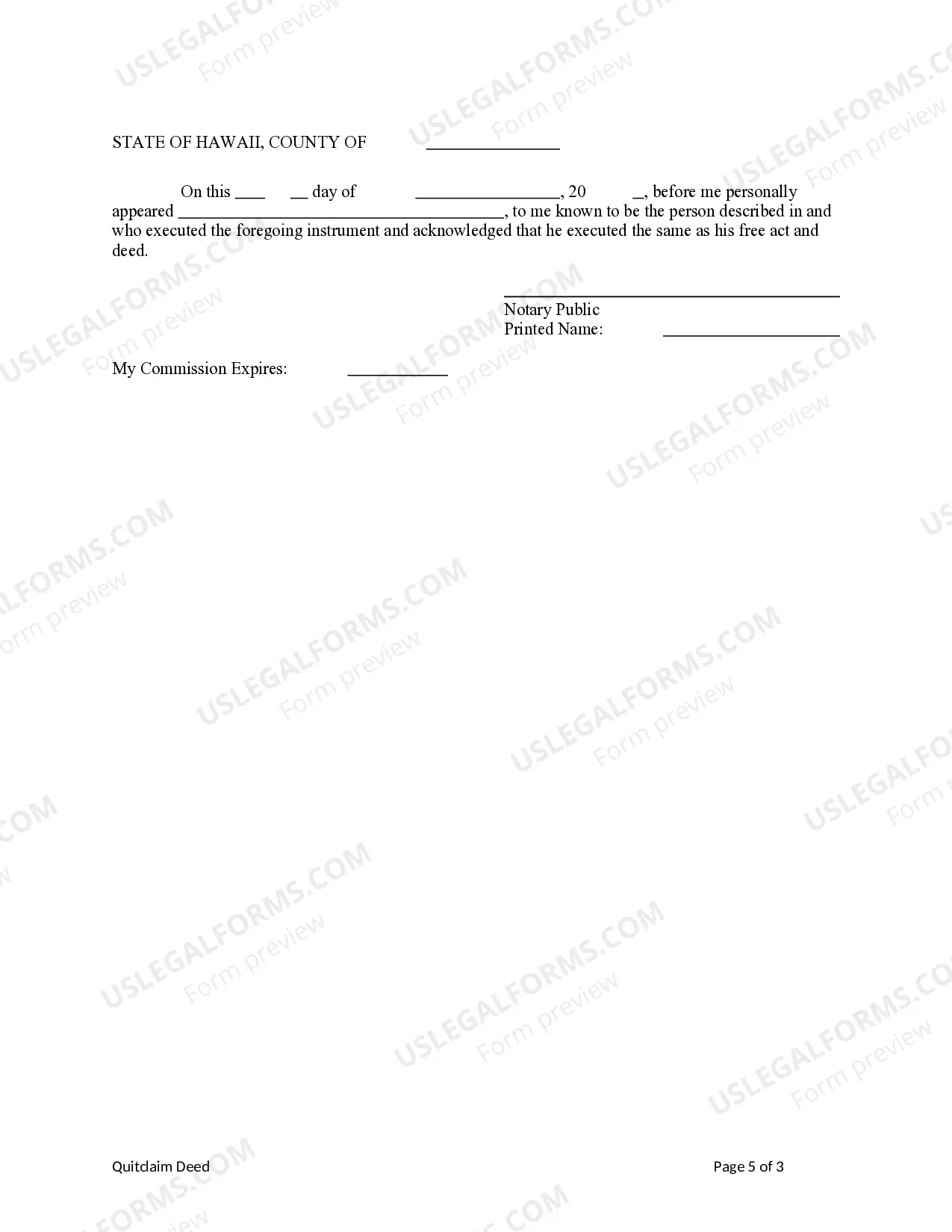

This form is a Quitclaim Deed where the grantors are two individuals and the grantee is also an individual. Grantors convey and quitclaim the described property to grantee. This deed complies with all state statutory laws.

Deed State Hawaii Form N-11

Description

How to fill out Deed State Hawaii Form N-11?

Well-prepared official paperwork is one of the fundamental assurances for preventing problems and legal disputes, but acquiring it without assistance from an attorney may require time.

Whether you need to swiftly locate an updated Deed State Hawaii Form N-11 or any other forms for work, family, or business scenarios, US Legal Forms is consistently available to assist.

The process is even more convenient for current users of the US Legal Forms library. If your subscription is active, you simply need to Log In to your account and click the Download button next to the chosen document. Additionally, you can retrieve the Deed State Hawaii Form N-11 at any time later, as all documents ever obtained on the platform can be found within the My documents section of your profile. Conserve time and money on preparing official documents. Experience US Legal Forms today!

- Confirm that the form is appropriate for your situation and area by reviewing the description and preview.

- Search for another sample (if necessary) using the Search bar located in the page header.

- Press Buy Now once you find the relevant template.

- Select the pricing option, Log Into your account, or create a new one.

- Choose your preferred payment method to purchase the subscription plan (via credit card or PayPal).

- Pick PDF or DOCX file format for your Deed State Hawaii Form N-11.

- Press Download, then print the document to complete it or upload it to an online editor.

Form popularity

FAQ

You can file your US tax return online easily through various IRS-approved e-filing services. Many platforms provide user-friendly interfaces to guide you through the process, including the completion of the Deed state Hawaii form N-11. Choosing to file online facilitates a quicker and more accurate filing experience.

Yes, Hawaii allows electronic filing for tax returns. By using the state’s online platform, you can conveniently submit your Deed state Hawaii form N-11. This option minimizes the risk of delays and errors, ensuring your return is processed faster.

You can file your Hawaii state tax return, including your Deed state Hawaii form N-11, through the Hawaii Department of Taxation's online portal. If you prefer, you can also mail your return to the appropriate address listed on the department’s website. Make sure to check the latest guidelines for filing to avoid any issues.

Yes, obtaining a Hawaii tax ID number is necessary for certain tax filings. If you plan on filing your Deed state Hawaii form N-11, having a tax ID will streamline the process and keep your tax records organized. You can easily apply for a tax ID through the Hawaii Department of Taxation.

To file G49 Hawaii online, you can use the official website provided by the state. Start by creating an account or logging in, then follow the step-by-step instructions to complete your Deed state Hawaii form N-11. Utilizing online services can make the filing process smoother and more efficient.

Yes, you can file electronically in Hawaii. The state offers an efficient online system for submitting your Deed state Hawaii form N-11. This process simplifies your filing experience and helps ensure your documents are submitted accurately and on time.

To be considered a resident of Hawaii, you must have lived in the state for more than 200 days during the tax year. Additionally, you should demonstrate intent to reside in Hawaii, which can be shown through actions such as obtaining a Hawaii driver's license or registering to vote. Understanding the residency requirements is vital for filing your taxes correctly, especially when using the Deed state hawaii form n-11. The usa legal forms platform can provide clarity on residency status and tax obligations.

Non-residents must file a Hawaii state tax return if they earn income sourced from Hawaii. This includes wages earned while working in Hawaii or income from property located in the state. For non-residents, the Deed state hawaii form n-11 is essential to report income accurately. Utilizing a reliable platform like uslegalforms can help simplify the filing process for non-residents.

Residents of Hawaii must file a state tax return if they earn income above a specific threshold. This includes those who receive wages, self-employment income, or other types of income. If you are using the Deed state hawaii form n-11, ensure that you meet the filing requirements based on your income level to avoid potential penalties. It's crucial to stay informed about Hawaii's tax regulations to comply properly.

The Hawaii N-11 form is the state income tax return for residents, used to report personal income to the state. It involves various calculations to determine your tax liability and may require supporting documents. If you're looking to file your Deed state hawaii form n-11, US Legal Forms can provide helpful guidance and templates.