Repossession With Child

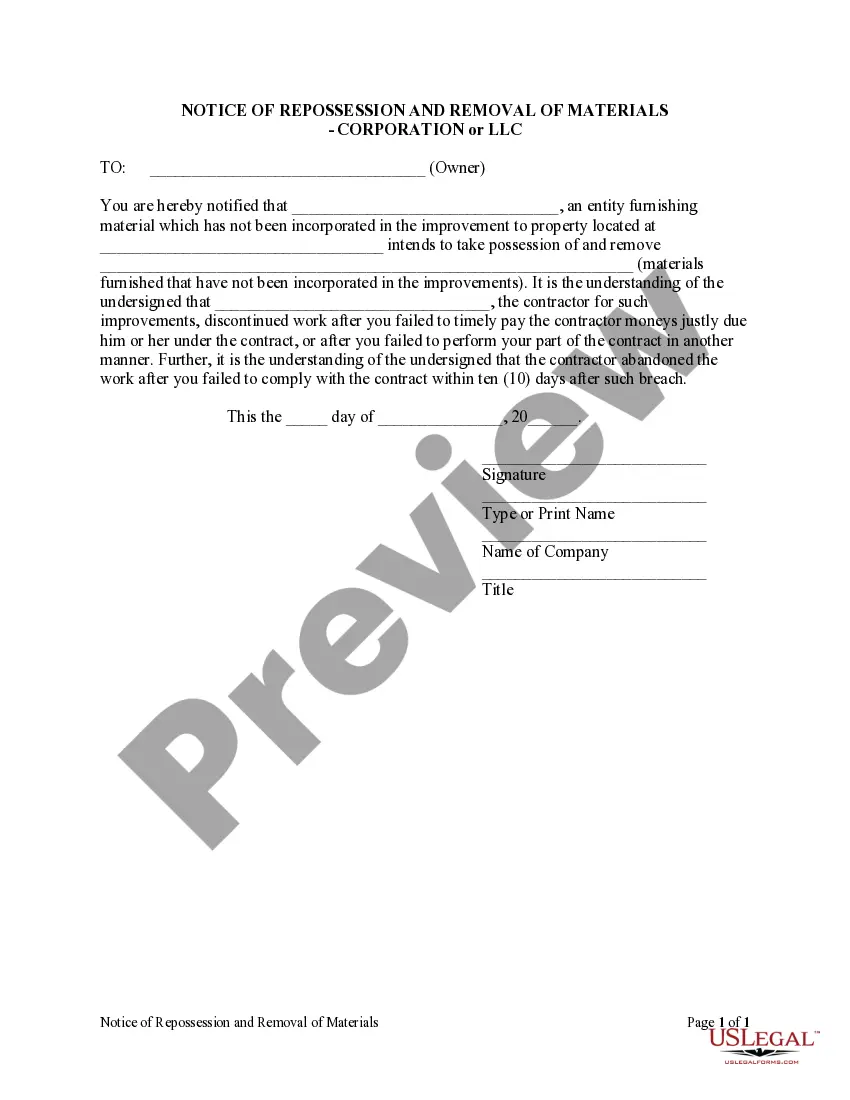

Description

How to fill out Repossession With Child?

Properly formulated formal documentation is a key safeguard for preventing issues and lawsuits, but obtaining it without the assistance of an attorney may require some time.

If you need to swiftly locate an up-to-date Repossession With Child or any other forms for employment, family, or business circumstances, US Legal Forms is always available to assist.

The process is even more straightforward for existing users of the US Legal Forms library. If your subscription is active, you simply need to sign in to your account and click the Download button next to the selected file. Furthermore, you can access the Repossession With Child at any time later, as all documents ever obtained on the platform are retrievable within the My documents section of your profile. Conserve time and money on preparing official documentation. Experience US Legal Forms today!

- Verify that the form is appropriate for your situation and location by reviewing the description and preview.

- Search for another sample (if necessary) using the Search bar located in the page header.

- Select Buy Now once you identify the suitable template.

- Choose your pricing plan, Log Into your account or create a new one.

- Select your preferred payment option to purchase the subscription plan (using a credit card or PayPal).

- Decide between PDF or DOCX file format for your Repossession With Child.

- Click Download, then print the document to complete it or upload it to an online editor.

Form popularity

FAQ

If the bank cannot locate your vehicle, they may choose to leave the account open while they continue searching. It may ultimately lead to other collection methods if the vehicle is not found. Staying informed about your financial obligations pertaining to repossession with child can be essential for effectively managing your situation.

You may express your concerns to a repossession agent, but it is important to know that they are acting within their legal rights. Refusing to allow repossession can lead to further complications, possibly escalating legal actions. Consulting legal resources can clarify your rights during repossession with child.

While child support agencies do not directly repossess cars, they can garnish wages or seek court orders for financial recovery. If you fall behind on child support, your financial obligations may affect asset recovery. Understanding the implications of child support on repossession with child is crucial for wise financial planning.

If a lender cannot locate your vehicle for repossession, they may continue searching or take alternative actions. This could include pursuing legal remedy to collect the owed amount. Seeking assistance through platforms like USLegalForms can help you understand your rights during repossession with child.

The repossession process can vary based on several factors, but it generally does not take long once initiated. Banks and lenders often act quickly to recover vehicles after missed payments. If you face repossession with child, it's important to act swiftly to resolve any issues that may avoid vehicle loss.

A bank can locate your car using various methods, including tracking devices and GPS technology. They may also hire professional repossession agents who have access to databases that list vehicles. By using this information, they can efficiently locate vehicles in the event of repossession with child.

The entire repossession process can take anywhere from a few days to several weeks, as each case is unique. Your lender will typically assess your payment history and attempt to contact you before taking action. If there are children involved, a repossession with child may involve legal nuances that further prolong the process. Seeking advice from professionals like US Legal Forms can provide you with the necessary tools to understand your rights and options.

Legally repossessing a vehicle from a family member typically requires documentation to show you own the car. You must inform them of your intentions, as repossession with child complicates family relationships. You might need to consult a lawyer to navigate this process without escalating tensions. Legal guidance ensures that you follow the right steps to reclaim your property while maintaining family ties.

The timeline for a repossession to start can vary based on the lender's policies and your payment history. Typically, a lender will begin the repossession process after you miss a few payments, which often occurs around 60 to 90 days past due. If you are facing a repossession with child involved, it's crucial to act quickly and seek legal advice. Many borrowers may find solutions through negotiation or restructuring their payment plans, which can help avoid repossession altogether.

If the repossession agent cannot locate your vehicle, they may take a break and attempt again later. They will likely follow leads on where your car might be kept, such as your home or workplace. Keep in mind that your lender wants the car back, especially if it pertains to a repossession with child involved. This situation can cause additional stress, so being proactive and communicating with your lender might help you find a resolution.