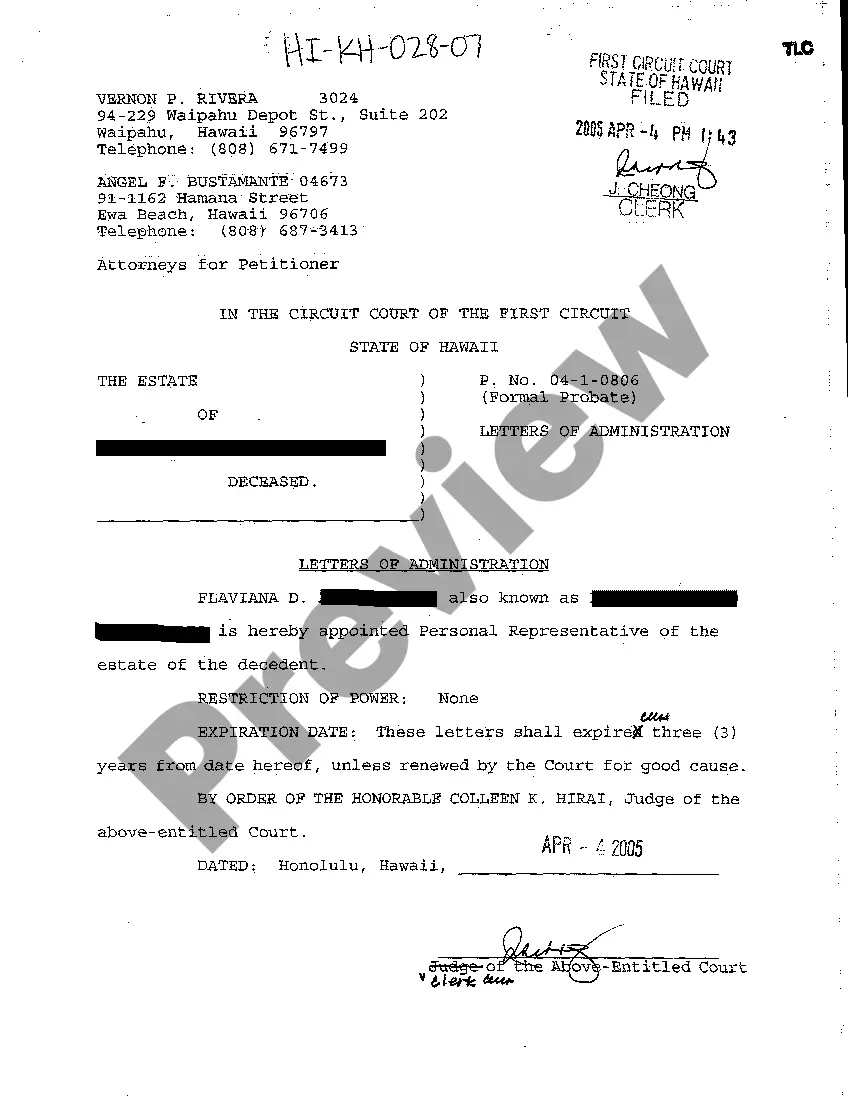

Letters Of Administration Hawaii Without Will

Description

How to fill out Letters Of Administration Hawaii Without Will?

What is the most trustworthy service for obtaining the Letters Of Administration Hawaii Without Will and other recent versions of legal documents? US Legal Forms is the answer!

It's the largest collection of legal documents available for any situation. Every template is precisely crafted and validated for adherence to federal and local regulations.

Form compliance assessment. Prior to acquiring any template, ensure it aligns with your usage requirements as well as your state or county's regulations. Review the form description and utilize the Preview if it is available. Alternative form search. If discrepancies exist, use the search bar in the page header to discover another document. Click Buy Now to select the suitable one. Registration and subscription acquisition. Opt for the most suitable pricing plan, Log In or register for your account, and complete your subscription payment through PayPal or credit card. Downloading the documents. Select the format you wish to store the Letters Of Administration Hawaii Without Will (PDF or DOCX) and click Download to retrieve it. US Legal Forms is an outstanding resource for anyone needing to manage legal documents. Premium users can enjoy additional features, including the ability to complete and sign previously saved forms electronically at any time using the built-in PDF editing tool. Explore it now!

- Collected by area and state of application, making it simple to locate the document you require.

- Experienced users of the site just need to Log In, verify their subscription, and click the Download button next to the Letters Of Administration Hawaii Without Will to obtain it.

- Once downloaded, the document remains accessible for future use in the My documents section of your profile.

- If you do not possess an account with our library yet, follow these steps to create one.

Form popularity

FAQ

Rule 42 in Hawaii probate pertains to the procedures surrounding the administration of estates. It governs the requirements for filing petitions and provides specific guidelines on what information must be included when seeking Letters of Administration Hawaii without a will. Understanding this rule is crucial for personal representatives, as it helps navigate the probate process effectively. Utilizing resources from platforms like USLegalForms can simplify the process and ensure compliance with these regulations.

If there is no will, inheritance goes through intestate succession rules, which vary by state. In Hawaii, the distribution is determined based on familial relationships. The court will issue Letters of Administration Hawaii without a will to an appointed personal representative, who will oversee the property distribution according to local laws. This process ensures that legal heirs receive their rightful share, promoting fairness and clarity.

In Hawaii, when there is no will, inheritance follows a specific order established by state law. Generally, the deceased's spouse and children inherit first; if there are no children, parents or siblings may receive the estate. The court appoints a personal representative to help manage the process using Letters of Administration Hawaii without a will. It's essential to understand this process to ensure equitable distribution of assets.

When someone dies without a will in Hawaii, the court oversees the distribution of the deceased's assets. This process involves obtaining Letters of Administration Hawaii without a will, which allows a personal representative to manage the estate. The representative will identify, gather, and distribute the assets according to Hawaii's intestate succession laws. These laws dictate how property is divided, ensuring that the deceased's wishes are respected as closely as possible.

In Hawaii, an estate must typically exceed $100,000 in value for it to go through the probate process. If a person passes away without a will, their estate may require letters of administration, Hawaii without will being the focus. It is important to consider the value of all assets, including real estate and personal property, when determining if probate is necessary. Using a platform like US Legal Forms can help simplify the process and guide you through obtaining letters of administration in Hawaii.

An administrator has significant authority to manage the deceased's estate, including handling debts, managing assets, and distributing property among heirs. Their power is not unlimited, as they must act according to the law and the court's directives. They are accountable for their actions to the court and must provide an accounting of the estate's activities. For comprehensive guidance on the administrator's responsibilities, checking resources related to letters of administration in Hawaii without will can be beneficial.

An executor cannot take everything if there is no will because, in such cases, the court appoints an administrator to distribute the estate according to Hawaii’s intestacy laws. The assets will be divided among the deceased’s heirs, which may include spouses, children, and other relatives. This legal framework ensures fair distribution rather than allowing an individual to claim all assets. Hence, understanding the letters of administration in Hawaii without will can help clarify the administrator’s role.

To obtain a letter of testamentary in Hawaii, you need to file a probate petition and prove that a valid will exists. This petition should be submitted to the court along with the original will and any required fees. Upon approval, the court grants the letter of testamentary, which allows the executor to manage the deceased’s estate according to the will. For those facing issues of intestacy, exploring letters of administration in Hawaii without will might be necessary.

To obtain a letter of administration without a will, you must file a petition for probate with the local probate court. This petition should include relevant details like the deceased's assets and liabilities. After reviewing your petition, the court will appoint an administrator and issue the letter of administration. It's important to follow the court's requirements closely; using a platform like USLegalForms can simplify this process and ensure accuracy.

The probate process in Hawaii without a will usually takes several months to over a year, depending on the complexity of the estate and any complications that arise. Factors such as the size of the estate, outstanding debts, and the number of heirs can impact the timeline. Engaging experienced professionals can help streamline the process. Thus, having a letter of administration in Hawaii without will is critical to begin the proceedings efficiently.