I Trust For You

Description

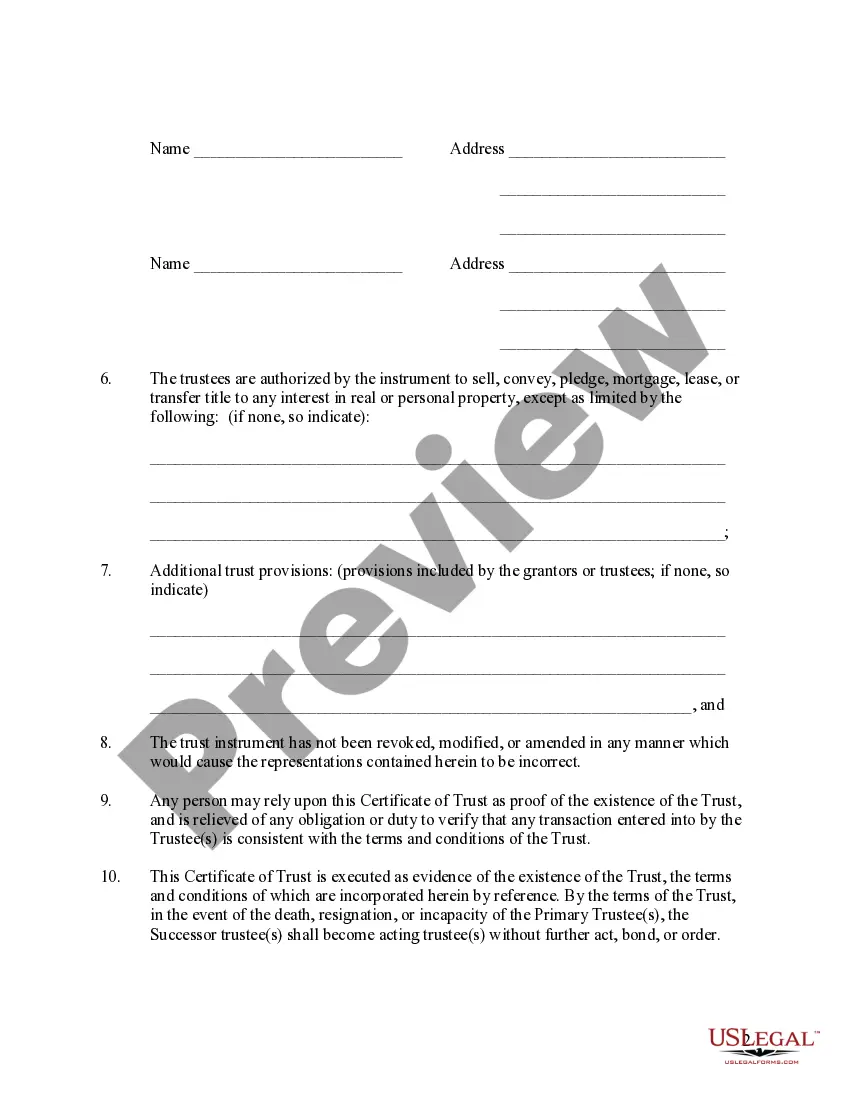

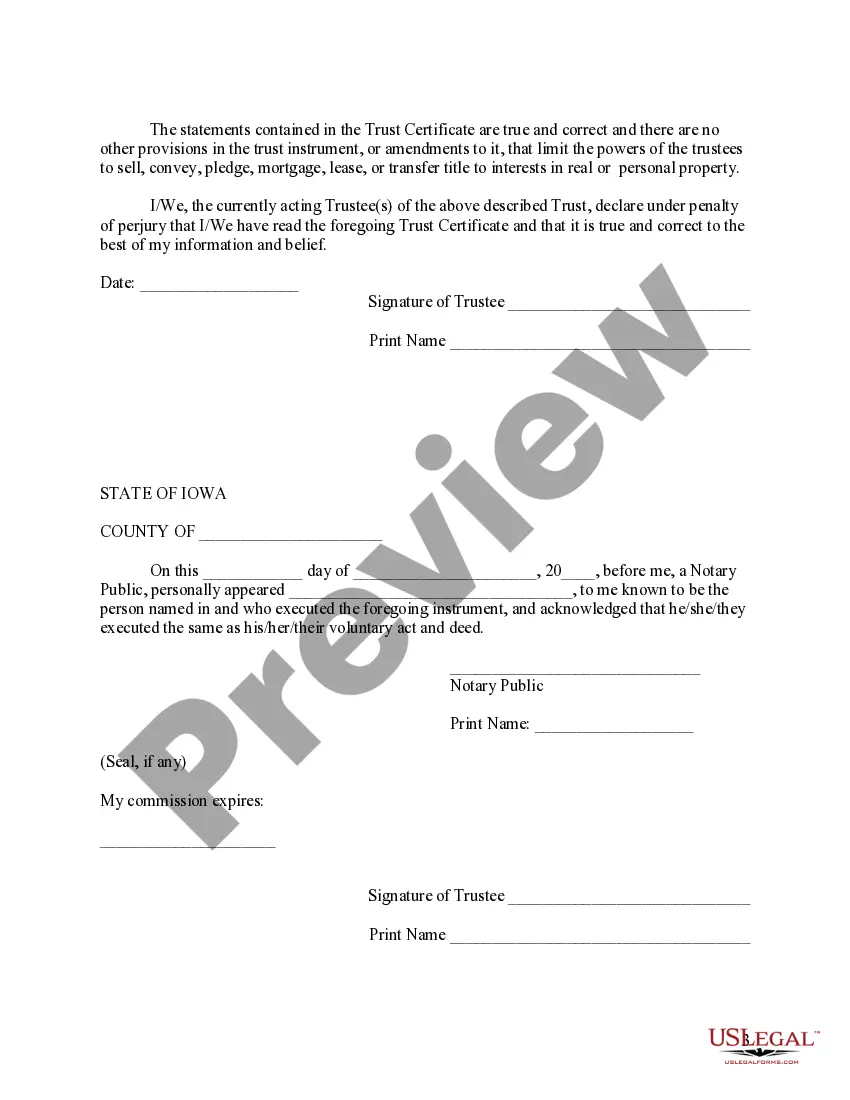

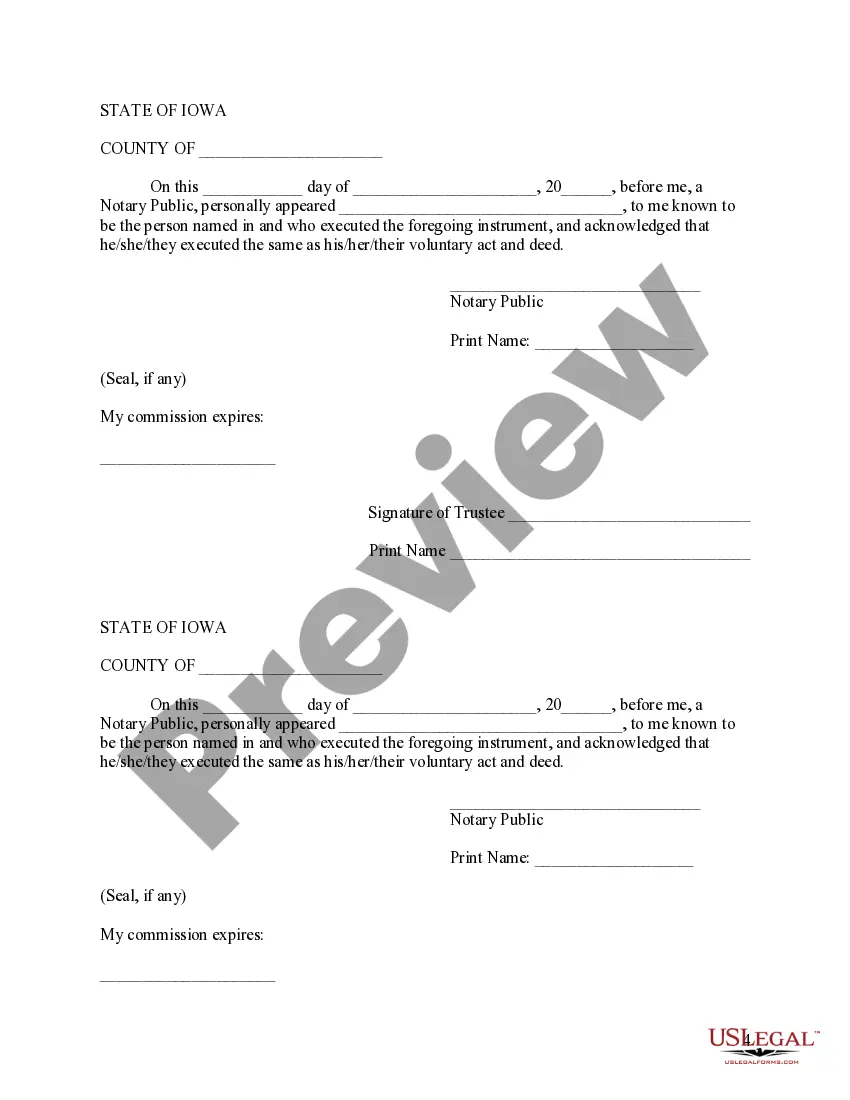

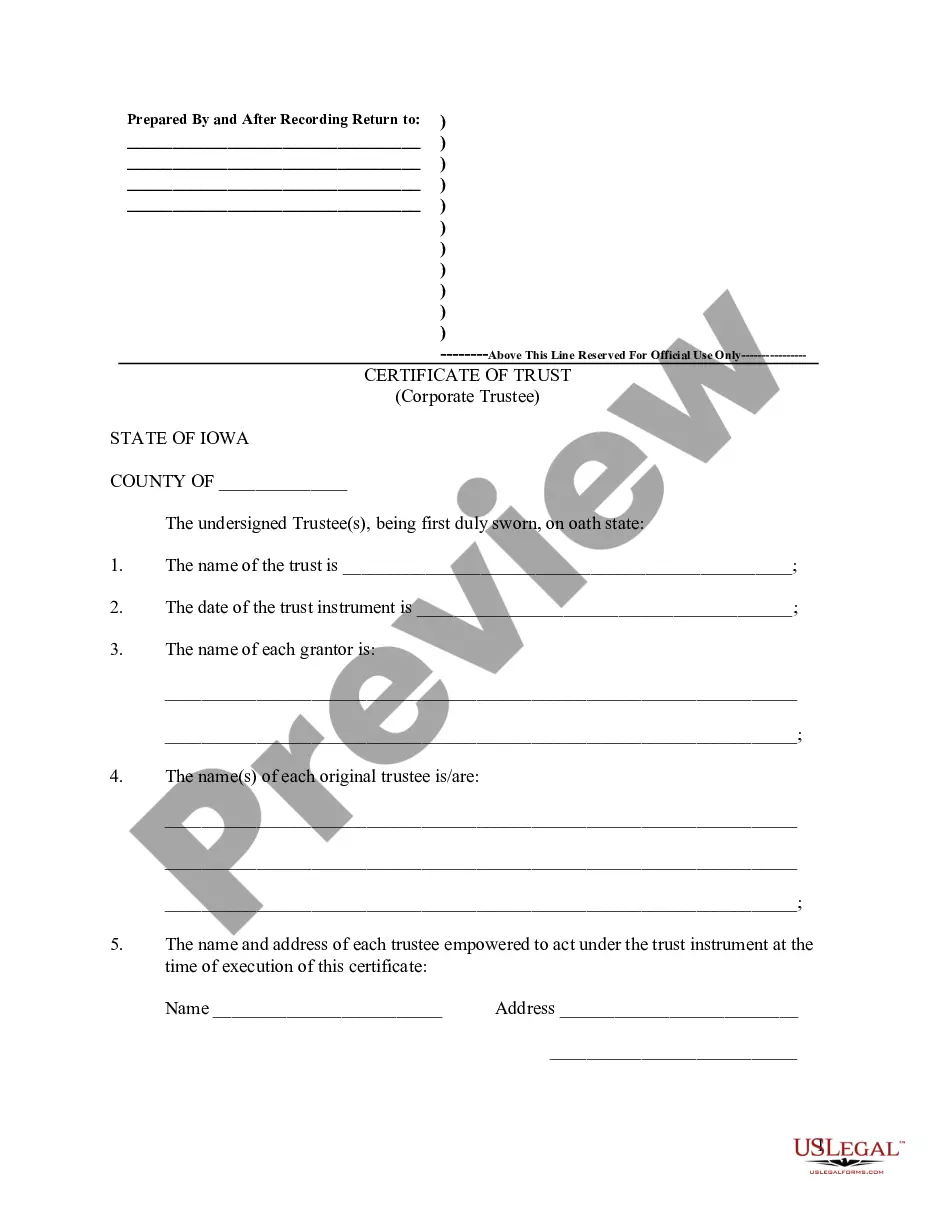

How to fill out Iowa Certificate Of Trust By Individual?

- Log in to your existing US Legal Forms account or create a new one if you’re a first-time user.

- Navigate to the Preview mode and carefully review the form description to ensure it meets your local jurisdiction requirements.

- If you still need a different template, utilize the Search tab to find the correct one that fulfills your needs.

- Select the Buy Now button and choose your preferred subscription plan. Remember to register your account for full access to all resources.

- Complete your purchase by entering your credit card details or using your PayPal account.

- Finally, download the document to your device and access it anytime from the My Forms section in your profile.

In conclusion, US Legal Forms empowers both individuals and attorneys by providing a robust collection of legal documents. With the ability to connect with premium experts for guidance, you can ensure that your documents are completed accurately and tailored to your needs.

Don’t hesitate to try US Legal Forms today and simplify your legal processes!

Form popularity

FAQ

The three pillars of trust are transparency, accountability, and reliability. Transparency involves sharing information openly, which fosters understanding. Accountability means taking responsibility for actions, ensuring trustworthiness. Reliability ensures that others can depend on you consistently. By focusing on these pillars, you’ll reinforce the core idea of I trust for you.

The 3 C's of trust are Competence, Character, and Caring. Competence ensures that someone is capable of fulfilling their commitments. Character reflects ethical behavior and honesty in all interactions. Caring, on the other hand, demonstrates concern for others. Together, these elements create an atmosphere where I trust for you can truly thrive.

The three key factors to build trust are communication, integrity, and time. Effective communication helps clarify intentions, while integrity ensures that you act consistently with your values. Over time, showing reliability reinforces trust. When you embody these factors, you effectively create an environment of I trust for you.

The three main ingredients of trust are honesty, reliability, and empathy. Honesty lays the groundwork by ensuring transparency in actions and words. Reliability shows that you can be counted on over time. Empathy enhances understanding and connection. Utilizing these ingredients can lead to a powerful sense of I trust for you.

Gaining trust starts with open communication. When you listen actively and show genuine interest, it helps build a strong foundation. Additionally, being honest and following through on promises makes a significant impact. By applying the principles of I trust for you in your interactions, you can foster lasting relationships.

The 3 C's stand for Credibility, Consistency, and Connection. Credibility means being reliable and trustworthy, while consistency refers to doing what you say repeatedly. Lastly, connection highlights the importance of interpersonal relationships. Together, these concepts illustrate how I trust for you can be established in personal and professional settings.

Filing taxes for a trust typically requires submitting IRS Form 1041, which reports the income generated by the trust. It's crucial to identify whether the trust is a simple or complex trust, as tax implications vary. Consulting a tax professional can provide clarity and assistance in ensuring compliance. Remember, I trust for you to manage your trust's tax responsibilities appropriately.

In California, a trust must have a designated grantor, trustee, and beneficiaries. Additionally, the trust document must be in writing and signed by the grantor. It is crucial to comply with state regulations to ensure your trust is valid. I trust for you to seek professional advice to meet these legal requirements effectively.

The creator of a trust is usually referred to as the grantor or settlor. This is the individual who determines how the trust will operate, including appointing the trustee and identifying beneficiaries. If you are considering a trust, think about how you want your wishes to be fulfilled, as I trust for you to protect your legacy.

When establishing a trust, you generally need to file a trust agreement, which serves as the foundational document. In some cases, you may also need to file additional documents, such as tax forms for the trust's income. It’s essential to consult with a legal expert to ensure all forms are completed correctly. With the right forms, I trust for you that your estate plan will be secure.