Transfer Death Deed Sample For Sale

Description

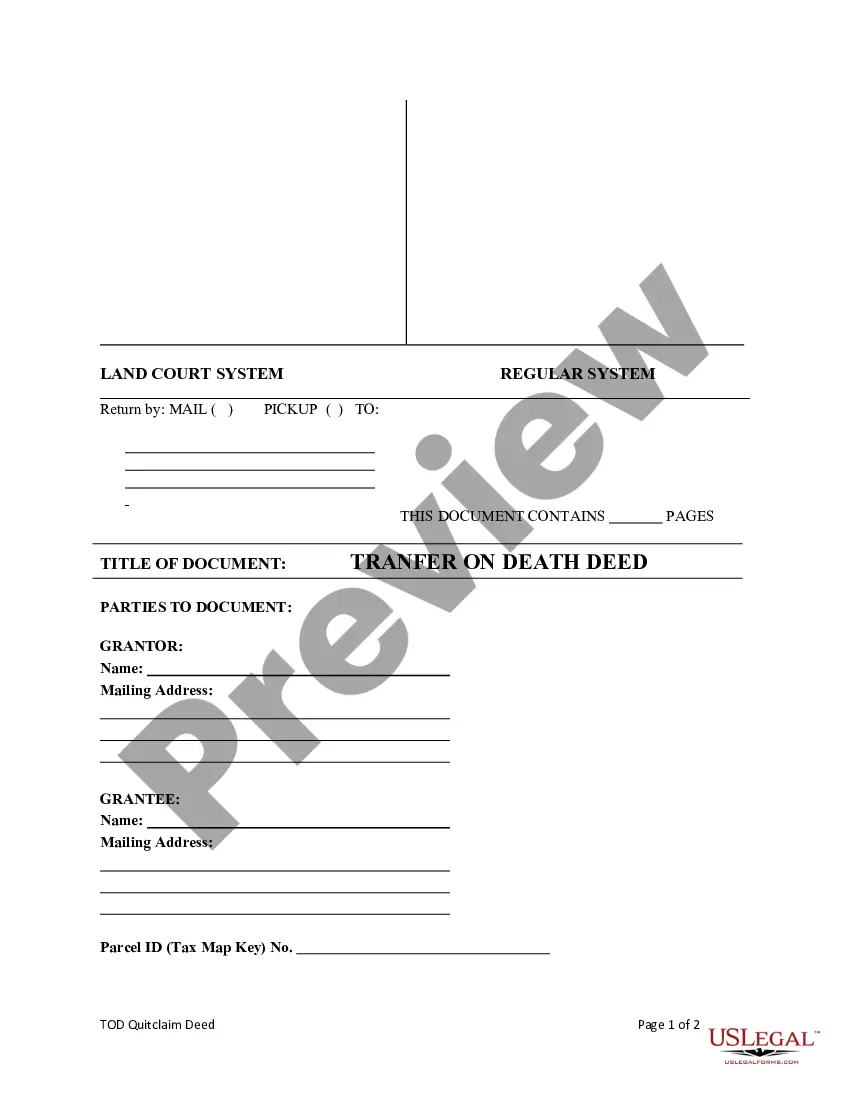

How to fill out Hawaii Transfer On Death Quitclaim Deed From Individual To Individual?

- Log in to your existing US Legal Forms account to access your document library. Ensure your subscription is active; if expired, renew it using your payment plan.

- Browse through the available forms and check the Preview mode to find the transfer death deed sample that meets your needs and local requirements.

- Utilize the Search feature for alternative templates if your initial choice doesn’t meet your criteria.

- Purchase the selected document by clicking on the Buy Now button and selecting a suitable subscription plan. You’ll need to create an account to proceed.

- Complete your purchase by entering payment information through a credit card or your PayPal account.

- Download your form directly to your device for completion, and revisit it anytime via the My Forms section in your account.

With US Legal Forms, you gain access to an expansive collection of over 85,000 legal templates designed for ease of use. This platform not only saves you time but also ensures accuracy in your legal documents.

Start simplifying your legal paperwork today by visiting US Legal Forms and exploring the multitude of resources available!

Form popularity

FAQ

You do not have to have an attorney for a transfer on death, but it is beneficial. An attorney can help clarify any legal implications and prevent mistakes that could cause issues later. Reviewing a transfer death deed sample for sale can also guide you, but consider consulting an expert to confirm the accuracy of your deed.

While it is not strictly necessary to hire a lawyer for a transfer on death deed, it is advisable in many cases. An attorney can help ensure that the deed is structured correctly and adheres to state laws. Using a transfer death deed sample for sale can simplify the process, but legal advice can provide additional peace of mind.

The time it takes to transfer a deed after death can vary significantly. Generally, it may take several weeks to months, depending on the complexity of the estate and any court proceedings involved. To streamline the process, consider using a transfer death deed sample for sale to ensure proper and timely execution in alignment with your wishes.

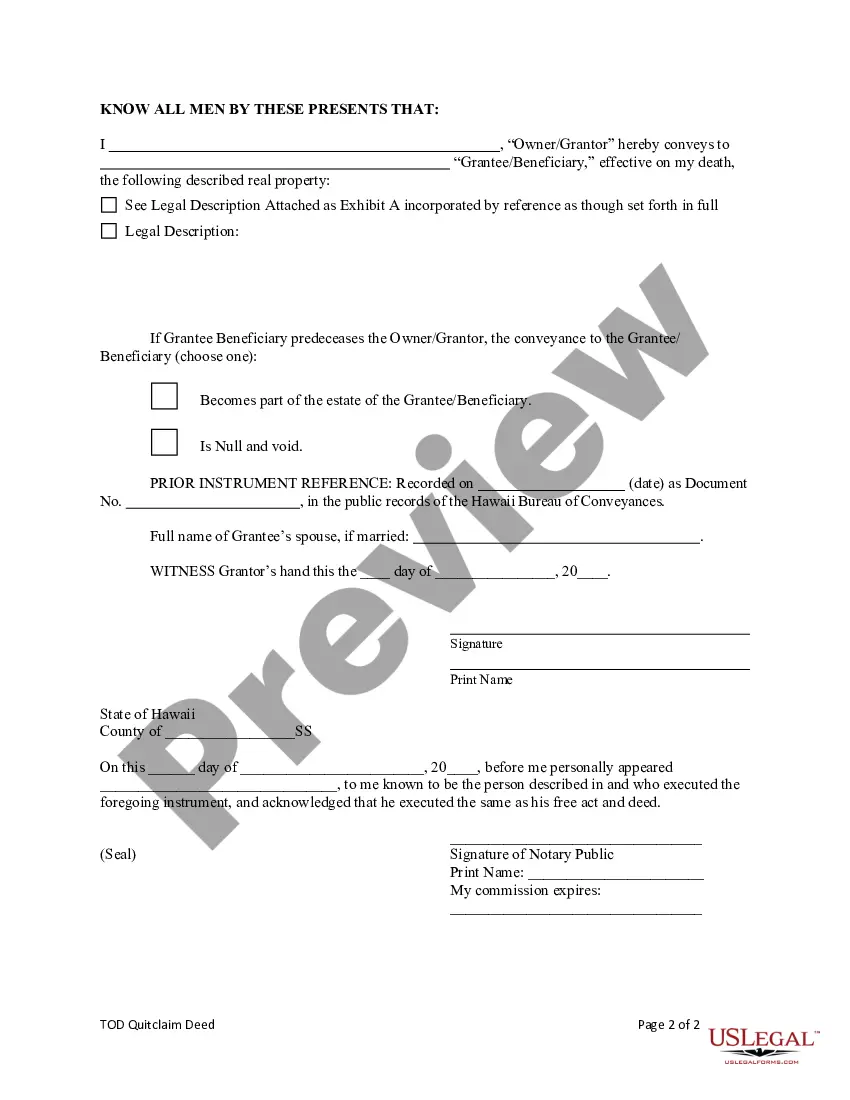

Writing a transfer deed requires clarity and precision. You'll start by including the title of the document, the names of the parties involved, and a clear description of the property. When reviewing a transfer death deed sample for sale, you'll notice that legally binding language is crucial to ensure that the deed accurately conveys your intentions.

A transfer on death deed does not automatically avoid capital gains tax. The property may still be subject to taxation based on its appreciated value at the time of sale or transfer. This is an important consideration when reviewing a transfer death deed sample for sale, so you may want to consult a tax professional for guidance.

Yes, you can transfer a deed without an attorney. However, doing so may involve risks, especially if you are unfamiliar with the legal requirements. Utilizing resources, like a transfer death deed sample for sale, can help guide you through the process. It's often safer to at least consult with a professional to ensure everything is done correctly.

A transfer on death (TOD) deed can have disadvantages. For example, if you want to sell the property before passing away, the title might complicate the sales process. Additionally, a TOD deed does not protect against creditors, leading to potential claims against the property after death. Therefore, it's crucial to understand these aspects when considering a transfer death deed sample for sale.

While a transfer on death deed can be a useful estate planning tool, it does have some disadvantages. One concern is that it may not provide the same level of control as a living trust does, since the property will pass to your designated beneficiary without any restrictions. Additionally, if the property owner has outstanding debts, creditors may still claim against the property even after death. Before choosing this option, consider reviewing a transfer death deed sample for sale to understand its implications fully.

To transfer property and avoid capital gains tax, consider using a transfer on death deed. This document allows you to designate a beneficiary for your property, ensuring the property passes directly to them upon your death without going through probate. By doing this, you may bypass capital gains tax, as the property receives a step-up in basis that reflects its current market value. For more guidance, look for a transfer death deed sample for sale that can help simplify the process.

While a transfer on death deed can provide a straightforward way to pass on property, it is not without its drawbacks. One key disadvantage is that it does not address creditor claims or liabilities, meaning that if debts exist, they might still affect the property after your passing. Additionally, relying solely on a transfer death deed sample for sale may lead to complications in estate planning if there are multiple beneficiaries or if the property is part of a larger estate. Therefore, it’s crucial to consider all aspects of your estate to ensure a smooth transition.