Conservator Deed Georgia With Mortgage

Description

How to fill out Georgia Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries?

What is the most reliable service to obtain the Conservator Deed Georgia With Mortgage and other updated versions of legal documents? US Legal Forms is your solution! It's the finest collection of legal paperwork for any situation.

Each template is adequately drafted and confirmed for adherence to federal and local laws and regulations. They are organized by area and state of application, making it easy to find what you require.

US Legal Forms is an excellent option for anyone who needs to manage legal documentation. Premium users can benefit even more, as they can fill out and approve previously saved files electronically at any time using the built-in PDF editing tool. Try it out today!

- Experienced users of the platform just need to Log In to their account, verify the validity of their subscription, and click the Download button next to the Conservator Deed Georgia With Mortgage to acquire it.

- Once saved, the template is accessible for future use within the My documents section of your account.

- If you do not have an account yet, follow these steps to create one.

- Form compliance validation. Before you acquire any template, ensure it meets your usage requirements and the regulations of your state or county. Review the form description and use the Preview option if available.

Form popularity

FAQ

Georgia guardianship provides a legal framework to protect individuals who are unable to manage their own affairs. This can include minors or adults with disabilities. A conservator deed in Georgia with mortgage implications allows a designated guardian to handle financial matters on behalf of the ward. If you're navigating this process, consider using US Legal Forms for reliable documents to ensure the proper management of assets.

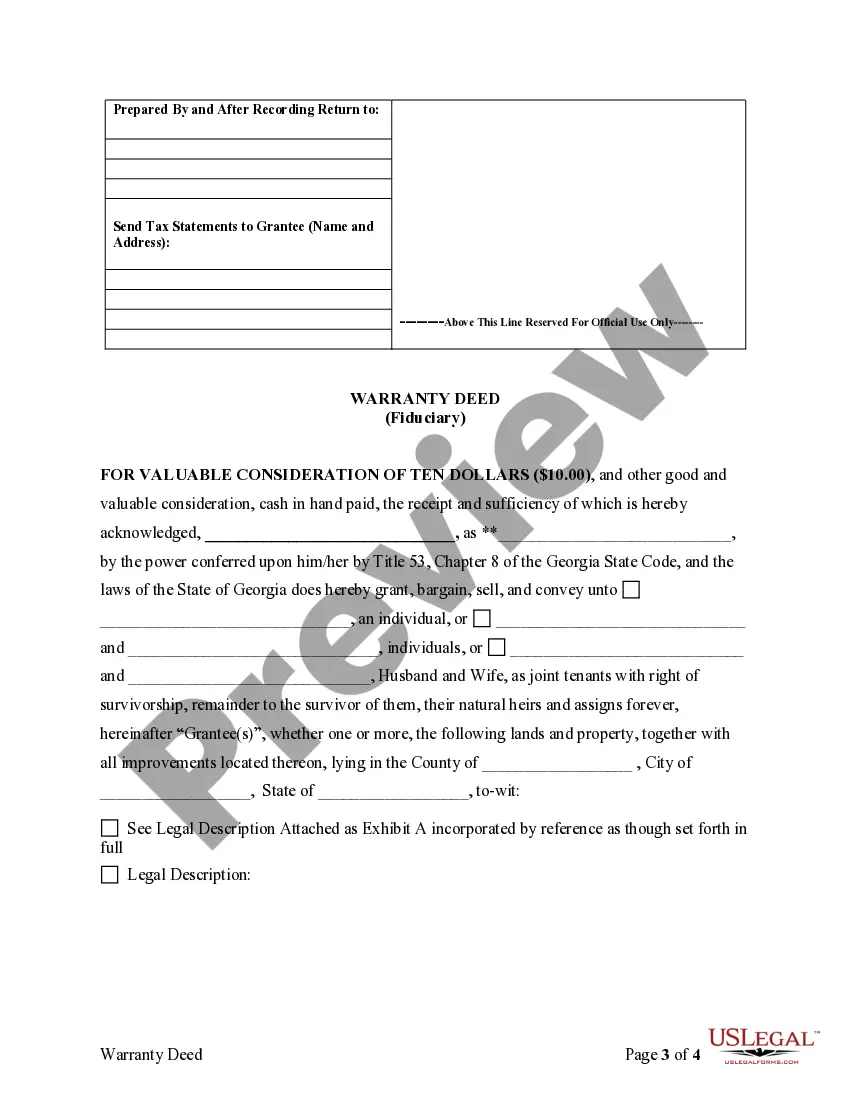

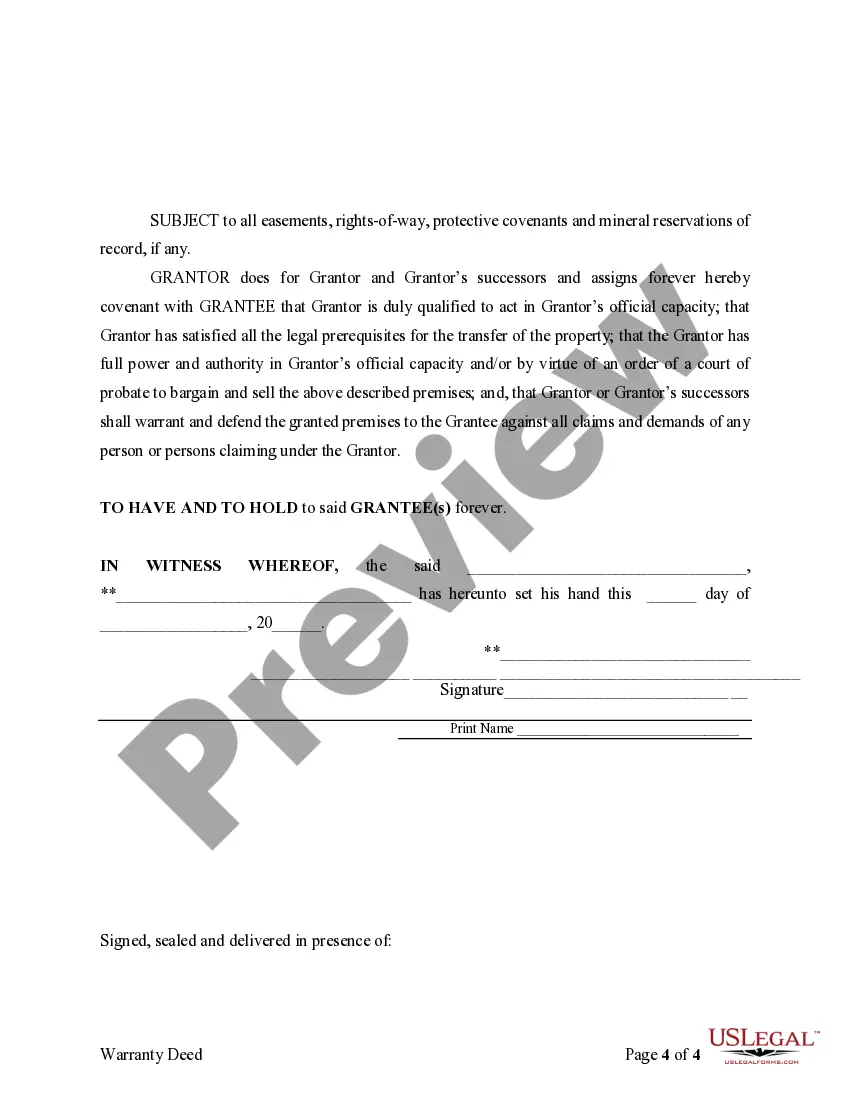

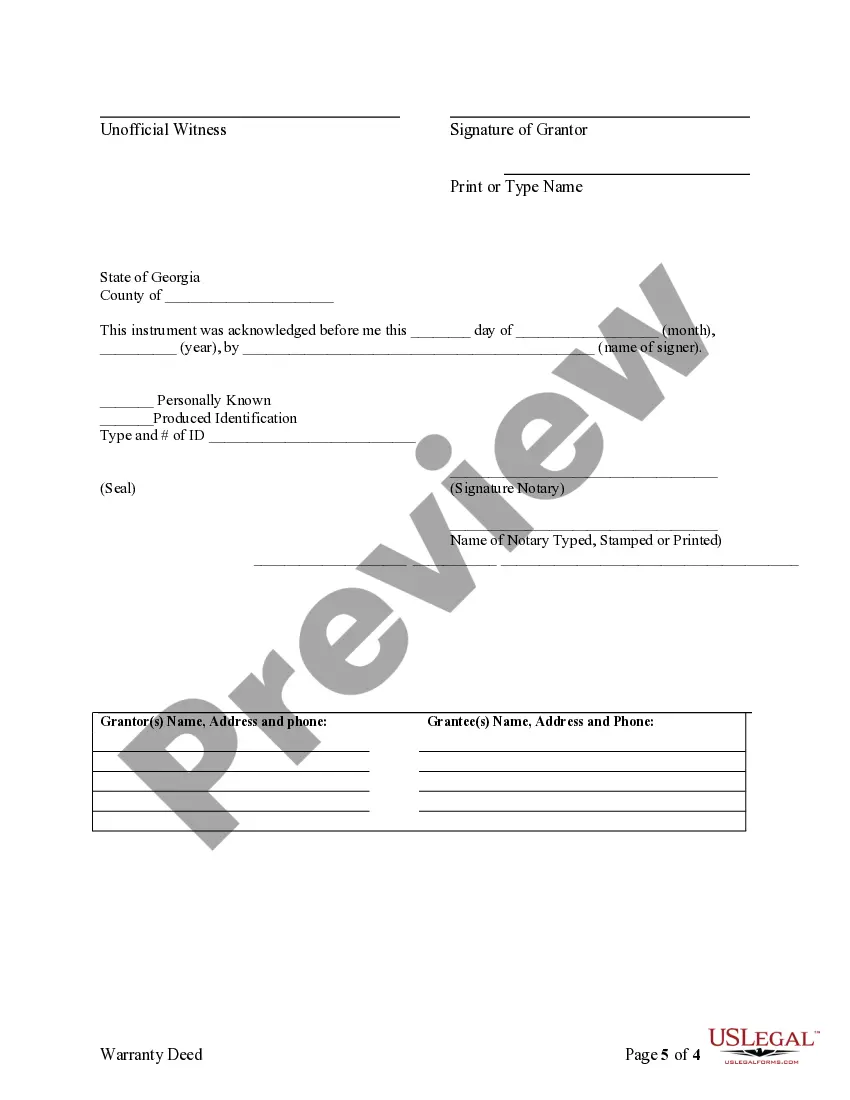

To record a deed in Georgia, the document must be properly signed, notarized, and include the legal description of the property. The execution also requires all parties' names and a statement confirming the grantee's identity. Additionally, recording the deed ensures public notice and protects your property rights, particularly when dealing with a conservator deed in Georgia with mortgage. For seamless recording and compliance, consider using uslegalforms to guide you through the necessary steps.

Georgia operates as a title theory state, which means that the deed conveys ownership while the mortgage acts as a lien on the property. This distinction emphasizes the importance of understanding both documents, especially if you are dealing with a conservator deed in Georgia with mortgage. In legal scenarios, knowing the implications of each can inform your decisions regarding property ownership and liability. For tailored resources, uslegalforms is here to assist you.

In Georgia, obtaining power of attorney for someone who is incapacitated can be a complex process. Typically, power of attorney must be established while the individual is still competent. If someone is already incapacitated, you may need to seek conservatorship instead. Resources such as USLegalForms can help guide you through creating necessary documents, including considerations about a conservator deed Georgia with mortgage.

In Georgia, guardianship does not automatically override a power of attorney. However, if a court determines someone is incapacitated, it may appoint a guardian who takes over the decision-making process. It's crucial to ensure that the power of attorney documents are comprehensive to avoid conflicts. If financial decisions arise, a conservator deed Georgia with mortgage may come into play, depending on the circumstances.

A conservator in Georgia has the authority to manage a person's financial resources and make decisions related to their assets. This includes paying bills, managing investments, and handling property. The conservator must act in the best interest of the individual and report to the court regularly. In cases that involve property, a conservator deed Georgia with mortgage can be utilized to properly document and manage these responsibilities.

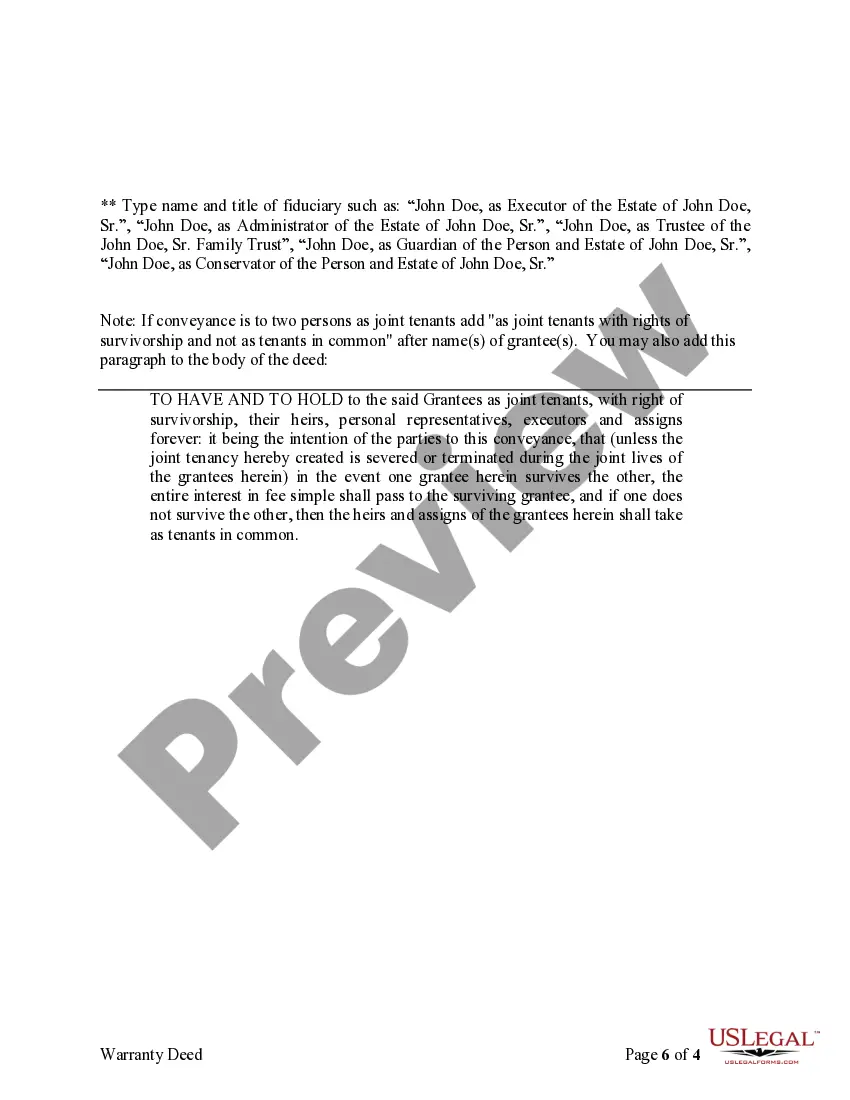

Guardianship and conservatorship in Georgia serve different purposes. Guardianship focuses on protecting individuals and managing their personal affairs, while conservatorship deals with managing financial matters. It’s essential to determine which legal arrangement is necessary based on an individual's specific needs. If financial management is required, a conservator deed Georgia with mortgage might be used.

In Georgia, the main difference between a guardian and a conservator lies in their roles. A guardian is responsible for the personal care and well-being of an individual, whereas a conservator manages the financial responsibilities. Both roles can be essential depending on the individual's needs. When dealing with financial matters, especially concerning a conservator deed Georgia with mortgage, understanding the differences is essential.

The statute of conservatorship in Georgia is primarily governed by Title 29 of the Official Code of Georgia Annotated. This code outlines the processes and requirements for establishing a conservatorship. It covers the roles, responsibilities, and powers of a conservator appointed by the court. Understanding these statutes is crucial, especially when dealing with a conservator deed Georgia with mortgage.

To get someone declared mentally incompetent in Georgia, you must present a petition to the probate court. This petition must include medical evidence and testimony indicating that the person cannot make sound decisions. The court evaluates the evidence and may hold a hearing. If the court finds the person incompetent, it may appoint a conservator who will manage their affairs, potentially involving a conservator deed Georgia with mortgage.