Idaho Workman Compensation Withholding

Description

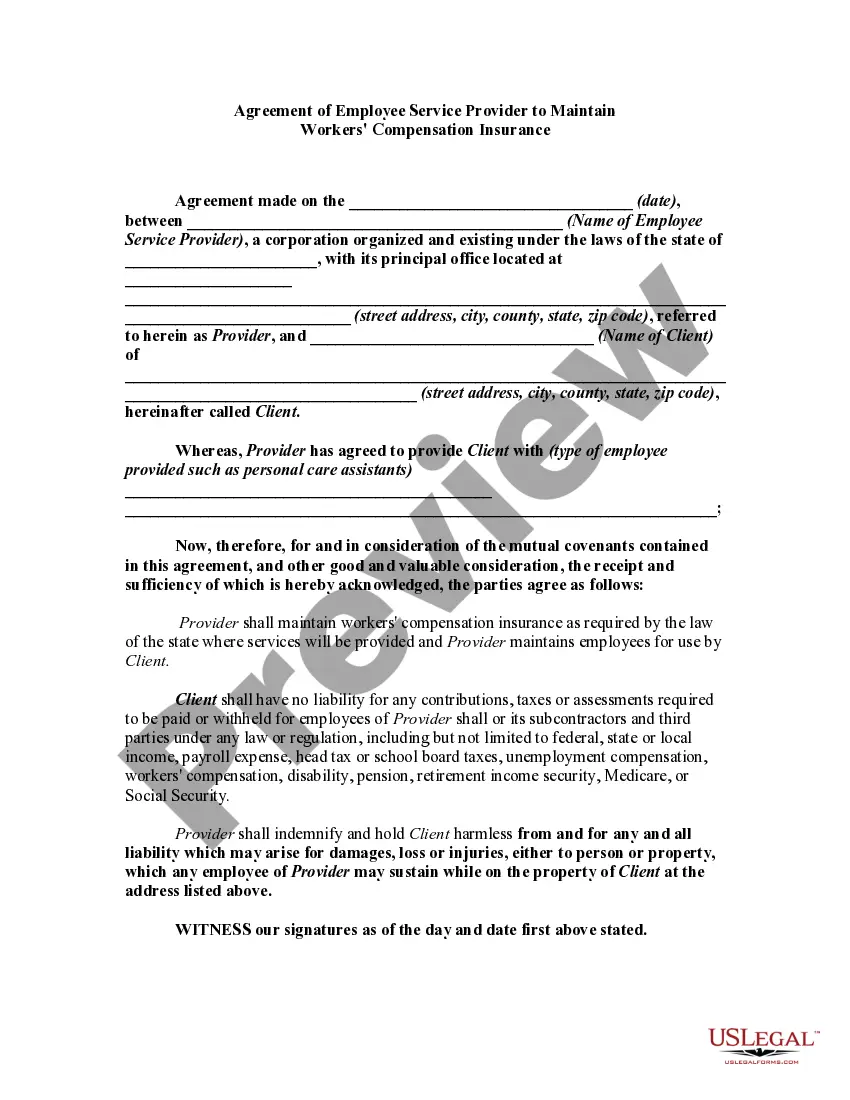

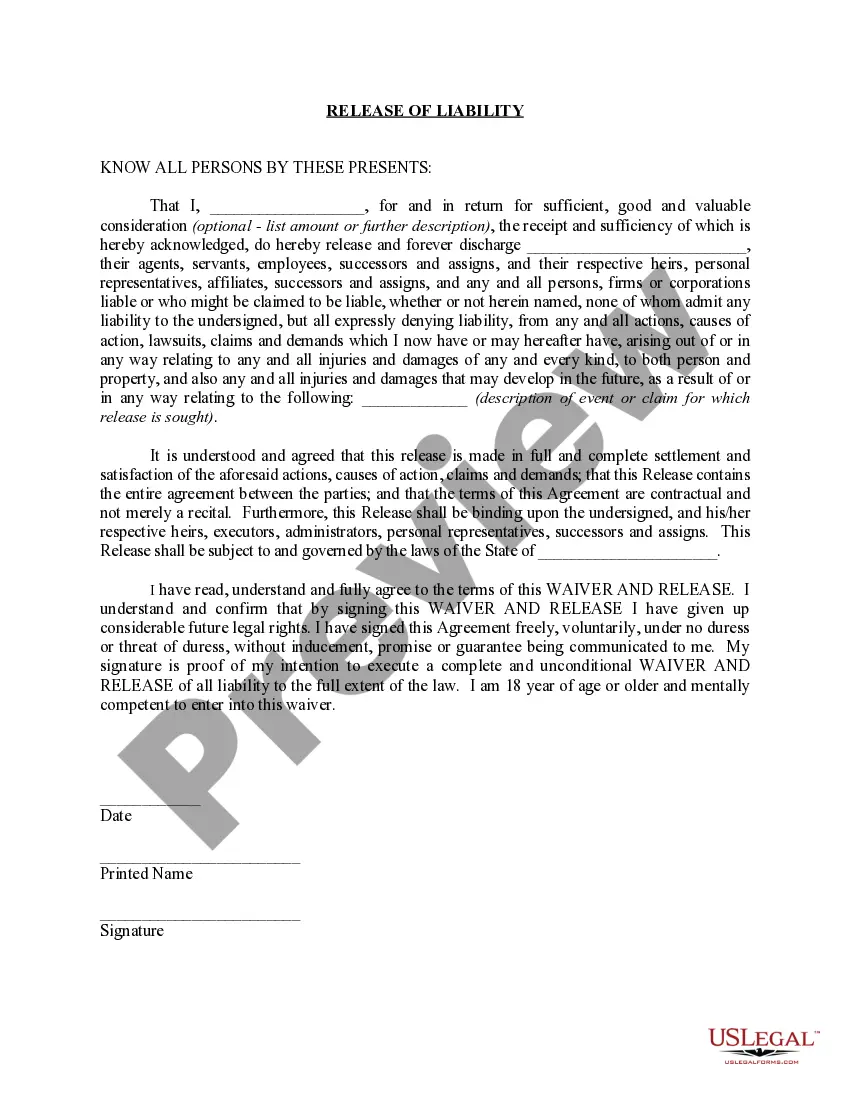

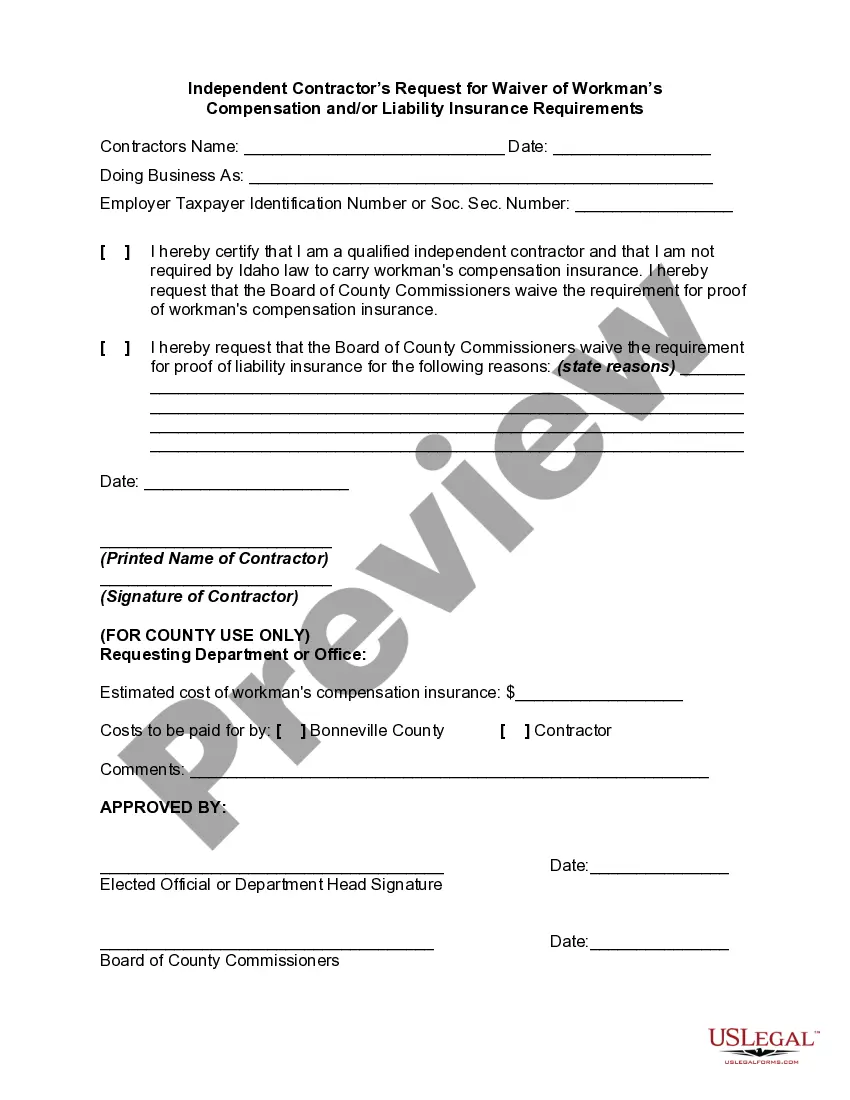

How to fill out Idaho Independent Contractor's Request For Waiver Of Workman's Compensation And/or Liability Insurance Requirements?

Utilizing legal templates that conform to federal and local regulations is essential, and the internet provides numerous options to select from.

However, what’s the advantage of spending time searching for the accurately drafted Idaho Workman Compensation Withholding example online when the US Legal Forms digital library already consolidates such templates in one location.

US Legal Forms is the most extensive online legal catalog featuring over 85,000 editable templates created by attorneys for various business and personal circumstances.

Review the template using the Preview function or through the text outline to confirm it meets your requirements.

- They are straightforward to navigate with all documents organized by state and intended use.

- Our experts stay updated with legislative modifications, ensuring your documents are current and compliant when obtaining an Idaho Workman Compensation Withholding from our site.

- Acquiring an Idaho Workman Compensation Withholding is quick and uncomplicated for both existing and new users.

- If you possess an account with a valid subscription, Log In and download the document template you require in your desired format.

- If you are a newcomer to our platform, follow the instructions outlined below.

Form popularity

FAQ

Employers are required by Idaho law to withhold income tax from their employees' wages. If you're an employee, your employer probably withholds income tax from your pay.

A single filer with no children should claim a maximum of 1 allowance, while a married couple with one source of income should file a joint return with 2 allowances.

How to fill out a W-4: step by step Step 1: Enter your personal information. ... Step 2: Account for all jobs you and your spouse have. ... Step 3: Claim your children and other dependents. ... Step 4: Make other adjustments. ... Step 5: Sign and date your form.

If you are single and have one job, or married and filing jointly then claiming one allowance makes the most sense. An individual can claim two allowances if they are single and have more than one job, or are married and are filing taxes separately.

Annualized Wage method Multiply the wages for the pay period by the number of pay periods in the calendar year. Subtract the Idaho Child Tax Credit allowances from the gross wages to determine the amount subject to withholding. Use this figure and the annual tables to compute the amount of withholding required.