Llc Stands For Limited Liability Corporation

Description

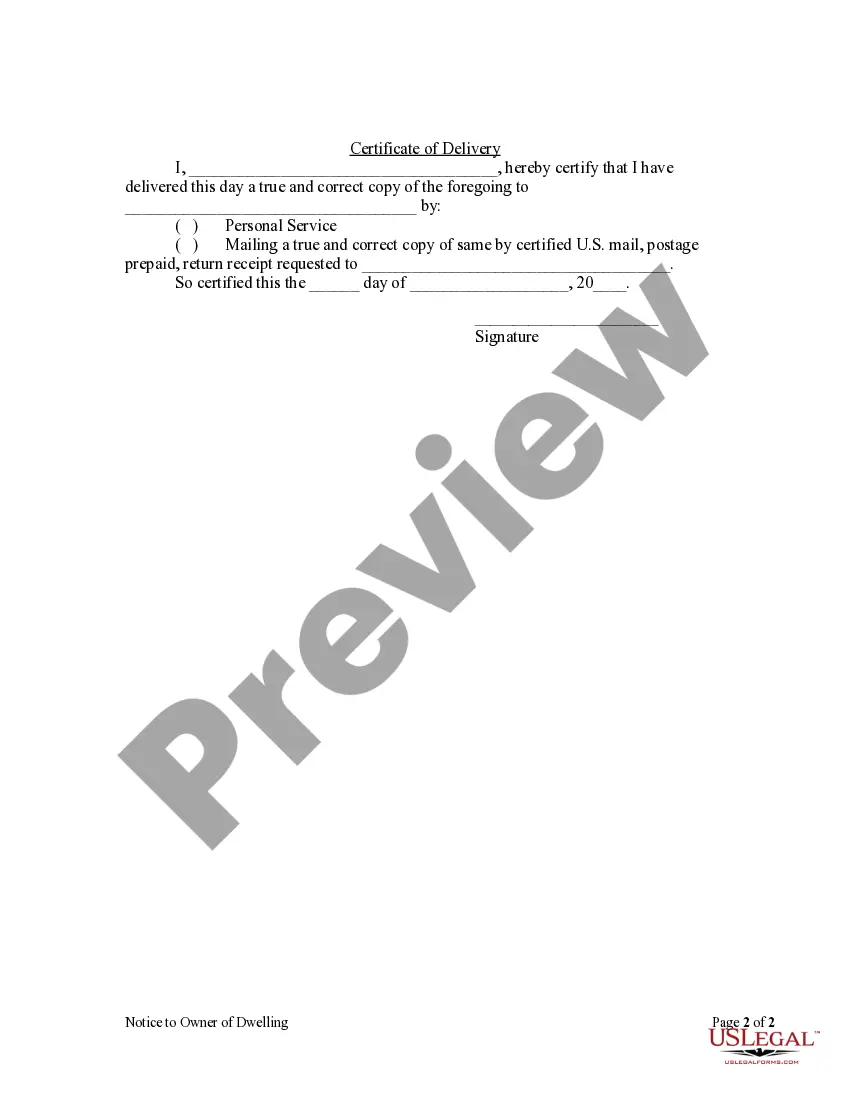

How to fill out Iowa Notice To Owner Of Dwelling By Corporation Or LLC?

- If you're a returning user, log into your account and download the desired form by clicking the Download button, ensuring your subscription is active. If necessary, update your subscription according to your payment plan.

- For first-time users, start by exploring the Preview mode and the form description to confirm the chosen template meets your requirements and local jurisdiction standards.

- If the existing form doesn't meet your needs, use the Search tab to browse for alternative templates until you find the right one.

- Make your selection by clicking the Buy Now button and choosing an appropriate subscription plan. To gain access to the resources, you will need to create an account.

- Proceed to purchase by entering your credit card details or opting for PayPal to complete your subscription payment.

- Finally, download your form to save it on your device for future use. You can access it anytime from the My Forms section of your profile.

US Legal Forms empowers both individuals and attorneys to quickly execute legal documents using a comprehensive and user-friendly library.

With more forms than competitors, extensive options for fillable and editable documents, and access to premium experts for assistance, you can ensure that your legal forms are accurate and reliable. Start today to simplify your legal needs!

Form popularity

FAQ

Identifying whether a company is an LLC or a C Corporation usually involves checking its formation documents or state registration. LLCs will typically include 'LLC' in their name, while C Corporations may use 'Inc.' or 'Corporation.' You can also verify classification through the Secretary of State’s business registry in the relevant state. If you're unsure or need assistance, platforms like US Legal Forms can guide you in gathering the necessary information.

To determine the classification of your LLC, you should review the organizational documents and tax election forms you filed with the IRS. An LLC stands for limited liability corporation and can adopt either pass-through taxation or corporate taxation, depending on elections made. If you are uncertain, checking with tax documents or a tax professional can provide clarity on your LLC's current status. Additionally, resources like US Legal Forms can help you navigate these requirements seamlessly.

No, an LLC is not automatically classified as an S Corp. While an LLC stands for limited liability corporation and offers flexible taxation options, it starts as a disregarded entity by default unless you file for S Corporation status. This requires submitting Form 2553 to the IRS within the specified timeframe. Thus, it's crucial to actively choose this classification if it aligns with your business goals.

Understanding whether your LLC is classified as an S Corp or a C Corp relies on your tax election. When you form an LLC, it automatically defaults to a disregarded entity or partnership, but you can choose S Corporation treatment, which requires filing Form 2553. If you haven’t filed this form or haven't made an election, your LLC is considered a C Corporation for tax purposes. It's essential to consult with a tax adviser to ensure you fully understand your LLC's classification.

To determine if your LLC is treated as an S Corporation, you need to review your tax election status with the IRS. An LLC stands for limited liability corporation and can elect to be taxed as an S Corp by filing Form 2553. This election must be made within 75 days of forming your LLC or during the tax year before you want the designation to take effect. Checking your tax filings or consulting a tax professional can clarify your LLC's classification.

Determining whether an LLC or LP is better depends largely on your specific business goals and needs. An LLC stands for limited liability corporation and provides broad flexibility and protection for all members involved. Conversely, an LP allows for a distinct split between general partners, who manage the business, and limited partners, who invest but do not control. Evaluating your business model, funding, and management preferences will guide you in making the best choice.

Choosing an LP, or limited partnership, might suit you better if you want to have both general and limited partners. This structure allows you to attract investors who want limited liability while still allowing you to maintain control. In contrast, an LLC stands for limited liability corporation but offers flexibility without needing to differentiate between partners. Understanding these distinctions enables you to tailor your business structure to your desired level of involvement and investment.

The biggest disadvantage of an LLC is the complex regulations and compliance requirements. While an LLC provides limited liability protection, managing tax paperwork and annual filings can become burdensome. Additionally, if profits are not distributed properly, owners may face double taxation. Therefore, while LLC stands for limited liability corporation, it is essential to weigh these factors carefully to determine if it's the right fit for your business.

Choosing an LLP, or limited liability partnership, can be beneficial if you seek a structure that offers liability protection while retaining flexibility in management. Unlike an LLC, an LLP allows for a partnership dynamic, which can be advantageous for professional services. It's important to consider your specific business needs, as LLCs provide strong protection but might come with different regulations. Overall, both structures have their strengths, but understanding the differences helps you make an informed choice.

Income from an LLC typically falls under pass-through taxation. This means the income is reported on the personal tax returns of the members, without the entity itself being taxed. In this manner, members can avoid double taxation which is often seen in corporations. Depending on your business model, you might explore the opportunities that an LLC, which stands for limited liability corporation, offers for income generation.