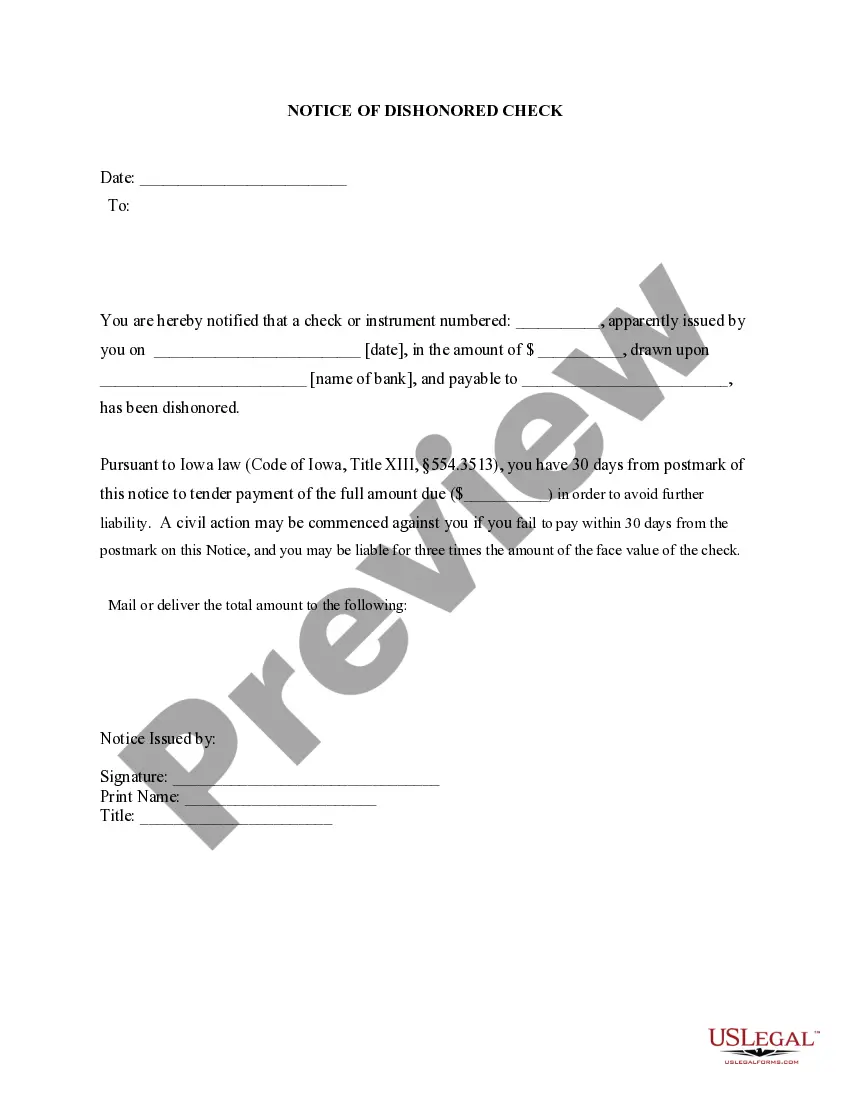

This is a Notice of Dishonored Check - Civil. A "dishonored check" (also known as a "bounced check" or "bad check") is a check which the bank will not pay because there is no such checking account, or there are insufficient funds in the account to pay the check. In order to attempt the greatest possible recovery on a dishonored check, the business owner, or any other person given a dishonored check, may be required by state law to notify the debtor that the check was dishonored.

Notice Issued Iowa Withholding Notice

Description

How to fill out Iowa Notice Of Dishonored Check - Civil - Keywords: Bad Check, Bounced Check?

- Log in to your US Legal Forms account if you're a returning user. Ensure your subscription is active. If it requires renewal, update it according to your selected payment plan.

- Preview the available templates. Confirm that you've selected one that aligns with your needs and adheres to your local jurisdiction.

- Search for alternative templates if necessary. Should you discover any discrepancies, use the Search tab to find a suitable option.

- Purchase the required document. Click 'Buy Now,' select your subscription plan, and create an account to access the forms library.

- Complete your payment. Input your credit card information or utilize your PayPal account to finalize the subscription.

- Download the form. Save the template on your device to fill it out, and access it anytime via the 'My Forms' section of your account.

In conclusion, US Legal Forms is dedicated to providing a robust collection of legal documents, empowering individuals and attorneys alike to efficiently manage their legal needs. With over 85,000 legal forms, you can ensure your documents are both comprehensive and compliant.

Don't hesitate to explore our library today and simplify your legal paperwork!

Form popularity

FAQ

It is not illegal for employers to withhold federal taxes; in fact, employers are required to do so under IRS regulations. They must withhold the right amount based on the information provided by employees on their W-4 forms. If you encounter issues, a Notice issued Iowa withholding notice may assist in resolving any discrepancies with your employer.

Yes, you can complete Form W-4V online but ensure you print and submit it to your employer. Many platforms support online completion for convenience. If you receive a Notice issued Iowa withholding notice, ensuring proper documentation is submitted can help clarify your withholding status.

To file employee withholding, you need to complete and submit Form W-4 to your employer. Employers use this information to determine the amount of tax to withhold from your paycheck. If you find it challenging to navigate this process, consider looking into resources provided by the USLegalForms platform for comprehensive guidance on tax forms and compliance.

Claiming 0 may result in higher tax withholding, while claiming 1 might reduce your withheld amount. It depends on your financial situation and tax obligations. If you're unsure, consult a tax professional or review the Notice issued Iowa withholding notice to understand your withholding options better.

Withholding an employee's W2 is generally considered illegal. Employers are required to provide W2 forms to employees by January 31 each year. If you receive a Notice issued Iowa withholding notice, it may indicate that there are issues related to tax compliance. It's essential to know your rights and ensure you receive your W2 on time.

Employees cannot simply choose not to withhold taxes unless they meet certain criteria set by the IRS and state laws. If employees qualify for exemptions, they must formally notify their employer to avoid withholding. If any issues arise regarding withholding, a notice issued Iowa withholding notice may clarify obligations and deadlines for compliance.

Certain individuals may qualify for exemptions from Iowa taxes, including specific educational institutions or certain income types. However, employees must meet criteria set by the Iowa Department of Revenue. If you receive a notice issued Iowa withholding notice that applies to your situation, you can appeal or discuss your tax status with a professional.

To obtain your Iowa withholding permit number, you first need to register with the Iowa Department of Revenue. After successful registration, they will issue your permit number, often communicated through a notice issued Iowa withholding notice. Keep this number handy for all future withholding tax filings and inquiries.

Several states, including Iowa, require mandatory state tax withholding from employee wages. These laws vary, so it’s crucial to check the specifics for each state. If you receive a notice issued Iowa withholding notice, understand that Iowa enforces these requirements, and others may do the same. Be sure to consult local regulations for complete compliance.

To register for an Iowa withholding account, visit the Iowa Department of Revenue website. You’ll need to provide basic information about your business and employees. Once you submit the registration, you may receive a notice issued Iowa withholding notice confirming your account. Use this information to stay compliant with withholding tax obligations.