Collection Form Letter Sample

Description

How to fill out Collection Form Letter Sample?

Navigating the complexities of official documents and templates can be difficult, particularly for those not engaged in that field professionally.

Choosing the correct template for the Collection Form Letter Sample can also be labor-intensive, as it must be accurate and precise to the finest detail.

Nevertheless, you will find that discovering an appropriate template takes considerably less time if it is sourced from a trusted resource.

Acquire the necessary form in just a few straightforward steps: Enter the document title in the search field. Select the appropriate Collection Form Letter Sample from the search results. Review the sample's description or view its preview. If the template meets your requirements, click Buy Now. Choose your subscription plan. Use your email to create a password to set up an account at US Legal Forms. Select either a credit card or PayPal for payment. Download the template file to your device in your preferred format. US Legal Forms will save you significant time in determining if the form you found online fits your needs. Establish an account and gain unlimited access to all the templates you need.

- US Legal Forms is a service that streamlines the search for suitable forms on the web.

- US Legal Forms serves as a singular destination to obtain the latest samples of documents, confirm their applicability, and download these examples for completion.

- The platform houses a compilation of over 85K forms relevant to diverse professional fields.

- When searching for a Collection Form Letter Sample, you can be confident in its reliability since all documents are authenticated.

- Having an account with US Legal Forms ensures that you have all the essential samples at your fingertips.

- You can keep them in your history or add them to the My documents directory.

- Your saved documents can be accessed from any device with a simple click on the Log In option at the library website.

- If you haven't created an account yet, you can still seek out the template you require.

Form popularity

FAQ

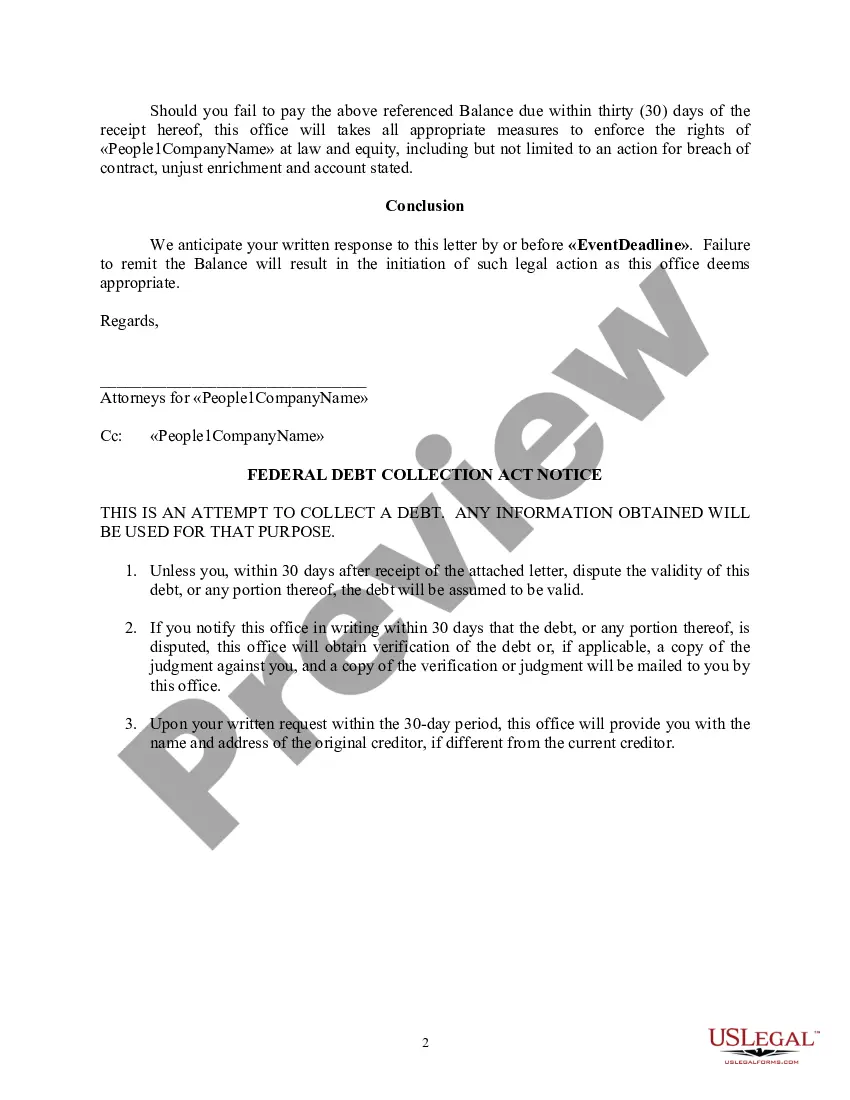

To write a debt collection letter, start with addressing the debtor professionally and stating the reason for your correspondence. Be direct about the outstanding debt and include payment options, deadlines, and any consequences of non-payment. Refer to a collection form letter sample for effective wording and formatting to enhance clarity and professionalism in your letter.

When writing a letter of request for data collection, be clear about the information you seek and the purpose behind your request. Specify any deadlines for a response and ensure your contact information is readily available. A collection form letter sample can serve as a useful guide in organizing your request to achieve the best results.

The 7 7 7 rule for debt collection refers to the timeline for follow-ups after a payment becomes overdue. It suggests reaching out at intervals of seven days for three cycles to maintain consistent communication with the debtor. This method enhances the chances of recovery while allowing you to stay within compliant practices—using a collection form letter sample can help frame these communications effectively.

Writing a letter of debt collection involves several key steps. Start with a polite yet firm tone, outlining the debt along with any relevant account information. Use a collection form letter sample to provide a structured approach, making it easier for the debtor to understand their obligations and respond appropriately.

To make a letter of collection, begin by clearly addressing the recipient and stating the purpose of your letter. Include details about the debt, such as the amount owed and the due date. Additionally, refer to a collection form letter sample to ensure you cover all necessary points, making your letter clear and professional.

An example of a letter of collection would include elements like a respectful greeting, a clear outline of the debt details, and a call-to-action for the debtor to settle the account. It often highlights options for repayment and specifies a date by which payment should be made. A well-crafted collection form letter sample can be an excellent tool for this purpose.

A nice collection letter maintains a friendly tone while addressing an overdue payment. It might say something like, 'We understand that oversights happen, and we want to help you resolve your account.' An effective collection form letter sample keeps the communication positive while encouraging prompt payment, fostering good relations between parties.

To write a letter for debt collection, start with your contact information followed by the date, and then the debtor's information. Clearly explain the debt, including the total amount and any relevant dates. Finally, state the next steps to take and express your willingness to assist, which can reflect in a good collection form letter sample.

When writing a letter to collect, be clear and straightforward with your message. Begin by addressing the debtor directly and provide a summary of the debt, including the amount owed and due date. End with a friendly reminder about the importance of paying on time, similar to what you would find in a collection form letter sample.

In a collection letter, convey the importance of resolving the debt promptly. Start by restating the details of the debt, then politely request payment. It is helpful to include options for payment methods and emphasize the potential consequences of non-payment, all while maintaining a professional tone, as shown in a good collection form letter sample.