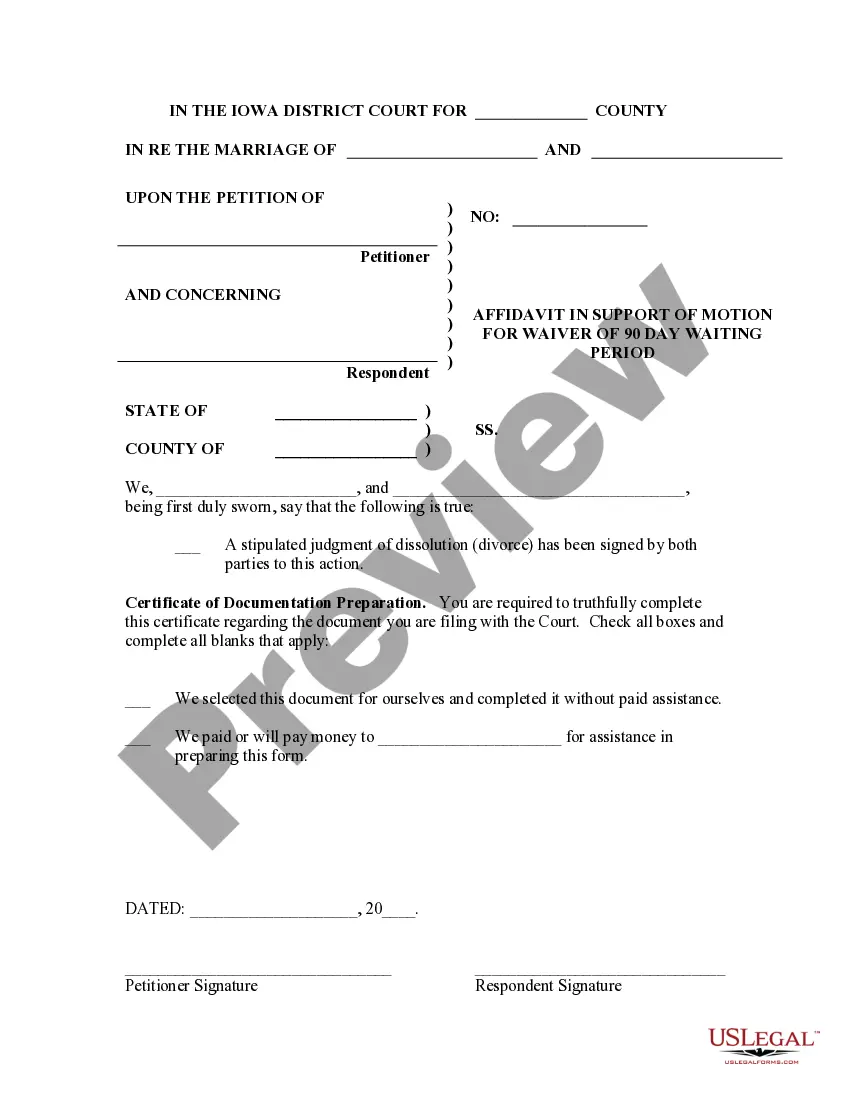

This a motion to waive the 90 day waiting period to grant a divorce.

222 Marriage Rule With 3 Terms

Description

How to fill out Iowa Motion For Waiver Of 90 Day Waiting Period?

Dealing with legal paperwork and processes can be a labor-intensive addition to the day.

222 Marriage Rule With 3 Terms and similar forms often require you to search for them and comprehend how to fill them out correctly.

For this reason, whether you are managing financial, legal, or personal issues, utilizing a comprehensive and efficient online directory of forms readily available will prove advantageous.

US Legal Forms is the premier online resource for legal templates, offering more than 85,000 state-specific documents and various resources to help you complete your paperwork swiftly.

Simply Log In to your account, locate 222 Marriage Rule With 3 Terms and retrieve it instantly from the My documents section. You can also access previously downloaded forms.

- Explore the catalog of relevant documents accessible to you with a single click.

- US Legal Forms offers you state- and county-specific forms available for download at any time.

- Streamline your document administration tasks with a superior service that enables you to prepare any form in just a few minutes without any added or hidden fees.

Form popularity

FAQ

You can apply for a FEIN online or download the form through the IRS' website, or can call them at 1-800-829-4933. Remember, you must have a Maryland SDAT Identification Number in order to apply for a Federal Employer Identification Number.

Most Maryland businesses will need an EIN, since most will either be formed by multiple people, need to hire employees, or will apply for loans and bank accounts. However, you may also need a Maryland state tax ID.

More In File Applying for an Employer Identification Number (EIN) is a free service offered by the Internal Revenue Service. Beware of websites on the Internet that charge for this free service.

Your Entity Identification Number is assigned by the Maryland Department of Assessments and Taxation. It is an alpha-numeric identifier that appears on the acknowledgement received from that Department. The identifier can also be found on that Department's website at .dat.state.md.us.

Applying for an EIN for your Maryland LLC is completely free. The IRS doesn't charge any service fees for the EIN online application.

If the company is publicly traded and registered with the Securities and Exchange Commission (SEC), you can use the SEC's EDGAR system to look up such a company's EIN for free. You can do an EIN lookup for nonprofit organizations on Guidestar.

Your previously filed return should be notated with your EIN. Ask the IRS to search for your EIN by calling the Business & Specialty Tax Line at 800-829-4933.