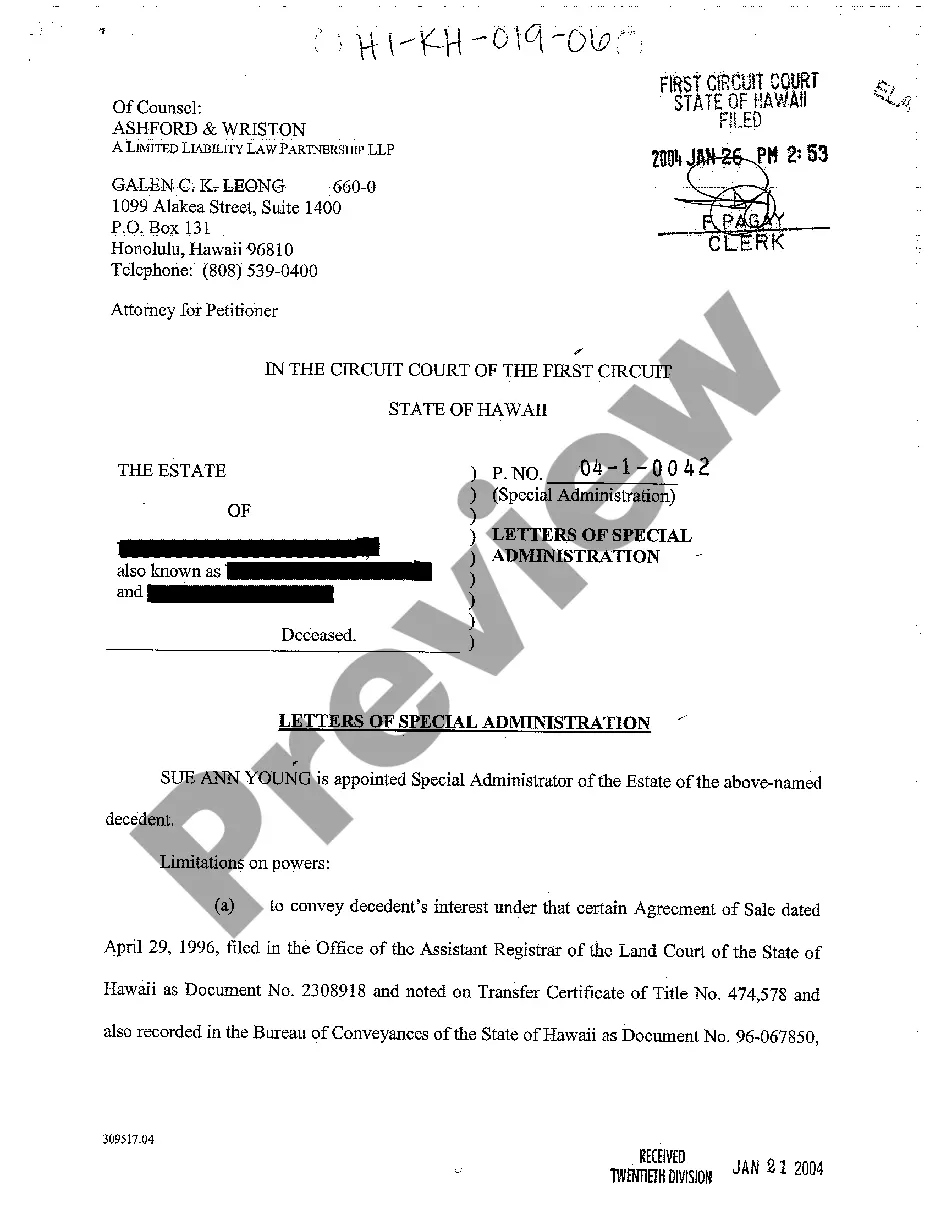

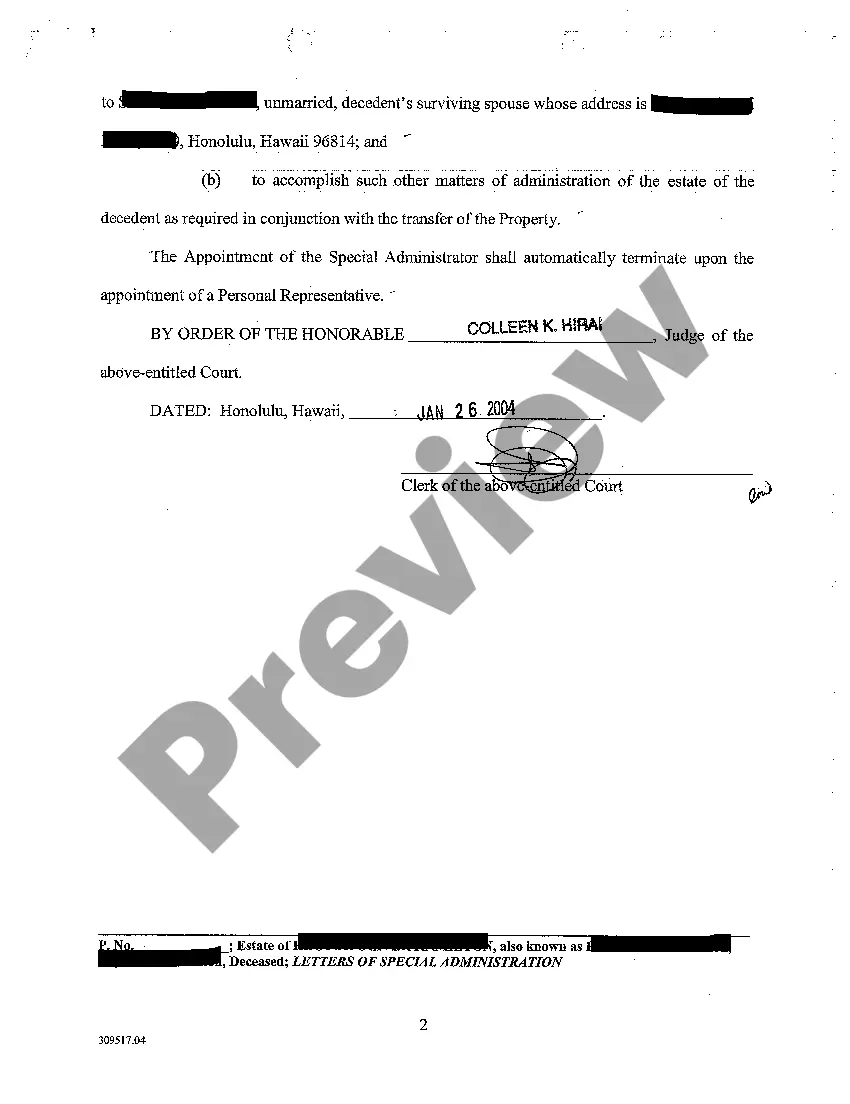

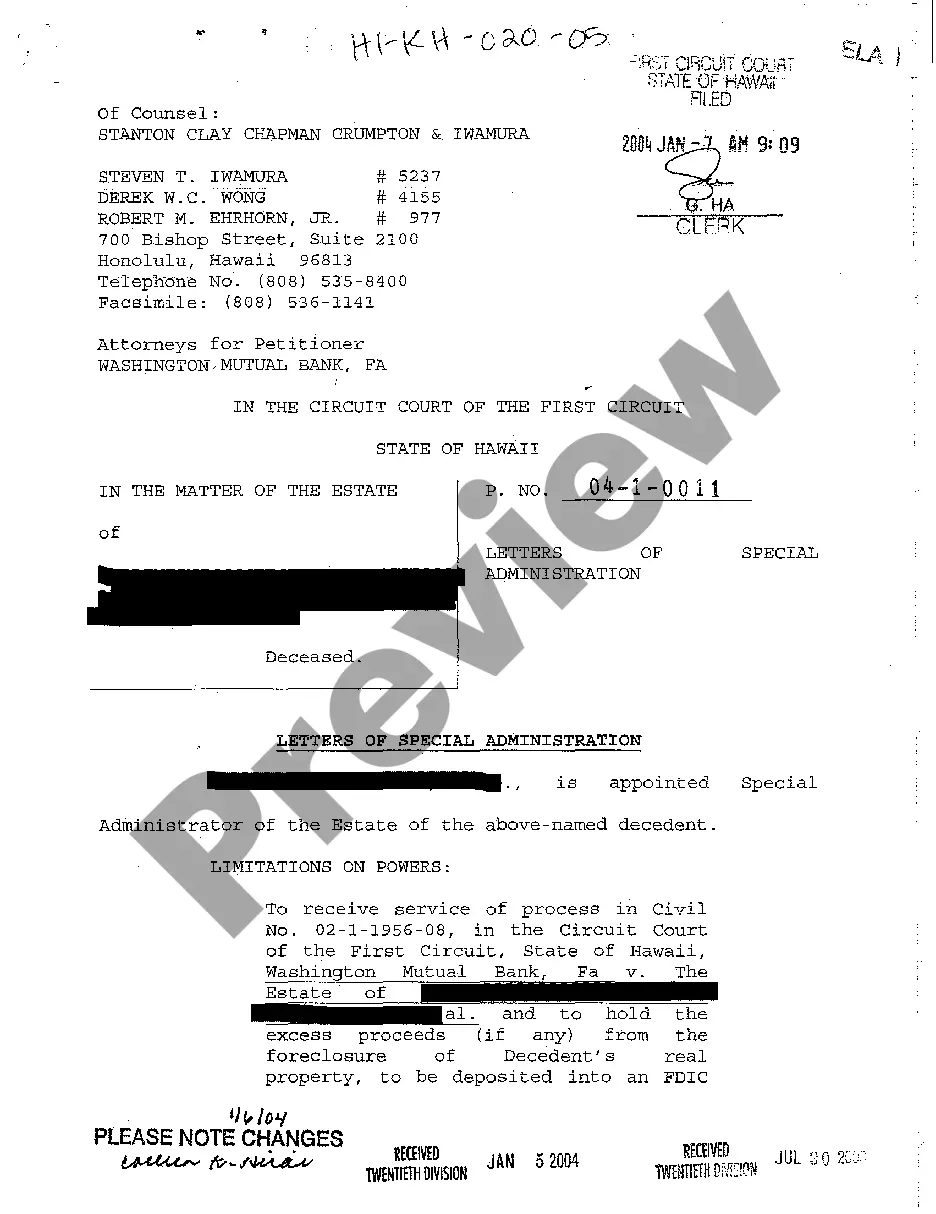

Hawaii And Letters Of Administration For Deceased

Description

How to fill out Hawaii Letters Of Special Administration?

Well-constructed formal documentation stands as one of the crucial assurances for precluding complications and legal disputes, yet obtaining it without the help of a lawyer might require some time.

Whether you require promptly locating an updated Hawaii And Letters Of Administration For Deceased or any alternative forms for employment, family, or business matters, US Legal Forms is perpetually available to assist.

The procedure is even easier for current users of the US Legal Forms library. If your subscription is active, you merely need to Log In to your account and click the Download button near the selected file. Furthermore, you can access the Hawaii And Letters Of Administration For Deceased at any point, as all documents ever obtained from the platform are accessible within the My documents section of your profile. Conserve time and money while preparing official documents. Experience US Legal Forms today!

- Verify that the form fits your situation and area by reviewing the description and preview.

- Search for another example (if necessary) using the Search bar in the header of the page.

- Hit Buy Now upon finding the appropriate template.

- Select a pricing plan, Log In to your account or create a new one.

- Choose your preferred payment method to acquire the subscription plan (using a credit card or PayPal).

- Select PDF or DOCX format for your Hawaii And Letters Of Administration For Deceased.

- Press Download, then print the template to complete it or upload it to an online editor.

Form popularity

FAQ

To order a testamentary letter, start by filing your will with the local probate court in Hawaii. After filing, submit a petition to the court, requesting the issuance of the letter. You may find platforms like US Legal Forms helpful, as they provide the necessary forms and guidance for this process, ensuring a smoother application experience.

An alternative to a letter of testamentary is a letter of administration, which you can get when there is no will in place. This document allows you to manage the affairs of someone who has died without specifying how their estate should be handled. Additionally, you may use a trust if the deceased set one up, as it can bypass the probate process entirely.

To obtain a letter of administration in Hawaii, you must first file a petition with the probate court in the county where the deceased resided. This petition usually requires specific documents, including the death certificate and details about the estate's assets. After approval from the court, you will receive the letter, allowing you to handle the deceased's financial matters legally.

In Hawaii, a letter of testamentary typically remains valid until the estate is fully settled and distributed. This may take several months to a few years, depending on the complexity of the estate. It is essential for you to manage the estate affairs during this time. Once the estate is closed, the letters will no longer hold any authority.

In Hawaii, you typically have three years to file for probate after a person's death. However, it's advisable to start the process as soon as possible to avoid complications. Timely filing helps ensure the efficient processing of letters of administration for deceased estates, which can facilitate the distribution of assets and resolution of debts.

To obtain a letter of testamentary in Hawaii, you must first file a petition for probate with the court. This process confirms the validity of the deceased's will and appoints you as the executor. Once the court approves your request, you will receive the letter, which grants you the authority to manage the estate, including handling letters of administration for deceased assets.

After obtaining a letter of administration, the personal representative can begin managing the deceased's estate. This includes gathering assets, paying debts, and ultimately distributing what remains according to Hawaii probate laws. It marks the start of an organized process to settle affairs and honor the deceased's wishes.

The purpose of a letter of administration is to formally recognize the personal representative's authority to handle the estate of a deceased person. This document is crucial for executing the deceased's wishes and ensuring that all obligations are fulfilled. In Hawaii, letters of administration for deceased estates facilitate the transition of assets and expedite the probate process.

A letter of administration for deceased individuals is a legal document issued by the court. It authorizes an appointed personal representative to manage and distribute the deceased person's estate according to Hawaii laws. This letter is essential for initiating the probate process, allowing the representative to access assets and settle any debts.

Rule 42 in Hawaii probate establishes the procedure for appointing a personal representative when someone dies. This rule outlines how the court determines eligibility for individuals to act on behalf of the deceased. Understanding Rule 42 is vital for navigating the letters of administration for deceased estates, ensuring that the process moves smoothly and legally.