Agreement Between Two Parties For Loan

Description

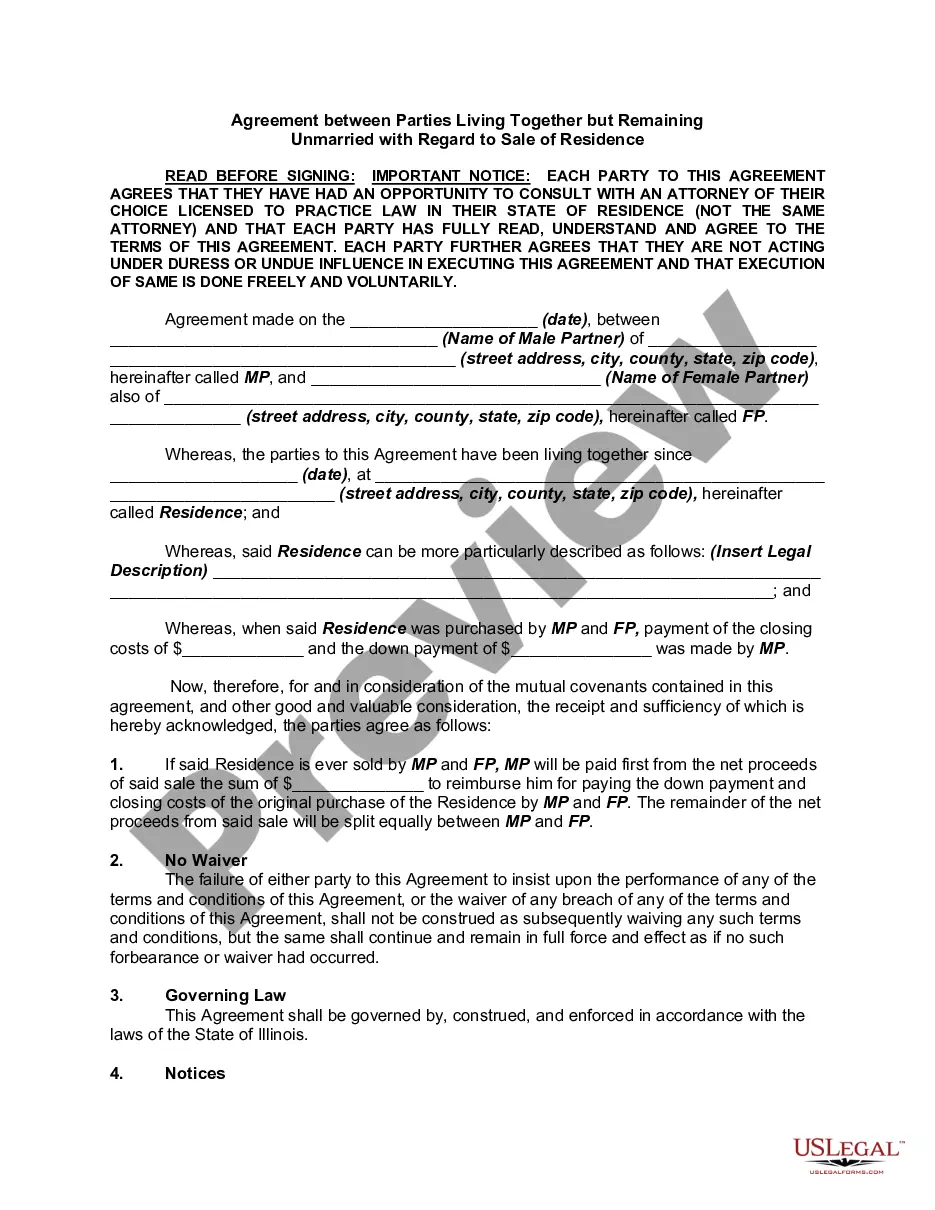

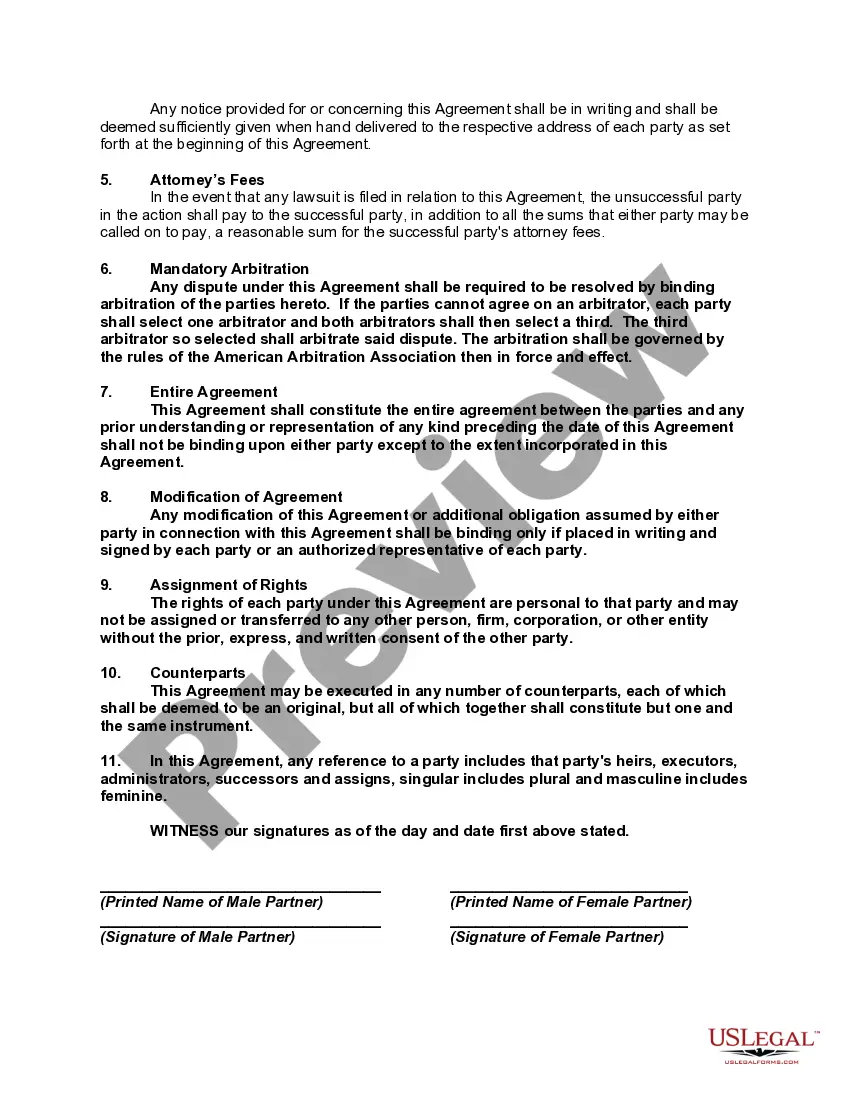

How to fill out Illinois Agreement Between Parties Living Together But Remaining Unmarried With Regard To Sale Of Residence?

It’s clear that you cannot transform into a legal expert in a flash, nor can you determine how to swiftly create an Agreement Between Two Parties For Loan without possessing a specialized skill set.

Drafting legal documents is a lengthy process that demands specific training and expertise. So why not entrust the crafting of the Agreement Between Two Parties For Loan to the professionals.

With US Legal Forms, one of the largest repositories of legal documents, you can locate anything from court forms to templates for internal business communication.

You can retrieve your documents from the My documents section at any time. If you’re already a customer, just Log In, and you can find and download the template from the same section.

Whatever the goal of your paperwork—whether it’s financial, legal, or personal—our platform is here to assist you. Try US Legal Forms today!

- Start by using the search bar at the top of the page to find the document you require.

- Preview it (if this option is available) and review the supporting description to confirm whether Agreement Between Two Parties For Loan is what you’re looking for.

- Begin your search anew if you need a different template.

- Create a free account and choose a subscription plan to purchase the document.

- Click Buy now. Once the payment is processed, you can access the Agreement Between Two Parties For Loan, complete it, print it, and deliver it by mail to the relevant parties or entities.

Form popularity

FAQ

To write a simple agreement between two parties for a loan, start by clearly identifying both parties and their roles. Next, outline the loan amount, repayment terms, interest rates, and any collateral involved. It’s essential to include a section for signatures and the date to make it official. For your convenience, USLegalForms offers templates that can guide you in creating a comprehensive agreement tailored to your needs.

Writing a basic loan agreement involves outlining key components such as the names of the parties, loan amount, interest rate, repayment terms, and signatures. It's important to be clear and concise to avoid confusion later. For simplicity, consider using a template from US Legal Forms, which can provide a solid foundation for your agreement between two parties for loan.

To write a loan agreement between two parties, begin by defining the roles of the lender and borrower. Include essential terms such as the total loan amount, interest rate, payment timeline, and any additional conditions. Utilizing a professional template from US Legal Forms can help ensure your agreement is comprehensive and legally sound.

Yes, you can write your own loan agreement, provided you include all necessary details. A thorough agreement between two parties for loan should cover the loan amount, interest rate, repayment schedule, and any potential penalties. If you feel uncertain about the format or legal implications, using a reliable template from US Legal Forms can simplify the process.

To write a loan agreement between two people, start by clearly stating the names and contact information of both parties. Next, outline the loan amount, interest rate, repayment terms, and any collateral involved. Ensure that both parties understand and agree to the terms, and consider using a template from US Legal Forms for added clarity.

A contract between two people for a loan is a legally binding document that outlines the terms of the loan. This agreement includes details such as the loan amount, interest rate, repayment schedule, and consequences for default. Having a clear agreement between two parties for loan can foster trust and clarity in the transaction.

You do not necessarily need a lawyer to draft a loan agreement, but it can be beneficial. A well-structured agreement between two parties for loan can prevent misunderstandings and protect both parties' interests. If you are unsure about the legal language or terms, consider using resources like US Legal Forms to guide you.

Drafting an agreement between two people requires careful consideration of the agreement's purpose, terms, and conditions. Start by identifying the agreement's subject, then outline the obligations and rights of each party. Using US Legal Forms can greatly assist in this task by offering pre-made templates tailored for various agreements, including those for loans. This ensures that you create a comprehensive and effective agreement between two parties for a loan.

Writing a loan agreement between two people involves detailing the specific terms of the loan, such as the principal, interest rate, and repayment plan. It's essential to include the full names and addresses of both parties, as well as the date the agreement is made. You can enhance clarity by using a template from US Legal Forms, which guides you through creating a structured agreement between two parties for a loan. This approach ensures that both parties have a clear understanding of their obligations.

To create a legally binding loan agreement, you should first clearly outline the terms, including the loan amount, interest rate, repayment schedule, and any collateral involved. Ensure both parties understand and agree to the terms, and include signatures to validate the agreement. Utilizing a reliable platform like US Legal Forms can simplify this process by providing templates that adhere to legal standards. This way, you can establish a solid agreement between two parties for a loan.