Pay Rent Tenant With Credit Card

Description

How to fill out Illinois 5 Day Notice To Pay Rent Or Lease Terminates - Nonresidential Or Commercial?

It’s no secret that you can’t become a legal professional immediately, nor can you figure out how to quickly prepare Pay Rent Tenant With Credit Card without having a specialized background. Creating legal forms is a time-consuming venture requiring a particular training and skills. So why not leave the preparation of the Pay Rent Tenant With Credit Card to the professionals?

With US Legal Forms, one of the most comprehensive legal template libraries, you can access anything from court documents to templates for internal corporate communication. We understand how important compliance and adherence to federal and local laws are. That’s why, on our platform, all forms are location specific and up to date.

Here’s start off with our website and obtain the document you require in mere minutes:

- Discover the form you need with the search bar at the top of the page.

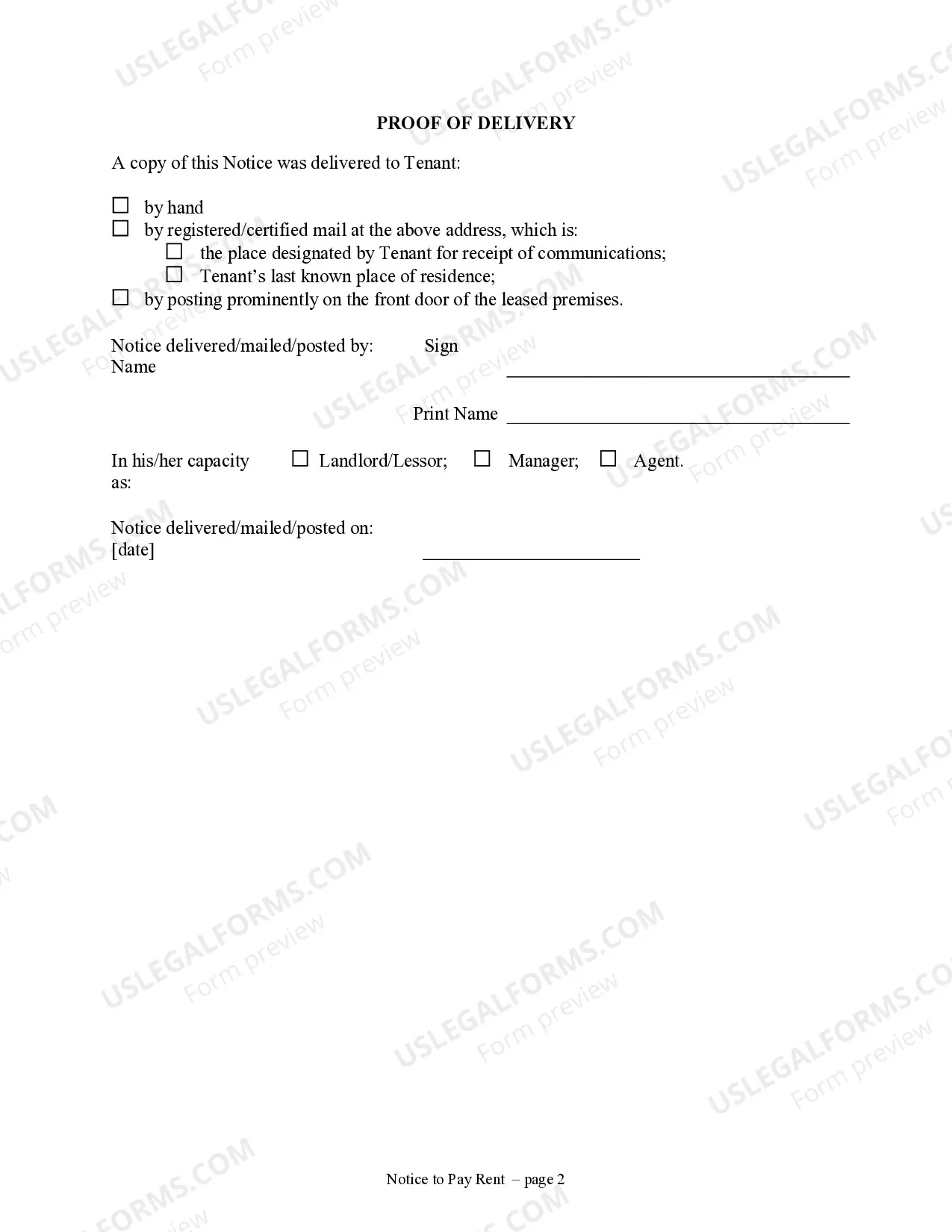

- Preview it (if this option available) and check the supporting description to determine whether Pay Rent Tenant With Credit Card is what you’re searching for.

- Begin your search over if you need any other template.

- Set up a free account and choose a subscription plan to purchase the template.

- Choose Buy now. As soon as the payment is through, you can get the Pay Rent Tenant With Credit Card, complete it, print it, and send or mail it to the necessary individuals or organizations.

You can re-access your forms from the My Forms tab at any time. If you’re an existing customer, you can simply log in, and locate and download the template from the same tab.

No matter the purpose of your documents-whether it’s financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

This company has you enter your landlord's payment address and information before charging your card. From there, your landlord can be paid via ACH transfer or a paper check sent by mail. Plastiq charges a 2.9% fee for card payments, which will be tacked on to your charge upfront.

Third-Party Apps for Paying Rent with a Credit Card: NameFees ChargedPlacePay2.99% or free (landlord has the choice to cover the fee for you)Rent Track2.95% or free (landlord has the choice to cover the fee for you) Or, $9.95 monthly subscription fee with no processing feesApartments.com2.75%Zego3%6 more rows

Rent payment online on Freecharge is as easy as a cakewalk. Enter Landlord's Details. Provide your landlord's bank account details, IFSC code, mobile number. Make Payment. Enter your credit card details and make rent payment. Payment is Done. Payment gets credited to the landlord's bank account. Live worry-free.

Unless you or your landlord have signed up for a rent reporting service, the three major credit bureaus ? Equifax, Experian and TransUnion ? will not put rent payments on your credit report. That means your credit score and credit report aren't affected by your rent payments.

You can make sure your on-time rent payments are being reported to credit bureaus through rent reporting services. There are two ways that your rent can be reported through a rent reporting service: your property manager can report payments for you, or you can report payments yourself.