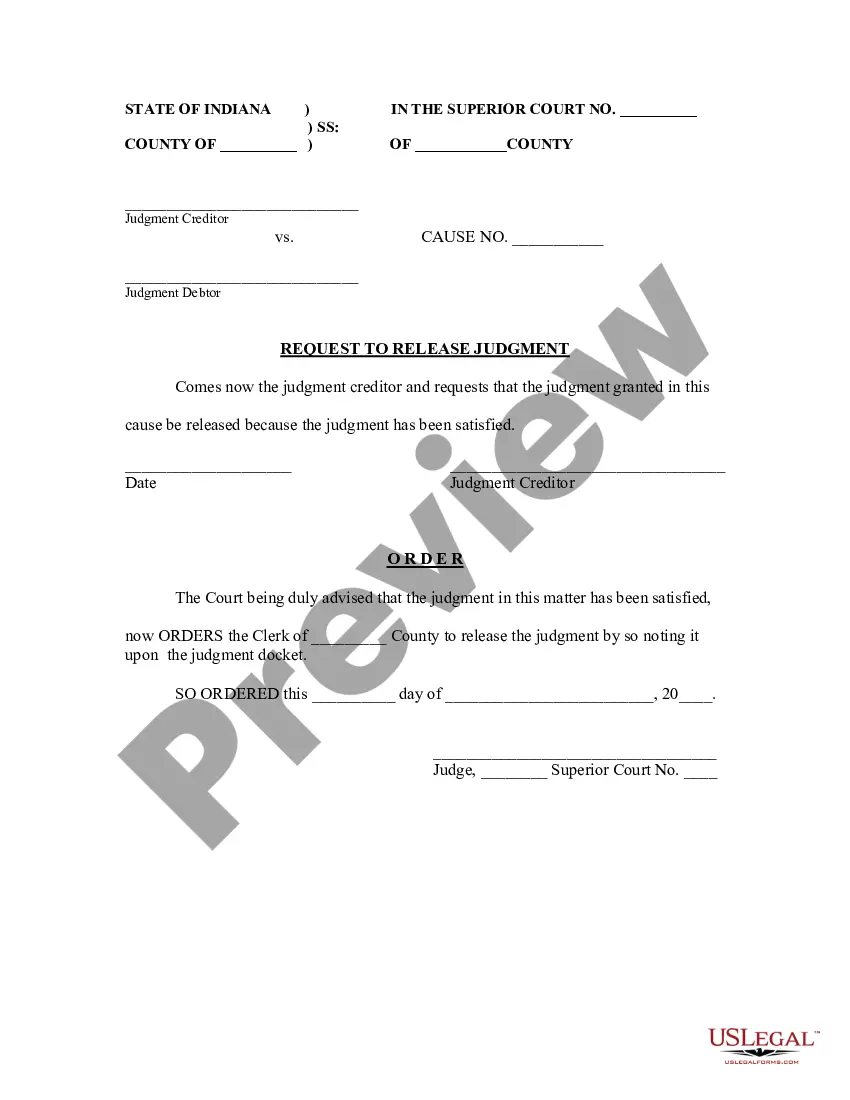

A Complaint is the first pleading filed in a lawsuit. It lists the allegations made against the Defendant by the Plaintiff. This particular lawsuit centers around damages to a rental property.

Summary Possession Hawaii Withholding

Description

How to fill out Hawaii Complaint Regarding Assumpsit And Summary Possession And Damages - Landlord Tenant?

Getting a go-to place to take the most current and appropriate legal templates is half the struggle of dealing with bureaucracy. Discovering the right legal papers needs precision and attention to detail, which is why it is important to take samples of Summary Possession Hawaii Withholding only from reliable sources, like US Legal Forms. A wrong template will waste your time and hold off the situation you are in. With US Legal Forms, you have little to be concerned about. You can access and see all the information regarding the document’s use and relevance for your situation and in your state or county.

Take the listed steps to complete your Summary Possession Hawaii Withholding:

- Utilize the catalog navigation or search field to find your sample.

- View the form’s description to ascertain if it fits the requirements of your state and region.

- View the form preview, if available, to ensure the form is the one you are searching for.

- Get back to the search and look for the appropriate template if the Summary Possession Hawaii Withholding does not fit your requirements.

- When you are positive about the form’s relevance, download it.

- When you are a registered customer, click Log in to authenticate and access your picked forms in My Forms.

- If you do not have a profile yet, click Buy now to obtain the form.

- Choose the pricing plan that fits your preferences.

- Proceed to the registration to finalize your purchase.

- Finalize your purchase by picking a transaction method (credit card or PayPal).

- Choose the file format for downloading Summary Possession Hawaii Withholding.

- When you have the form on your device, you may modify it with the editor or print it and complete it manually.

Remove the headache that accompanies your legal paperwork. Explore the comprehensive US Legal Forms library where you can find legal templates, check their relevance to your situation, and download them on the spot.

Form popularity

FAQ

If a Hawaii residential or commercial tenant defaults under the Hawaii Rental Agreement or Hawaii Lease, or fails to timely pay his or her rent, we can begin Hawaii eviction activity, leading to the summary possession of the Hawaii residence or commercial space.

A 7.25% withholding obligation is generally imposed on the transferee/buyer when a Hawaii real property interest is acquired from a nonresident person. This withholding serves to collect Hawaii income tax that may be owed by the nonresident person. Use this form to report and transmit the amount withheld.

Overview. Employers need to withhold Hawaii income taxes on employee wages. Employers then pay the withheld taxes to the State of Hawaii, Department of Taxation (DOTAX). Employees reconcile their withholding taxes paid as part of their Individual Income tax return.

Use Form BB-1 (found by clicking Register New Business License under Registration) to request a withholding (WH) account number. You may also add a withholding account on Hawaii Tax Online if you already have a login.

Overview. Employers need to withhold Hawaii income taxes on employee wages. Employers then pay the withheld taxes to the State of Hawaii, Department of Taxation (DOTAX). Employees reconcile their withholding taxes paid as part of their Individual Income tax return.