Trust Executed Certificate For The Request

Description

How to fill out Iowa Certificate Of Trust By Individual?

- For existing users, log in to your account, confirm your subscription status, and download the required template by clicking the Download button.

- If you're a new user, start by browsing the Preview mode to find the form that best fits your needs and meets local jurisdiction requirements.

- If necessary, utilize the Search tab to find alternate templates until you find one that is consistent with your needs.

- Click the Buy Now button to select your preferred subscription plan, ensuring you register an account for full access.

- Complete your purchase by entering your payment details through credit card or PayPal.

- Once purchased, download your form and save it on your device, allowing easy access to it anytime in the My Forms section of your profile.

By following these straightforward steps, you can swiftly navigate through the process and secure the legal documents you need with confidence.

Explore the extensive collection of US Legal Forms today and leverage the expertise of premium professionals to complete your paperwork accurately.

Form popularity

FAQ

A trust certificate serves to confirm the existence and specifics of a trust without disclosing every detail contained in the trust agreement. It allows trustees and beneficiaries to perform transactions while providing a simplified overview of the trust. By having a trust executed certificate for the request on hand, you can streamline communication with banks and other institutions when addressing trust-related matters.

To check your trust certificate, you should refer to the original trust document and confirm that the certificate matches the trust's terms. You may also consult with an attorney or a trust professional for any clarifications. If you need a new or updated trust executed certificate for the request, platforms like uslegalforms can guide you through the process.

Trust certifications do not have a fixed expiration date; however, they may become outdated if changes occur within the trust or its terms. It is important to review and update your trust executed certificate for the request whenever significant amendments take place. Ensuring your certificate reflects the most current information helps prevent complications in financial transactions.

To acquire a certificate of trust, you usually need to approach the attorney who drafted the original trust document. This professional can help you prepare a trust executed certificate for the request that meets legal requirements. Additionally, many online platforms, like uslegalforms, offer resources and templates to assist you in creating a valid certificate of trust.

A trust agreement is a detailed legal document that outlines the terms and conditions of the trust. In contrast, a trust executed certificate for the request is a condensed version that highlights key details, such as the trustee and trust beneficiaries. While the trust agreement provides comprehensive information, the certificate is easier to present to financial institutions or other parties when needed.

Most banks do not store copies of trust documents for their clients. Instead, they may keep a trust executed certificate for the request, which outlines the essential details of the trust. This document serves as a summary and provides important information that the bank may need. It's wise to keep your original trust documents in a secure location and maintain updated records.

A family trust may have disadvantages such as administrative complexity and potential tax implications. Keeping a family trust can involve ongoing management responsibilities, which may deter some individuals. Additionally, not all family assets may be suitable for inclusion in a trust. Understanding these factors through a Trust executed certificate for the request can help in making informed decisions.

Despite their many advantages, trusts can come with some drawbacks. Establishing a trust often incurs initial setup costs and may require ongoing maintenance fees. Furthermore, trusts might limit flexibility in accessing funds, depending on their terms. A Trust executed certificate for the request can offer useful information to confidently navigate these elements.

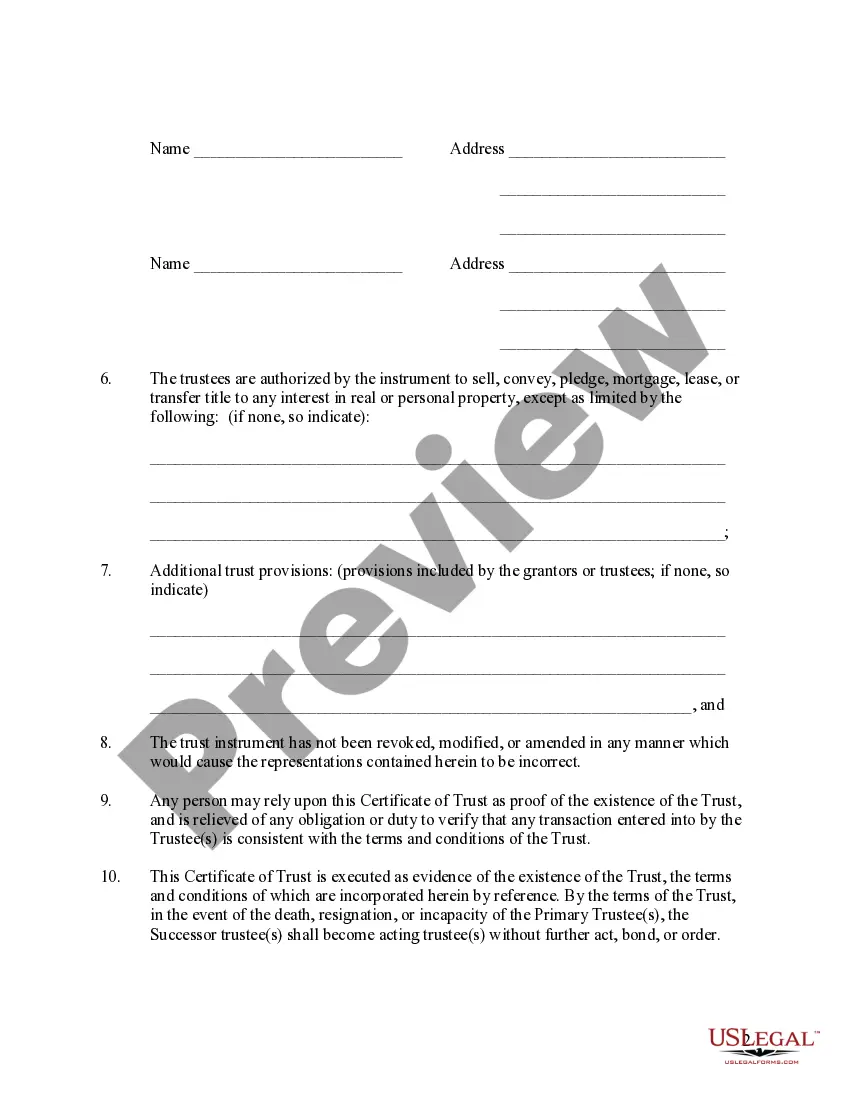

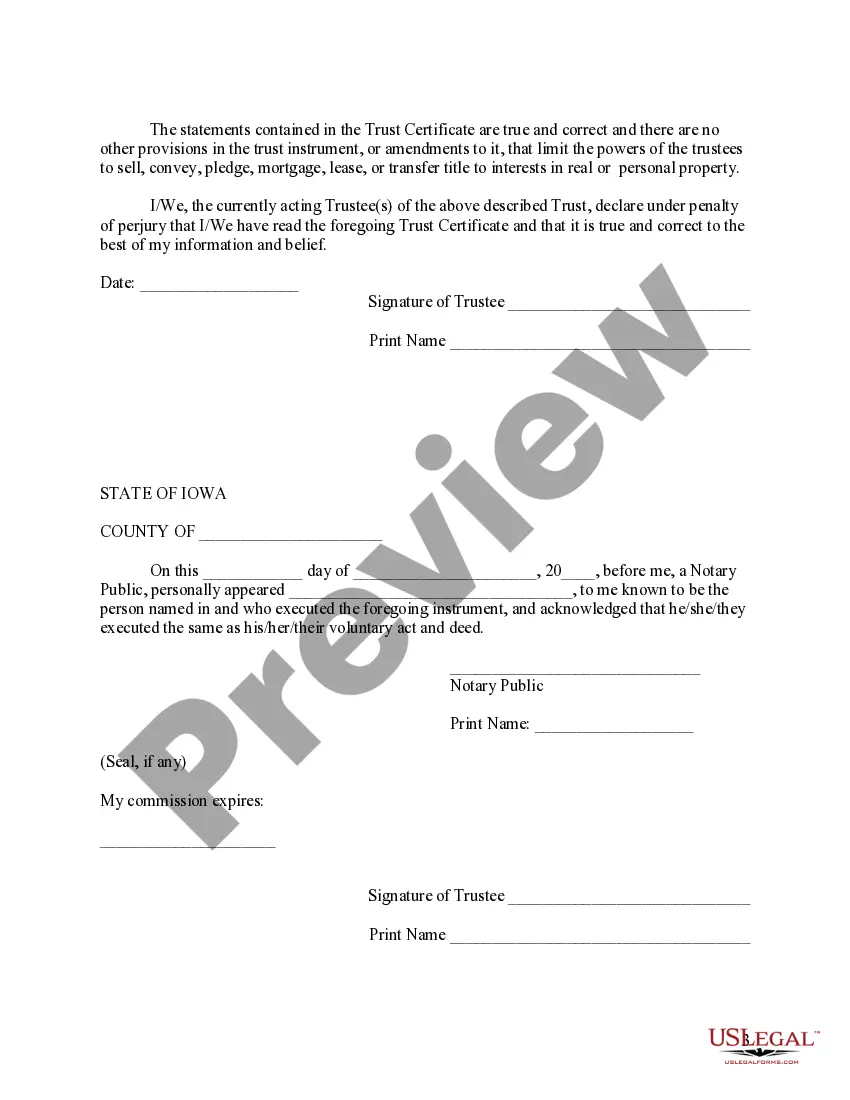

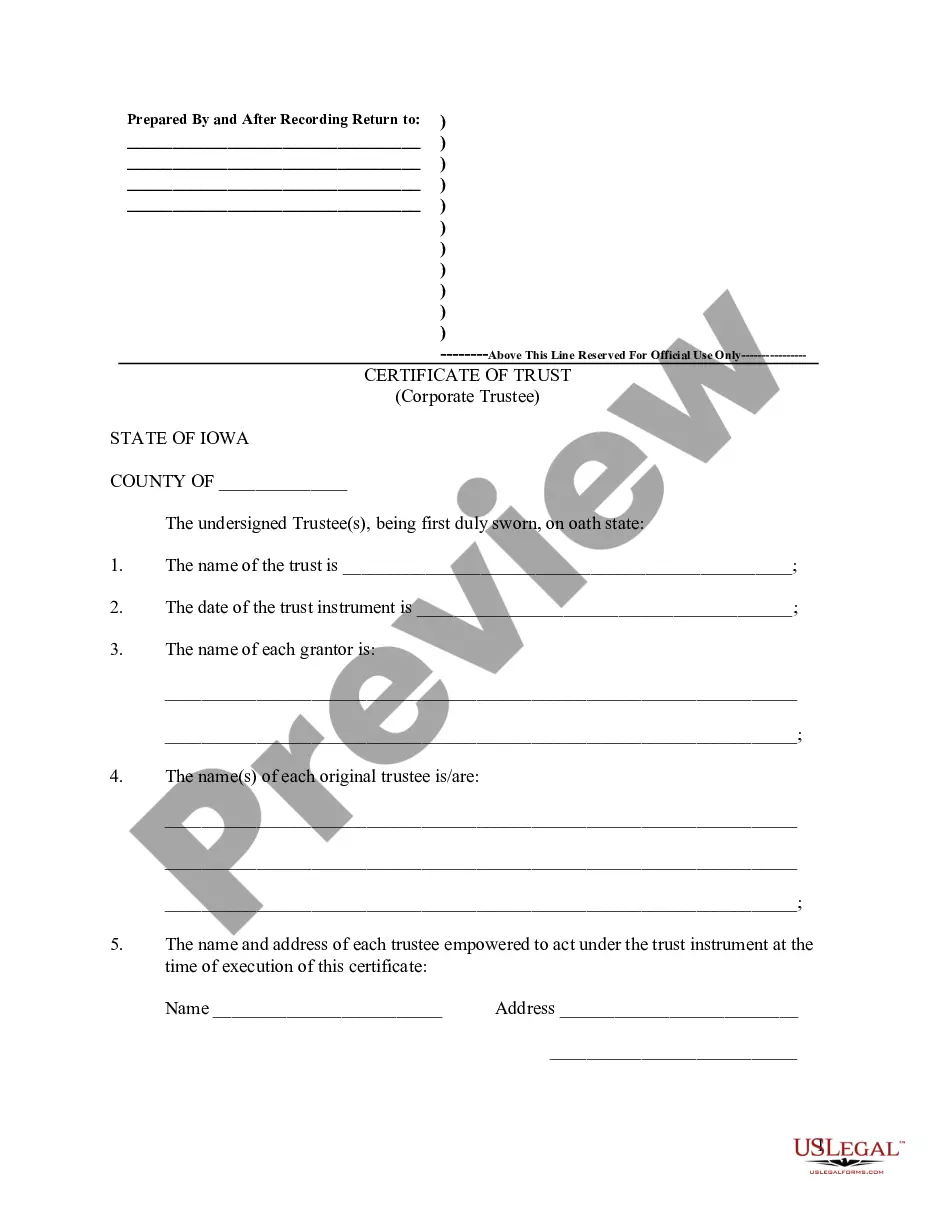

Filling out a trust certification requires precision and attention to detail. Start by providing the trust’s name, date of establishment, and essential terms. Ensure you list the names of the trustees and beneficiaries accurately. A Trust executed certificate for the request can guide you through this process.

One common mistake is not adequately funding the trust. Many parents establish a trust but neglect to transfer their assets into it, rendering the trust ineffective. Additionally, failing to regularly review and update the trust can lead to issues down the line. Utilizing a Trust executed certificate for the request can help avoid these pitfalls.