Hawaii Child Support Calculator Excel Formula

Description

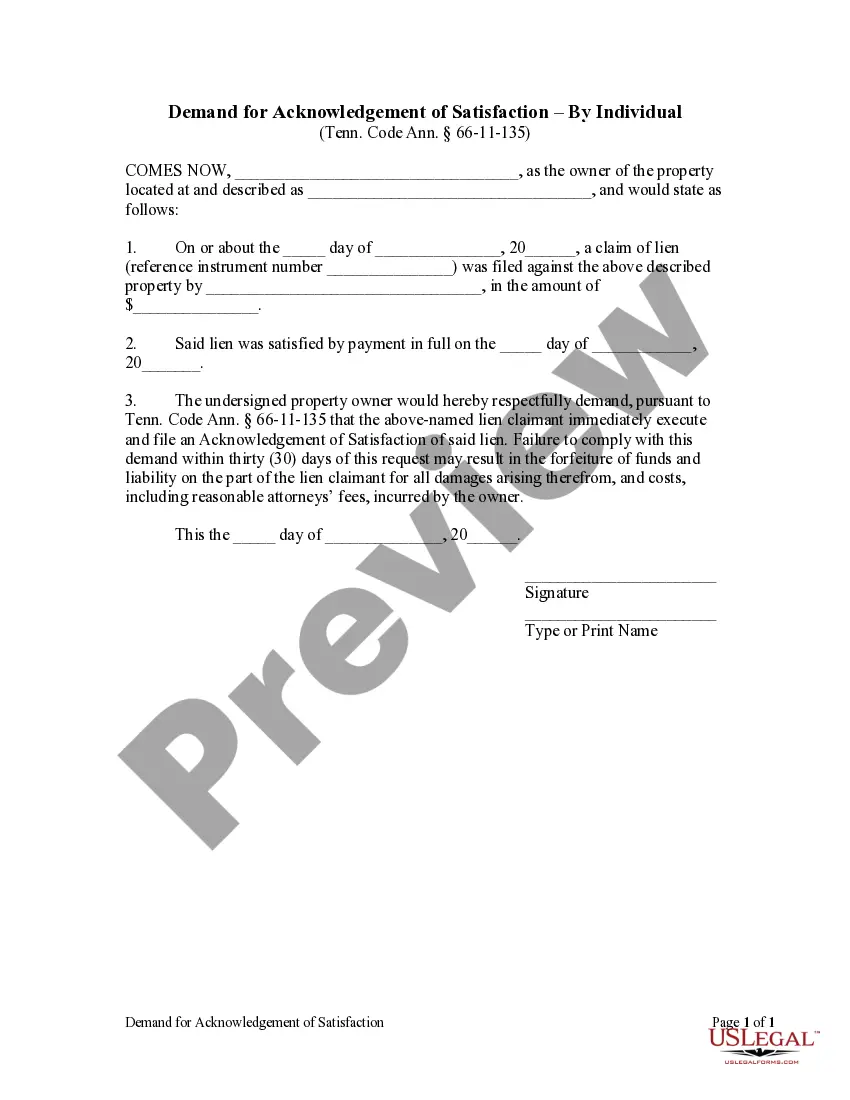

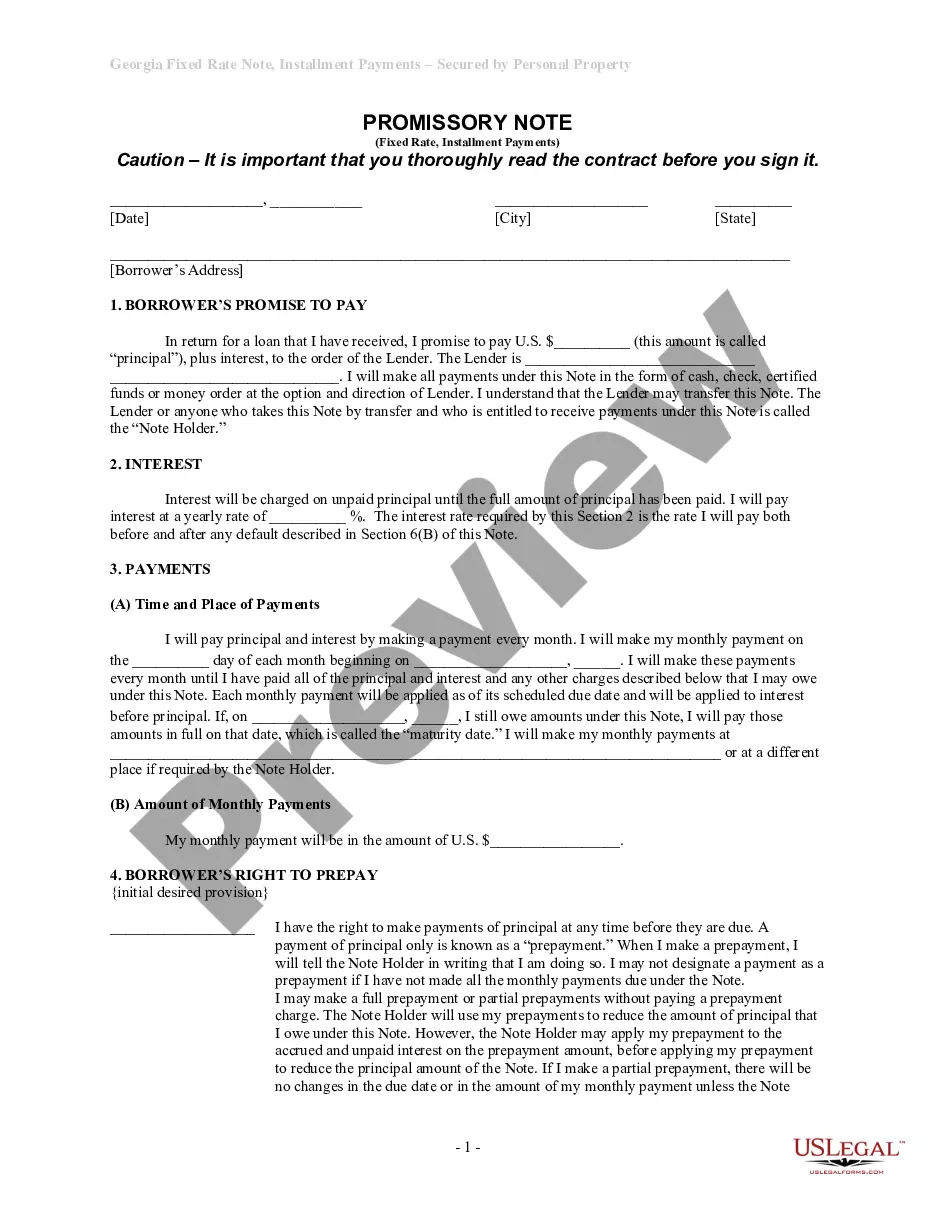

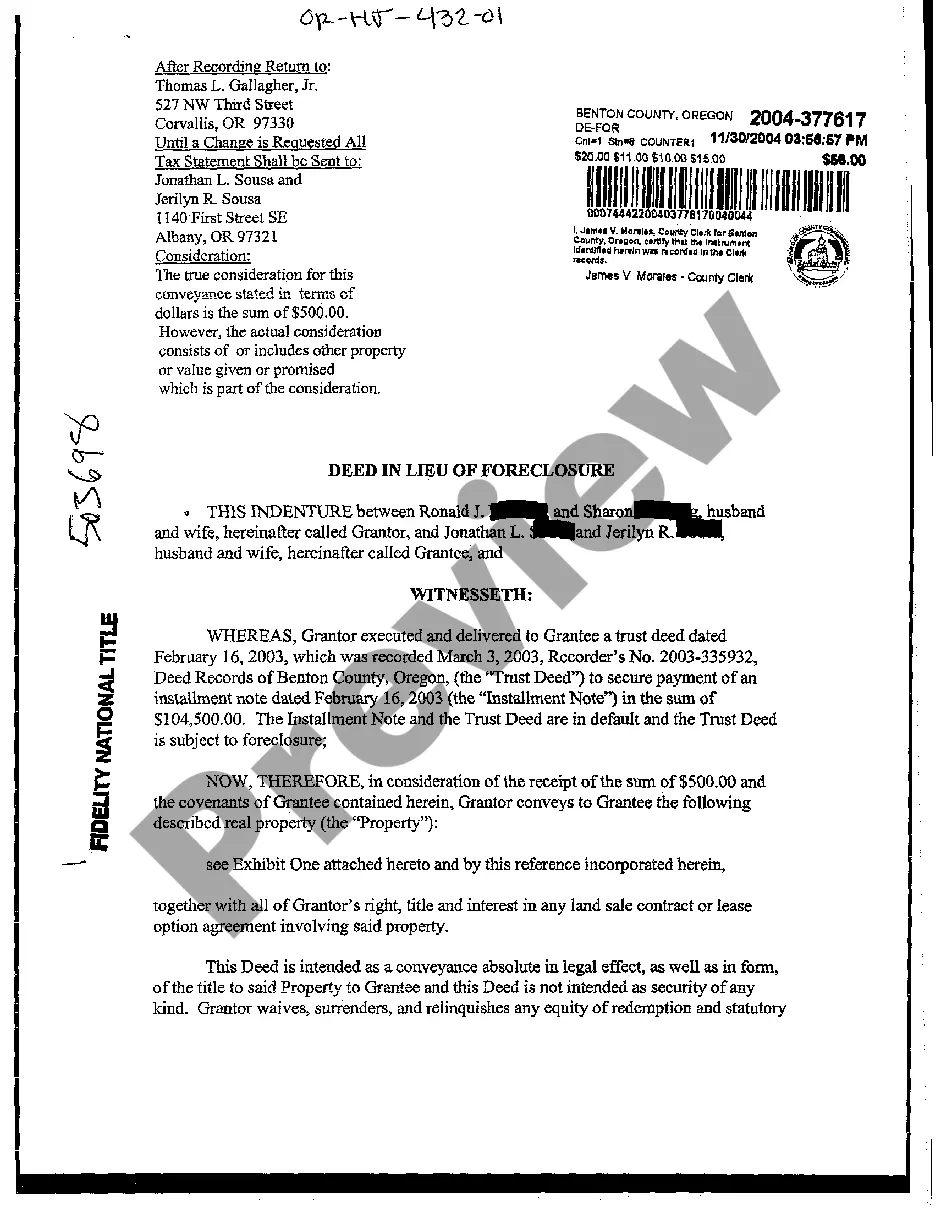

How to fill out Hawaii Child Support Guidelines Worksheet?

Legal administration can be daunting, even for the most experienced experts.

When you are seeking a Hawaii Child Support Calculator Excel Formula and lack the time to invest in finding the appropriate and updated version, the process can be anxiety-inducing.

Access a repository of articles, guides, and resources pertinent to your situation and needs.

Conserve time and effort in procuring the documents you require, and utilize US Legal Forms’ sophisticated search and Preview feature to locate the Hawaii Child Support Calculator Excel Formula and download it.

Take advantage of the US Legal Forms online library, supported by 25 years of experience and trustworthiness. Improve your daily document management in a straightforward and user-friendly manner today.

- If you have a monthly subscription, Log In to your US Legal Forms account, search for the form, and download it.

- Check your My documents section to view the documents you have previously saved and manage your folders as needed.

- If this is your first encounter with US Legal Forms, create an account to gain unlimited access to all the benefits of the platform.

- Here are the steps to follow after obtaining the form you desire.

- Verify this is the correct form by previewing it and reviewing its description.

- Ensure that the template is approved in your state or county.

- Click Buy Now when you are prepared.

- Choose a monthly subscription plan.

- Select the desired format, and Download, fill out, sign, print, and send your documents.

- Access state- or county-specific legal and business documents.

- US Legal Forms caters to any requirements you may have, from personal to corporate paperwork, all in one location.

- Utilize cutting-edge tools to complete and manage your Hawaii Child Support Calculator Excel Formula.

Form popularity

FAQ

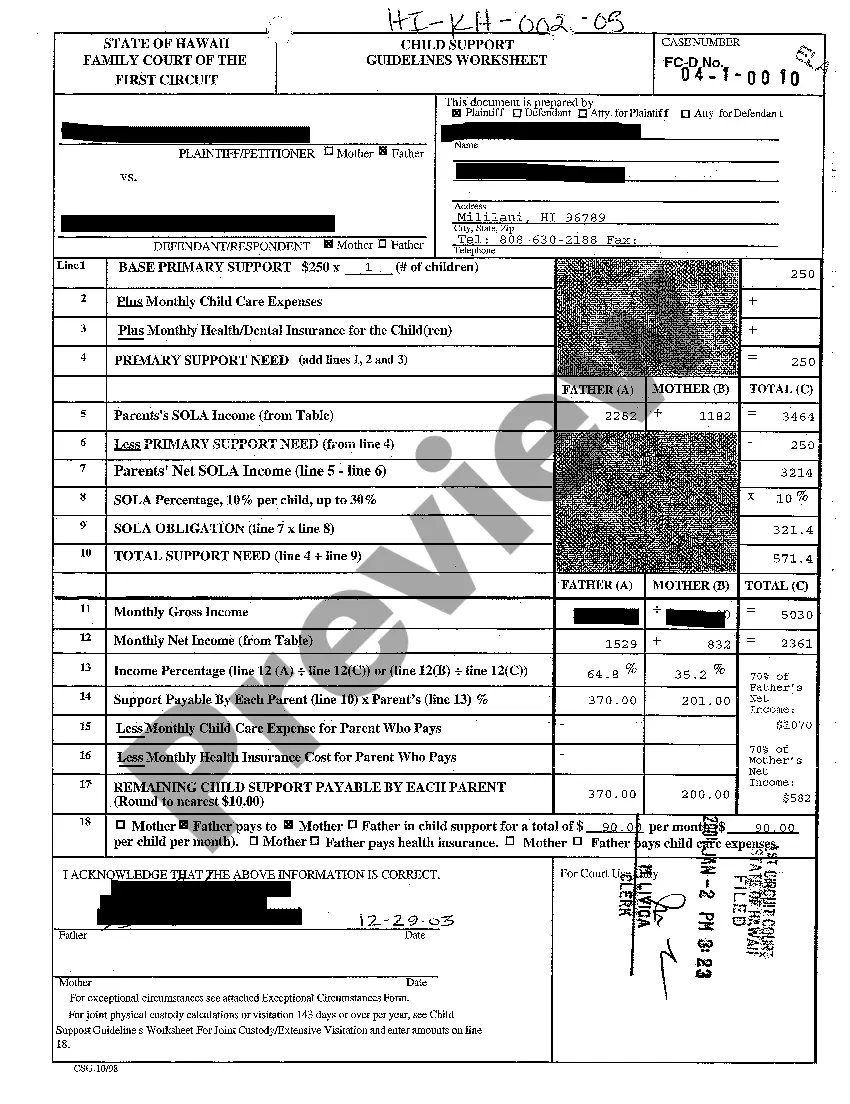

The biggest factor in calculating child support is typically the income of both parents. Courts look at each parent's ability to provide financial support based on their earnings and other financial resources. In Hawaii, utilizing a Hawaii child support calculator excel formula can help you better understand how different income levels affect the final support amount. As you navigate this process, consider using US Legal Forms for accurate calculations and guidance tailored to your situation.

The formula for calculating child support varies by state, but generally, it involves considering the income of both parents, the number of children, and any special needs or expenses. In Hawaii, using a Hawaii child support calculator excel formula can simplify this process. This formula helps you input relevant financial data, making it easier to determine the appropriate amount of support. You can find tools on platforms like US Legal Forms that guide you through the calculation seamlessly.

The Guidelines set a minimum child support amount of $83.00 per child per month.

The total child-support obligation shall be divided between the parents in proportion to their adjusted gross incomes. The obligation of each parent is computed by multiplying the total child-support obligation by each parent's percentage share of their combined adjusted gross income.

Common examples of exceptional circumstances are that the obligor has to pay child support for additional children, the children or the other parent have extraordinary needs (such as a physical or emotional disability), other payments are required by court order or law to the other parent, the support amount exceeds ...

This usually occurs when the child turns eighteen (18) years of age unless the child is attending high school or the child is under twenty-three (23) years of age and is presently enrolled as a full-time student or has been accepted into and plans to attend as a full-time student for the next semester a post-high ...

Hawaii child support is based on the number of overnight visits. Hawaii uses overnights or where the children sleep as the basis for figuring shared custody timeshare percentages in its child support formula. Besides income, overnight totals are a key part of the Hawaii child support formula.