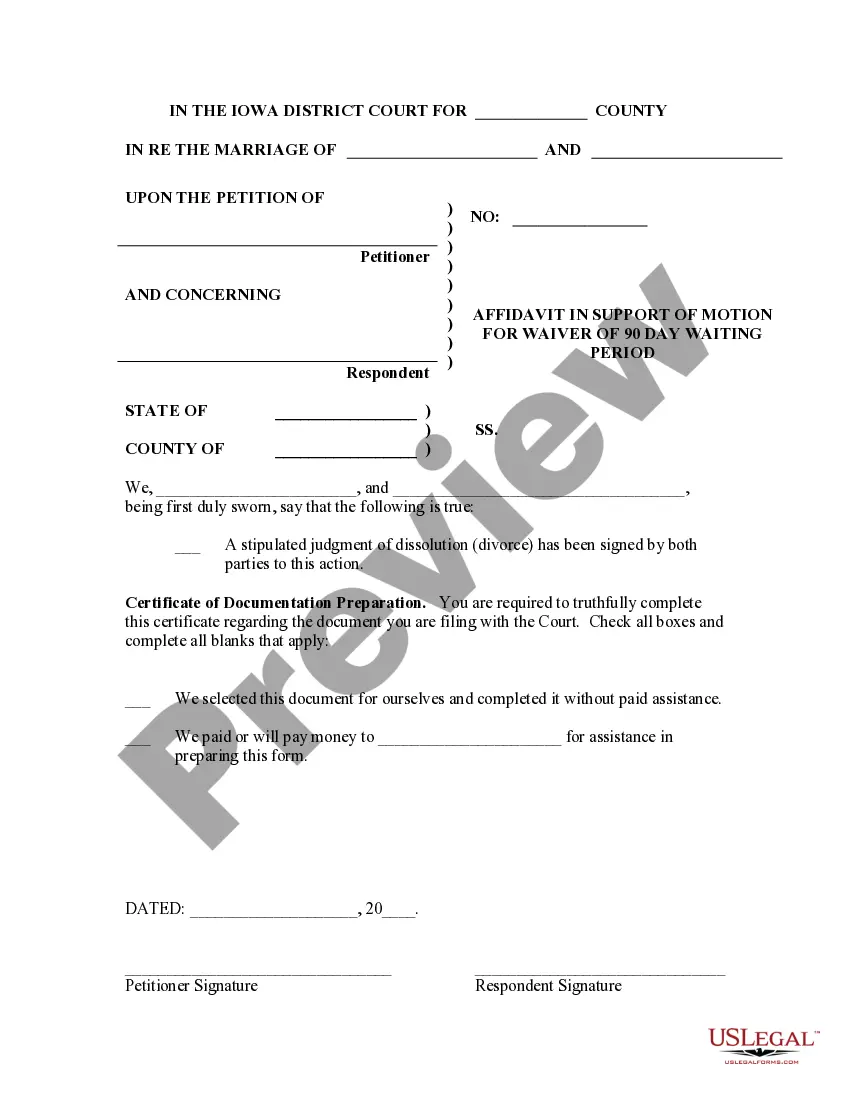

This a motion to waive the 90 day waiting period to grant a divorce.

222 Rule For Marriage

Description

How to fill out Iowa Motion For Waiver Of 90 Day Waiting Period?

It’s widely known that you can’t become a legal authority instantaneously, nor can you ascertain how to swiftly prepare the 222 Rule For Marriage without possessing a specialized education.

Compiling legal documents is an extensive undertaking that necessitates specific knowledge and expertise. So why not entrust the creation of the 222 Rule For Marriage to the professionals.

With US Legal Forms, offering one of the largest collections of legal documents, you can find everything from courtroom filings to formats for internal corporate communication. We understand how crucial it is to comply with federal and local regulations.

You can revisit your documents anytime from the My documents section. If you're already a client, simply Log In to locate and download the template from the same area.

Regardless of your document’s purpose—be it financial, legal, or personal—our platform accommodates your needs. Experience US Legal Forms today!

- To start, use the search bar located at the top of the page to find the document you need.

- If available, preview it and review the accompanying description to ascertain if the 222 Rule For Marriage meets your needs.

- If you're searching for a different template, start your search anew.

- Create a complimentary account and select a subscription plan to acquire the form.

- Click Buy now. Once payment is finalized, you can download the 222 Rule For Marriage, complete it, print it, and send it or dispatch it via mail to the appropriate individuals or entities.

Form popularity

FAQ

A creditor who obtains a judgment against you is the "judgment creditor." You are the "judgment debtor" in the case. A judgment lasts for 12 years and the plaintiff can renew the judgment for another 12 years.

Maryland Resident Debt Relief. InCharge provides free, nonprofit credit counseling and debt management programs to Maryland residents. If you live in Maryland and need help paying off your credit card debt, InCharge can help you.

In most cases, the statute of limitations for a debt will have passed after 10 years. This means a debt collector may still attempt to pursue it (and you technically do still owe it), but they can't typically take legal action against you.

The Act provides that any collector who violates any provision of the Act is liable for any damages proximately caused by the violation, including damages for emotional distress, or mental anguish suffered with, or without accompanying physical injury.

Yes. If you don't pay, the creditor may file a lawsuit against you. You should respond to the lawsuit by the deadline to preserve your rights, otherwise you could lose by default because you failed to respond to the lawsuit. If the creditor wins the lawsuit, it will get a judgment.

Maryland is a consumer-friendly state. The statute of limitations allows a creditor three years to collect on debts. That's a shorter timeframe than many states. There also are limits on how long a debt collector has to collect on a debt.

To get a judgment, a creditor must bring the claim to court within 3 years after the debt comes due. If someone claims in court that you owe them money and you believe that the money became due more than 3 years ago, you may be able to raise the 3-year statute of limitation as a defense.