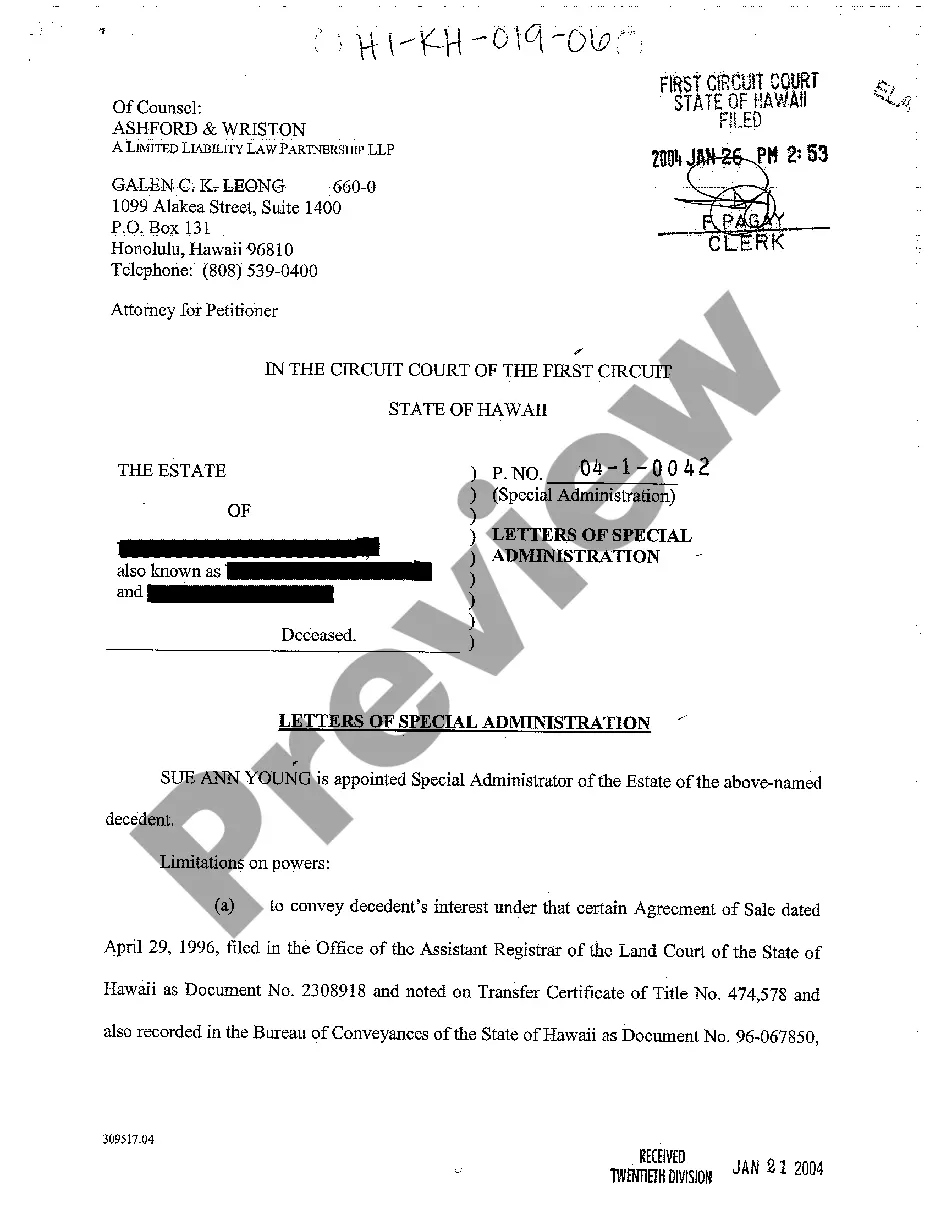

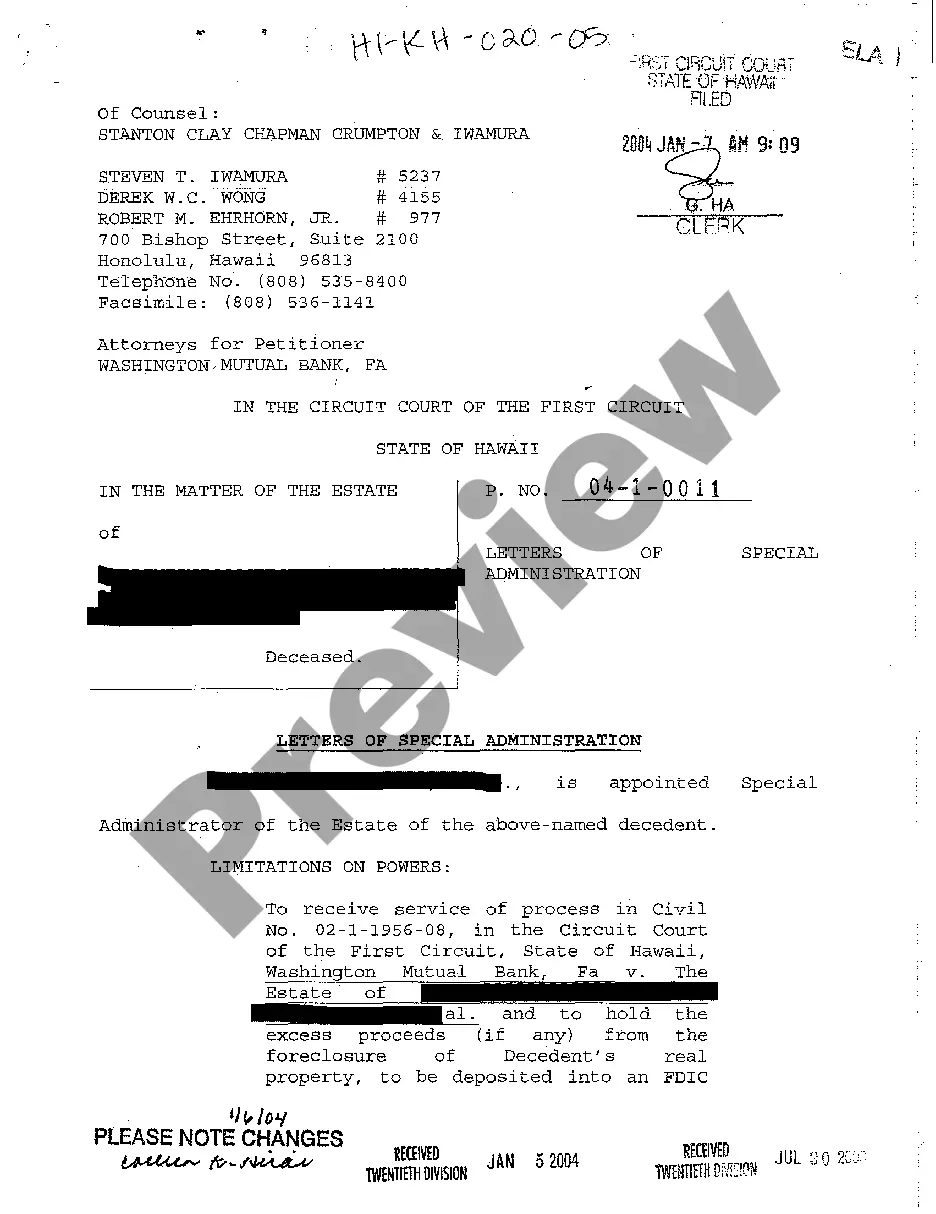

Hawaii And Letters Of Administration For Probate

Description

How to fill out Hawaii Letters Of Special Administration?

When you are required to finalize Hawaii And Letters Of Administration For Probate based on your local state's statutes, there might be a variety of options available.

There's no requirement to review every document to ensure it fulfills all the legal prerequisites if you are a US Legal Forms member.

It is a reliable resource that can assist you in acquiring a reusable and current template on any topic.

Acquiring expertly crafted official documents becomes effortless with US Legal Forms. Furthermore, Premium users can also take advantage of the robust integrated solutions for online PDF modification and signing. Try it out today!

- US Legal Forms is the largest online repository with a selection of over 85,000 ready-to-use documents for both business and personal legal matters.

- All forms are validated to adhere to each state's laws and regulations.

- Thus, when you retrieve Hawaii And Letters Of Administration For Probate from our site, you can be assured that you possess a legitimate and current document.

- Obtaining the required template from our platform is incredibly straightforward.

- If you already hold an account, just Log In to the system, ensure your subscription is current, and save the selected file.

- Later, you can access the My documents section in your account and keep access to the Hawaii And Letters Of Administration For Probate at any time.

- If this is your first time with our collection, please follow the instructions below.

Form popularity

FAQ

A letter of administration is a legal document issued by the register of wills that authorizes someone to manage the estate of a deceased person when there is no will. This document is crucial for handling assets, paying debts, and distributing remaining property in Hawaii. Without this letter, you cannot proceed with probate, making it essential to understand the requirements for obtaining it. US Legal Forms can assist you in navigating this process and ensure you have the correct documentation.

Starting probate in Hawaii begins with gathering the deceased person's assets and determining their value. You can then file the necessary documents with the probate court to initiate the process. It's important to secure a letter of administration for probate, which allows you to manage the estate. Utilizing resources like US Legal Forms can simplify this process by providing the necessary forms and guidance.

Yes, in Hawaii, there is a time limit for starting probate. Generally, you should initiate the probate process within three years after the individual's passing. However, it is wise to begin as soon as possible to address estate matters promptly. If you need assistance with understanding time limits and the requirements for Hawaii and letters of administration for probate, USLegalForms offers helpful resources to guide you through the process.

To obtain a letter of testamentary in Hawaii, you must first file a petition for probate in the appropriate court. This involves submitting the deceased's will, if one exists, along with other required documents. Once the court approves your petition, you will receive the letter of testamentary, which grants you the authority to act on behalf of the estate. Utilizing resources like USLegalForms can simplify this process and help you gather the necessary paperwork efficiently.

An executor is a person appointed in a will to manage the deceased's estate according to the instructions laid out in that will. In contrast, a letter of administration is a court-issued document that appoints a personal representative to manage the estate of someone who died without a will. This designation is essential for distributing assets and settling debts. Understanding these roles is crucial, and platforms like USLegalForms can help clarify these processes as they pertain to Hawaii and letters of administration for probate.

To obtain a letter of testamentary in Hawaii, you need to file a petition in the probate court where the deceased's estate is being administered. This letter authorizes the named executor to manage the estate as per the deceased's will. You will need to submit a certified copy of the will, the death certificate, and other supporting documents required by the court. USLegalForms can assist you in completing the necessary paperwork accurately, ensuring you have all you need for a smooth probate process in Hawaii and letters of administration for probate.

Getting a letter of administration for an estate involves filing the appropriate petition with your local probate court in Hawaii. You should gather all required documents, including the death certificate and any relevant information about the deceased's assets and heirs. After submitting your petition, the court will review the details and may schedule a hearing. USLegalForms offers resources to help you navigate this process smoothly, especially when dealing with the specific requirements for Hawaii and letters of administration for probate.

To obtain a letter of administration for an estate in Hawaii, you must first file a petition with the probate court in the jurisdiction where the deceased resided. This paperwork outlines the need for a letter of administration and identifies the administrator of the estate. Additionally, you might need to notify interested parties and provide the court with necessary documentation. Using platforms like USLegalForms can simplify this process by providing you with the correct forms and guidance tailored to Hawaii and letters of administration for probate.

The threshold for probate in Hawaii is typically set at $100,000 for personal property. If the value of the decedent's estate exceeds this amount, probate proceedings are generally required. However, real estate may have different considerations and may require probate regardless of the value. By understanding Hawaii and letters of administration for probate, you can better assess whether probate is necessary for your situation.

Rule 126 governs the notice requirements for probate proceedings in Hawaii. This rule mandates that interested parties be informed about the probate application and the appointment of a personal representative. Adhering to this rule is essential for maintaining transparency and ensuring all parties are aware of the proceedings. Engaging with resources related to Hawaii and letters of administration for probate can help you understand these requirements better.