Sample Agreement Between Two Parties For Payment

Description

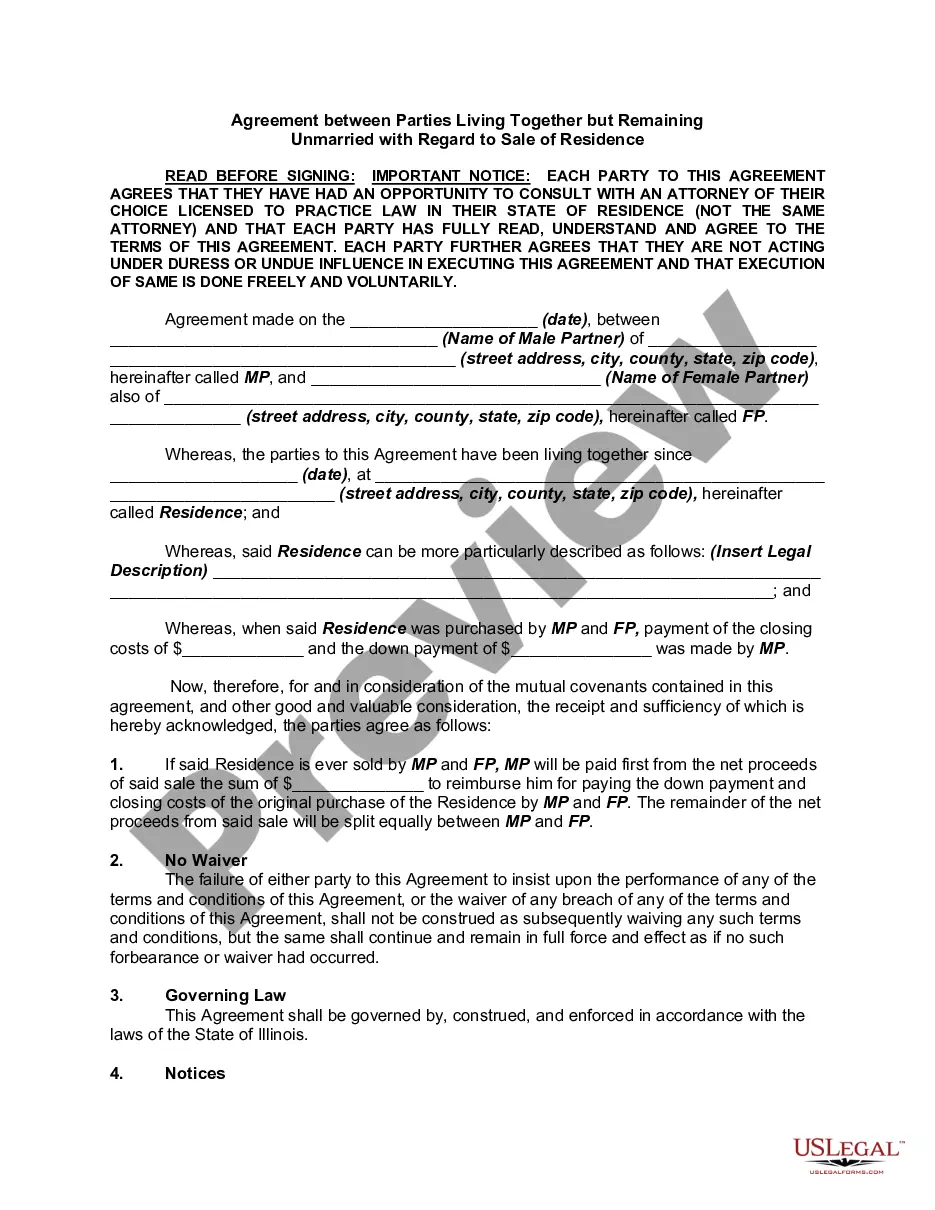

How to fill out Illinois Agreement Between Parties Living Together But Remaining Unmarried With Regard To Sale Of Residence?

Locating a reliable source for the latest and most pertinent legal templates is a significant part of dealing with bureaucracy.

Identifying the correct legal documents requires precision and careful consideration, which is why it's crucial to obtain samples of Sample Agreement Between Two Parties For Payment exclusively from reputable providers, like US Legal Forms. An incorrect template can squander your time and delay your situation.

Once you have the document on your device, you can edit it using the editor or print it and complete it manually. Remove the hassle associated with your legal paperwork. Explore the comprehensive US Legal Forms collection to discover legal templates, evaluate their applicability to your situation, and download them right away.

- Use the directory navigation or search function to locate your sample.

- Review the form’s details to ensure it meets the criteria of your state and county.

- Check the form preview, if available, to verify that the template is indeed the one you need.

- Continue searching and find the suitable document if the Sample Agreement Between Two Parties For Payment does not meet your specifications.

- When you are confident about the document’s suitability, download it.

- If you are a registered user, click Log in to verify and access your chosen templates in My documents.

- If you have yet to create an account, click Buy now to purchase the template.

- Choose the pricing option that fits your requirements.

- Proceed to registration to finalize your order.

- Complete your transaction by selecting a payment method (credit card or PayPal).

- Choose the document format for downloading Sample Agreement Between Two Parties For Payment.

Form popularity

FAQ

To write a contract agreement for payment between two parties, start by clearly outlining the names of the parties involved, the payment amount, and the payment schedule. Include terms regarding late fees, payment methods, and dispute resolution. Using a sample agreement between two parties for payment can greatly simplify this process, ensuring that you include all necessary elements for a comprehensive agreement.

Yes, a payment agreement can be legally binding if it meets certain criteria. Both parties must willingly agree to the terms, and the agreement must include specific details such as payment amounts, due dates, and consequences for non-compliance. To create a strong and enforceable document, consider using a sample agreement between two parties for payment as a guide.

A legally binding agreement between two parties is known as a contract. This contract signifies that both parties have reached a mutual understanding and have agreed to specific terms. Utilizing a sample agreement between two parties for payment can provide a solid foundation for creating a binding contract that protects everyone's interests.

To draw up a payment agreement, start by gathering relevant information from both parties, including names and contact details. Structure the document by outlining the payment terms, including amounts and schedules, and ensure both parties sign it. Utilizing a sample agreement between two parties for payment can streamline this process and help you create a comprehensive and effective document.

Writing a simple agreement between two parties involves clearly stating the purpose of the agreement and the obligations of each party. Use straightforward language and include essential details like payment terms and deadlines. A sample agreement between two parties for payment can provide a solid foundation to ensure you include all necessary components.

To write a payment agreement between two parties, start by including the names and contact information of both parties. Clearly outline the payment terms, including the amount, payment schedule, and any penalties for late payments. A sample agreement between two parties for payment can serve as a helpful template to ensure you cover all necessary details.

A payment agreement does not necessarily need to be notarized for it to be valid. However, notarization can add an extra layer of security and authenticity to the document. When you create a sample agreement between two parties for payment, consider notarizing it if the amount is substantial or if either party requires additional assurance.