to collect. Summary of account. Instructions- what would you like them to do next? Due date for payment- it is important to use an actually date, not ?in the next 7 business days? as this can be vague.