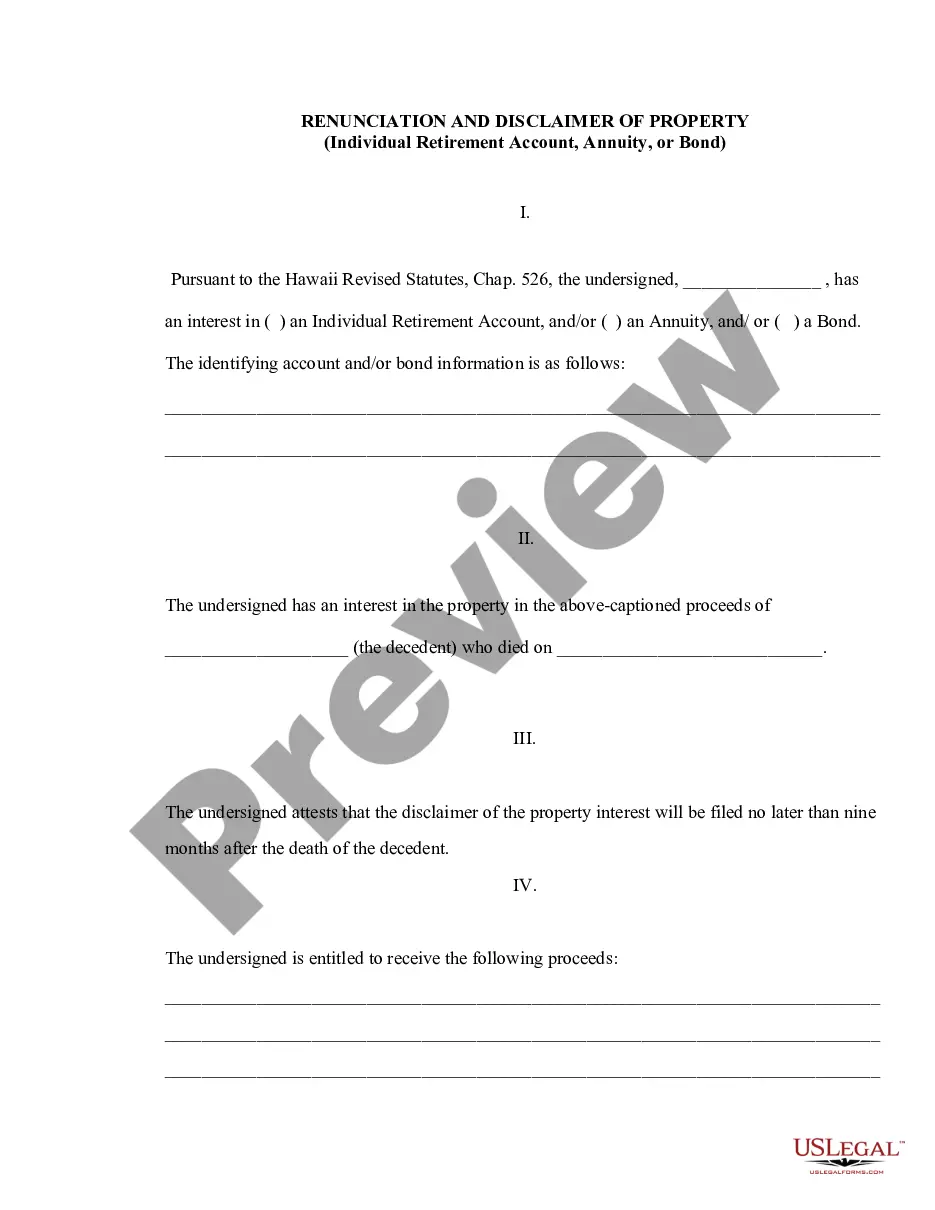

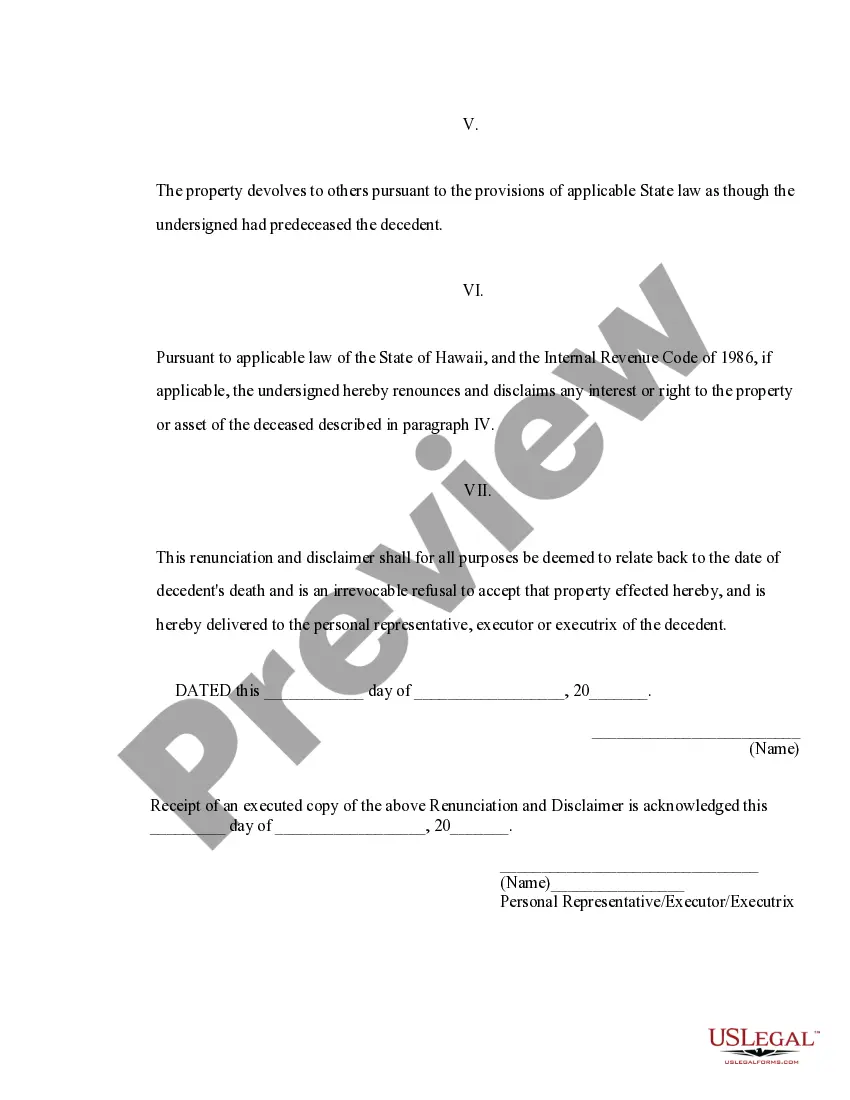

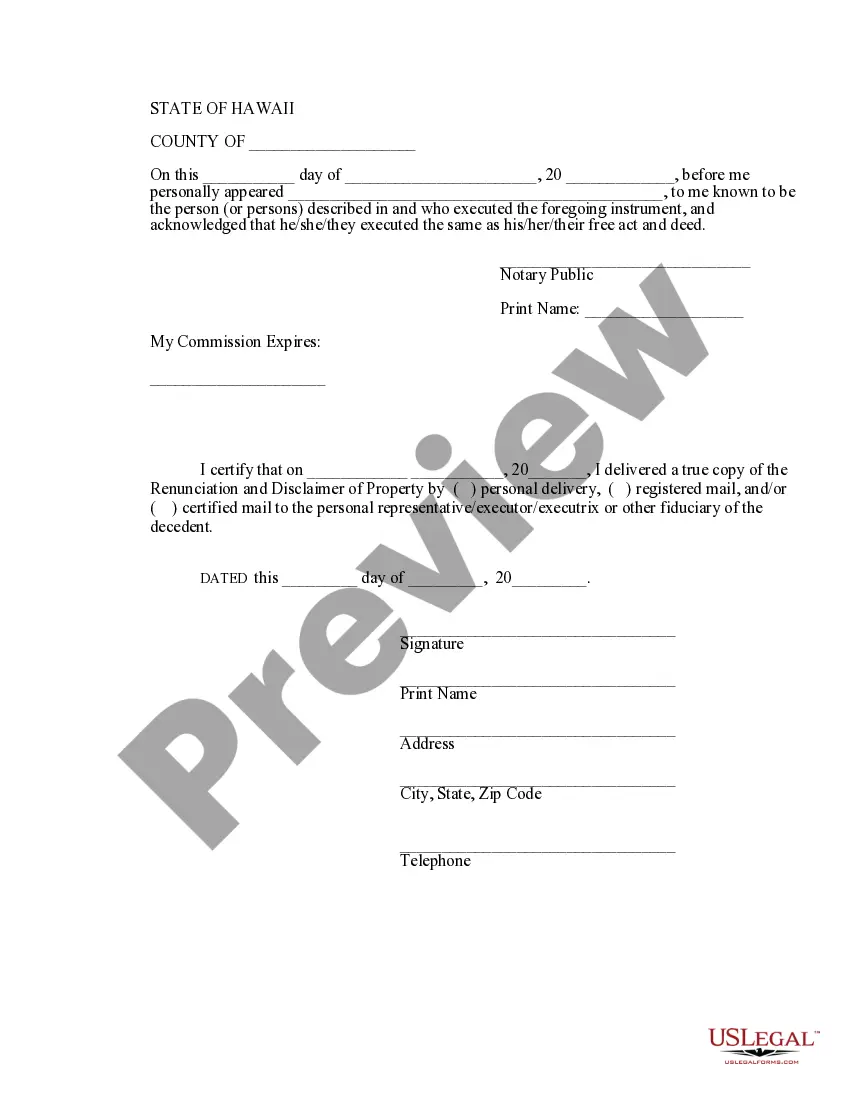

This form is a Renunciation and Disclaimer of an Individual Retirement Account (IRA), an Annuity, or Bond. The beneficiary has gained an interest in the proceeds of the account(s) due to the death of the decedent. However, the beneficiary has chosen to disclaim his/her rights to the proceeds pursuant to the Hawaii Revised Statutes, Chap. 526. The disclaimer will relate back to the death of the decedent and it will serve as an irrevocable refusal of the property. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Hawaii Individual Retirement Account Withdrawal Form

Description

Form popularity

FAQ

To report retirement withdrawals, you must complete the appropriate forms required by the IRS. Specifically, you will need the Hawaii individual retirement account withdrawal form to document the distribution from your retirement account. This form ensures that you correctly report your withdrawals and fulfill any tax obligations that may arise. Using a platform like US Legal Forms can streamline this process, providing you with easy access to the necessary documentation.

Typically, post offices do not carry tax forms, including the Hawaii individual retirement account withdrawal form. However, you may find tax forms at nearby libraries or government offices. Checking the IRS website is also a great way to access the forms you need.

Tax forms in Hawaii are available at various public places, such as libraries and government offices. You can also check online for downloadable options, especially the Hawaii individual retirement account withdrawal form, which is crucial for effective tax filing. Ensure you have the right forms before the tax deadline.

You can obtain Hawaii tax forms directly from the Hawaii Department of Taxation's website. They offer downloadable forms, including the Hawaii individual retirement account withdrawal form. Additionally, physical copies may be available at local tax offices and libraries.

In general, distributions from an inherited IRA are considered taxable income in Hawaii. This means if you use a Hawaii individual retirement account withdrawal form to access funds from an inherited account, taxes may apply. Always confirm with a financial advisor to understand the tax implications of inherited IRAs.

Yes, most IRA withdrawals, including those from a Hawaii individual retirement account withdrawal form, are subject to income tax. The taxed amount depends on your overall income and the types of contributions you made. It's essential to consult a tax professional for guidance on your specific circumstances.

You can find tax forms at several locations in Hawaii. Local libraries and community centers often provide a selection of tax forms. Additionally, you can visit the IRS website to download tax forms, including the Hawaii individual retirement account withdrawal form.

The primary tax document for retirement withdrawal is the 1099-R. This form outlines the total distribution amount and the taxable portion of your withdrawal. When dealing with retirement funds, using the Hawaii individual retirement account withdrawal form alongside the 1099-R ensures that your tax reporting is complete and accurate.

To get a copy of your 1099 from your retirement account, you can contact your plan administrator or the financial institution holding your account. They can provide you with a reissue of the form, which you will need for tax purposes. Having this document is important when filling out the Hawaii individual retirement account withdrawal form to report your withdrawal correctly.

You can mail Hawaii form N-15 to the address specified on the form instructions, which is often the Department of Taxation in Hawaii. Ensure that you double-check the latest mailing address, as it may change. If you're completing tax-related documents like the Hawaii individual retirement account withdrawal form, keep a copy for your records to ensure everything is managed properly.