Hawaii Child Support Calculator Excel With Formula

Description

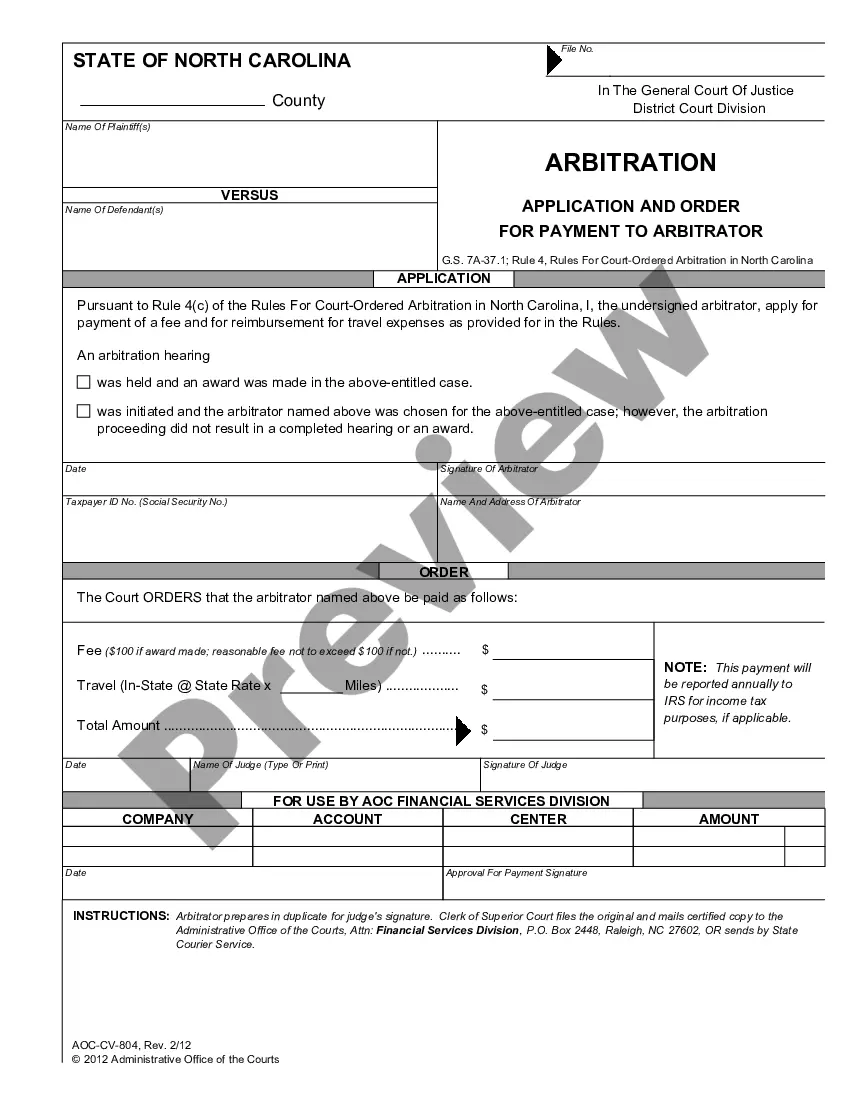

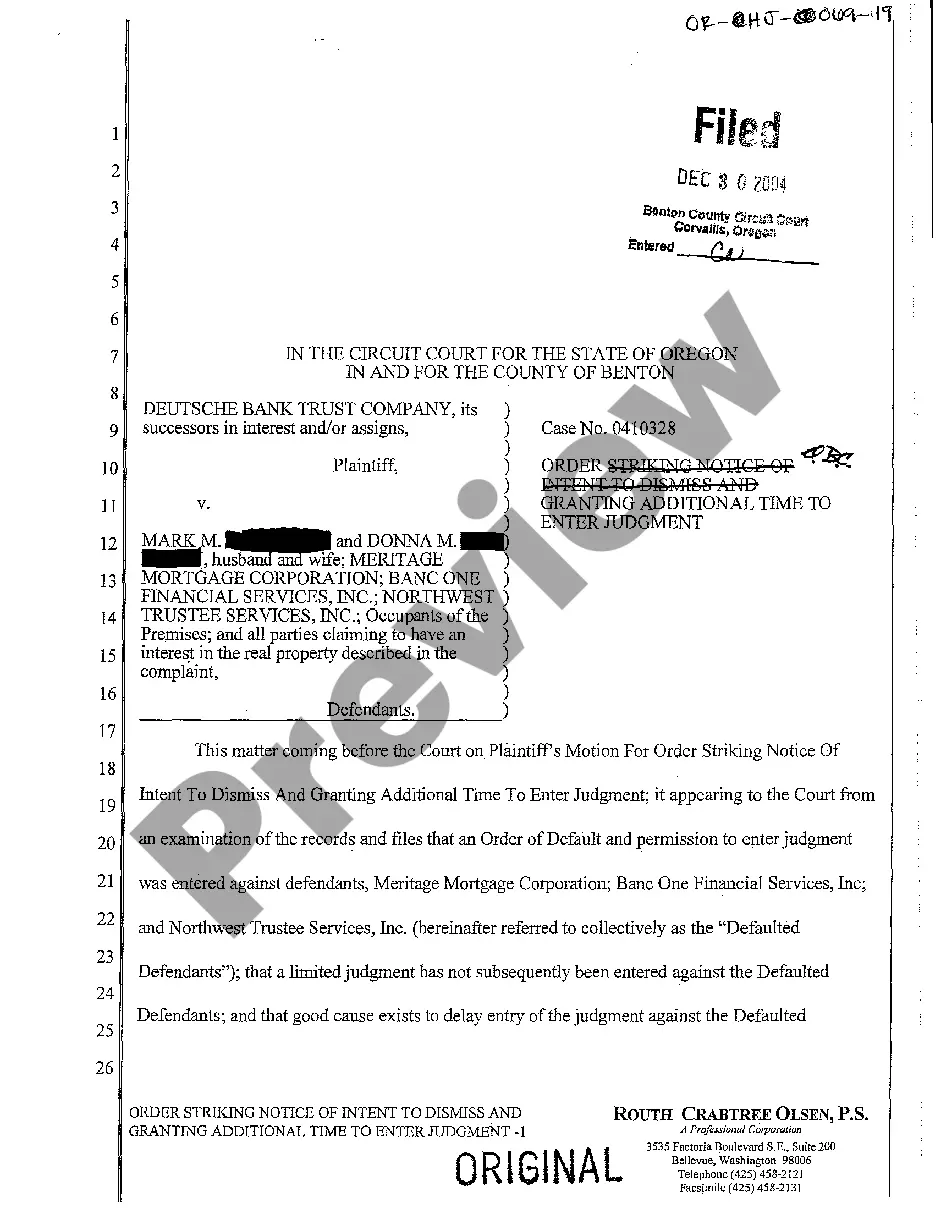

How to fill out Hawaii Child Support Guidelines Worksheet?

Managing legal documents and processes can be a labor-intensive addition to your day.

Hawaii Child Support Calculator Excel With Formula and similar forms usually necessitate that you search for them and figure out how to fill them out correctly.

Therefore, if you are handling financial, legal, or personal issues, utilizing a comprehensive and user-friendly online repository of forms when needed will be beneficial.

US Legal Forms is the top online platform for legal templates, offering over 85,000 state-specific forms along with various resources to help you complete your documents swiftly.

Is it your first time using US Legal Forms? Create and set up an account in just a few minutes to gain access to the form library and Hawaii Child Support Calculator Excel With Formula. Then, follow the steps below to finalize your form: Make sure you have located the correct form using the Preview feature and reviewing the form description. Select Buy Now when ready, and choose the monthly subscription plan that suits your requirements. Click Download, then fill out, eSign, and print the form. US Legal Forms has 25 years of experience aiding users with their legal documents. Find the form you need today and enhance any process effortlessly.

- Explore the library of relevant documents available with just one click.

- US Legal Forms provides state- and county-specific forms available for download at any time.

- Protect your document management tasks using a premium service that enables you to create any form within minutes without extra or hidden costs.

- Simply Log In to your account, find Hawaii Child Support Calculator Excel With Formula, and download it directly from the My documents section.

- You can also access previously downloaded forms.

Form popularity

FAQ

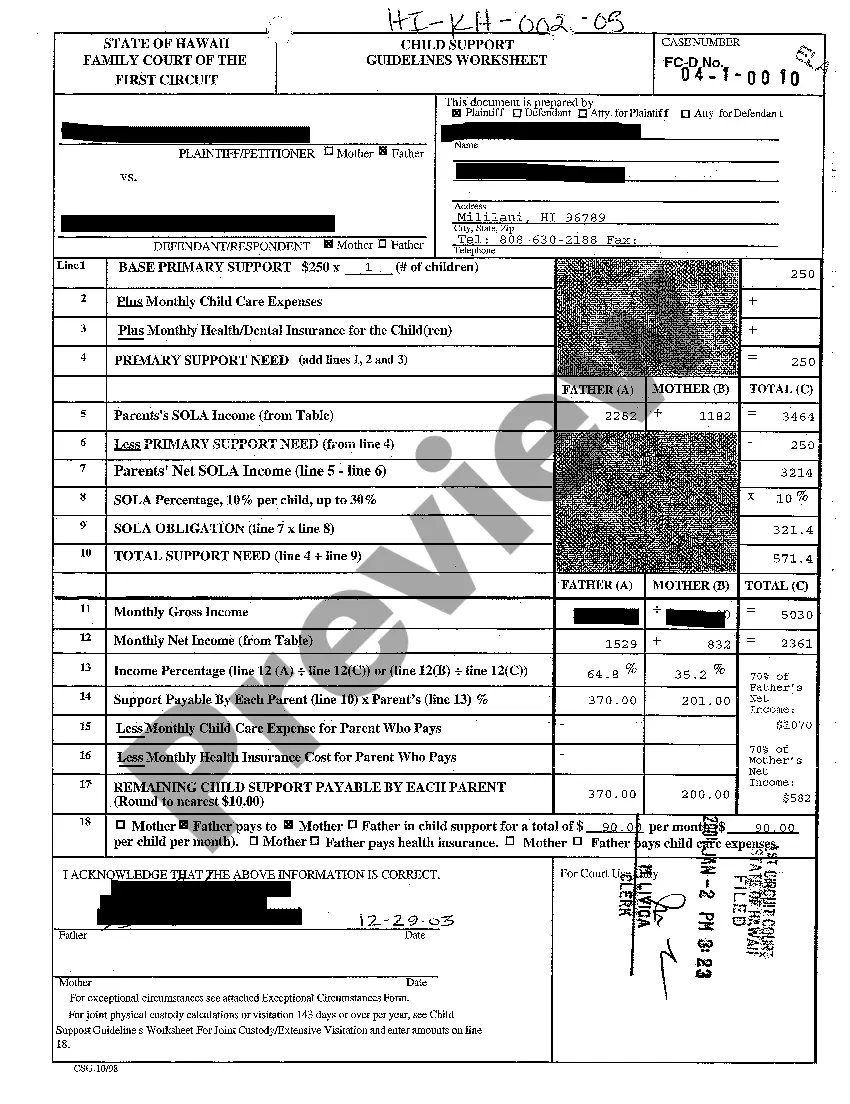

The biggest factor in calculating child support is usually the income of both parents. Courts often look at both gross and net income to determine how much support is necessary for the child's welfare. Utilizing a Hawaii child support calculator excel with formula can help clarify how income levels impact support obligations. By understanding these factors, parents can make informed decisions about their financial planning and responsibilities.

The formula for calculating child support typically considers the income of both parents, the number of children, and any special needs or additional expenses. Using a Hawaii child support calculator excel with formula can simplify this process by automatically applying the relevant guidelines. It’s essential to input accurate income figures and expenses to get a reliable estimate. This tool can help parents understand their responsibilities and plan accordingly.

This usually occurs when the child turns eighteen (18) years of age unless the child is attending high school or the child is under twenty-three (23) years of age and is presently enrolled as a full-time student or has been accepted into and plans to attend as a full-time student for the next semester a post-high ...

Common examples of exceptional circumstances are that the obligor has to pay child support for additional children, the children or the other parent have extraordinary needs (such as a physical or emotional disability), other payments are required by court order or law to the other parent, the support amount exceeds ...

This usually occurs when the child turns eighteen (18) years of age unless the child is attending high school or the child is under twenty-three (23) years of age and is presently enrolled as a full-time student or has been accepted into and plans to attend as a full-time student for the next semester a post-high ...

Is there a limit to the amount of money that can be taken from my paycheck for child support? 50 percent of disposable income if an obligated parent has a second family. 60 percent if there is no second family.

Hawaii child support is based on the number of overnight visits. Hawaii uses overnights or where the children sleep as the basis for figuring shared custody timeshare percentages in its child support formula. Besides income, overnight totals are a key part of the Hawaii child support formula.