1031 Exchange Benefits

Description

How to fill out Hawaii Tax Free Exchange Package?

Regardless of whether it's for commercial aims or personal issues, everyone encounters legal circumstances at some stage in their existence.

Completing legal paperwork requires meticulous focus, starting with selecting the correct form template.

With an extensive collection of US Legal Forms available, there's no need to waste time searching for the suitable template online. Utilize the library’s straightforward navigation to find the right template for any scenario.

- Locate the template you require by using the search bar or browsing the catalog.

- Review the form’s details to verify it aligns with your case, jurisdiction, and region.

- Access the form’s preview to examine it.

- If it’s not the correct document, return to the search option to find the 1031 Exchange Benefits template you need.

- Obtain the document once it satisfies your criteria.

- If you possess a US Legal Forms account, click Log in to access previously stored documents in My documents.

- If you haven't created an account yet, you can retrieve the form by clicking Buy now.

- Select the suitable pricing plan.

- Fill out the account registration form.

- Choose your payment option: use a credit card or PayPal.

- Specify the document format desired and download the 1031 Exchange Benefits.

- After it’s downloaded, you can complete the form with editing software or print it and finish it by hand.

Form popularity

FAQ

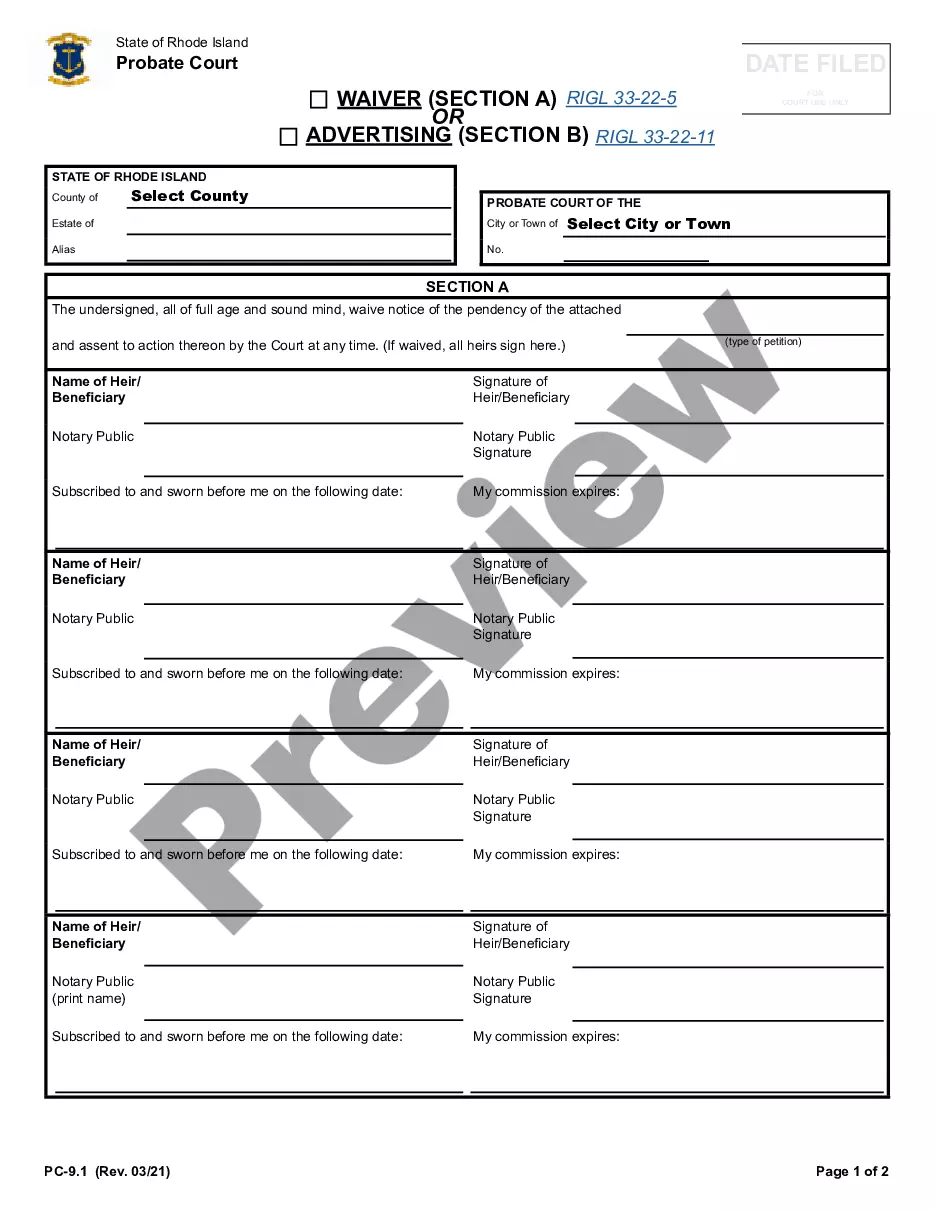

How do you report Section 1031 Like-Kind Exchanges to the IRS? You must report an exchange to the IRS on Form 8824, Like-Kind Exchanges and file it with your tax return for the year in which the exchange occurred.

Steps to Successfully Complete a 1031 Exchange Identify Your 1031 Exchange Objectives & Property Search. ... Find a Qualified Intermediary. ... Add a Cooperation Clause in Your Sales Contract. ... Provide a Copy of the Contract to the Intermediary. ... Funds for the Exchange are Wired to the Exchange Account.

Tax Benefits A 1031 exchange allows you to defer capital gains tax, thus freeing more capital for investment in the replacement property. In a 1031 tax deferred exchange type of transaction, you sell one property and defer the payment of capital gains taxes by acquiring a replacement property or properties.

Exchange Structure and Complexity ? Unlike a straight real estate sale, a 1031 exchange involves much more complexity, including meeting timing and other regulations. The IRS requires that the seller not directly receive the funds from the transaction, which calls for a qualified intermediary to be involved.

The property must be a business or investment property, which means that it can't be personal property. Your home won't qualify for a 1031 exchange. However, a single-family rental property that you own could be exchanged for commercial rental property.