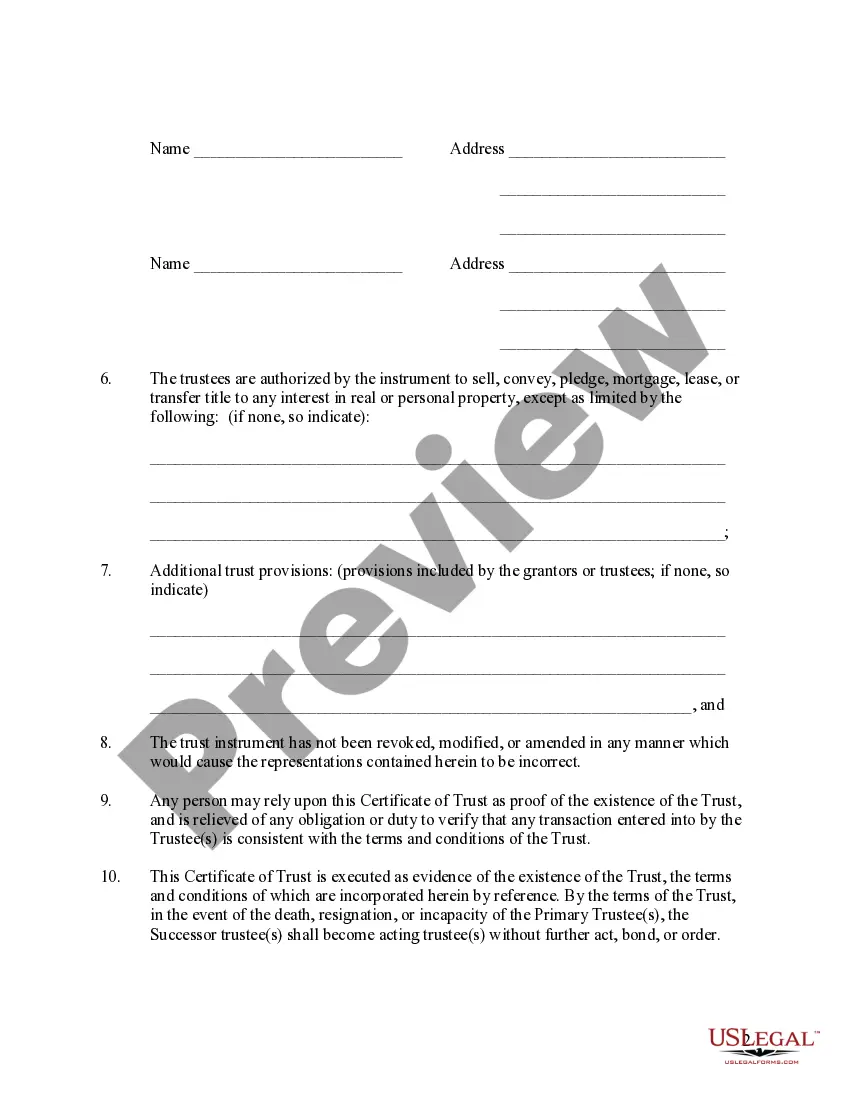

This is a certificate of trust for filing evidence of a trust without having to record the entire trust document. The individual trustee may present a certification of trust to

any person in lieu of providing a copy of the trust instrument to establish

the existence or terms of the trust. A certification of trust may be executed

by the trustee voluntarily or at the request of the person with whom the

trustee is dealing.

Iowa Miller Trust Form

Description

Form popularity

FAQ

Miller trust funds can be used for various essential expenses, including medical care, housing, and daily living costs. Once you establish an Iowa miller trust form, the funds you place in the trust are specifically allocated for these necessary expenditures. This allows you to access critical services while remaining compliant with Medicaid eligibility requirements. Understanding how to use these funds effectively can enhance your financial stability in the long run.

To protect your assets from Medicaid in Iowa, consider using an Iowa miller trust form. This specialized trust allows you to allocate excess income into a trust, making you eligible for Medicaid benefits while safeguarding your assets. By depositing your income into the trust, you can ensure it is not counted as part of your assets. Utilizing the Iowa miller trust form can help you meet Medicaid guidelines and better manage your financial situation.

The purpose of a Miller trust is to help individuals maintain eligibility for Medicaid benefits while protecting a portion of their income. By completing the Iowa miller trust form, you can allocate excess income into the trust, allowing Medicaid to consider only the necessary amount for eligibility. This trust serves as a financial tool to balance healthcare needs and asset protection. Understanding its purpose can empower you to make informed decisions for your future.

The primary benefit of a Miller trust is that it helps individuals qualify for Medicaid while protecting their assets. By using the Iowa miller trust form, you can effectively manage excess income that might otherwise disqualify you from receiving benefits. This trust allows you to meet the income requirements for Medicaid without losing your hard-earned assets. It’s a strategic solution for many families facing healthcare costs.

Yes, you can set up a Miller trust without a lawyer, but it requires careful attention to detail. Using resources like the Iowa miller trust form can help ensure that you include all necessary information. However, consulting a legal professional can provide valuable guidance and ensure compliance with state laws. This way, you can avoid potential pitfalls and make the process smoother.

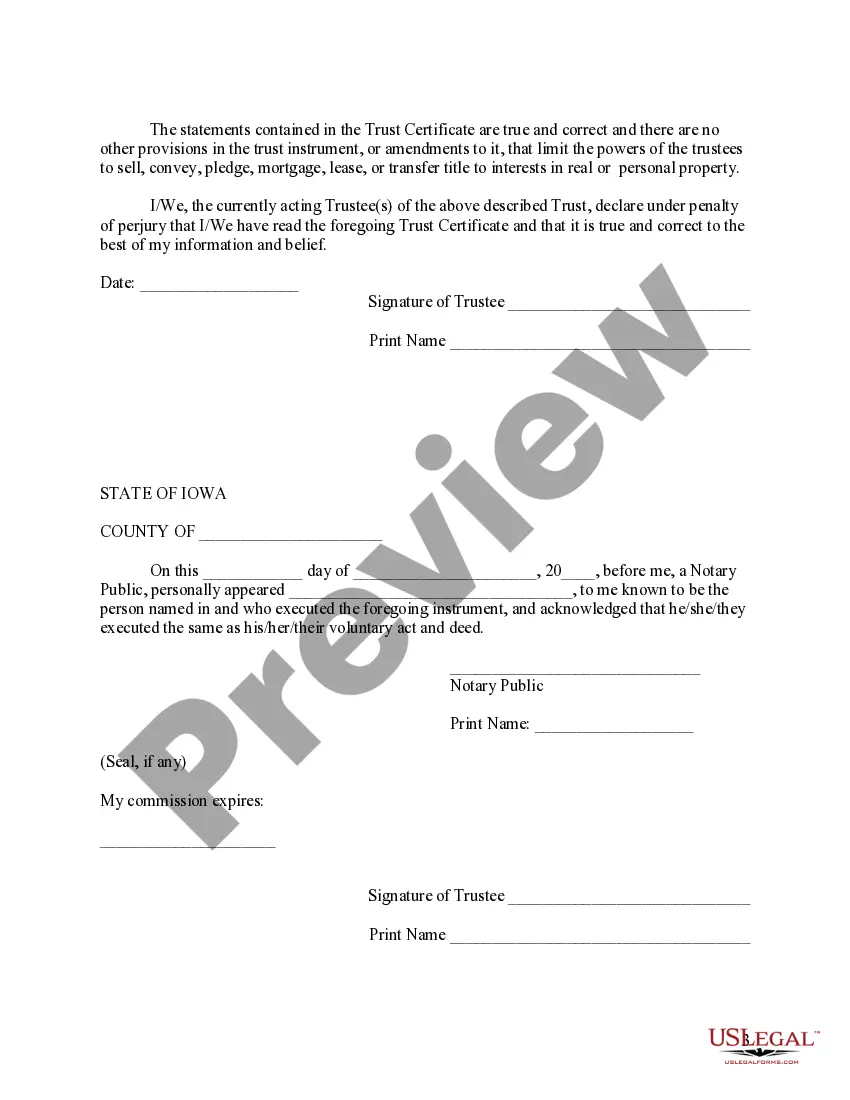

In Iowa, a trust often does not require notarization to be legally recognized. However, having your Iowa miller trust form notarized can provide additional security and credibility. Notarization can help ensure that your intentions are clear and reduce disputes in the future. It's always a good idea to consult with a legal professional to ensure all requirements for your trust are met.

Miller trusts are allowed in several states, including Iowa, to help individuals qualify for Medicaid by setting income limits. States vary in their specific regulations and requirements for the Iowa miller trust form. It’s crucial to check the guidelines in your state, as each location may have different eligibility criteria. For comprehensive help, consider using services like USLegalForms to locate the appropriate forms and understand your state’s rules.

Forming a trust in Iowa involves several key steps, starting with completing the Iowa miller trust form if your goal is to protect assets while qualifying for Medicaid. You should define the trust's terms, appoint a trustee, and outline the beneficiaries. It's wise to consult legal resources or a qualified attorney to ensure compliance with Iowa laws. Platforms like USLegalForms can also simplify this process by providing the necessary forms and guidance.

To apply for the Miller trust, you need to complete the Iowa miller trust form. This form allows you to set aside income to qualify for Medicaid while ensuring your resources meet state requirements. You can obtain the form through various sources, including legal services or online platforms like USLegalForms. After filling out the necessary details, submit your application to the appropriate agency.