Power Of Attorney Irs

Description

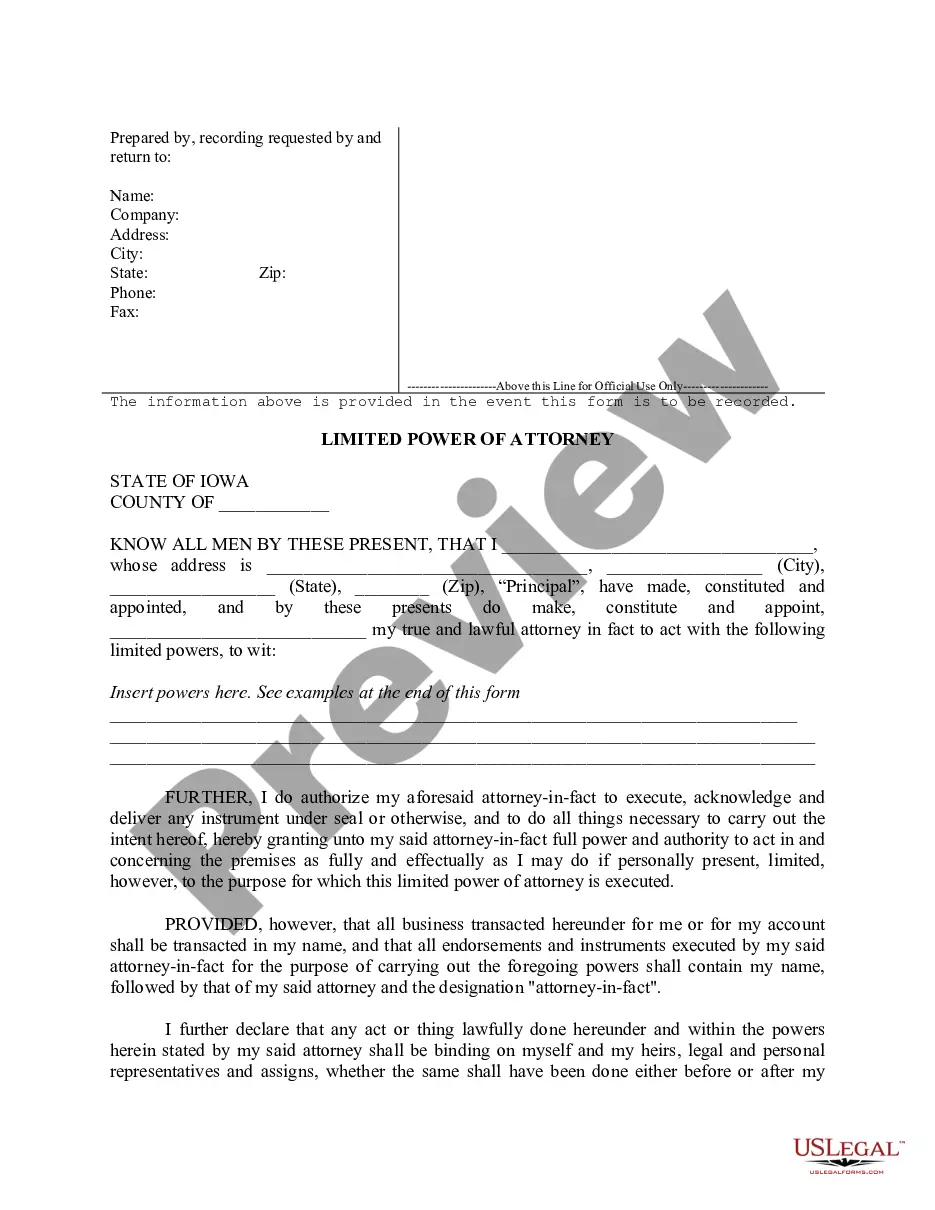

How to fill out Iowa Limited Power Of Attorney Where You Specify Powers With Sample Powers Included?

- Log in to your existing US Legal Forms account. Ensure your subscription is active to avoid any interruptions. If your subscription has expired, consider renewing it based on your payment preferences.

- Browse the extensive form collection and check the Preview mode along with the description. It's crucial to select the form that aligns perfectly with your local jurisdiction requirements.

- If necessary, utilize the Search tool to find alternative templates. Ensure that the chosen document meets all your legal needs before proceeding.

- Purchase the document by clicking the Buy Now button. Select a subscription plan that suits your legal needs, keeping in mind that you’ll have to create an account to unlock the resources.

- Complete the transaction by entering your payment details, through either credit card or PayPal.

- Download the completed form directly to your device. You can find it later in the My Forms section of your profile for easy access and completion.

By following these straightforward steps, you can leverage the robust capabilities of US Legal Forms. This platform not only saves time but also assures that you are accessing reliable and legally sound documentation.

Don’t hesitate—visit US Legal Forms today and take the first step towards acquiring your necessary legal documents with ease!

Form popularity

FAQ

In Texas, a power of attorney must be signed by the principal and must include specific language regarding the powers granted. A notary or two witnesses must also sign the document. It’s essential to follow these guidelines closely, particularly if the POA will be used for IRS purposes. For added assistance, you can use US Legal Forms to create a compliant power of attorney tailored to Texas law.

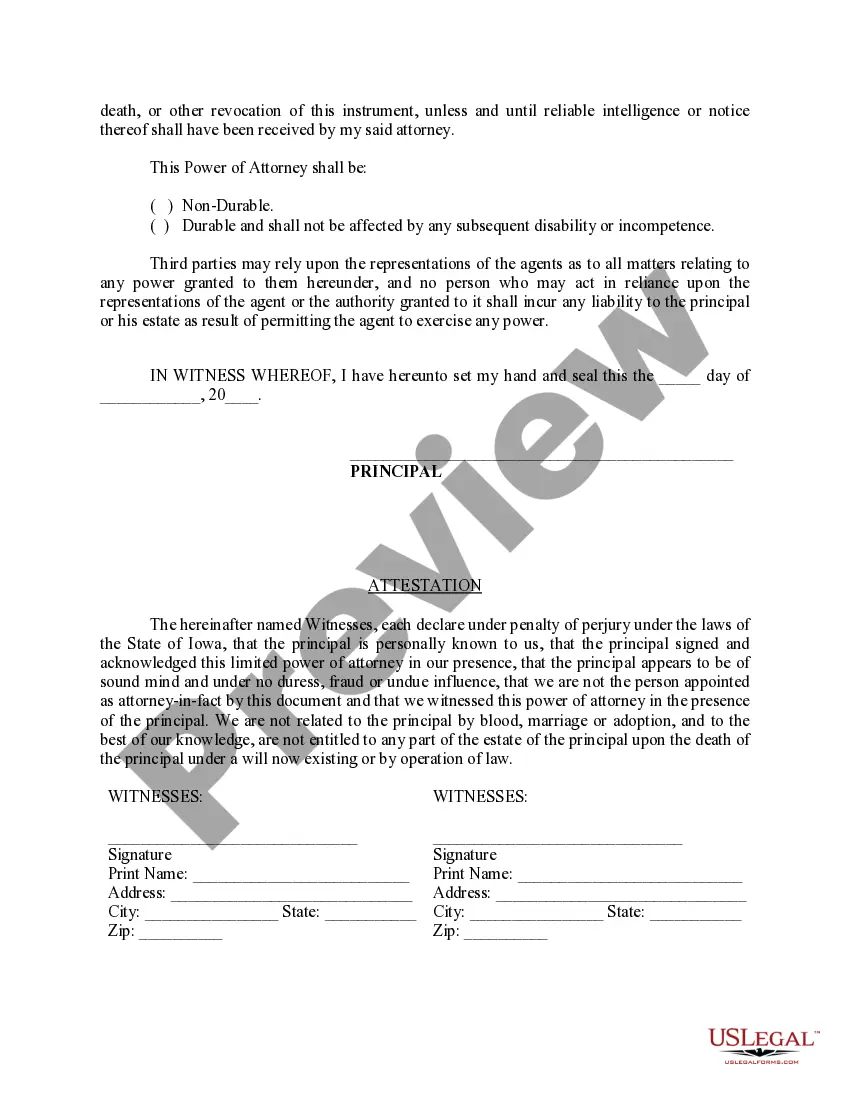

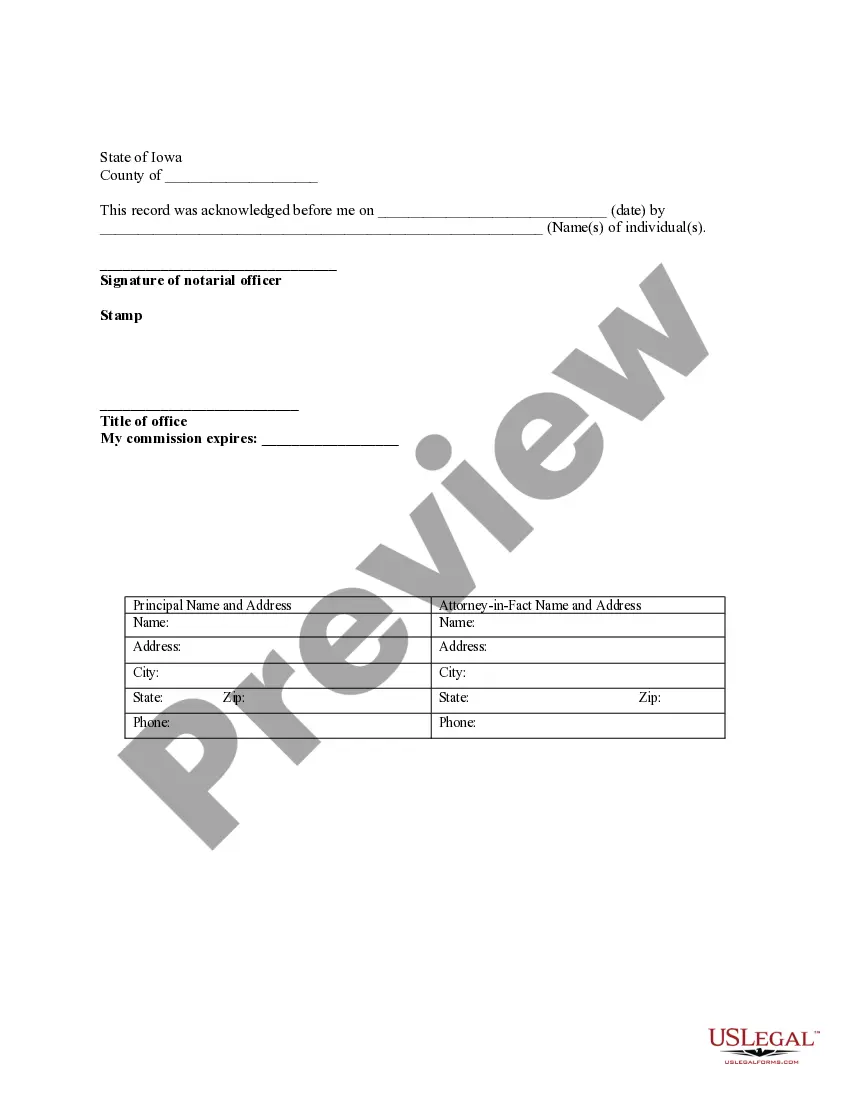

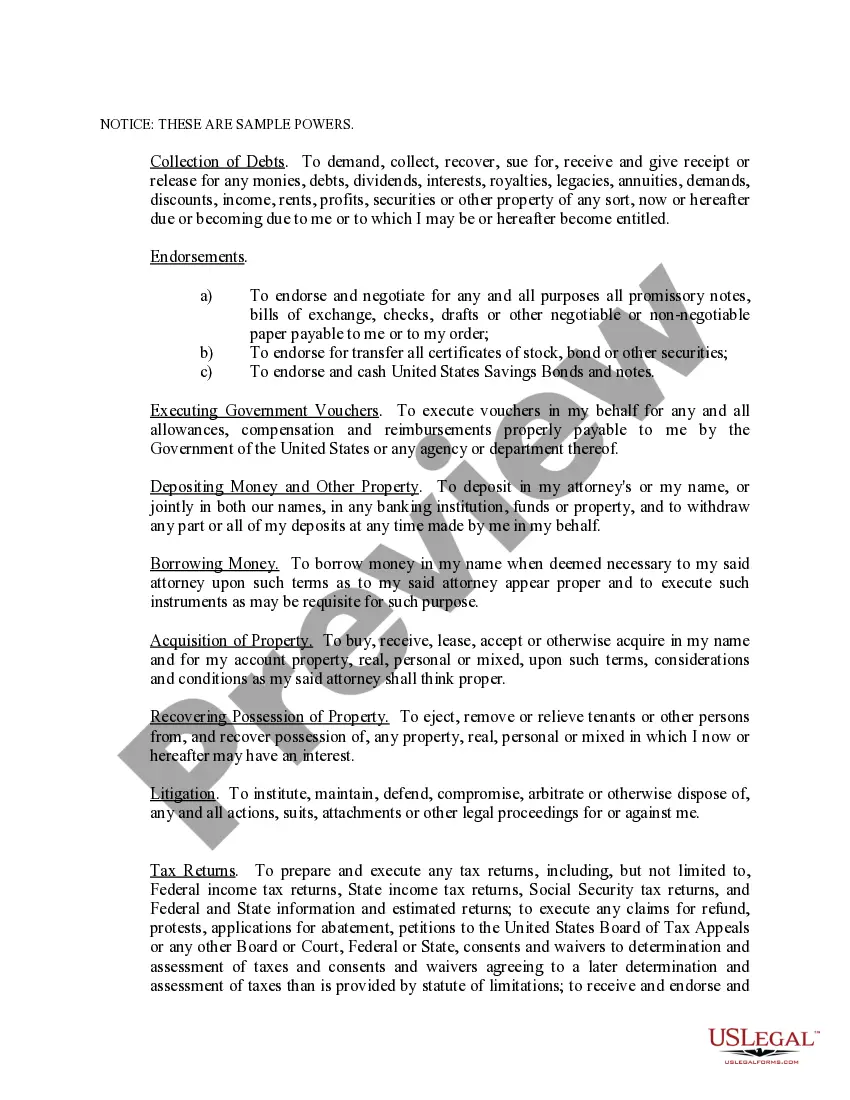

Filling out a power of attorney form involves several essential steps. Start by clearly stating the principal's full name and the agent's details, followed by the specific powers granted. Check that all required signatures, including witnesses or notary, are included, as missing any could invalidate the form. If needed, consider using US Legal Forms for a structured approach and helpful guidance.

Yes, a power of attorney can be signed virtually, provided that it meets legal requirements in your state. Virtual signing options often include electronic signatures and document-sharing tools that ensure authentication. However, it's vital to confirm your state's regulations, as they can vary. Using a platform like US Legal Forms can streamline the virtual signing process while keeping legal compliance in mind.

The IRS allows electronic signatures on Form 8655 under certain conditions. To qualify, your electronic signature must meet specific authentication requirements outlined by the IRS. It's crucial to follow these guidelines precisely to avoid any issues. Consulting a platform like US Legal Forms can help you with the correct process and ensure compliance.

Filling out a power of attorney requires clarity about your wishes. Start by providing your name and the agent's information, followed by the specific powers you wish to grant. It's essential to read the instructions carefully, as slight errors can delay the process. Consider using US Legal Forms for easy-to-follow templates to ensure accuracy and completeness.

In New Jersey, a power of attorney must be signed by the principal and two witnesses or a notary public. Additionally, the document should specify the powers granted to the agent. If you intend to use the power of attorney for IRS matters, make sure to include relevant tax notifications. You might find it helpful to utilize resources like US Legal Forms to create a compliant document tailored to New Jersey laws.

Yes, the IRS does accept electronic signatures for a power of attorney, but there are specific conditions that must be met. Your electronic signature must comply with IRS requirements, including proper identification and authenticity measures. To ensure compliance, it's advisable to review the IRS guidelines or seek assistance from a professional. Platforms like US Legal Forms can provide useful templates that adhere to these requirements.

Choosing the best person to act as your power of attorney involves careful consideration. This person should be trustworthy, responsible, and understand your financial and personal wishes. Often, people choose family members, close friends, or experienced professionals. Remember, the right choice can significantly impact how your affairs are managed, especially in dealings with the IRS.

To submit a power of attorney to the IRS, you must complete Form 2848, also known as the Power of Attorney and Declaration of Representative. After filling out the form, you should send it to the appropriate address, which depends on the specific situation. Using the correct mailing address helps ensure your power of attorney is processed in a timely manner. If you're uncertain about the details, consider using a platform like US Legal Forms to simplify the process.

Typically, the IRS processes power of attorney forms within 30 days of submission, but times may vary depending on their workload. If there are any issues with your form, the IRS will notify you directly. Staying proactive can help ensure a quicker response. For assistance and expert resources, explore the solutions offered by uslegalforms.