Corporation Assignment Of Deed Of Trust Mortgage With Bad Credit

Description

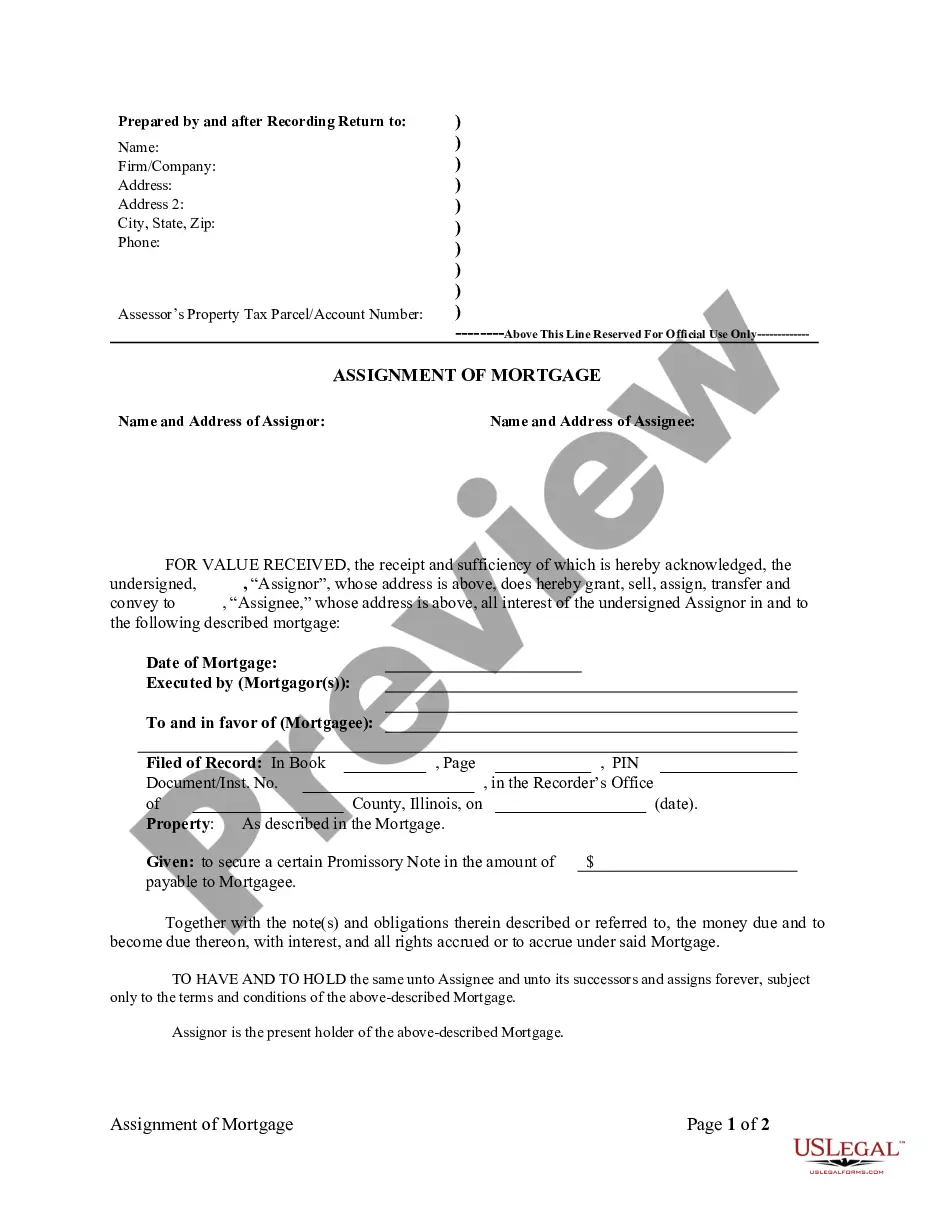

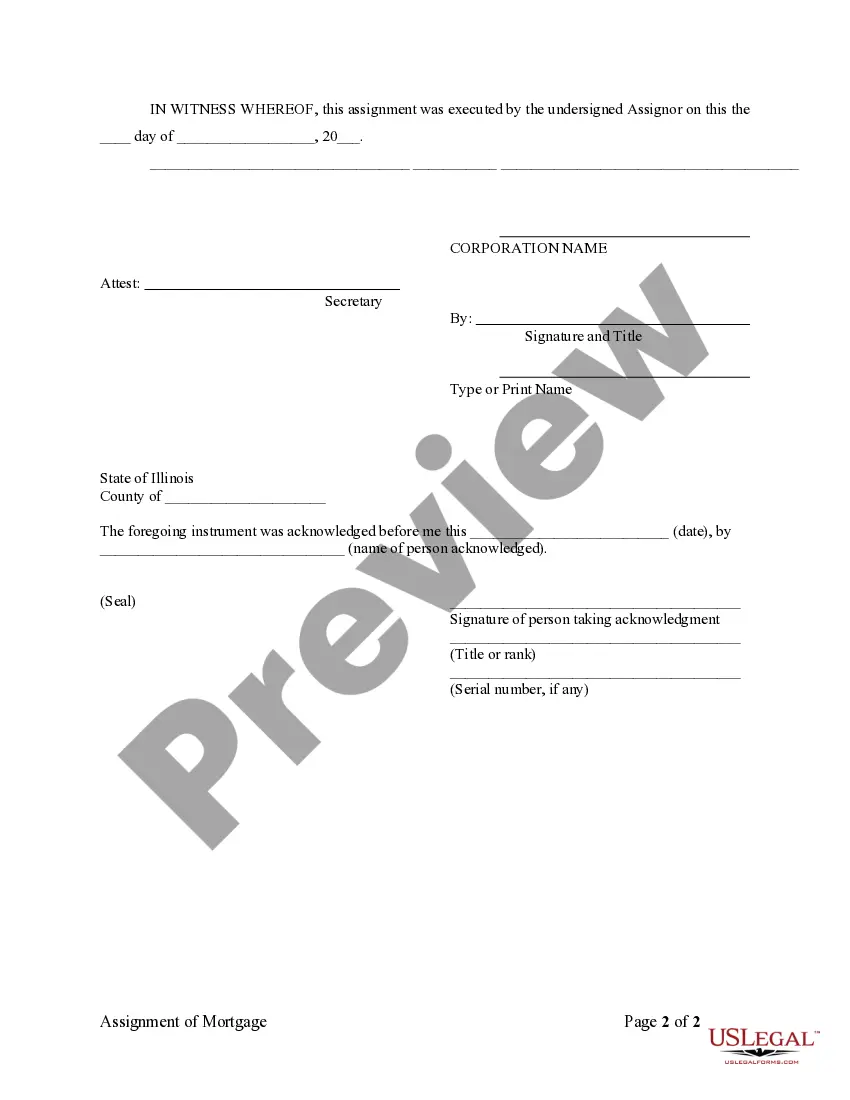

How to fill out Illinois Assignment Of Mortgage By Corporate Mortgage Holder?

Which service is the most trustworthy for acquiring the Corporation Assignment Of Deed Of Trust Mortgage With Poor Credit and other current versions of legal documents.

US Legal Forms is the solution! It boasts the broadest array of legal forms for any application. Each document is precisely composed and confirmed for adherence to both federal and state laws and regulations.

US Legal Forms is an excellent resource for anyone needing assistance with legal documentation. Premium subscribers can benefit even more by filling out and signing previously saved documents electronically at any time using the built-in PDF editing feature. Check it out today!

- Experienced users of the platform only need to Log In to the system, verify their subscription status, and click the Download button next to the Corporation Assignment Of Deed Of Trust Mortgage With Poor Credit to obtain it.

- Once saved, the template will remain accessible for future reference in the My documents section of your account.

- If you do not yet possess an account with our database, here are the steps you should follow to create one.

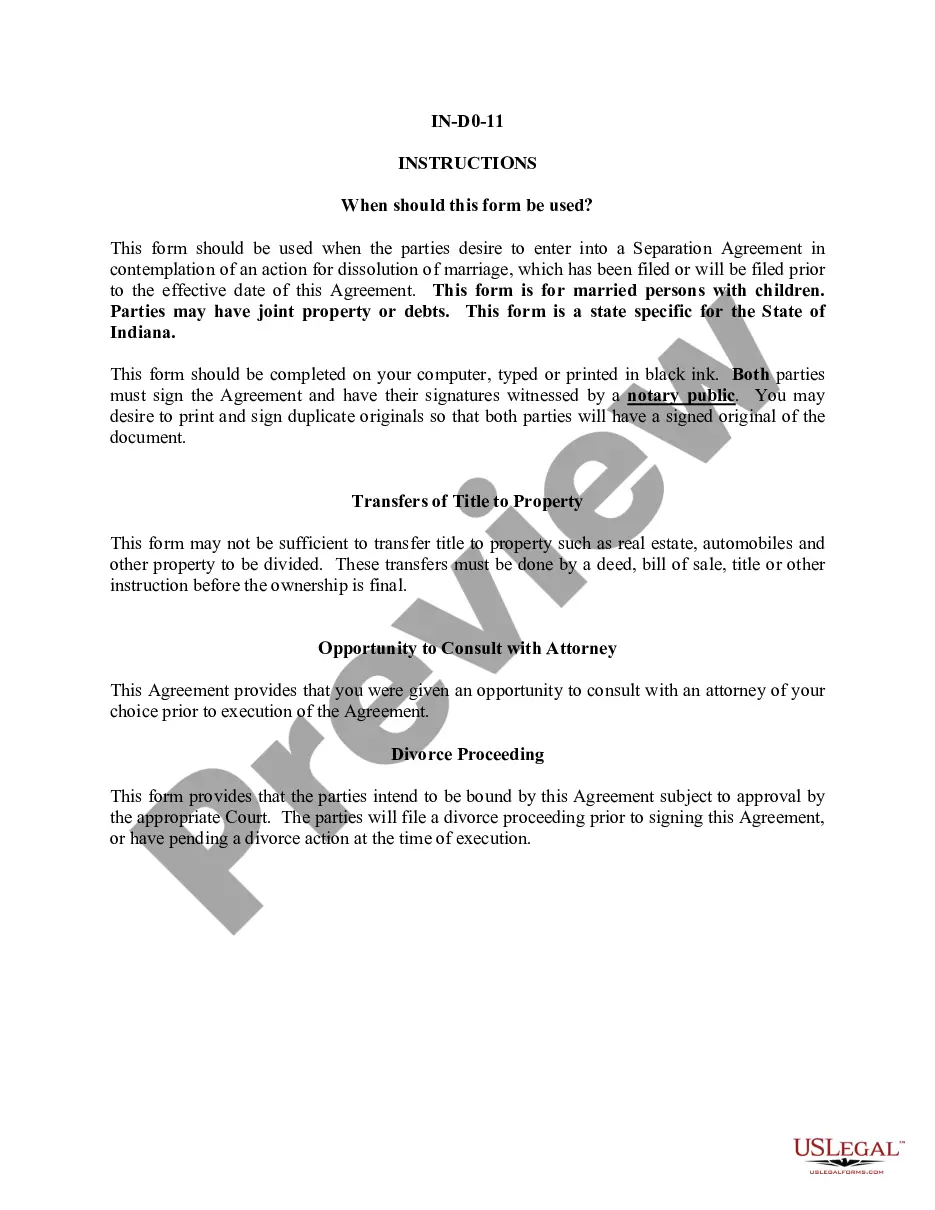

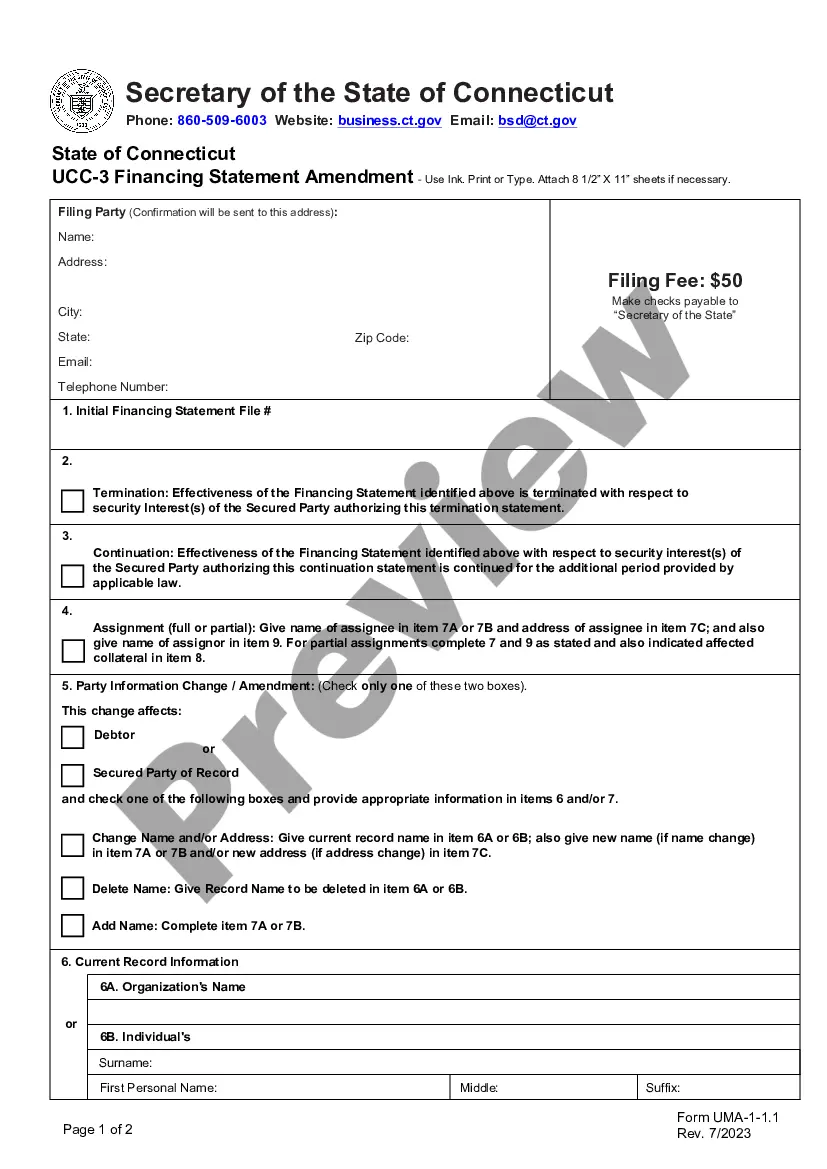

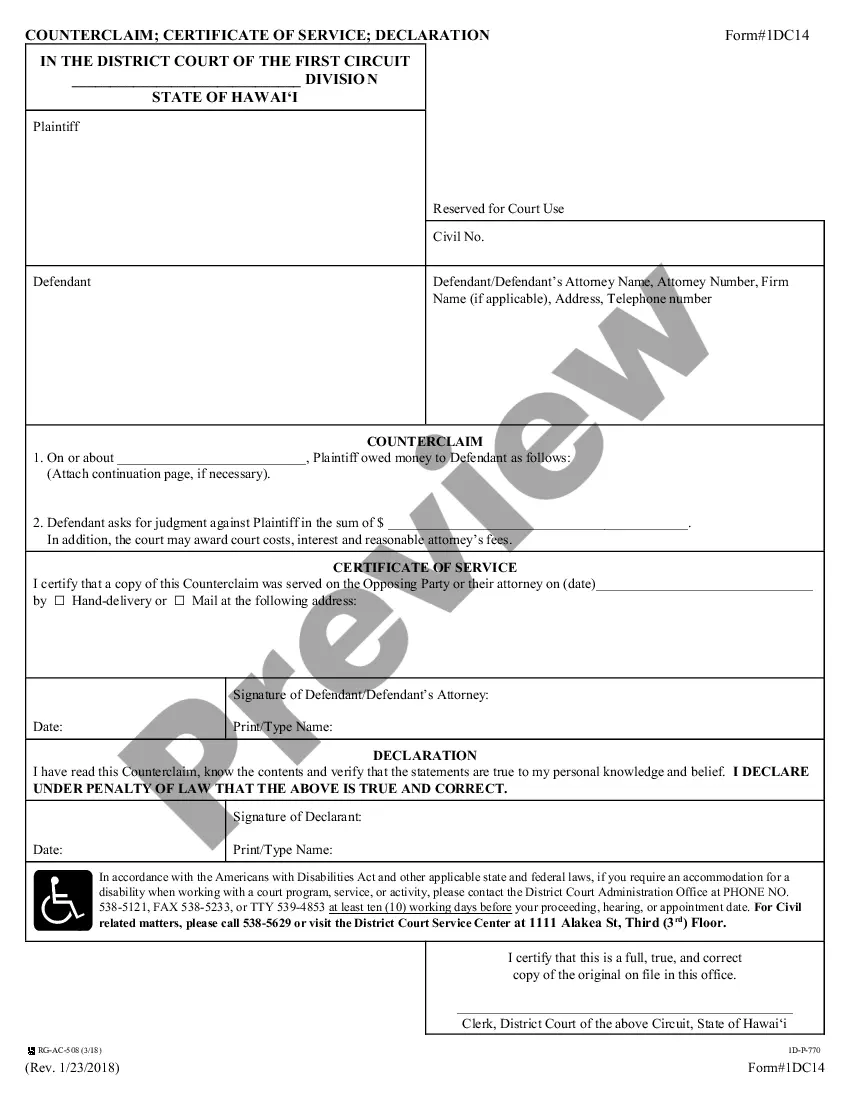

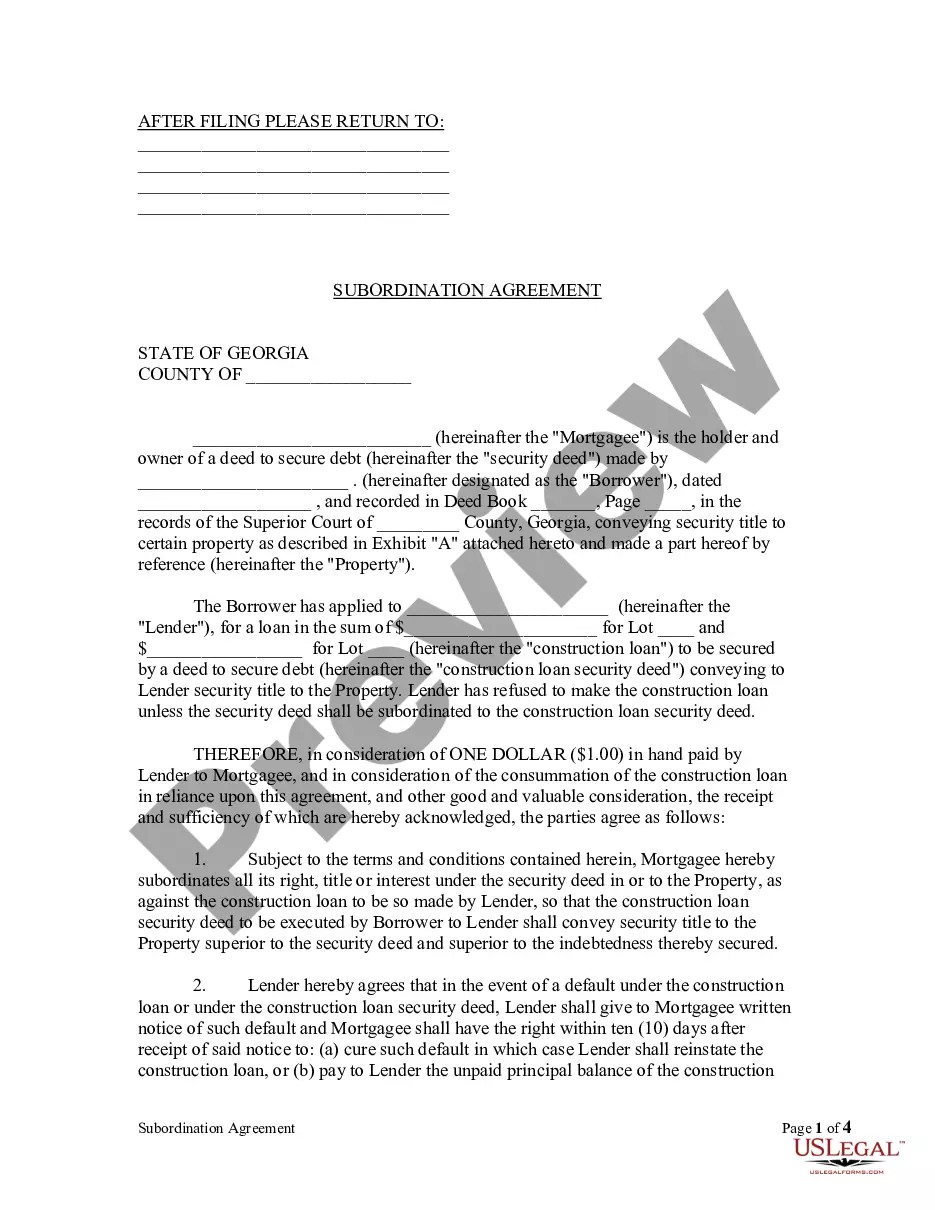

- Verification of form compliance. Prior to acquiring any template, ensure it meets your usage criteria and the laws of your state or county. Review the form description and use the Preview if it is available.

Form popularity

FAQ

In California, a deed of trust can be deemed invalid for several reasons. These include insufficient signatures, failure to record the deed, and misrepresentation during the signing process. Additionally, if the borrower has a corporation assignment of deed of trust mortgage with bad credit, it may lead to further scrutiny and potential validity issues. Ensuring all paperwork is accurate and following legal procedures is crucial to prevent complications.

The purpose of a trust deed is to provide a formal structure for managing outstanding debts, protecting assets while allowing individuals to make agreed payments. It serves as a legally binding contract between the debtor and creditors. Engaging in a corporation assignment of deed of trust mortgage with bad credit can help individuals reorganize debts and regain financial stability.

Acquiring a credit card while under a trust deed is often difficult, as lenders tend to be cautious with high-risk applicants. Still, after completing the trust deed and demonstrating financial responsibility, you may qualify for secured credit cards. Keeping track of your corporation assignment of deed of trust mortgage with bad credit can also help you show lenders growth in creditworthiness.

In the UK, placing your house in a trust while having an existing mortgage is possible but requires careful consideration. You need to inform your lender and potentially seek their consent. If you're managing a corporation assignment of deed of trust mortgage with bad credit, consulting with a legal expert may benefit you in this situation.

At the end of a trust deed, any remaining debts covered by the deed are typically forgiven, allowing you to start fresh. This also means you regain full ownership of your assets. Successfully navigating the end of a corporation assignment of deed of trust mortgage with bad credit can pave the way for stronger future financial decisions.

Yes, you can obtain credit after completing a trust deed, but it may take some time. Lenders often view you as a risk until you rebuild your credit history. Engaging in practices that improve your financial health, like managing your corporation assignment of deed of trust mortgage with bad credit effectively, can help you qualify for credit sooner.

Obtaining credit while under a trust deed is typically challenging, as it signifies you are in a debt solution plan. Creditors may view you as a higher risk, limiting your ability to secure new credit. However, with actions such as completing your corporation assignment of deed of trust mortgage with bad credit, you can improve your financial outlook over time.

An assignment of duties occurs when an individual passes on specific responsibilities to someone else, such as delegating tasks in a business setting. If you are involved in a Corporation assignment of deed of trust mortgage with bad credit, understanding how to handle assignments can streamline operations and enhance efficiency. Clear assignments of duties ensure everyone knows their roles, ultimately benefiting the organization.

An assignment of mortgage is the process where a mortgage lender transfers the rights to receive payments and enforce the mortgage terms to another party. When approaching a Corporation assignment of deed of trust mortgage with bad credit, knowing how assignments work can affect your financing and repayment strategies. This concept is vital for maintaining clarity and success in your financial journey.

An assignment of property typically refers to transferring the rights to a lease or rental agreement from one tenant to another. If you're considering a Corporation assignment of deed of trust mortgage with bad credit, this process may impact your options for securing property. Understanding the nuances of property assignments can help you make better choices in your real estate dealings.