Llc Operating Agreement Hawaii With Llc

Description

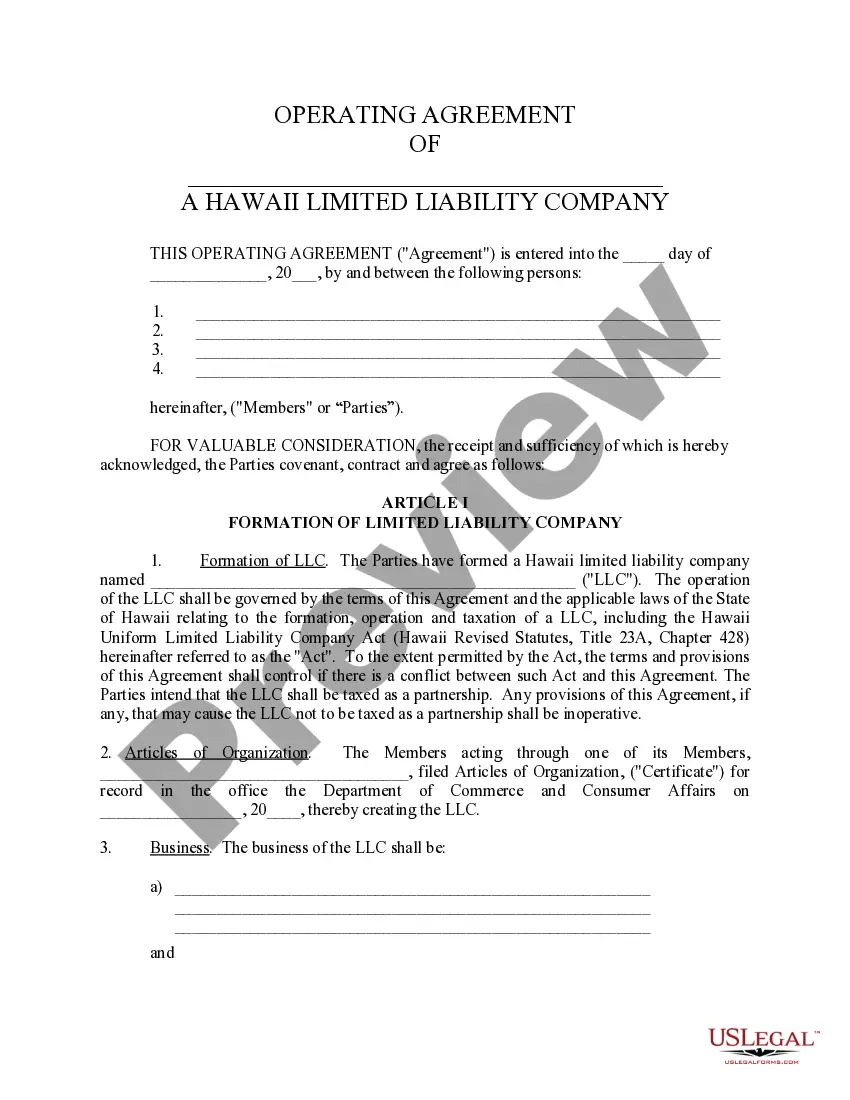

How to fill out Hawaii Limited Liability Company LLC Operating Agreement?

Whether for business purposes or for personal affairs, everyone has to handle legal situations sooner or later in their life. Completing legal papers requires careful attention, beginning from picking the proper form template. For instance, when you select a wrong edition of the Llc Operating Agreement Hawaii With Llc, it will be rejected when you submit it. It is therefore crucial to get a dependable source of legal documents like US Legal Forms.

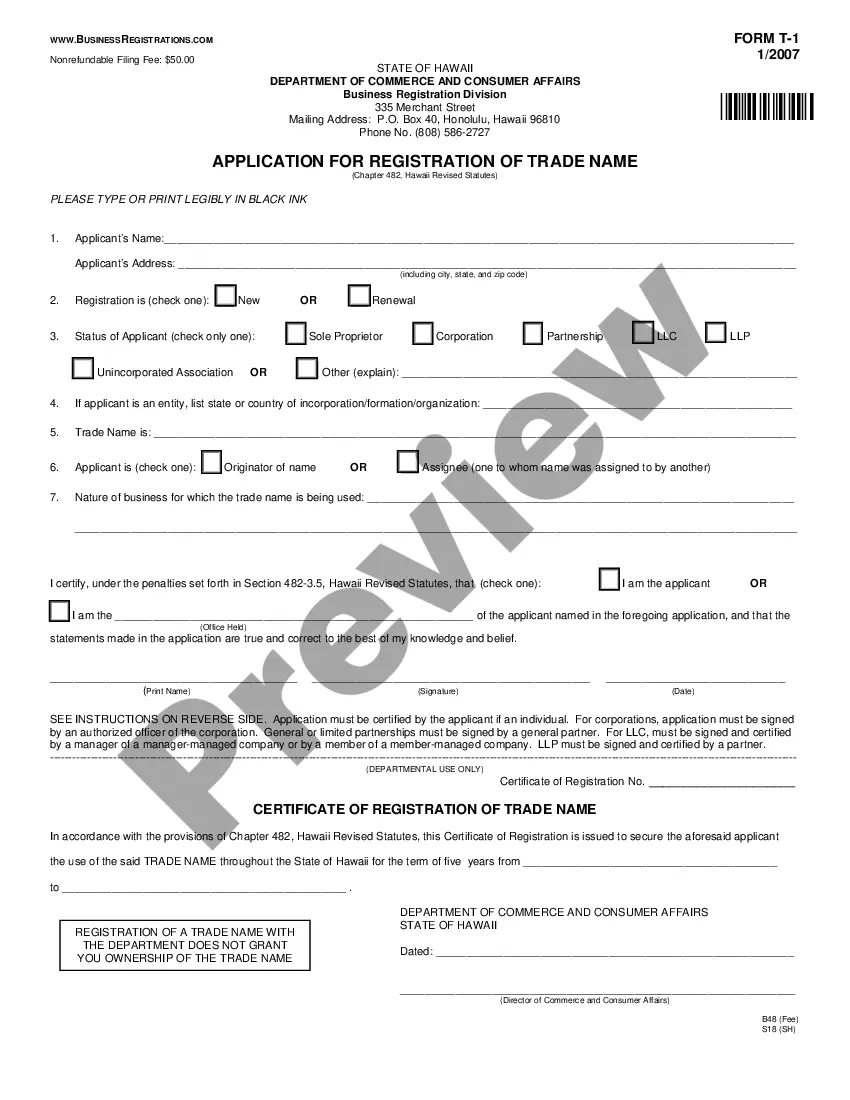

If you have to obtain a Llc Operating Agreement Hawaii With Llc template, stick to these easy steps:

- Get the sample you need using the search field or catalog navigation.

- Look through the form’s information to make sure it fits your situation, state, and region.

- Click on the form’s preview to examine it.

- If it is the incorrect document, go back to the search function to find the Llc Operating Agreement Hawaii With Llc sample you need.

- Download the template if it matches your requirements.

- If you have a US Legal Forms profile, simply click Log in to access previously saved files in My Forms.

- If you don’t have an account yet, you can download the form by clicking Buy now.

- Choose the proper pricing option.

- Finish the profile registration form.

- Choose your transaction method: use a credit card or PayPal account.

- Choose the file format you want and download the Llc Operating Agreement Hawaii With Llc.

- After it is saved, you are able to complete the form by using editing applications or print it and finish it manually.

With a substantial US Legal Forms catalog at hand, you do not need to spend time seeking for the appropriate sample across the internet. Make use of the library’s straightforward navigation to get the correct form for any situation.

Form popularity

FAQ

Corporations, LLCs, and LLPs are required to pay $15 to file an annual report. Nonprofits, general partnerships, LPs, and LLPs must pay a mere $5 to submit their report. If you do not file your report on time, the state of Hawaii will assess a $10 late fee, unless you are a nonprofit.

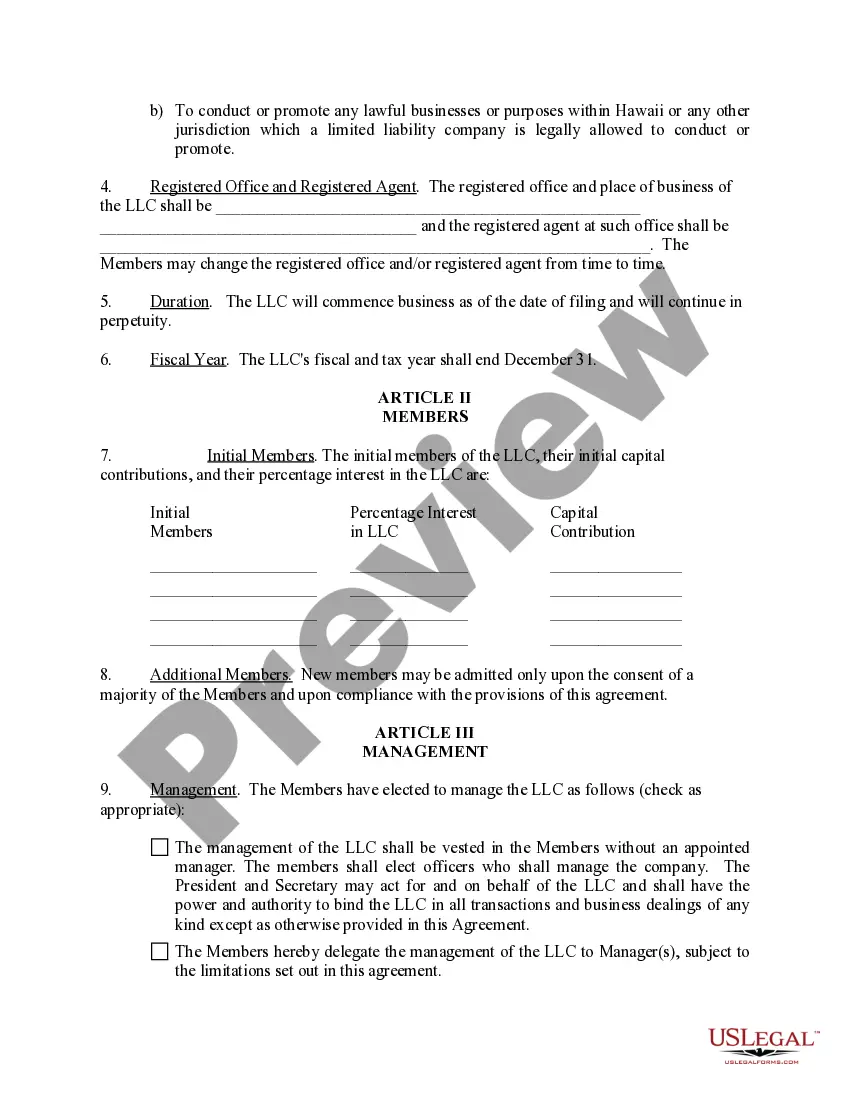

An operating agreement is a document that outlines the way your LLC will conduct business. You aren't required to file an operating agreement in Hawaii, but it is an essential component of your business.

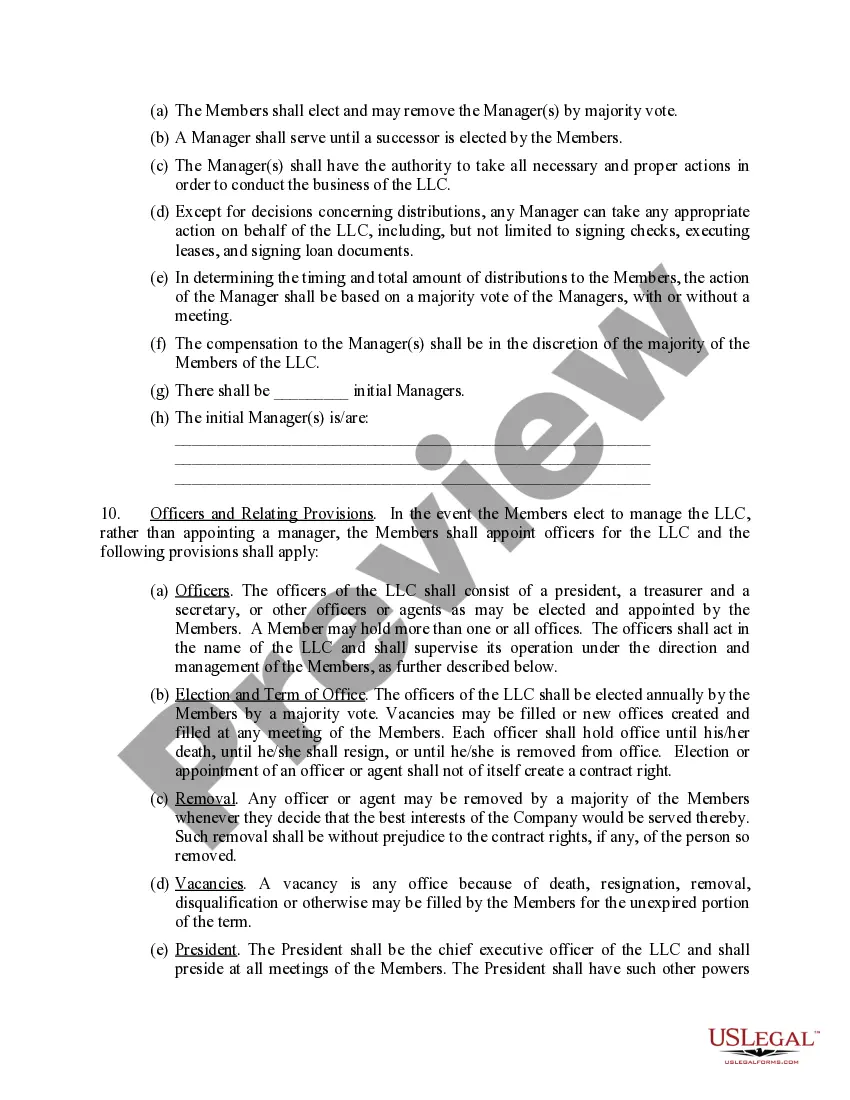

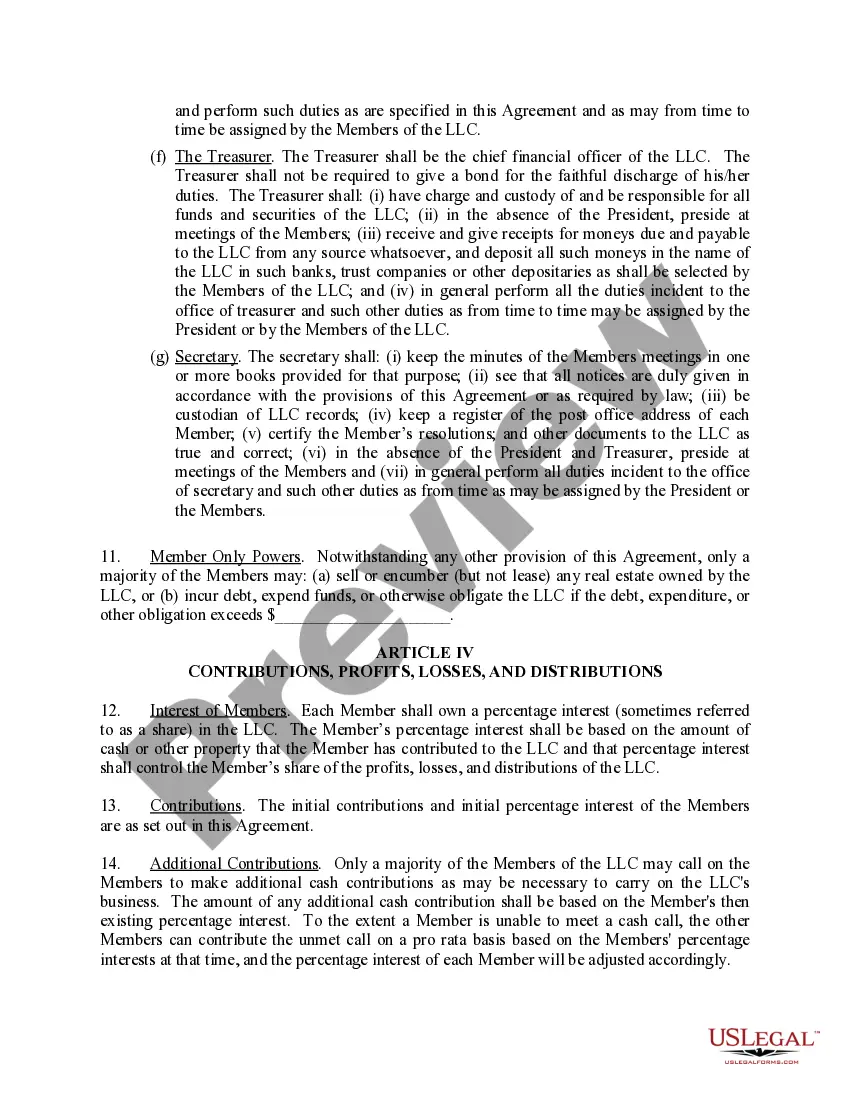

LLC operating agreements usually provide much more information, and almost all the provisions for how the business will be managed, and the rights, duties, and liabilities of members and managers are contained in the operating agreement. An operating agreement is a private document.

Hawaii Annual Report Fee: $12.50 Hawaii LLCs are required by state law to file an annual report. The report costs $12.50 if filed online, or $15 if you file your report by mail.

A Hawaii LLC Operating Agreement is a written contract between the LLC Members (LLC owners). This legal document includes detailed information about membership structure, who owns the company and how the LLC is managed.