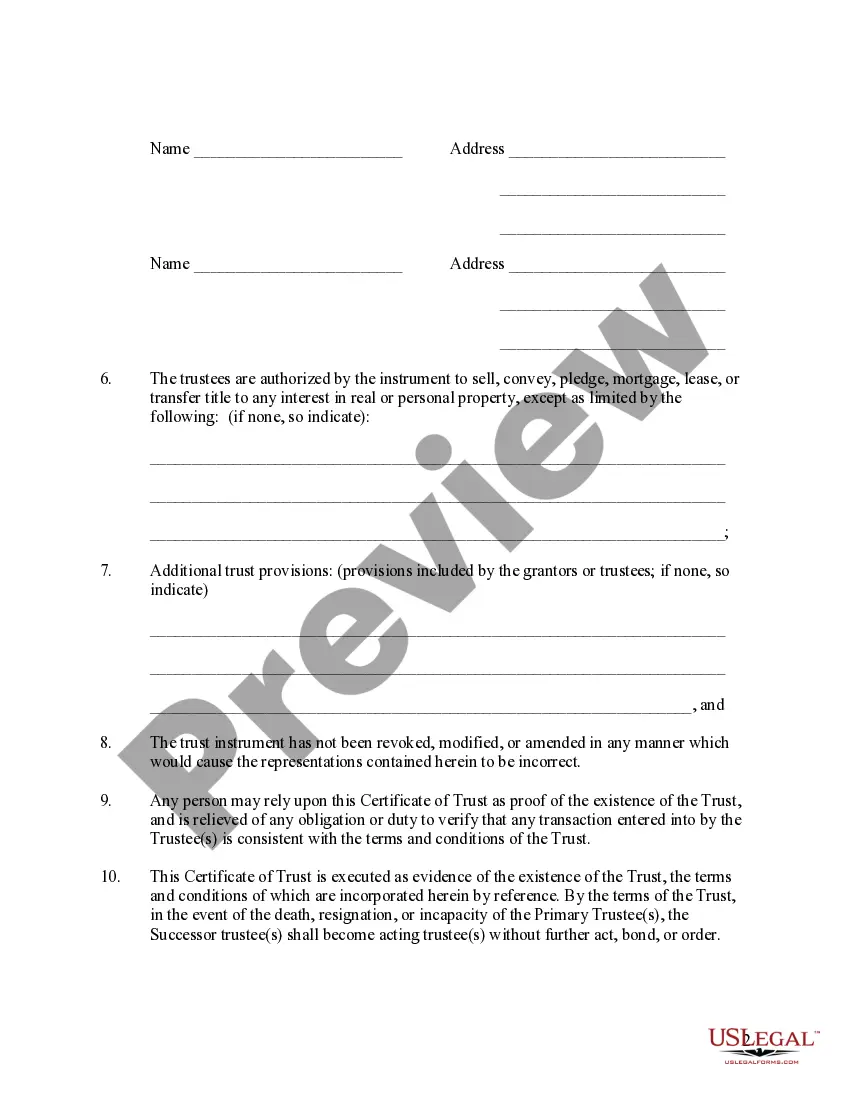

This is a certificate of trust for filing evidence of a trust without having to record the entire trust document. The individual trustee may present a certification of trust to

any person in lieu of providing a copy of the trust instrument to establish

the existence or terms of the trust. A certification of trust may be executed

by the trustee voluntarily or at the request of the person with whom the

trustee is dealing.

Iowa Trust Extension Form

Description

Form popularity

FAQ

You can easily obtain your 10 40 form online through the IRS website or by visiting local tax offices. Many tax preparation software programs also include this form for your convenience. If you’re handling a trust’s tax matters in Iowa, don’t forget about the Iowa trust extension form, which may be necessary for your specific situation. Staying organized with these forms can simplify your tax filing experience.

Currently, Iowa has not announced any plans to eliminate income tax. However, there is ongoing discussion about tax reforms that could impact rates and structures in the future. If you manage a trust and have concerns about evolving tax policies, using the Iowa trust extension form may provide you with more time to adjust and plan accordingly. Always stay informed by reviewing updates from reliable state resources.

Any individual who earns income in the United States typically must file a 1040 form. This requirement includes employees, freelancers, and self-employed individuals. As you navigate your tax responsibilities, knowing the role of the Iowa trust extension form can benefit those with trusts, ensuring timely and correct filing. Keep in mind that specific exceptions apply, so it’s best to check the latest guidelines.

The 10 40 form is essential for filing your federal tax return. This form helps you report your income, calculate your taxes owed, and determine if you’ll receive a refund. If you’re managing a trust in Iowa, you may need to use the Iowa trust extension form to ensure all tax obligations are met accurately. Filing correctly can help you avoid unnecessary complications with the IRS.

In Iowa, the Schedule 1 form is used as an attachment to your income tax return to report various types of income. This includes income from partnerships, S corporations, and estates or trusts, which may require you to file an Iowa trust extension form if more time is needed. Completing Schedule 1 accurately ensures that all your income sources are properly reported to the state. Using platforms like US Legal Forms can simplify the process of finding and filling out necessary forms.

The Iowa 1040 form is the state income tax return used by residents of Iowa to report their income and calculate their state taxes. This form allows taxpayers to claim various deductions and credits applicable in Iowa. To simplify your filing process, consider our platform to find the Iowa trust extension form and other related documents.

Yes, Iowa has its own extension form that allows residents to extend their tax filing deadline. Typically, you would use Iowa Form 71-007, which you can submit to the Iowa Department of Revenue. For convenience, you can access the Iowa trust extension form directly through our platform to ensure compliance.

You can get a tax extension form by visiting the IRS website or utilizing tax preparation software. Many platforms also offer downloadable forms, simplifying the process for users. If you need the Iowa trust extension form specifically, our service allows you to access it quickly and efficiently.

You can obtain a tax extension document by filling out the appropriate forms, such as IRS Form 4868 for individuals or Form 7004 for businesses and trusts. These forms are available on the IRS website or through online tax filing services. If you are specifically looking for the Iowa trust extension form, our service provides a straightforward way to download it.

To file a trust extension, you need to complete IRS Form 7004, which can be filed electronically or by mail. This form gives you an automatic six-month extension for filing your trust’s tax return. If you need the necessary forms, our platform offers easy access to the Iowa trust extension form that you can use to ensure you meet all requirements.