Illinois Quit Claim Deed Form Cook County

Description

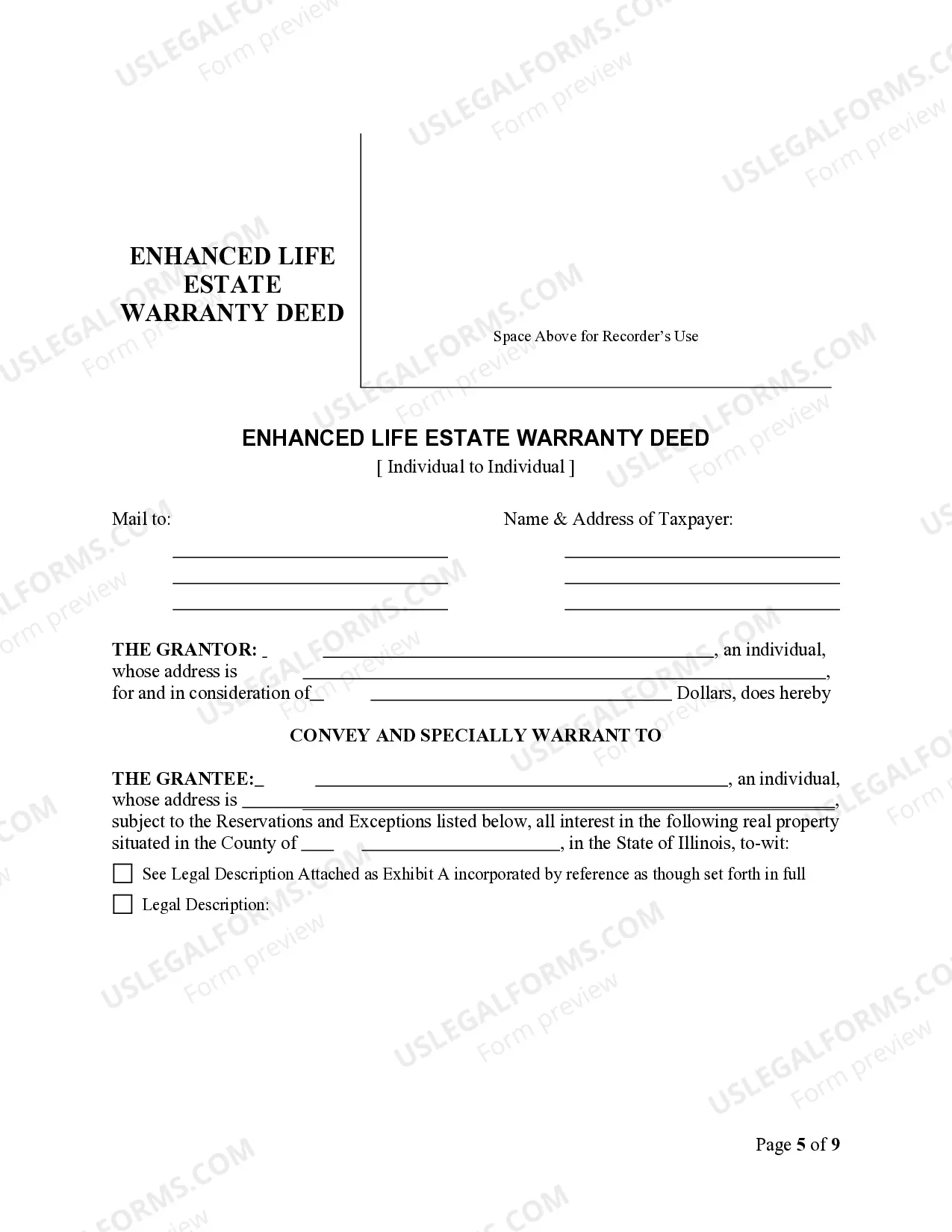

How to fill out Illinois Lady Bird Or Enhanced Life Estate Deed - Individual To Individual?

Utilizing legal document examples that comply with federal and local regulations is crucial, and the web provides a plethora of choices. However, what’s the purpose of spending time searching for the suitable Illinois Quit Claim Deed Form Cook County template online when the US Legal Forms digital library already has such documents gathered in one location.

US Legal Forms is the largest online legal repository with over 85,000 customizable templates created by lawyers for every professional and personal situation. They are simple to navigate with all documents organized by state and intended use. Our specialists stay updated with legislative changes, so you can always be assured that your documents are current and compliant when obtaining an Illinois Quit Claim Deed Form Cook County from our platform.

Acquiring an Illinois Quit Claim Deed Form Cook County is swift and straightforward for both existing and new users. If you already possess an account with an active subscription, Log In and save the document template you require in the appropriate format. If you are unfamiliar with our site, follow the steps outlined below.

All documents you find through US Legal Forms are reusable. To re-download and fill out previously acquired forms, access the My documents section in your account. Take advantage of the most comprehensive and user-friendly legal documentation service!

- Examine the template using the Preview function or via the text description to confirm it fulfills your requirements.

- Search for another template using the search feature at the top of the page if necessary.

- Click Buy Now once you’ve discovered the appropriate form and choose a subscription option.

- Create an account or Log In and complete your payment with PayPal or a credit card.

- Select the format for your Illinois Quit Claim Deed Form Cook County and download it.

Form popularity

FAQ

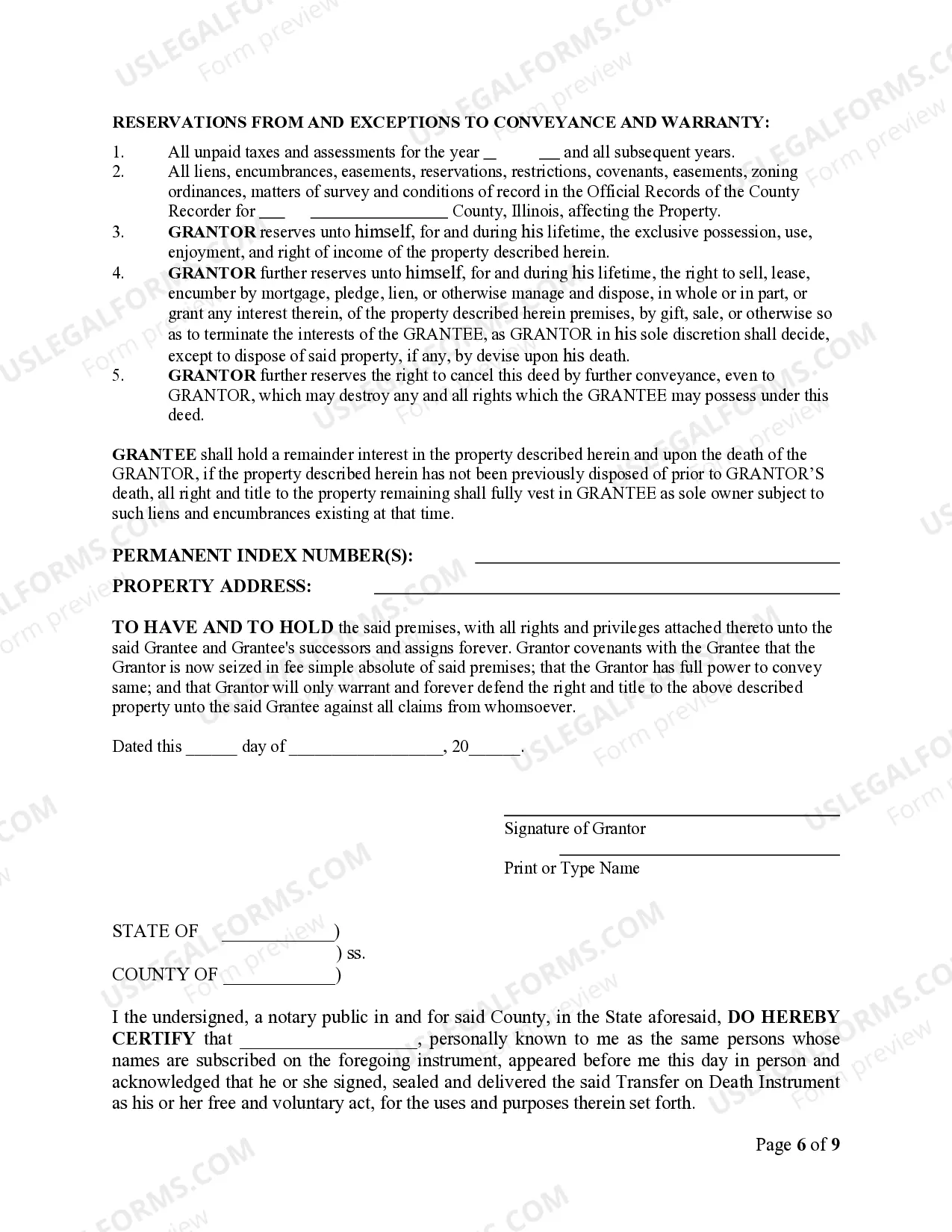

The primary method for transferring Illinois real estate is for the current owner to create and record a deed. An Illinois deed transfers property from one or more current owners (grantors) to one or more new owners (grantees).

In order to file a deed in Cook County, the necessary documents are as follows: (1) Tax Declaration (MyDec); (2) Tax Stamps (or ?Zero Stamps? if an exempt transfer); (3) A Grantor/Grantee Affidavit (exempt transfers); (4) The Deed to be Filed (which must contain PIN number, complete legal description, commonly known ...

If you're preparing the quitclaim deed yourself, make sure to enter the property description just as it appears on an older deed of the property. If you can't find an old deed, check with the County Recorder of Deeds in the county where the property is located. They can tell you where to get a copy of an earlier deed.

Form PTAX-203, Illinois Real Estate Transfer Declaration, is completed by the buyer and seller and filed at the county in which the property is located. Form PTAX-203-A, Illinois Real Estate Transfer Declaration Supplemental Form A, is used for non-residential property with a sale price over $1 million.

LEGAL FEES - ILLINOIS QUIT CLAIM DEEDS The fee is $150 (or $160 if paid by credit card). It will be your responsibility to get the transfer stamps (if necessary) and get the deed recorded with the County Recorder. There is nothing legal about obtaining the municipal stamp and recording the deed.